AI to Model the Volatility and Chain Reactions of DeFi Risks

DeFi doesn’t usually fail because of a single “bad trade.” It fails because volatility shocks propagate through liquidity, leverage, and incentive layers—and a small crack becomes a chain reaction. This is exactly why AI to model the volatility and chain reactions of DeFi risks is becoming a practical necessity for anyone allocating serious capital on-chain. In this research guide, we’ll build a rigorous framework: what “contagion” looks like in DeFi, which on-chain features matter, and how modern AI methods can simulate cascades before they happen. We’ll also show how teams can operationalize these models inside a repeatable research workflow with tools like SimianX AI.

1) What “chain reactions” mean in DeFi (and why volatility is the trigger)

In traditional finance, contagion often flows through balance sheets and funding markets. In DeFi, contagion is coded into protocols and amplified by composability:

A DeFi “shock” typically begins with a volatility impulse:

Key insight: In DeFi, volatility isn’t just a market condition—it is often the mechanism that turns local risk into systemic risk.

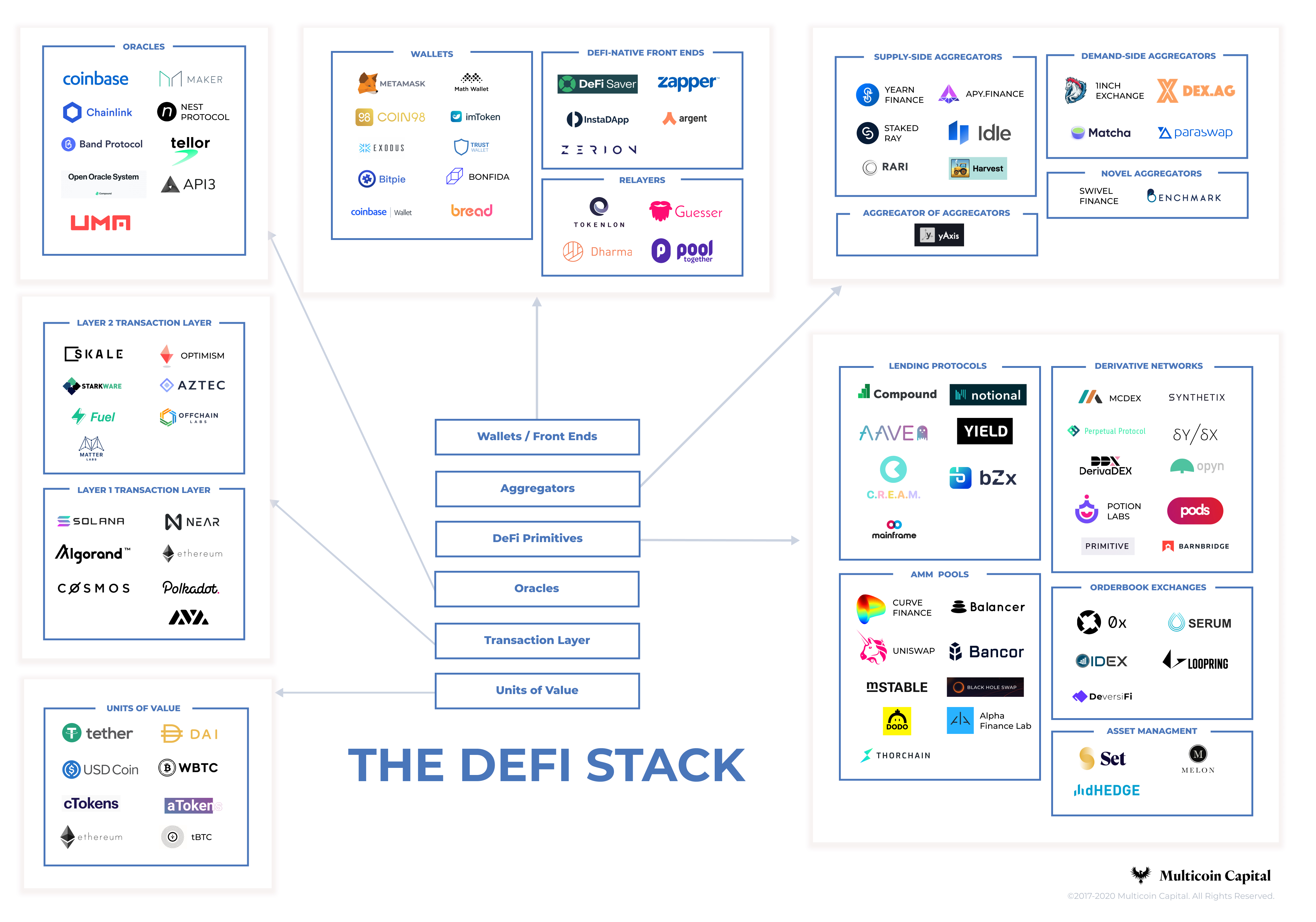

A simple mental model: DeFi risk as a layered stack

Think of your position as sitting on a stack:

1. Market layer: underlying asset volatility, correlation, funding conditions

2. Liquidity layer: exit capacity, slippage, depth, LP behavior

3. Mechanism layer: liquidation rules, oracles, rate models, circuit breakers

4. Incentive layer: emissions, bribes, governance, mercenary capital

5. Operational layer: upgrades, admin keys, dependencies, outages

“Chain reactions” happen when stress moves down or up the stack quickly.

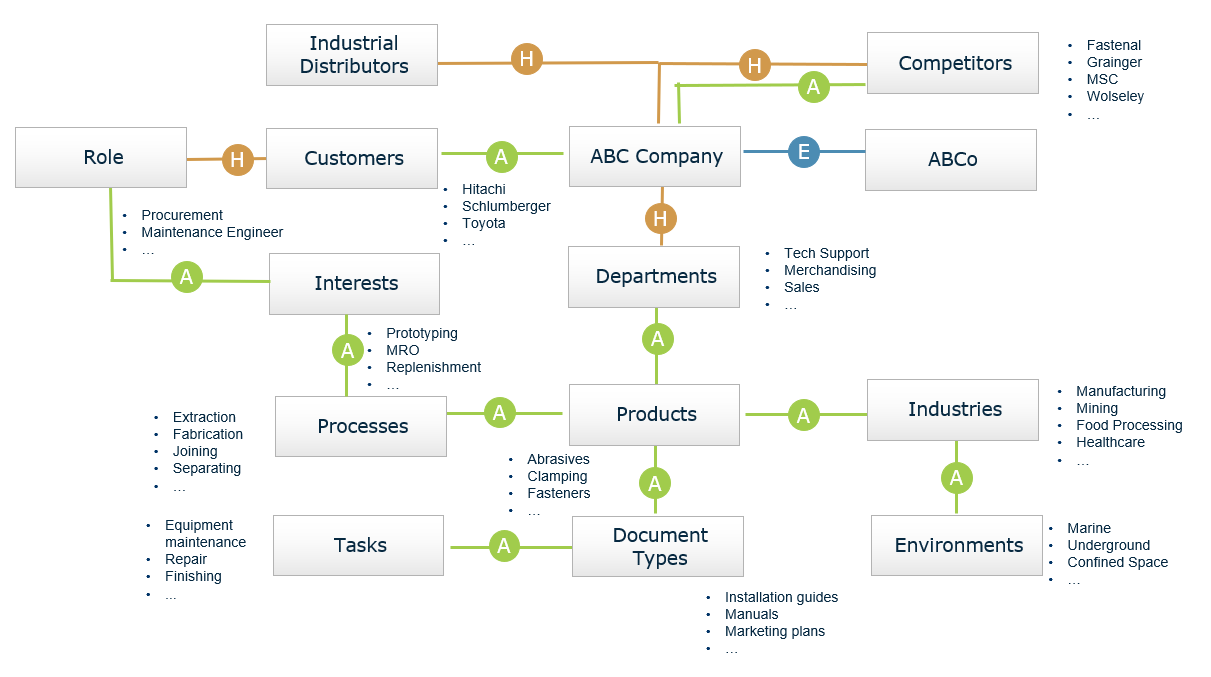

2) A data blueprint: what you must measure to model cascades

If you can’t measure it, you can’t simulate it. For DeFi cascades, you need features that capture (a) volatility regime, (b) leverage concentration, and (c) exit friction.

