Cryptocurrencies Based on Multi-Agent AI: Real-Time Prediction and Trading Strategies

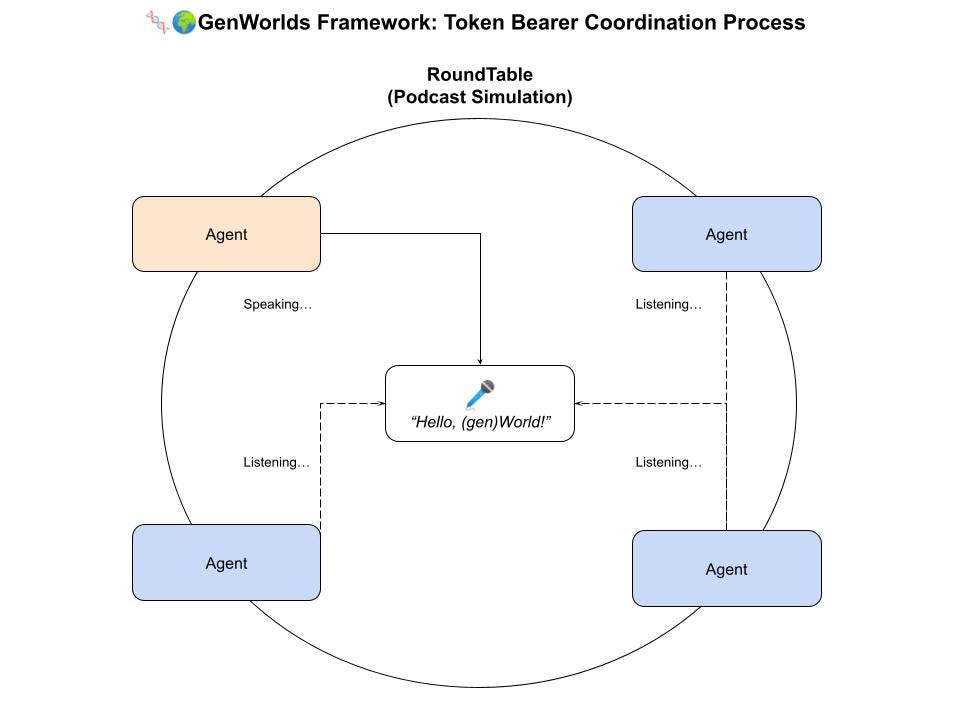

The rapid evolution of cryptocurrencies based on multi-agent AI is redefining how real-time prediction and trading strategies are designed and executed in volatile digital asset markets. Instead of relying on a single monolithic model, multi-agent AI systems coordinate multiple intelligent agents—each specializing in market signals, risk, execution, or strategy optimization—to operate collectively. For platforms like SimianX AI, this architecture offers a scalable and transparent approach to crypto analysis, helping traders and institutions respond faster to market changes while managing downside risk.

Why Multi-Agent AI Matters in Cryptocurrency Markets

Cryptocurrency markets are fragmented, highly volatile, and influenced by on-chain activity, derivatives flows, sentiment, and macro signals. Single-model systems often struggle to adapt in real time. Multi-agent AI addresses this by decomposing the trading problem into specialized roles.

Key advantages include:

In fast-moving crypto markets, speed alone is not enough—coordination between intelligent agents is what creates durable edge.

Multi-agent AI cryptocurrency trading systems are therefore better suited for environments where regime shifts happen without warning.

