Cryptocurrency Market Analysis Based on Multi-Agent AI for Real-Time Trading

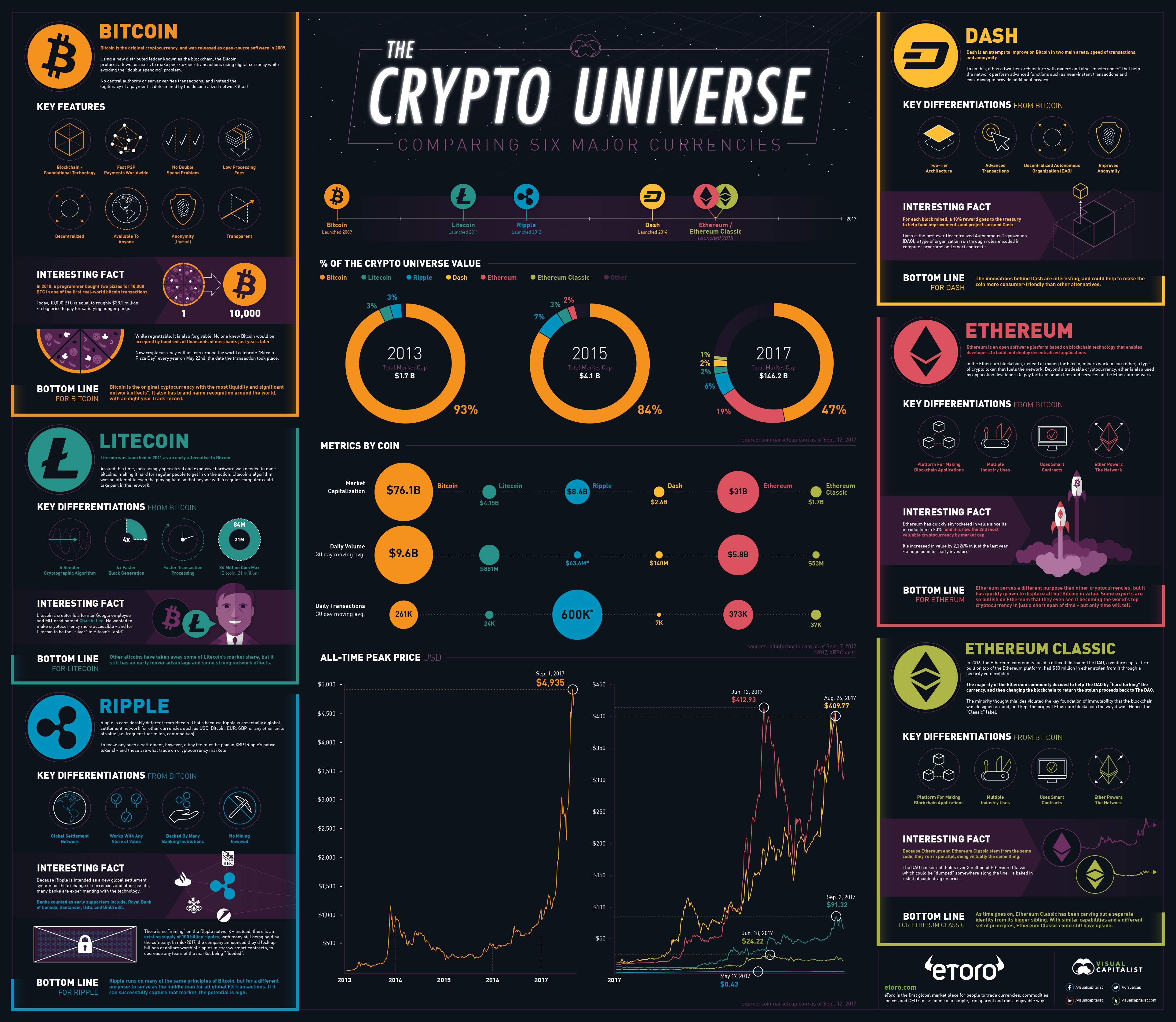

Cryptocurrency market analysis based on multi-agent AI is emerging as a new paradigm for real-time trading in highly volatile, always-on digital asset markets. Unlike traditional financial markets, crypto operates without centralized market makers, without trading halts, and with extreme reflexivity driven by narratives, liquidity flows, and on-chain behavior.

