Market Early Warning Intelligence Generated by Distributed AI Swarms in Encrypted Systems

Market early warning intelligence generated by distributed AI swarms in encrypted systems is an emerging approach to detect fragile market conditions before they become obvious in price, volatility spikes, or breaking news. Instead of relying on a single centralized model, a swarm uses many specialized agents that each watch a different slice of market reality—order book microstructure, liquidity pools, stablecoin flows, cross-chain bridges, governance events, and social coordination signals—then fuses those weak signals into a robust early-warning view.

For crypto and DeFi, where adversaries can manipulate narratives, spoof liquidity, or coordinate attacks, encryption is not “nice to have.” It’s the layer that makes swarm intelligence viable without leaking alpha or exposing participants. This is also why systems like SimianX AI increasingly position early-warning capability as a secure, agent-driven intelligence stack rather than a dashboard with lagging indicators.

Why Modern Markets Demand Early Warning (Not Just Forecasting)

In many crises, price is a late-stage symptom. The early stages tend to look like:

Traditional approaches often fail because they optimize for accuracy on historical labels, but the most dangerous scenarios are out-of-distribution. Early warning is a different objective: it tries to detect state transitions in the market’s underlying dynamics.

Key takeaway: The job of early warning is not to predict the next candle. It’s to detect when the rules of the game are changing.

Early warning vs. forecasting vs. monitoring

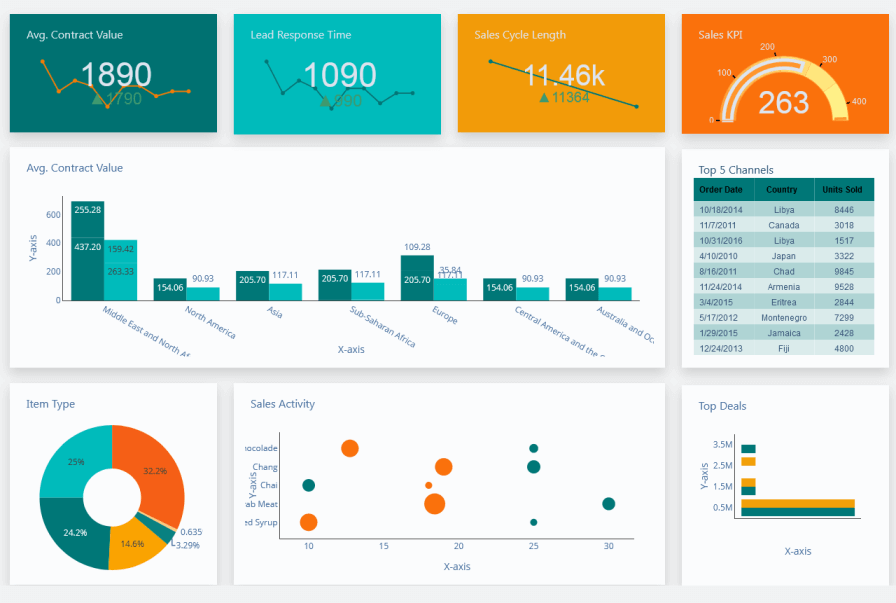

| Capability | What it answers | Typical outputs | Main weakness |

|---|---|---|---|

| Monitoring | “What is happening now?” | dashboards, KPIs | reactive |

| Forecasting | “What happens next?” | price/volatility predictions | fragile under regime change |

| Early Warning | “Are conditions becoming unstable?” | risk alerts, regime flags | requires multi-signal fusion |