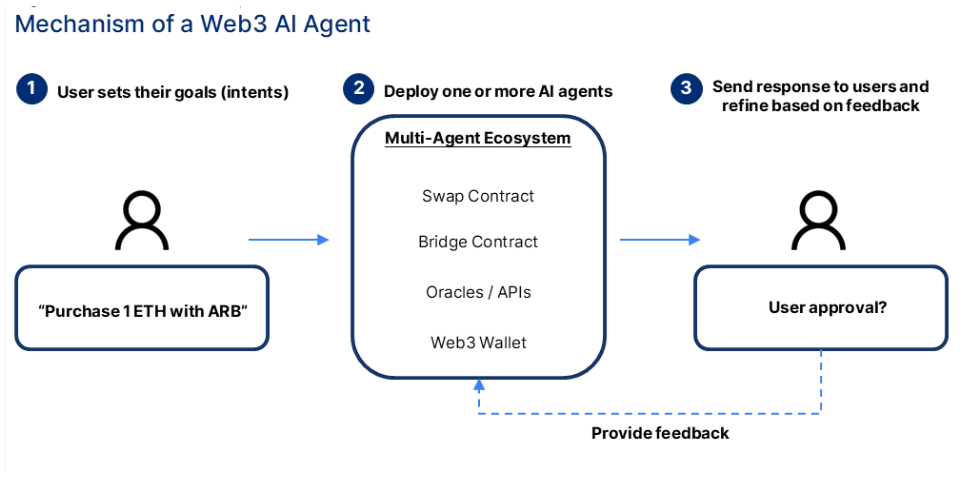

Architecture of Multi-Agent AI Crypto Trading Systems

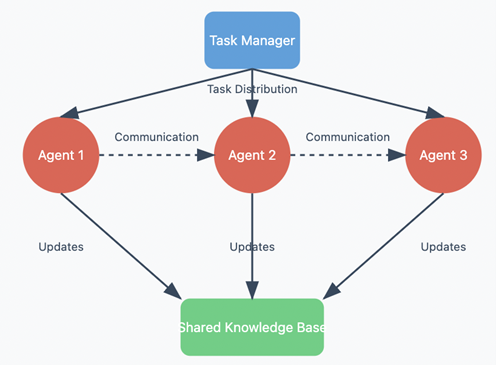

A typical multi-agent AI trading stack is composed of several interacting layers:

| Agent Type | Primary Function |

|---|---|

| Data Agent | Real-time data ingestion and normalization |

| Prediction Agent | Price and volatility forecasting |

| Strategy Agent | Signal generation and portfolio logic |

| Risk Agent | Exposure limits and stress testing |

| Execution Agent | Trade execution and cost optimization |

Platforms such as SimianX AI integrate these layers into a unified research and monitoring workflow, allowing users to understand not only what decision was made, but why it emerged from agent consensus.

Real-Time Prediction with Multi-Agent AI

How does multi-agent AI improve crypto price prediction?

Traditional models output a single forecast. In contrast, multi-agent AI for real-time crypto prediction produces a distribution of views:

The system then aggregates these perspectives into a probabilistic outlook rather than a fixed price target.

This approach improves:

1. Prediction stability during volatility spikes

2. Early detection of regime changes

3. Confidence-weighted signal generation

Trading Strategies Powered by Multi-Agent AI

Multi-agent AI does not rely on one universal strategy. Instead, agents dynamically activate or deactivate strategies based on market context.

Common strategies include:

AI agents trading strategies can be tested in parallel, with underperforming agents downgraded automatically.

The true strength of multi-agent systems lies in adaptive strategy selection, not static optimization.

Risk Management in Multi-Agent AI Trading

Risk in crypto markets is non-linear. Multi-agent systems explicitly model this by assigning risk agents to monitor:

AI-driven crypto risk management ensures that aggressive prediction agents cannot override systemic safety constraints. This separation of power is critical for sustainable performance.

| Risk Signal | Agent Response Example |

|---|---|

| TVL drop | Reduce exposure automatically |

| Funding spike | Hedge or neutralize positions |

| Volatility surge | Shift to capital preservation mode |

What Are the Limitations of Multi-Agent AI in Crypto?

What is the downside of multi-agent AI trading systems?

Despite their advantages, multi-agent AI cryptocurrency systems face real challenges:

This is why platforms like SimianX AI emphasize interpretability, auditability, and clear visualization of agent outputs rather than black-box execution.