Core feature families (practical and measurable)

| Feature family | What it measures | Example signals (on-chain) | Why it matters for cascades |

|---|---|---|---|

| Volatility & regime | Whether the system is calm or stressed | realized vol, return autocorrelation, jump frequency, funding swings | regime shifts change liquidation probability nonlinearly |

| Liquidity & slippage | How costly it is to exit | AMM curve sensitivity, pool depth, CEX/DEX basis, routing fragmentation | shallow liquidity turns liquidations into price impact |

| Leverage & concentration | Who gets liquidated first, and how hard | borrow utilization, collateral concentration, whale positions, health factor distribution | clustered leverage causes “domino liquidations” |

| Oracle fragility | Price integrity under stress | oracle update frequency, medianization, deviation bands, DEX-CEX divergence | oracles can transmit or amplify shocks |

| Stablecoin peg health | Whether the unit of account breaks | peg deviation, redemption queues, collateral quality drift | depegs rewrite all risk calculations instantly |

| Incentive reflexivity | TVL that can vanish overnight | emission APR share, mercenary LP churn, bribe dependence | incentives often disappear exactly when needed most |

Data hygiene rules (non-negotiable):

This is where platforms like SimianX AI can help: you want a documented, repeatable pipeline that turns noisy on-chain activity into defensible features and versioned assumptions.

3) Modeling volatility: from regimes to “shock likelihood”

Volatility modeling is not just forecasting returns. For DeFi risk, you’re forecasting the probability of structural stress.

A practical volatility modeling ladder

Level 1 — Baselines (fast, robust):

EWMA)

VaR, CVaR)

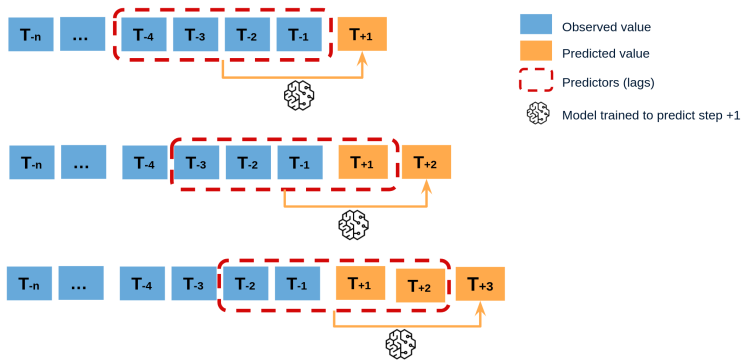

Level 2 — Regime detection (what you actually need):

Level 3 — ML/AI sequence models (when you have enough data):

Rule of thumb: For DeFi, the best objective is often not “predict price.” It’s “predict stress state and its transition probability.”

What to predict (targets that map to real risk)

Instead of predicting next_return, define targets like:

P(liquidation_wave_next_24h)

expected_slippage_at_size under stressed liquidity

probability_of_oracle_deviation_event

probability_of_peg_break > x bps

These targets are closer to what actually wipes out capital.

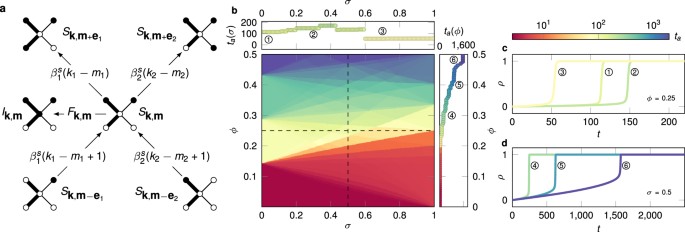

4) Modeling chain reactions: contagion graphs and liquidation dynamics

To model “chain reactions,” you need structure: who depends on whom, and what links tighten under stress.

