Artificial Intelligence in Cryptocurrency Analysis: A Practical Guide

Cryptocurrency markets move fast, trade 24/7, and combine price action, order-book dynamics, derivatives positioning, on-chain behavior, and social narratives into one noisy stream. That’s exactly why Artificial Intelligence in Cryptocurrency Analysis: A Practical Guide matters: AI helps you turn messy, multi-source data into repeatable research—not vibes.

In this guide, you’ll learn a practical, research-style workflow you can apply immediately. We’ll also reference SimianX AI as an example of how multi-agent, structured analysis thinking can keep your crypto research consistent—especially when you want a documented decision trail and clear next questions.

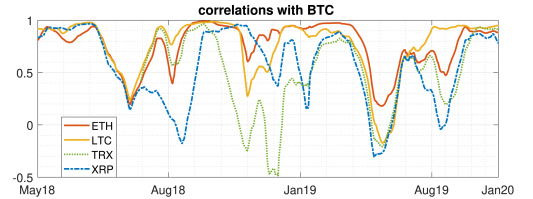

Why AI Works So Well for Crypto (and Where It Fails)

Crypto is a perfect “AI problem” because it’s:

Where AI fails is just as important:

Key takeaway: AI doesn’t replace thinking—it enforces a disciplined loop: hypothesis → data → model → evaluation → decision → monitoring.

How to Use Artificial Intelligence in Cryptocurrency Analysis Step by Step?

A practical workflow looks like this:

1. Define the decision

- Are you forecasting BTC direction (next 4h)? Detecting whale accumulation? Screening for altcoin momentum? Hedging risk?

2. Choose the target

- Examples: next-period return, volatility, liquidation risk, breakout probability, “smart money inflow” score.

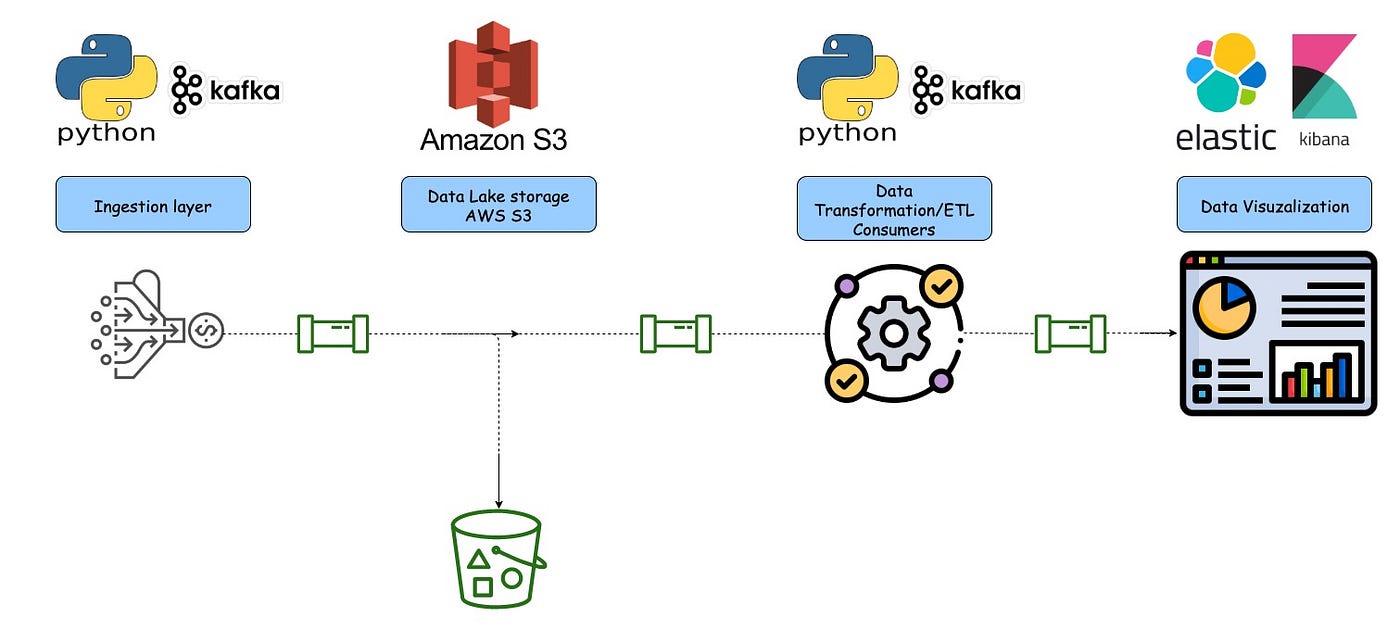

3. Build a data map

- Market data (OHLCV), order books, derivatives, on-chain, news, social, macro.

