Crypto Intelligence as a Decentralized Cognitive System for Predicting Market Evolution

Abstract

The cryptocurrency market represents one of the most complex financial systems ever observed: globally distributed, continuously operating, permissionless, adversarial, and reflexive. Traditional forecasting approaches—statistical models, technical indicators, and even centralized artificial intelligence—have proven insufficient to capture the evolving structure of these markets. This paper proposes a new research framework: crypto intelligence as a decentralized cognitive system. We conceptualize market prediction as an emergent property of distributed, multi-agent artificial intelligence operating over on-chain and off-chain data. By framing crypto markets as complex adaptive systems and intelligence as a collective cognitive process, we explore how decentralized AI architectures can improve robustness, adaptability, and early detection of market regime evolution. The paper further discusses architectural design principles, incentive alignment, evolutionary learning, and real-world implementation pathways, including applied systems such as SimianX AI.

---

1. Introduction

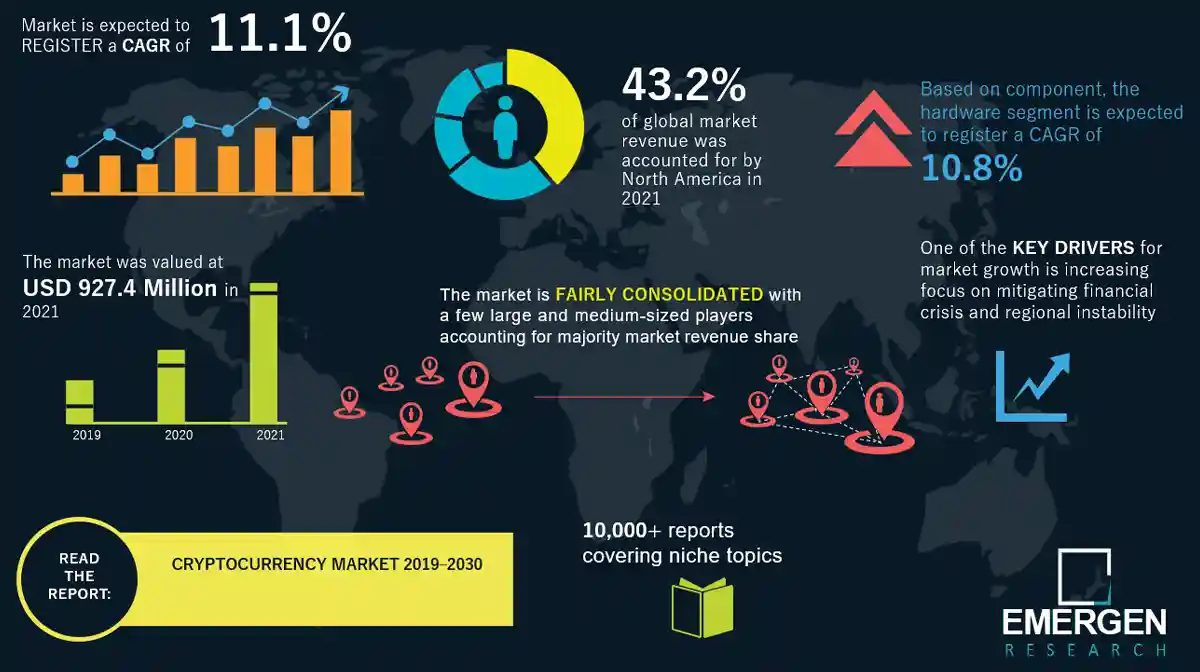

Crypto markets challenge nearly every assumption underlying traditional financial modeling. They are open, composable, rapidly mutating, and driven as much by incentives and narratives as by fundamentals. As a result, predicting market evolution—rather than short-term price movements—has become the central problem of crypto intelligence.

In this context, crypto intelligence refers not simply to algorithmic trading signals, but to systems capable of interpreting market structure, detecting regime shifts, and reasoning about future states. Platforms like SimianX AI approach this problem by treating intelligence itself as a decentralized process—mirroring the decentralized nature of blockchain networks.

This paper argues that only decentralized cognitive systems, composed of autonomous yet cooperative AI agents, can meaningfully address the complexity of crypto markets.