4.1 Build the DeFi dependency graph

Represent the ecosystem as a directed graph:

Edge weights should be state-dependent:

Token A and Stablecoin S might be weak

A is major collateral for S, that weight spikes

Graph features to track:

4.2 Liquidation cascade modeling (the engine of contagion)

Liquidations are often the mechanical driver of chain reactions. A useful abstraction:

1. A set of borrowers has collateral C and debt D

2. A price drop moves health factors below threshold

3. Liquidators sell collateral into available liquidity

4. Price impact creates second-order liquidations

You can model this cascade with:

Agent-based simulation (ABM): the most intuitive way to test cascades

Use agents representing:

ABM is powerful because DeFi stress is behavioral and mechanical:

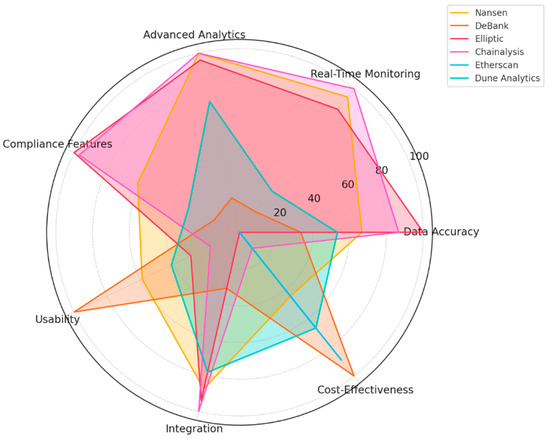

5) AI methods that actually help (and where they fail)

AI is useful when the system is nonlinear, multivariate, and regime-dependent—which is exactly DeFi.

What AI is great at

What AI is bad at (if you’re not careful)

Practical recommendation: Use AI as a risk radar (detection + scenario generation), and couple it with mechanistic simulations (liquidation/impact models) for decision-grade stress tests.

A robust hybrid architecture (recommended)

stress_probability and predicts conditional distributions of key state variables

This is also where SimianX AI fits naturally as an operational workflow: organize research into consistent stages, keep evidence attached to outputs, and ensure each risk conclusion is reproducible.