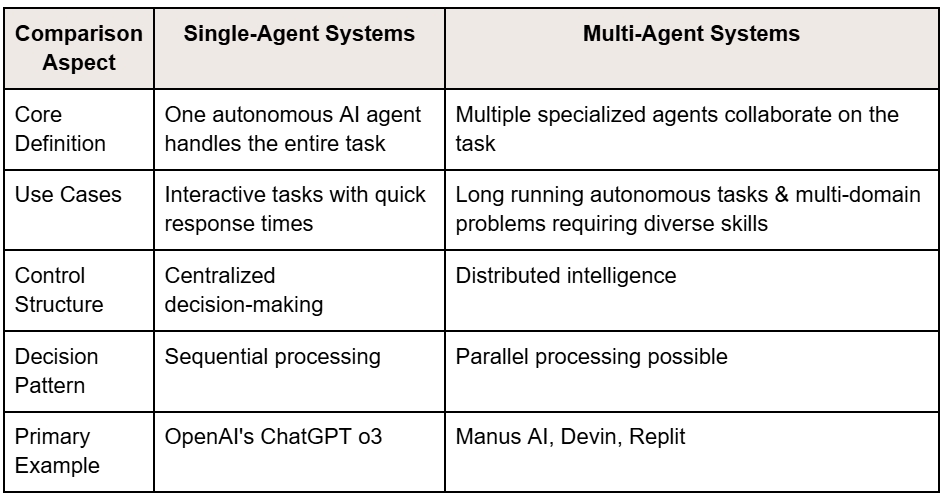

In this environment, single-model AI systems are structurally insufficient. They react too slowly, overfit historical regimes, and fail to contextualize real-time shocks. Multi-agent AI systems—now actively explored and operationalized by platforms like :contentReference[oaicite:0]{index=0}—offer a fundamentally different approach: distributed intelligence, parallel reasoning, and adaptive coordination.

---

The Structural Complexity of Cryptocurrency Markets

Cryptocurrency markets are not just volatile—they are structurally complex systems with interacting feedback loops:

Traditional models assume relative stationarity. Crypto markets violate this assumption constantly.

Crypto markets are not noisy versions of TradFi—they are nonlinear adaptive systems.

Why Real-Time Matters More in Crypto Than Anywhere Else

Real-time trading is not an optimization—it is a survival requirement.