---

2. Crypto Markets as Complex Adaptive Systems

2.1 Structural Characteristics

Crypto markets exhibit hallmark features of complex adaptive systems:

Unlike traditional markets, crypto systems externalize their internal state through on-chain data. Yet transparency does not imply intelligibility.

Complexity is not a data problem; it is a cognition problem.

2.2 Implications for Prediction

In such systems, prediction accuracy is less important than regime awareness. Forecasting market evolution requires understanding structural change, not extrapolating trends.

---

3. Limitations of Centralized Crypto Intelligence

3.1 Statistical and Technical Models

Classical approaches rely on assumptions of stationarity and linearity. These assumptions are routinely violated in crypto markets, leading to brittle forecasts and catastrophic tail risk.

3.2 Centralized AI Models

While deep learning models outperform traditional methods in pattern recognition, they suffer from:

Centralized intelligence creates systemic fragility.

---

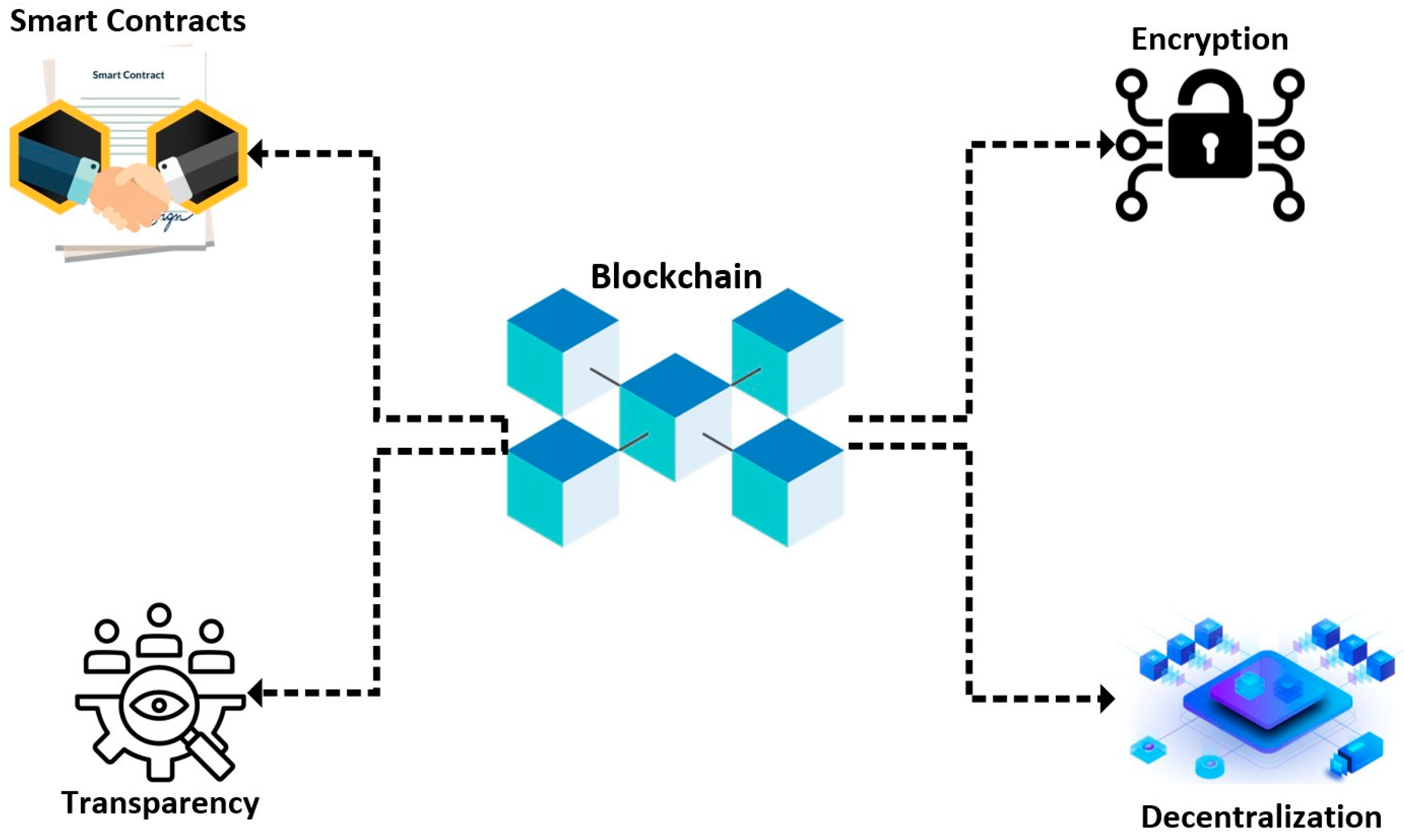

4. Conceptual Framework: Decentralized Cognitive Systems

4.1 Definition

A decentralized cognitive system is defined as a network of autonomous agents that:

This mirrors biological cognition, swarm intelligence, and distributed control systems.

4.2 Cognitive Layers

| Layer | Function | Crypto Context |

|---|---|---|

| Sensory | Data ingestion | On-chain events |

| Perceptual | Feature abstraction | Liquidity signals |

| Cognitive | Pattern reasoning | Regime detection |

| Meta-cognitive | Self-evaluation | Model confidence |

| Collective | Aggregation | Market state |

SimianX AI operationalizes these layers across multiple AI agents.