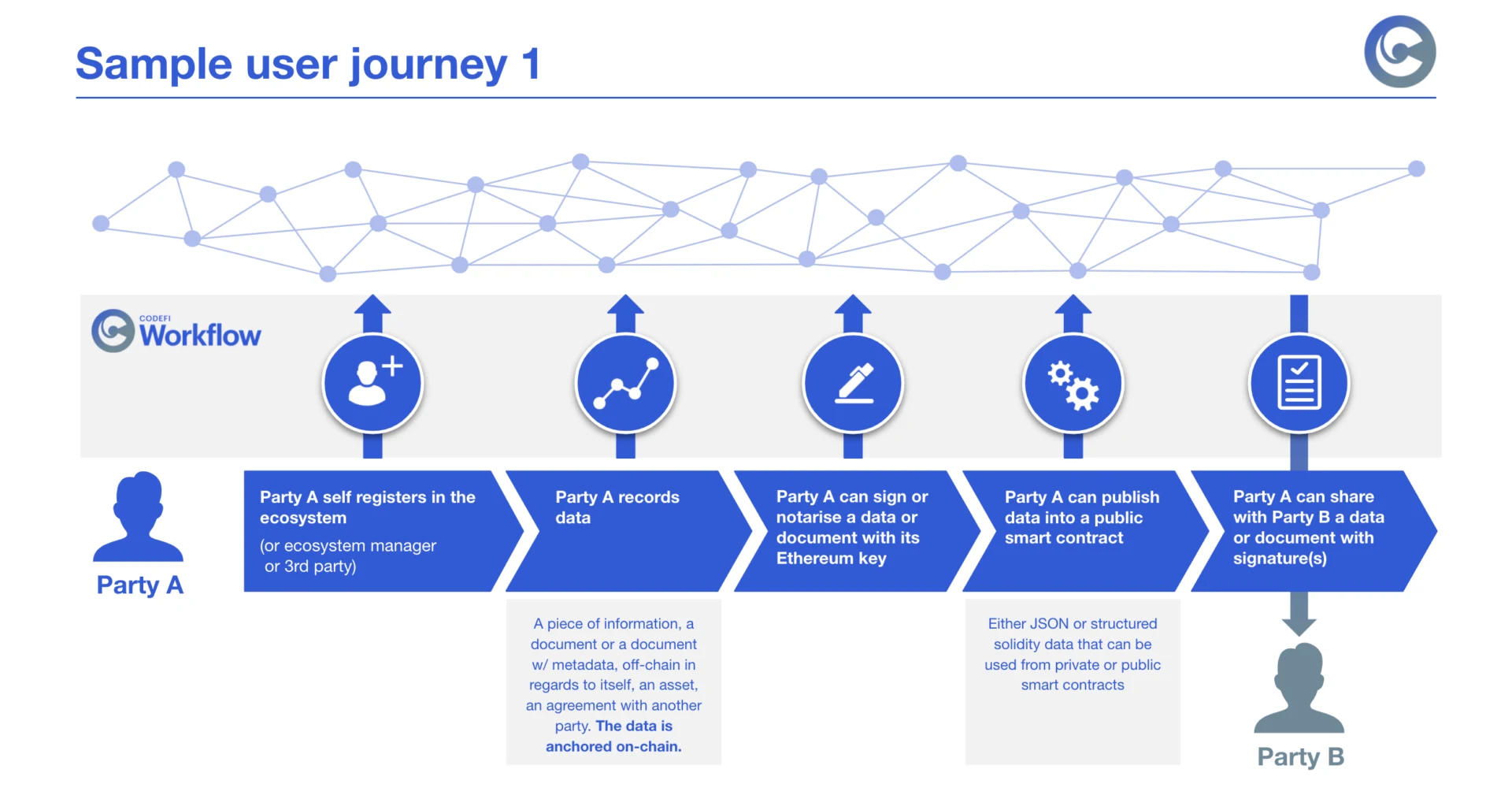

Practical Use Cases for Traders and Funds

Multi-agent AI is already being used for:

For individual traders, this means clearer signals and fewer emotional decisions. For funds, it enables scalable research without linear increases in analyst headcount.

SimianX AI provides practical tooling that bridges research, prediction, and execution into one coherent system.

FAQ About Cryptocurrencies Based on Multi-Agent AI

What is multi-agent AI in cryptocurrency trading?

Multi-agent AI uses multiple specialized AI agents that collaborate to analyze data, predict prices, manage risk, and execute trades in crypto markets.

How accurate is multi-agent AI for real-time crypto prediction?

Accuracy improves through consensus and redundancy. Instead of relying on one forecast, multi-agent systems weigh multiple independent signals to reduce error.

Can multi-agent AI reduce trading risk?

Yes. Dedicated risk agents continuously monitor exposure, liquidity, and tail risks, preventing overconfidence from any single strategy.

Is multi-agent AI suitable for retail traders?

When abstracted through platforms like SimianX AI, multi-agent systems become accessible without requiring deep technical expertise.

Conclusion

Cryptocurrencies based on multi-agent AI represent a structural shift in how prediction and trading strategies are built. By coordinating intelligent agents across data, strategy, and risk, these systems deliver more resilient real-time decision-making in volatile markets. As crypto continues to evolve, traders and institutions that adopt multi-agent architectures will gain a durable analytical edge. To explore practical applications and production-ready tools, visit SimianX AI and see how multi-agent intelligence can transform your crypto research and trading workflow.