---

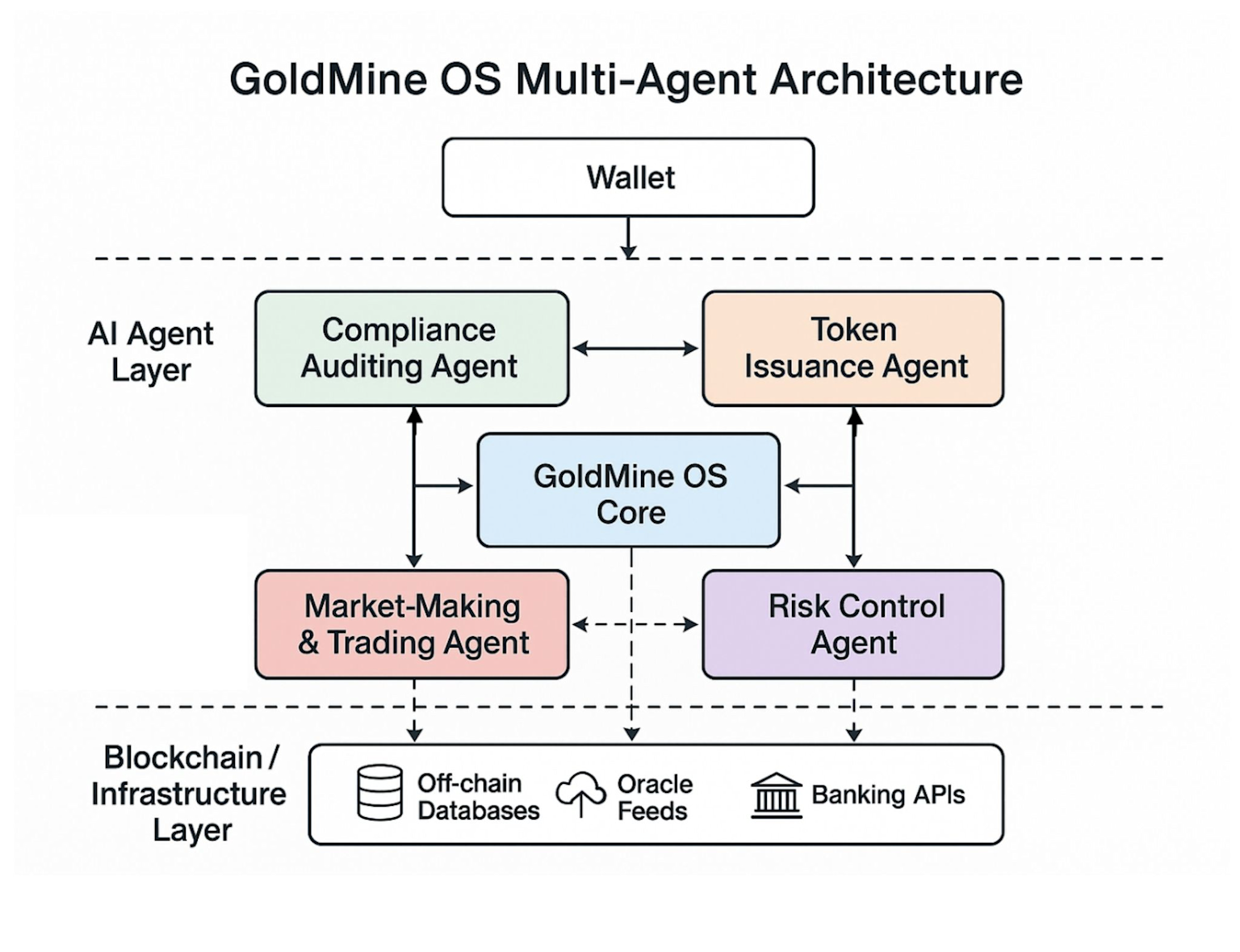

What Is Multi-Agent AI in Cryptocurrency Market Analysis?

Multi-agent AI refers to a system composed of multiple autonomous yet cooperative AI agents, each designed to perceive, reason, and act on a specific dimension of the market.

Instead of asking “What is the price going to do?”, the system asks:

Core Agent Archetypes in Crypto Trading

| Agent Type | Primary Role | Data Sources |

|---|---|---|

| Price Agent | Short-term price dynamics | Order books, OHLCV |

| On-Chain Agent | Capital movement & behavior | Wallets, TVL, flows |

| Sentiment Agent | Narrative & attention | Social, governance |

| Risk Agent | Tail risk & drawdowns | Volatility, correlations |

| Execution Agent | Trade quality | Slippage, liquidity |

Each agent is independently intelligent but collectively constrained.

---

Why Single-Model AI Trading Systems Fail in Crypto

1. Regime Collapse

Models trained on trending markets fail during chop or panic.

2. Signal Entanglement

Price, liquidity, and sentiment are collapsed into a single latent space.

3. Centralized Failure

One wrong assumption → total system failure.

In crypto, model monoculture equals systemic fragility.

Multi-agent AI introduces cognitive diversity—a proven principle in complex systems.