---

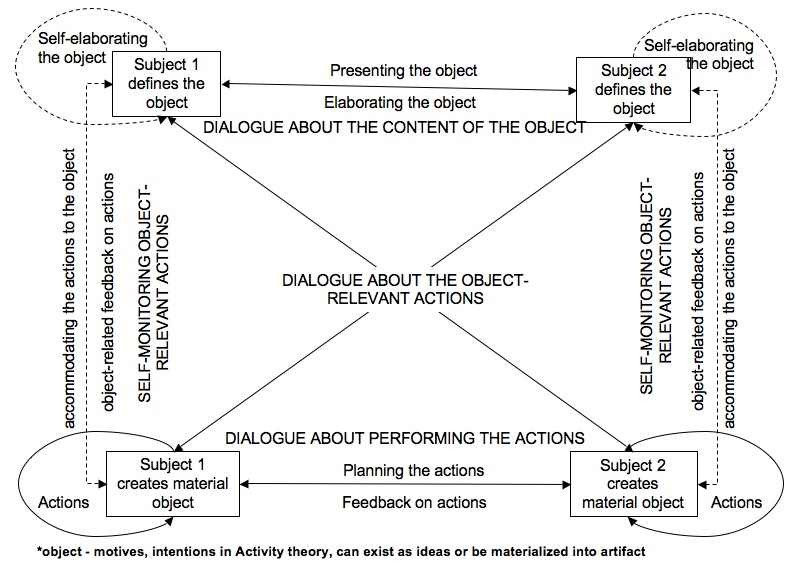

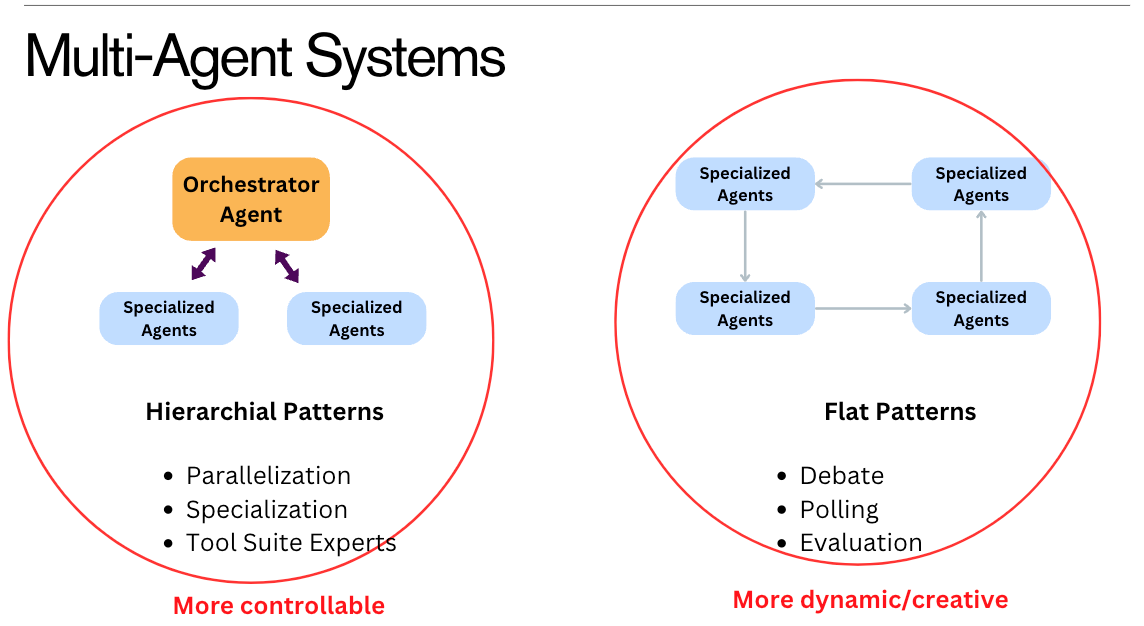

5. Multi-Agent Architecture for Crypto Intelligence

5.1 Agent Specialization

Agents are specialized by:

Specialization increases system diversity and resilience.

5.2 Interaction Mechanisms

Agents interact via:

Disagreement is preserved as informational richness rather than noise.

Consensus is valuable only when disagreement is first allowed.

---

6. On-Chain Data as a Cognitive Substrate

On-chain data forms the sensory field of crypto intelligence. However, raw data must be transformed into semantic representations, such as:

Decentralized systems excel at parallel abstraction.

---

7. Evolutionary Learning and Incentive Alignment

7.1 Performance-Based Selection

Agents are continuously evaluated. High-performing agents gain influence; poor performers are down-weighted or replaced.

7.2 Exploration vs Exploitation

Evolutionary pressure balances:

This prevents stagnation and improves adaptability.

| Mechanism | Role |

|---|---|

| Mutation | Innovation |

| Selection | Noise reduction |

| Diversity | Robustness |

SimianX AI integrates these principles to sustain long-term intelligence quality.

---

8. Predicting Market Evolution vs Price Prediction

Price prediction focuses on what will happen next. Market evolution focuses on what kind of market is forming.

8.1 Evolutionary Indicators

Decentralized cognitive systems identify these indicators earlier than centralized models.