4. Engineer features you can explain

- Use features that reflect mechanisms (flows, positioning, liquidity), not only “magic indicators.”

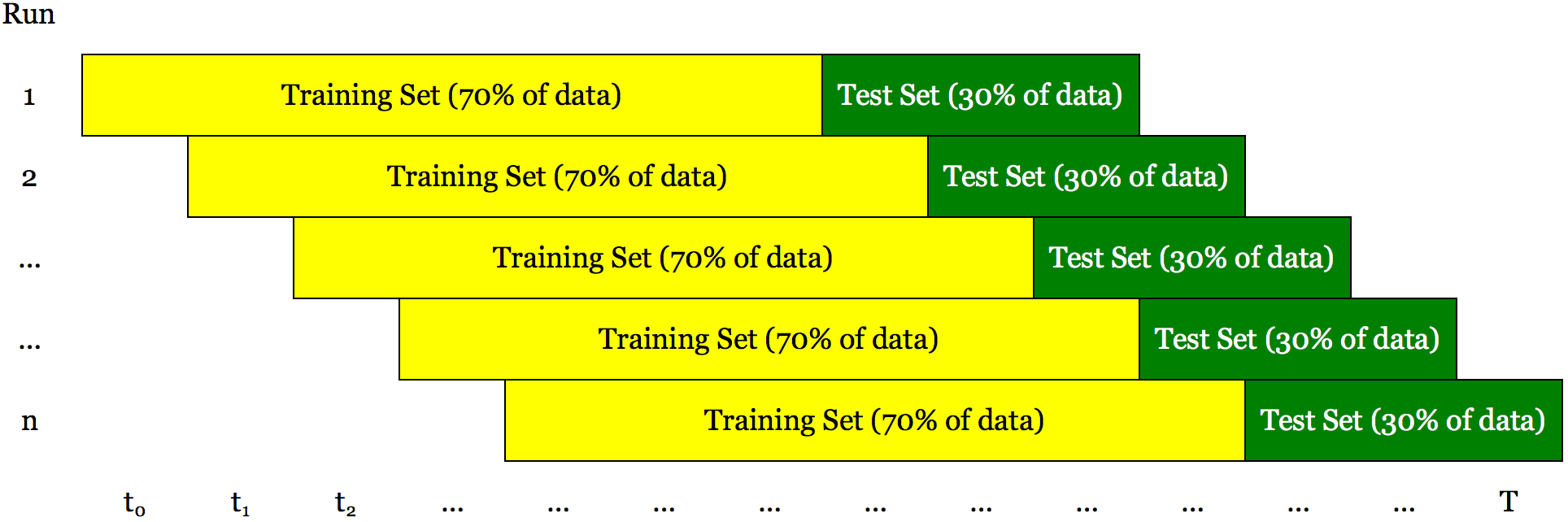

5. Train with leakage-proof splits

- Time-based split, walk-forward validation, purge overlapping windows.

6. Evaluate with trading reality

- Add costs, slippage, latency, and capacity constraints.

7. Deploy with guardrails

- Position sizing, stop rules, max drawdown, “model confidence” gating.

8. Monitor drift

- Regime changes, feature distribution shifts, performance decay.