---

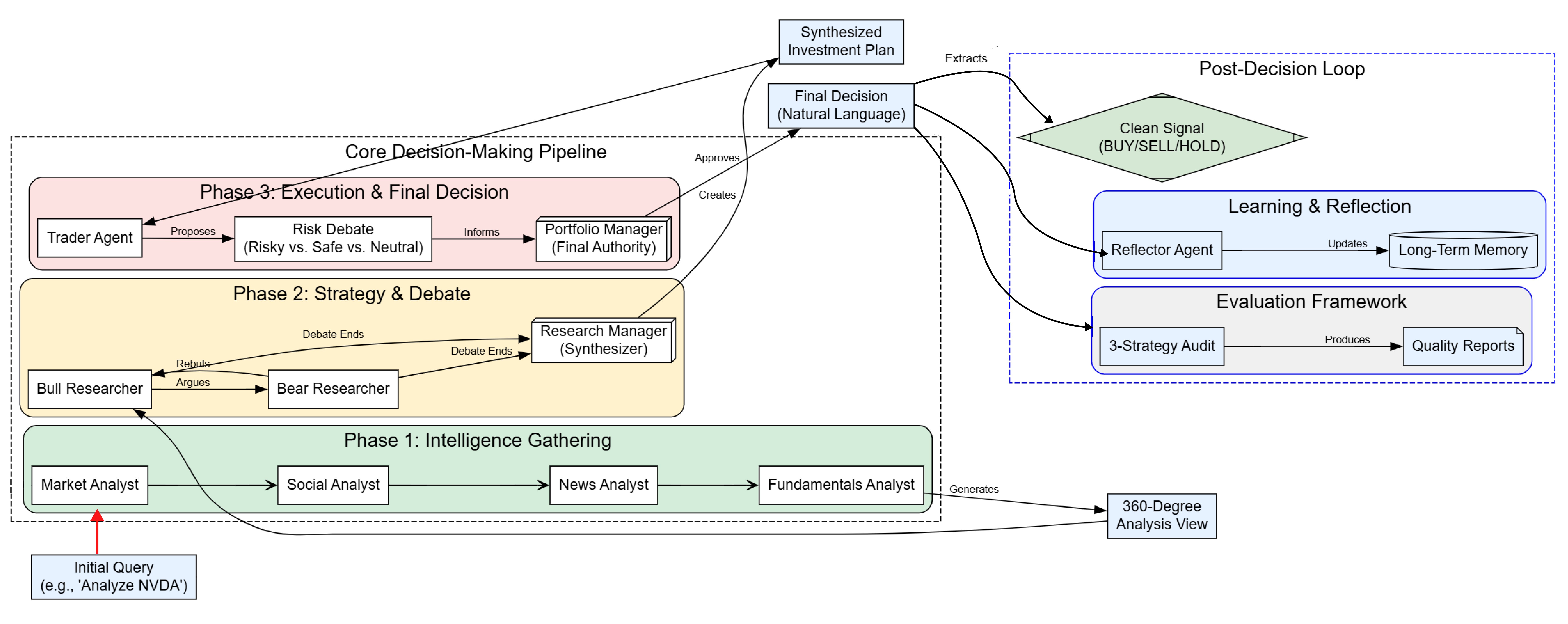

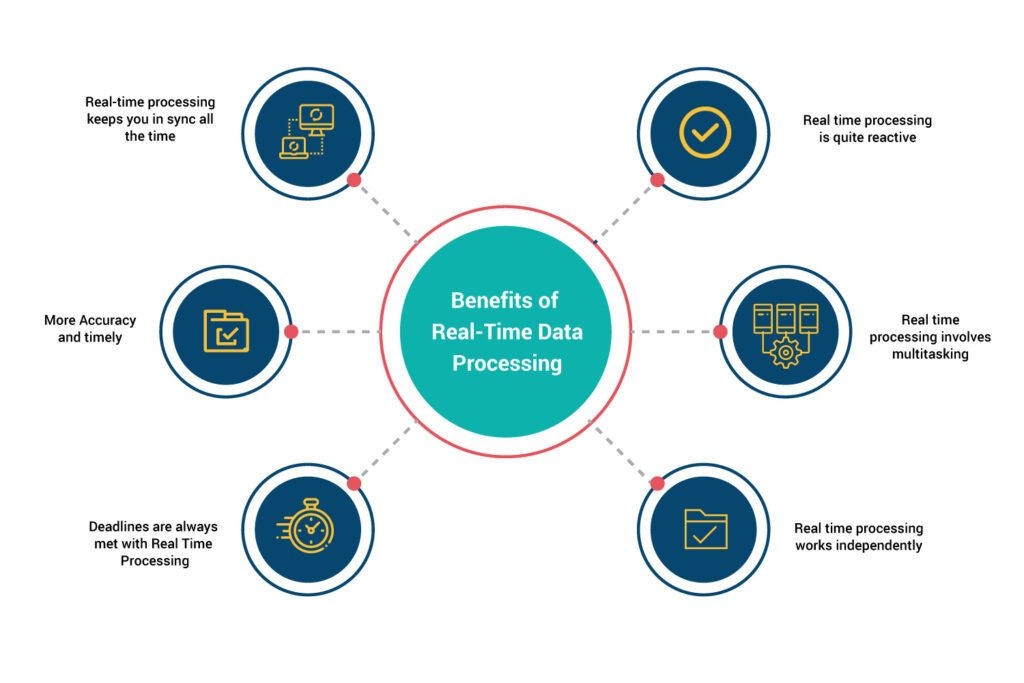

How Multi-Agent AI Enables Real-Time Crypto Trading

Parallel Signal Processing

Each agent ingests and updates signals simultaneously, reducing latency and blind spots.