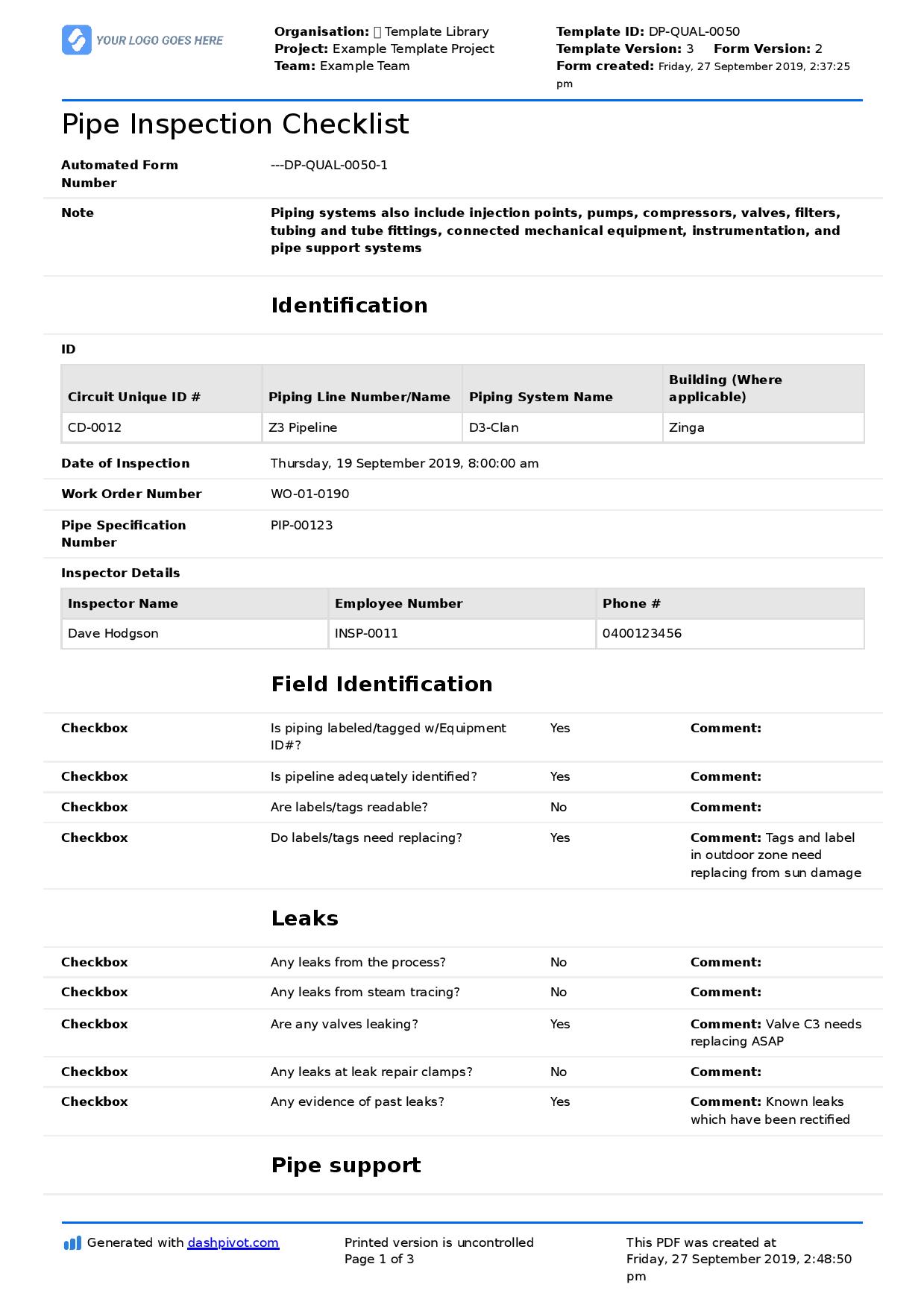

6) Step-by-step: a practical pipeline to model DeFi risk chain reactions

Here’s a concrete pipeline you can implement for any protocol category (lending, stablecoins, LP strategies):

Step 1 — Define your cascade endpoints

Pick outcomes you care about:

Step 2 — Build “stress state” labels

Create labels from observable events:

Step 3 — Train a stress classifier (interpretable first)

Start with something you can explain:

Then iterate to sequence models if needed.

Step 4 — Generate conditional scenarios

Instead of one forecast, generate a distribution:

Step 5 — Run cascade simulations

For each scenario:

1. simulate borrower health factors

2. simulate liquidation volumes

3. simulate market impact and price paths

4. re-evaluate health factors → iterate until stable

Step 6 — Convert outcomes into risk actions

Examples:

P(cascade) > threshold

Numbered checklist (operational):

1. Freeze a dataset version and feature set

2. Backtest on past stress windows

3. Calibrate thresholds to avoid “always alarm”

4. Add monitoring for feature drift

5. Document assumptions and failure modes

7) How can AI model the volatility and chain reactions of DeFi risks in real time?

Real-time modeling is less about “faster inference” and more about faster state updates.

The real-time loop (what matters)

Real-time signals worth prioritizing

If you only monitor prices, you’re late. Real-time DeFi risk is about monitoring the constraints that turn price moves into insolvency.