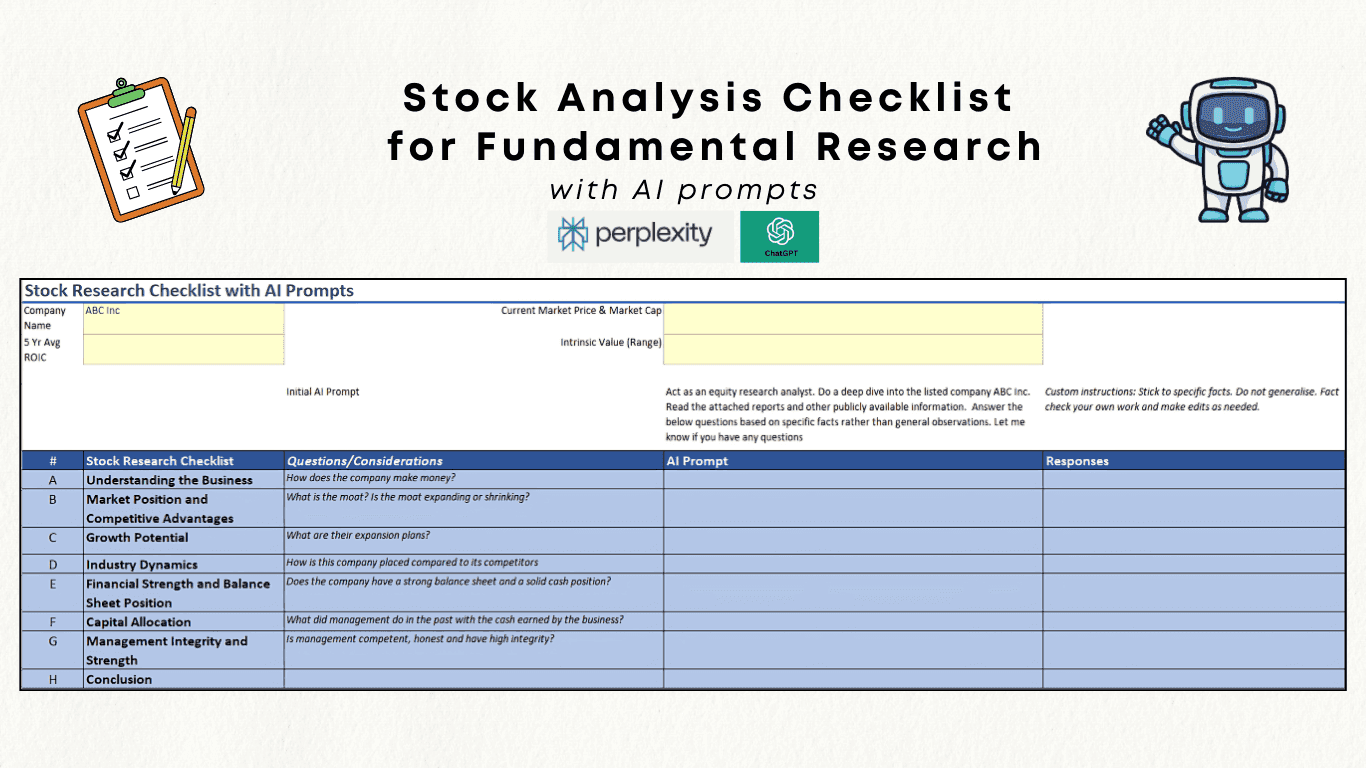

A simple research checklist you can reuse

| Step | What you do | Output you want | Common pitfall |

|---|---|---|---|

| Define | Choose decision + horizon | Clear target variable | “Predict price” (too vague) |

| Data | Select sources + frequency | Data dictionary | Mixing timestamps (leakage) |

| Features | Transform into signals | Explainable feature set | Over-engineering indicators |

| Model | Train baselines first | Benchmark comparison | Skipping baselines |

| Evaluate | Walk-forward + costs | Robust performance | Ignoring slippage |

| Deploy | Add risk rules | Safe execution | “Model says buy” with no guardrails |

The Data Stack: What to Collect (and Why)

You don’t need everything. You need the right things for your decision.

1) Market + microstructure data

Useful features:

2) Derivatives data

Useful features:

3) On-chain data (behavioral fundamentals)

Useful features:

4) Text data: news + narratives

Useful features:

Practical rule: if a feature can’t be described in one sentence, it’s hard to trust in a drawdown.

Modeling Approaches That Actually Work

Think in “model families,” then match them to your problem.

Time-series forecasting (prices/volatility)

When it fits:

NLP for sentiment and event extraction

When it fits:

Graph + anomaly detection for on-chain behavior

When it fits:

Portfolio and decision layers (the overlooked part)

Even a perfect predictor can fail if decisions are wrong.

Bold idea that saves real money: treat prediction as one input, and optimize the decision policy.

What is the best model for short-term crypto price prediction?

There isn’t one universal “best model.” In practice, feature-driven baselines (like boosted trees) often outperform deep models once you include realistic constraints (costs, slippage, regime changes). Deep models can win, but only when you control leakage, have stable data pipelines, and monitor drift aggressively.

