Which cryptocurrencies can and cannot be traded using artificial intelligence?

If you’re trying to understand which cryptocurrencies can and cannot be traded using artificial intelligence, the most accurate answer is not a fixed list of tickers—it’s a set of constraints. AI can “decide” to trade anything, but it can only execute trades where (1) a market exists, (2) you have legal and technical access, and (3) the asset’s mechanics don’t block you from entering and exiting. This research-style guide explains those constraints, then translates them into a practical taxonomy you can apply on any exchange or DEX. Along the way, we’ll reference SimianX AI as a structured research workflow that helps you document assumptions, test hypotheses, and avoid “black box” decisions in fast-moving crypto markets.

What “AI trading” really means in crypto (and why it matters)

“AI trading” can describe several different systems:

In practice, the question “can AI trade this coin?” becomes:

Can I get reliable market data and place orders, then exit the position, in a way that is legal and repeatable?

That definition reveals why “can” and “cannot” depend on the venue, jurisdiction, and token mechanics, not just the token name.

The tradability checklist: the 6 constraints that decide “can” vs “cannot”

A cryptocurrency is AI-tradable if it passes these constraints.

1. Market access (listing + pairs)

- The asset must be listed on a venue you can use (CEX/DEX).

- There must be a usable trading pair (e.g., BTC/USDT, ETH/USD, SOL/USDC).

2. Execution access (API + account permissions)

- Your venue must allow programmatic trading (API keys, rate limits, order types).

- Your account must be permitted to trade that asset (region rules, KYC tier, product eligibility).

3. Liquidity and market quality

- Enough depth to enter/exit without huge slippage.

- Reasonable spreads and stable order-book behavior.

4. Data availability

- Adequate historical data (OHLCV, order book, funding rates if derivatives).

- Stable, consistent symbol mapping (no constant re-tickering across venues).

5. Token mechanics and transfer rules

- No “can buy but cannot sell” mechanics.

- No blacklist/whitelist behavior that blocks your address.

- No transfer-pauses that trap inventory.

6. Compliance and operational risk

- Your jurisdiction and venue policies allow trading.

- You can custody, settle, and manage risk (position limits, circuit breakers).

If any of these fail, the coin is “cannot”—not in the philosophical sense, but in the engineering + risk + compliance sense that matters for AI systems.

A practical taxonomy: coins AI can trade (most of the time)

Below is a useful categorization for AI trading systems. These are not promises of profit—just execution feasibility.

Category A: “Almost always AI-tradable” (high liquidity, stable markets)

These tend to have:

Typical examples:

SOL, BNB, ADA, AVAX, MATIC/POL, ARB, OP

LINK

Why AI likes them: lower slippage, cleaner signals, more robust order-book behavior, better survivability in regime shifts.

Category B: “Usually tradable, but model risk is higher” (mid-cap & narrative-driven)

These are tradable on many venues but can be:

Typical examples (illustrative, not exhaustive):

UNI, AAVE, CRV (varies by venue)

AI caution: your model must handle regime changes (e.g., a token behaves “mean-reverting” for months, then becomes purely narrative-driven).

Category C: “Technically tradable, but execution is fragile” (new listings, small caps, meme coins)

Many meme coins and new listings are tradeable, but:

AI can trade them only if:

In AI trading, the hardest part isn’t prediction—it’s surviving bad liquidity.

Which cryptocurrencies cannot be traded using artificial intelligence (in practice)?

This is the part most traders actually mean by “cannot”: assets that block automation or safe exit.

1) Not listed on your accessible venue (or no API trading)

If a token isn’t listed where you can trade (or the venue doesn’t allow API execution for that market), then your AI cannot trade it—full stop.

2) Region-restricted or compliance-blocked assets

Even if a token is globally “tradable,” you may be blocked by:

For AI systems, compliance constraints are part of the “environment.” If your AI’s action space excludes a token, it’s non-tradable for that system.

3) Tokens with transfer restrictions that trap inventory

On-chain, some tokens include rules that can make you effectively unable to exit:

From an AI perspective, these are unmodeled state constraints—your “sell” action may fail or be economically irrational.

4) Honeypots and “can buy but cannot sell” scams

On DEXs especially, some tokens are engineered so users can buy but cannot sell (or can only sell if whitelisted). These are categorically non-tradable for any sane AI system, because the exit is structurally blocked.

5) Non-transferable or non-market assets

Some crypto-like items are not meant to be traded:

AI can “analyze” them, but cannot execute trades because there is no valid market mechanism.