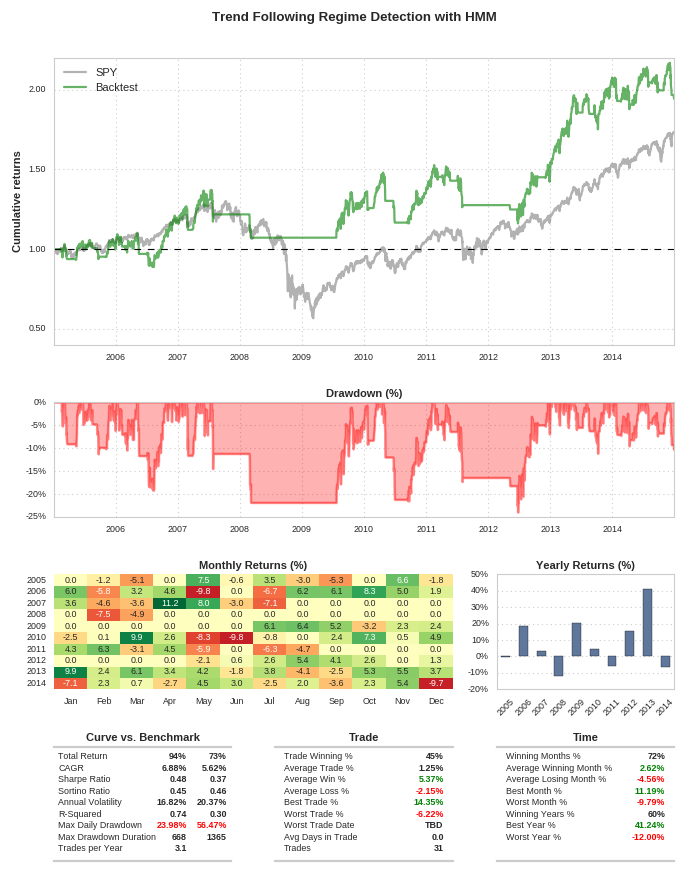

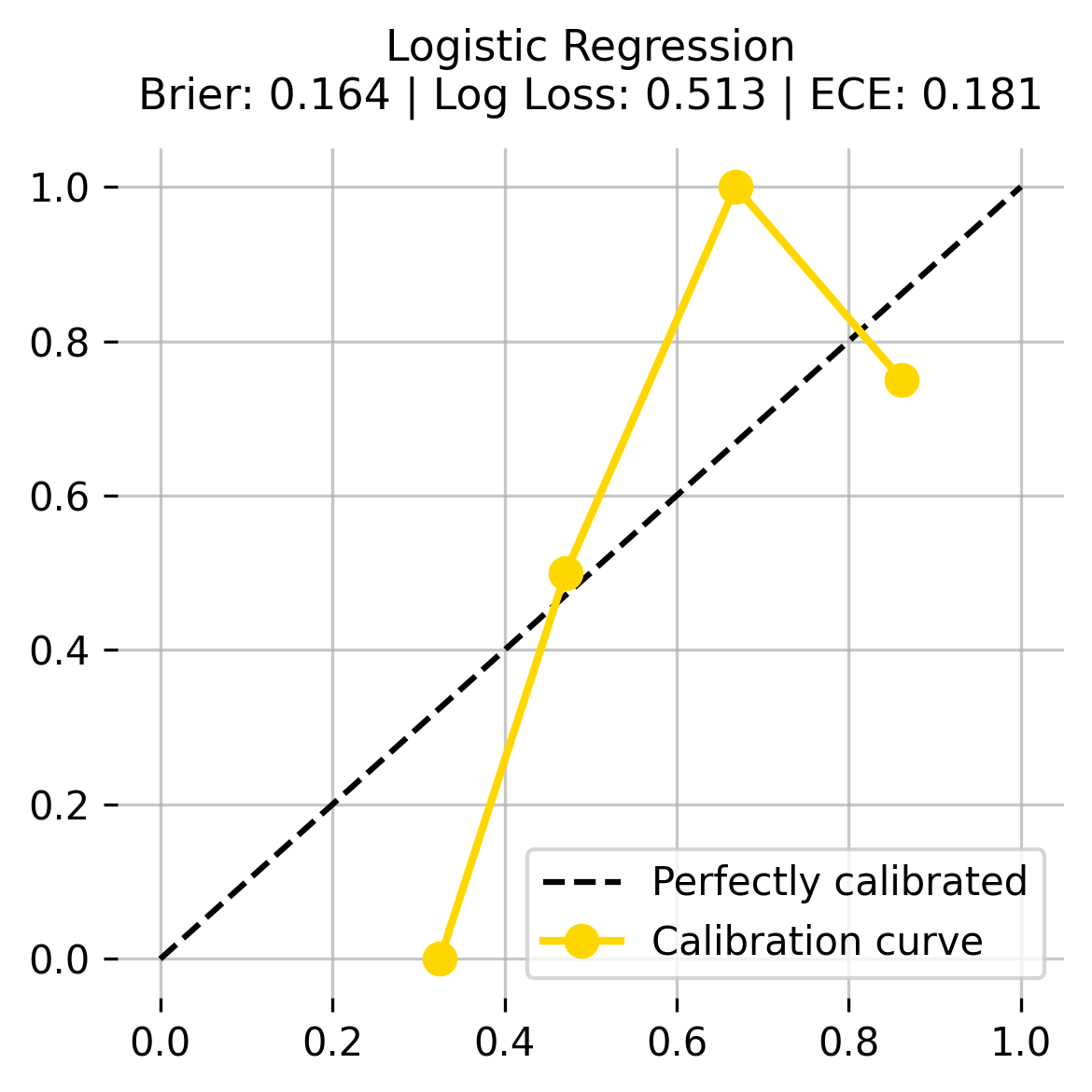

8) Evaluation: how to know your model is useful (not just fancy)

A DeFi risk model should be judged by decision utility, not just prediction scores.

Useful evaluation metrics

A simple evaluation table

| Evaluation question | What “good” looks like | What “bad” looks like |

|---|---|---|

| Does it warn early? | consistent lead time before stress | only triggers after damage |

| Is it calibrated? | 70% means ~70% in practice | overconfident probabilities |

| Does it generalize? | works across assets/chains | only fits one regime |

| Does it improve decisions? | lower drawdowns / better exits | no measurable benefit |

FAQ About AI to Model the Volatility and Chain Reactions of DeFi Risks

What is the best way to model DeFi liquidation cascades?

Start with a mechanistic cascade simulator (health factors + market impact), then condition scenarios with an AI stress model. The combination captures both the physics and the signals of DeFi contagion.

How to model DeFi risk cascades without perfect wallet attribution?

Use distributional features (health factor histograms, concentration indices, top-N borrower exposure) rather than per-entity identity. You can still simulate cascades with aggregate state variables and conservative assumptions.

What causes DeFi liquidation cascades most often?