Real-Time Consensus & Conflict Resolution

Agents do not need to agree. Instead, they negotiate through:

Continuous Policy Updating

Strategies are not static. They evolve with market conditions.

---

Multi-Agent Coordination Mechanisms

Coordination is the hardest problem—and the biggest advantage.

Common Coordination Models

1. Central Orchestrator

- Simple, fast

- Risk of bottleneck

2. Market-Based Agents

- Agents bid for capital

- Capital flows to strongest signals

3. Hierarchical Agents

- Macro agents constrain micro agents

SimianX AI focuses on risk-first coordination, where alpha is always subordinate to survivability.

---

On-Chain Intelligence as a First-Class Agent

Crypto is uniquely transparent. Multi-agent AI systems exploit this by assigning dedicated on-chain agents.

What On-Chain Agents Monitor

Price follows liquidity, but liquidity follows intent—on-chain data reveals intent.

---

Multi-Agent AI for Risk Management and Capital Preservation

How Does Multi-Agent AI Manage Risk?

Instead of embedding risk inside alpha models, risk becomes its own sovereign agent.

Risk agents evaluate:

When risk rises, alpha is throttled automatically.

---

Strategy Classes Enabled by Multi-Agent AI

1. Real-Time Market Regime Switching

Trend-following ↔ mean reversion ↔ capital preservation

2. Liquidity-Aware Execution

Avoiding slippage during thin books

3. Event-Driven Trading

Governance votes, unlocks, emissions changes

4. Yield-to-Risk Rotation

Capital shifts based on true yield sustainability

---

Practical Walkthrough: A Real-Time Trade Decision

1. On-chain agent detects stablecoin inflows to exchanges

2. Sentiment agent flags bullish narrative acceleration

3. Price agent confirms volatility expansion

4. Risk agent validates drawdown tolerance

5. Execution agent routes orders dynamically

All within seconds.

---

Performance Advantages Over Human and Traditional AI Trading

| Dimension | Human | Single AI | Multi-Agent AI |

|---|---|---|---|

| Speed | Slow | Fast | Ultra-fast |

| Adaptability | Medium | Low | High |

| Risk Control | Emotional | Implicit | Explicit |

| Transparency | Low | Low | High |

Multi-agent systems do not replace humans—they scale human intent.