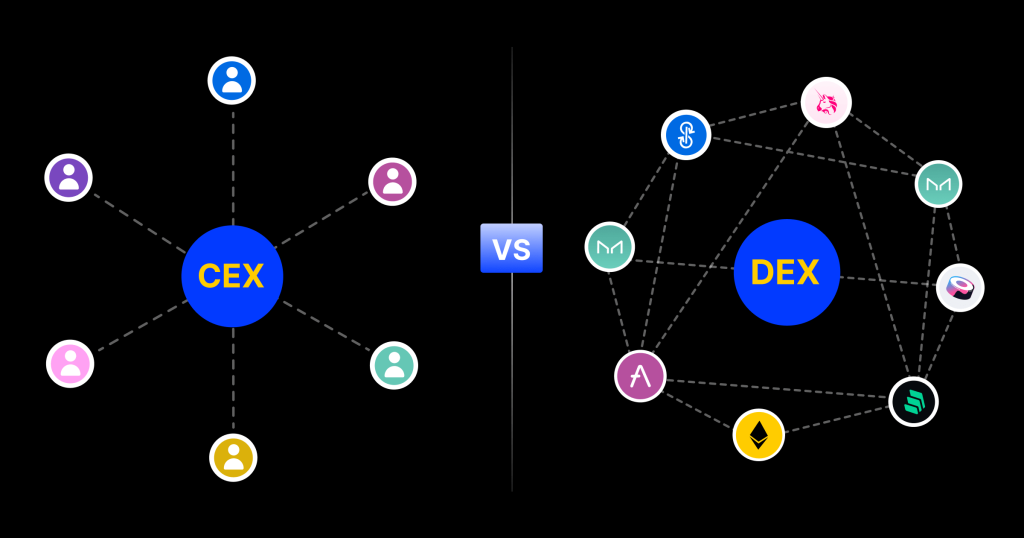

CEX vs DEX: where “can” becomes “maybe”

Centralized exchanges (CEXs)

Pros for AI trading:

Cons:

Decentralized exchanges (DEXs)

Pros:

Cons:

Rule of thumb:

AI trading on DEXs is feasible, but your “cannot” set grows because you must detect contract-level traps and execution hazards.