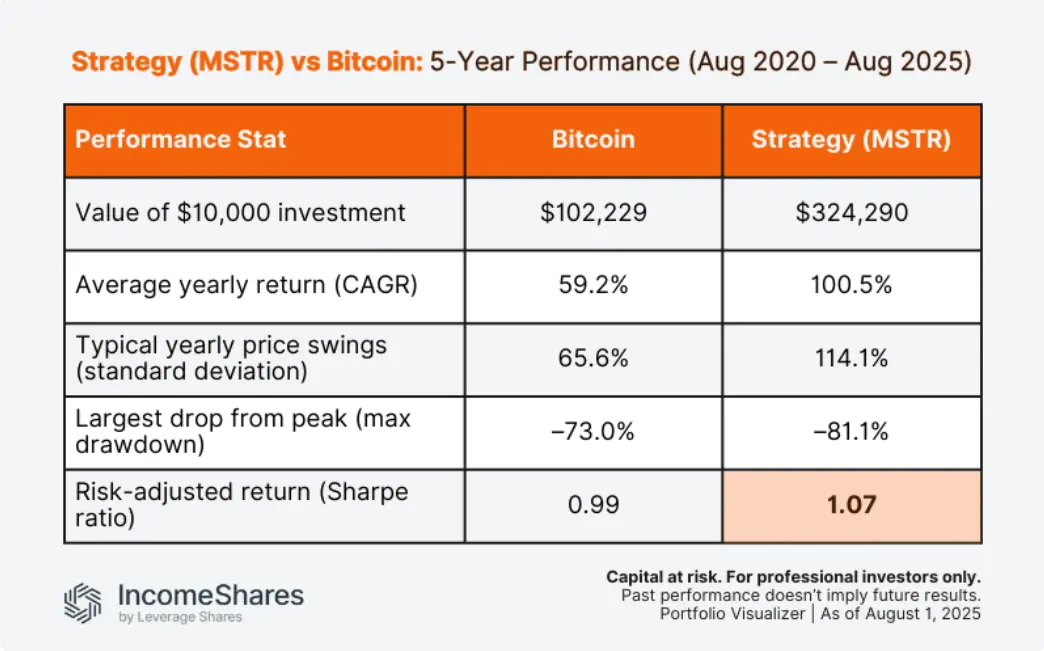

Evaluation: The Part Most “AI Crypto Signals” Get Wrong

To keep your research honest, evaluate at two levels:

1) Prediction quality

2) Trading performance (what matters)

A leakage-proof backtest routine

1. Use time-based splits

2. Perform walk-forward (train → validate → roll)

3. Purge overlapping samples if you use rolling windows

4. Add costs and slippage (stress test them)

A minimal pseudo-workflow (illustrative):

- Load data (timestamps aligned to exchange time)

- Create features using only past information

- Split: train (past) / validate (future)

- Walk-forward: repeat across multiple windows

- Convert predictions -> trades with risk rules

- Report: returns, drawdown, turnover, cost sensitivity

Risk, Robustness, and Failure Modes

Your model will break. Your job is to make sure it breaks safely.

Common failure modes in crypto AI

Guardrails you should implement

A strong crypto AI system is less about being right every time—and more about avoiding catastrophic wrongness.