---

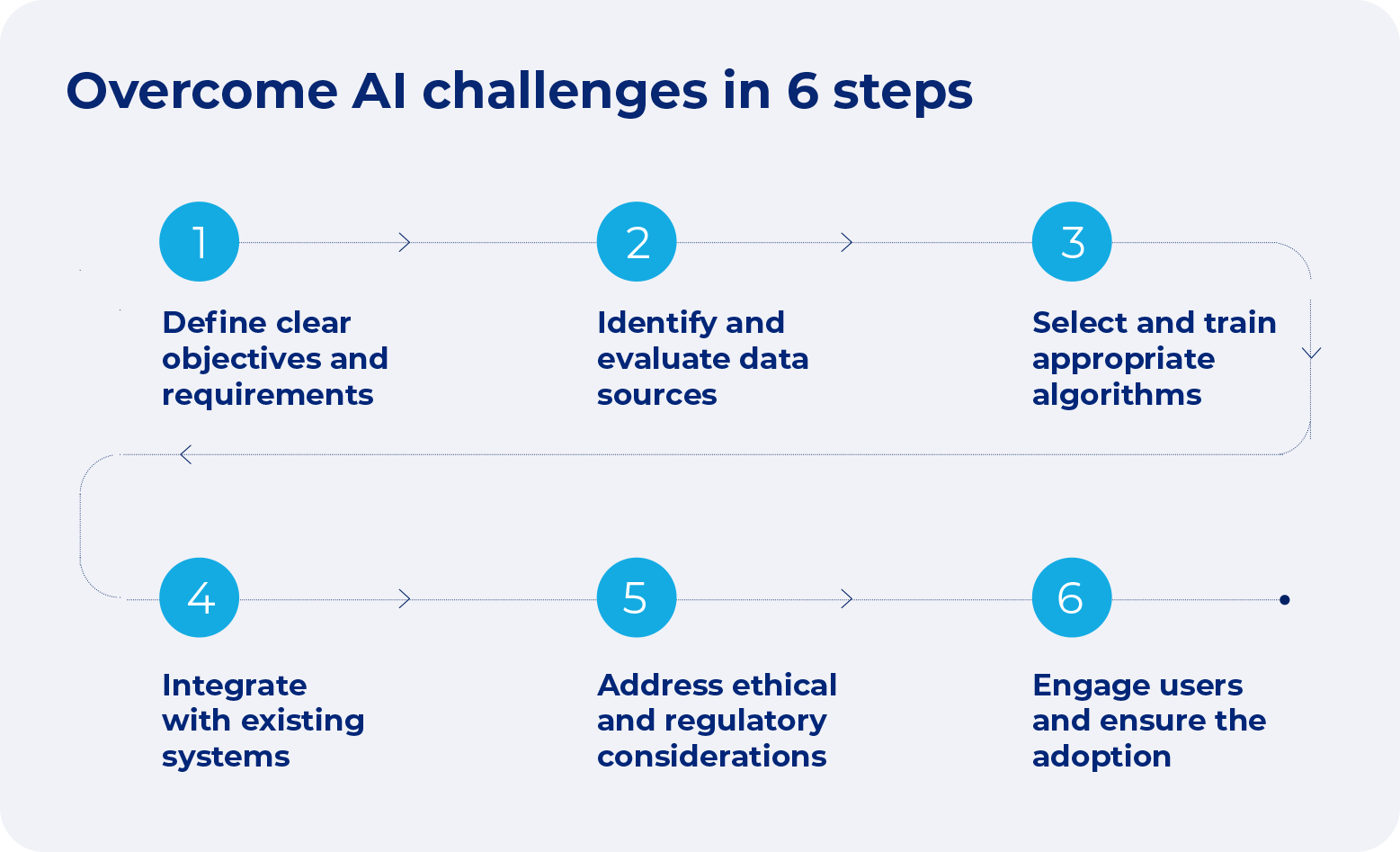

Challenges and Design Trade-Offs

Despite its power, multi-agent AI is not trivial.

Key Challenges

This is why platform abstraction matters. SimianX AI removes infrastructure friction while preserving strategic control.

---

Future Outlook: Toward Autonomous Crypto Markets

Multi-agent AI is a stepping stone toward:

Crypto markets are becoming machine-speed ecosystems.

---

FAQ About Cryptocurrency Market Analysis Based on Multi-Agent AI

What is multi-agent AI in crypto trading?

It is a system where multiple specialized AI agents collaborate to analyze markets, manage risk, and execute trades in real time.

How does multi-agent AI improve real-time trading?

By processing signals in parallel, adapting to regime shifts, and reducing single-model failure risk.

Is multi-agent AI only for quantitative funds?

No. Platforms like SimianX AI make multi-agent systems accessible to traders, teams, and protocols.

Does multi-agent AI rely heavily on on-chain data?

Yes. On-chain transparency is a core advantage of crypto markets and a key input for agents.

Can multi-agent AI reduce drawdowns?

While no system eliminates risk, explicit risk agents significantly improve downside protection.

---

Conclusion

Cryptocurrency market analysis based on multi-agent AI represents a structural evolution in real-time trading. By decomposing intelligence into specialized agents and coordinating them under adaptive risk constraints, traders gain resilience, speed, and clarity in chaotic markets.

As crypto markets continue to accelerate, multi-agent AI will not be optional—it will be foundational. Platforms like SimianX AI are defining how this intelligence is deployed in practice.

To explore real-time, risk-aware crypto trading powered by multi-agent AI, visit SimianX AI and step into the next generation of market intelligence.