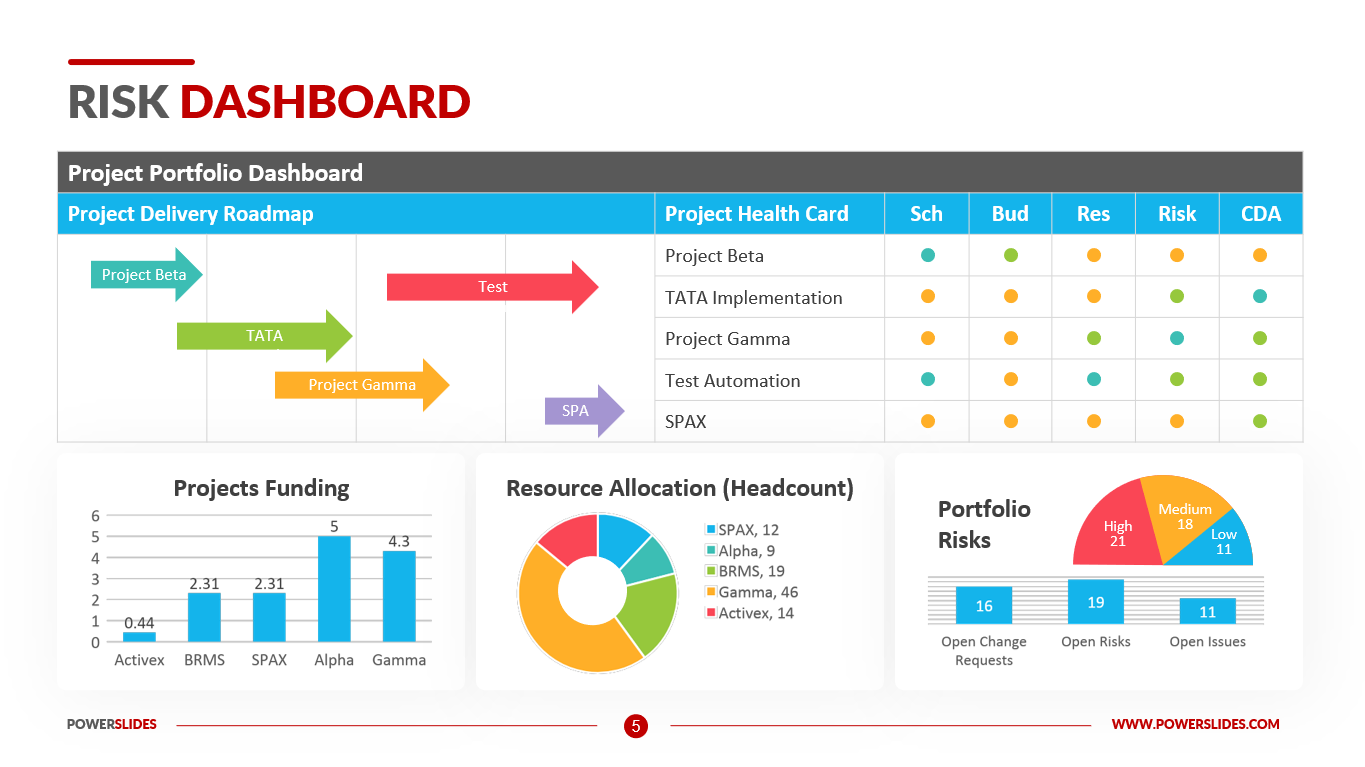

A scoring framework you can apply to any coin (including ones you’ve never seen)

Instead of asking for a static list, score each asset with a simple rubric.

Tradability score (0–10)

Assign 0–2 points for each dimension:

| Dimension | 0 points | 1 point | 2 points |

|---|---|---|---|

| Venue access | Not accessible | Limited | Fully accessible |

| API execution | No API / blocked | Partial | Full support |

| Liquidity | Thin / unstable | Moderate | Deep |

| Data history | Minimal | Some | Extensive |

| Exit reliability | Risky | Mostly ok | Reliable |

Interpretation:

This is where SimianX AI fits naturally: use a structured workflow to document the score, the evidence behind it, and the risk assumptions before capital is deployed.

Step-by-step: how to build an “AI-tradable universe” safely

1. Choose your venue(s) (CEX, DEX, or both) and list all available symbols.

2. Filter by compliance (your region + account eligibility + product type).

3. Filter by liquidity using objective metrics (spread, depth, volume, slippage simulation).

4. Check data availability (history length, missing candles, symbol stability).

5. Run token-mechanics checks for on-chain assets (transfer restrictions, taxes, blacklists).

6. Backtest with realistic costs (fees + slippage + latency + partial fills).

7. Deploy with guardrails:

- max position size,

- max daily loss,

- circuit breaker on abnormal spreads,

- kill-switch on repeated order failures.

A coin isn’t “AI-tradable” until it is tradable with guardrails.

A practical “red flags” list for the “cannot” bucket

Examples: what tends to be tradable vs non-tradable (patterns, not promises)

Usually tradable (pattern)

BTC, ETH

Often “cannot” (pattern)

FAQ About which cryptocurrencies can and cannot be traded using artificial intelligence

Can AI trade any coin that exists on a blockchain?

Not necessarily. AI can only trade what it can reliably execute and exit. Many tokens exist without liquid markets, accessible venues, or safe transfer mechanics.

What crypto is best for AI trading bots?

In general, highly liquid assets with long histories (often BTC and ETH) are easiest to trade with AI. They reduce slippage and make backtests more realistic.

How do I know if a token is a honeypot or has sell restrictions?

On DEXs, you should treat unknown tokens as hostile until proven otherwise: check contract behavior, simulate buys/sells, and verify transfer rules. If selling fails or fees become extreme, it’s functionally non-tradable.

Are stablecoins tradable using AI?

Yes, but stablecoins usually have low volatility, so they are typically used for pairing, routing, and risk-off parking rather than directional strategies.

Do I need a special platform to do AI crypto trading research?

You can build everything yourself, but a structured workflow helps avoid “model drift” and inconsistent assumptions. Tools like SimianX AI can help organize research, compare scenarios, and keep a documented decision trail.

Conclusion

So, which cryptocurrencies can and cannot be traded using artificial intelligence? Most major cryptocurrencies can be traded by AI if you have venue access, API execution, sufficient liquidity, reliable data, and a clean exit path. Coins that are unlisted, region-blocked, transfer-restricted, or engineered to prevent selling fall into the practical “cannot” category—especially for automated systems that must be robust, repeatable, and risk-controlled.

If you want a cleaner process to define your tradable universe, score assets consistently, and turn research into actionable rules, explore SimianX AI as a structured way to document assumptions and improve decision quality before you deploy capital.