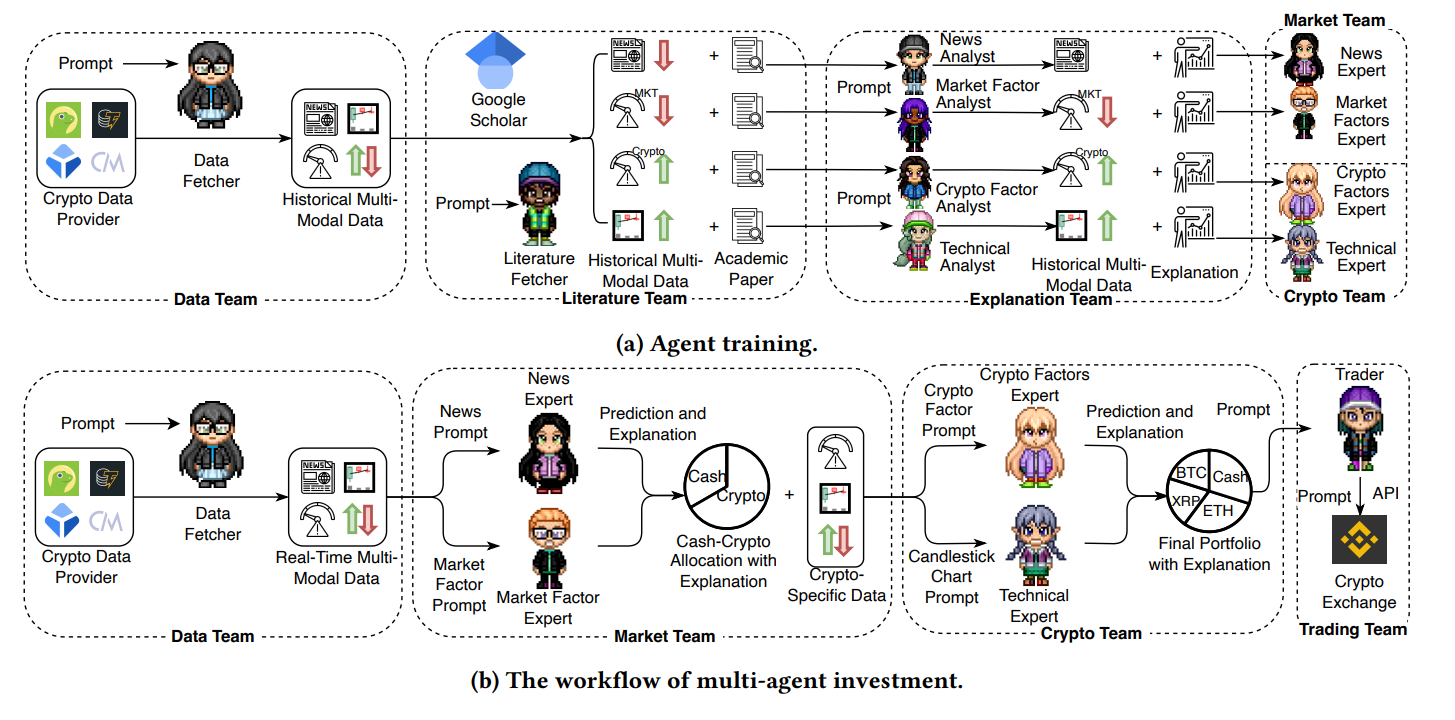

A Multi-Agent Workflow for Crypto Research (How to Stay Consistent)

One of the hardest parts of crypto research is consistency: you’re juggling microstructure, macro, on-chain behavior, and narratives at once. A practical solution is to adopt a multi-role workflow (human or AI-assisted) where each “agent” owns a slice of reality.

For example, SimianX AI popularizes the idea of parallel agents debating and producing a shareable report—use that structure as a template for crypto research even if your exact tools differ.

A crypto-oriented agent lineup:

Practical “debate” prompts (copy/paste)

1. “What evidence supports this trade besides price momentum?”

2. “Which data source could be lying or lagging?”

3. “What would falsify this thesis within 24 hours?”

4. “What’s the worst-case path and our exit plan?”

This is where mentioning SimianX becomes useful: you’re not just chasing a signal—you’re building a defensible research process that can be reviewed, improved, and repeated.

FAQ About Artificial Intelligence in Cryptocurrency Analysis

How do I avoid overfitting in AI crypto models?

Use time-based splits, walk-forward validation, and keep a strict boundary between feature creation and the future. Also, benchmark against simple baselines—if your model only beats them in one period, it’s probably not robust.

What data is most important for AI-based crypto analysis?

It depends on your decision horizon. For short-term trading, microstructure and derivatives often matter most. For medium-term research, on-chain flows and narrative shifts can add edge—if you validate them carefully.

Can AI read news and social media to predict crypto moves?

AI can summarize and classify narratives, but prediction is harder because social sentiment is noisy and sometimes manipulated. The best use is often filtering (e.g., avoid trades during high uncertainty) rather than direct “buy/sell from sentiment.”

Is “AI crypto analysis” the same as automated trading bots?

Not necessarily. AI analysis can support discretionary decisions, risk management, and research prioritization. Automated bots are an execution layer—useful, but only safe when the analysis and controls are solid.

How should beginners start with AI for crypto analysis?

Start small: pick one asset (BTC), one horizon (e.g., daily), one hypothesis (e.g., trend + volatility), and one baseline model. Build a clean evaluation loop before expanding features or assets.

Conclusion

Artificial Intelligence in cryptocurrency analysis works best when you treat it like applied research: define the decision, collect the right data, build explainable features, validate with leakage-proof methods, and wrap everything in risk controls. The goal is not “perfect prediction,” but repeatable decisions that survive regime shifts.

If you want to operationalize a structured, multi-agent style workflow (parallel viewpoints, debate, and documented outputs), explore SimianX AI and use its research-first mindset as a blueprint for building more defensible crypto analysis.