A volatility shock plus a liquidity cliff is the classic combo: falling prices trigger liquidations, and thin liquidity makes those liquidations push prices further. Oracle or peg instability can amplify the loop.

Can AI predict stablecoin depegs reliably?

AI can provide early-warning probabilities using peg deviation patterns, collateral quality drift, liquidity conditions, and redemption pressure proxies. But depegs are regime changes—treat AI as a probabilistic radar, then stress-test consequences mechanically.

How do I monitor DeFi tail risk in real time?

Prioritize state variables that represent constraints: liquidity depth, utilization, peg deviation, oracle divergence, and large LP withdrawals. Tail risk is often visible in system plumbing before it appears in price.

Conclusion

Using AI to model DeFi volatility is valuable—but the real edge comes from modeling how volatility becomes contagion: liquidation mechanics, liquidity cliffs, oracle dependencies, and peg fragility. A strong workflow combines (1) regime-aware AI stress probabilities, (2) scenario generation, and (3) mechanistic cascade simulation that translates stress into exit costs and insolvency risk. If you want to operationalize this into a repeatable research loop—features, simulations, dashboards, and documented assumptions—explore SimianX AI and build your DeFi risk models as systems, not opi:contentReference[oaicite:0]{index=0}

::contentReference[oaicite:1]{index=1}