---

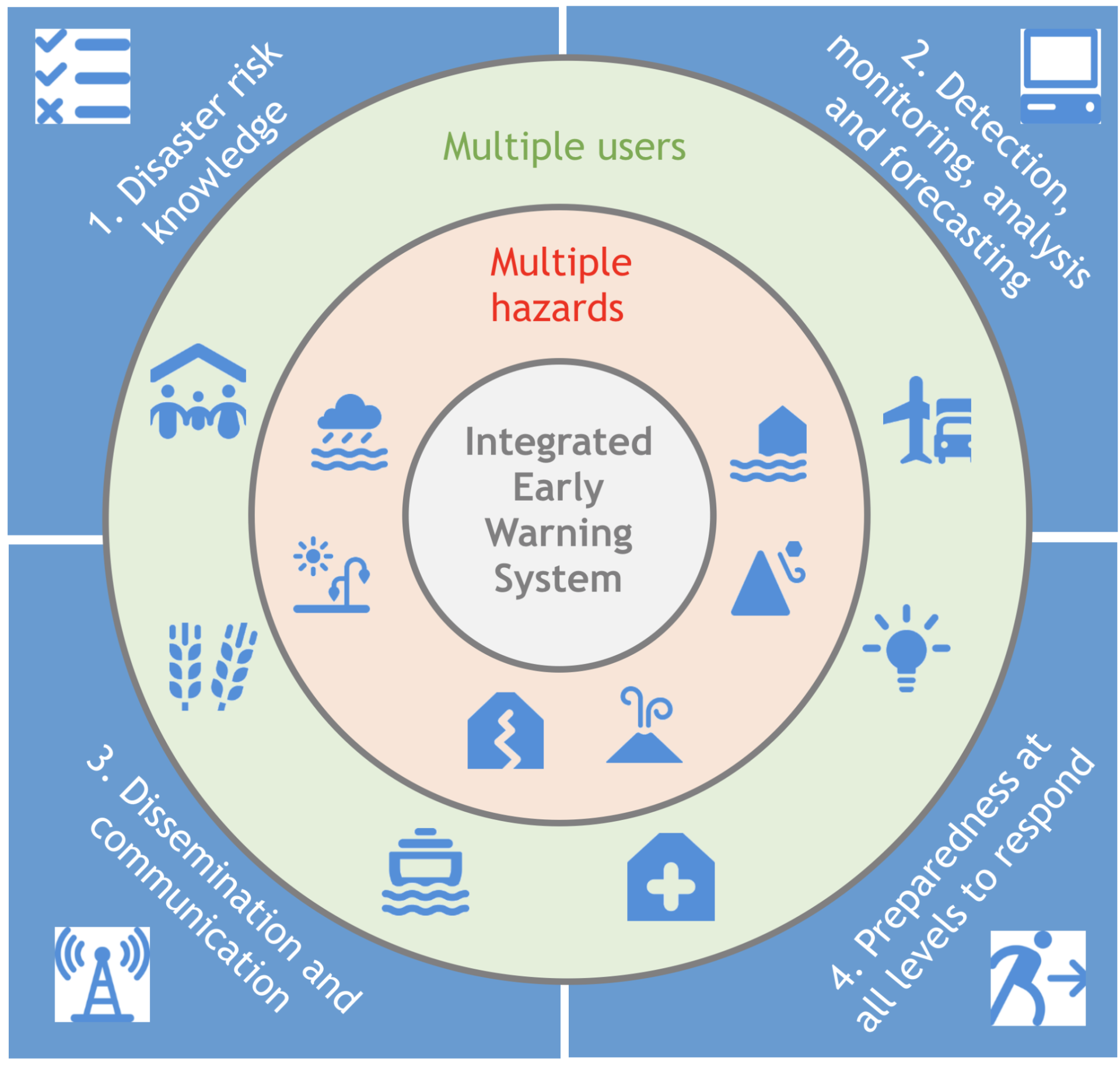

9. Risk Topology and Early Warning Systems

Decentralized crypto intelligence is particularly effective at tail-risk detection.

9.1 Early Warning Workflow

1. Liquidity agent detects abnormal outflows

2. Volatility agent confirms regime instability

3. Funding agent flags leverage imbalance

4. System escalates risk state

This layered confirmation reduces false positives.

---

10. Comparative Analysis of Intelligence Paradigms

| Paradigm | Adaptability | Robustness | Interpretability |

|---|---|---|---|

| Technical Analysis | Low | Low | Medium |

| Centralized AI | Medium | Medium | Low |

| Decentralized Cognition | High | Very High | High |

Decentralized cognition dominates in adversarial, fast-evolving environments.

---

11. Practical Applications

Decentralized crypto intelligence supports:

SimianX AI applies this framework to deliver actionable intelligence rather than opaque predictions.

---

12. Implementation Challenges and Open Research Questions

12.1 Coordination Overhead

Scaling agent interaction without information overload remains an open challenge.

12.2 Explainability

Balancing emergent intelligence with human interpretability requires careful system design.

12.3 Adversarial Resistance

Future research must address strategic manipulation of agent incentives.

---

13. Future Directions

Key research frontiers include:

Decentralized crypto intelligence may ultimately evolve into a general market cognition layer.

---

14. Conclusion

Crypto markets demand intelligence systems that match their complexity. Decentralized cognitive systems redefine crypto intelligence by distributing perception, reasoning, and learning across adaptive multi-agent networks. Rather than chasing price signals, these systems reason about market evolution, risk topology, and structural change.

Platforms such as SimianX AI demonstrate how decentralized cognition can be operationalized today—transforming raw blockchain data into resilient, interpretable, and forward-looking intelligence. As crypto markets continue to evolve, decentralized cognitive systems are not merely an improvement; they are a necessity.

To explore next-generation crypto intelligence in practice, visit SimianX AI.