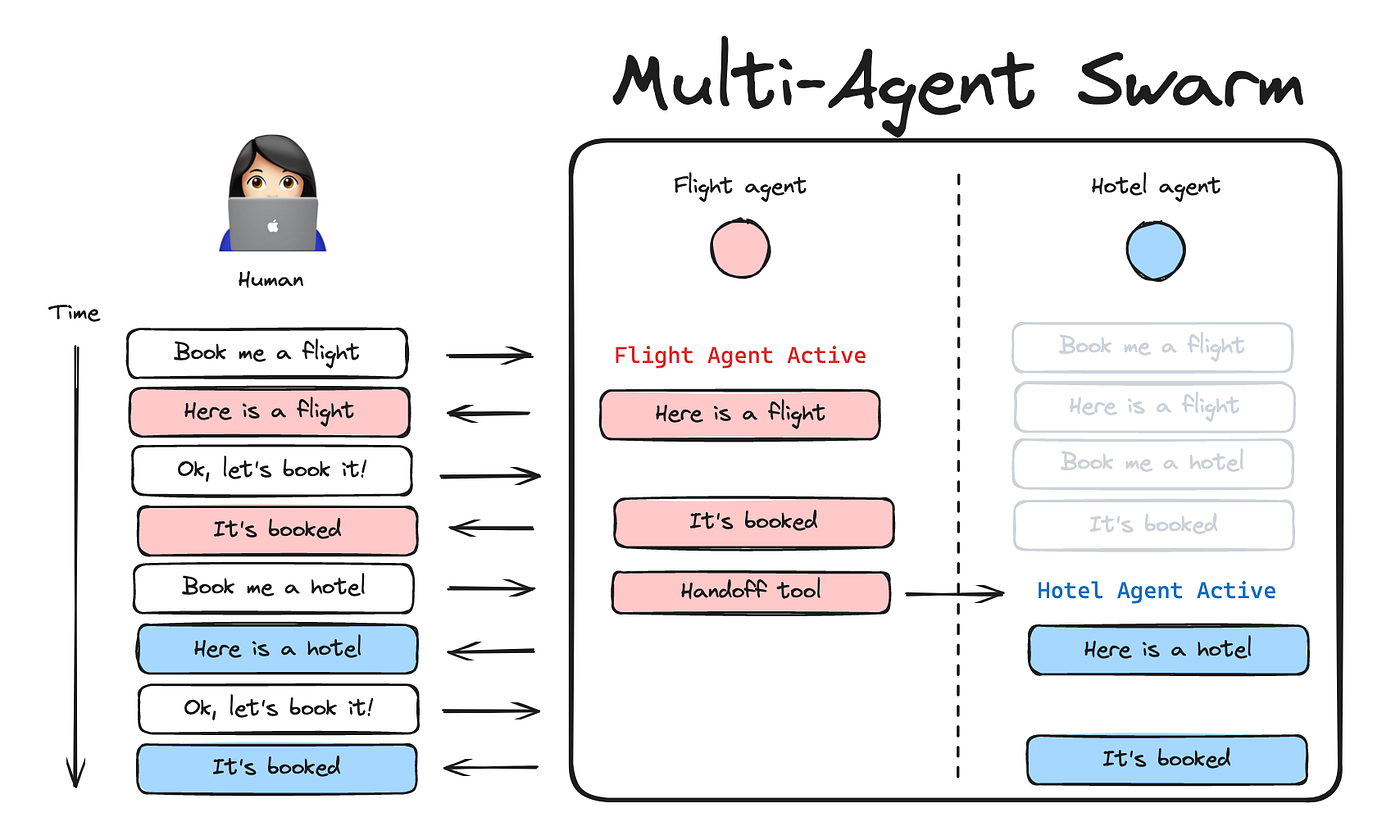

What Exactly Is a Distributed AI Swarm?

A distributed AI swarm is a population of agents that:

Unlike a monolithic model, the swarm’s strength comes from diversity:

A practical mental model

Think of the swarm as a distributed research team:

Each agent is fallible; together they become resilient.

Why Encryption Is a First-Class Requirement

Early-warning intelligence becomes less useful if:

Encrypted systems provide privacy-preserving collaboration. The goal is:

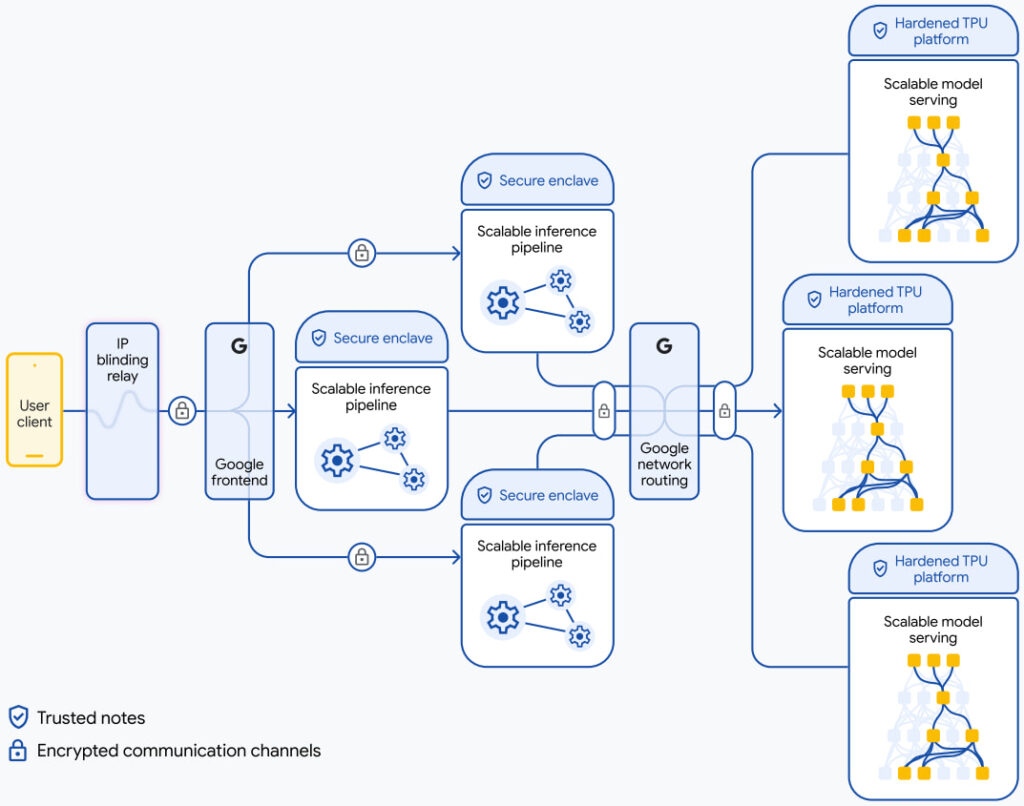

Three common secure computation paths

1. MPC (Secure Multi-Party Computation)

- Parties compute functions without revealing inputs

- Strong privacy, often higher latency and complexity

2. Homomorphic Encryption (HE)

- Compute directly on encrypted values

- Very strong privacy, heavy compute cost for complex models

3. TEEs (Trusted Execution Environments)

- Computation runs in a protected enclave

- Practical and fast, but depends on hardware trust assumptions

Design note: Most real systems are hybrid—TEEs for speed + MPC/HE for sensitive components.

A Full Architecture for Encrypted Swarm Early Warning

A production-grade system typically includes these layers:

1) Data layer (multi-domain sensing)

2) Agent layer (specialized modeling)

3) Coordination layer (encrypted fusion)

belief, confidence, evidence hash

4) Decision layer (actionable intelligence)

This is the type of architecture SimianX AI can map onto real trading and risk workflows—turning swarms into operational early-warning systems rather than research demos.

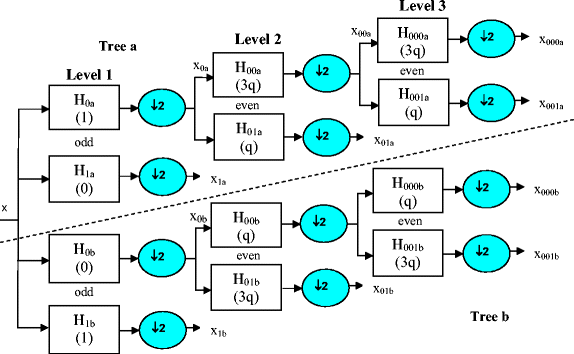

How Swarms Turn Weak Signals Into Strong Warnings

Early warning is an aggregation problem under uncertainty. A robust pipeline usually has four steps:

Step A: Local evidence extraction

Each agent produces:

Example: A liquidity agent might output:

Step B: Calibration (avoid overconfident agents)

Agents are calibrated against:

Calibration reduces “always alarm” agents and “never alarm” agents.

Step C: Robust fusion under adversaries

Instead of averaging, robust fusion can use:

Robust fusion principle: Assume some agents are wrong—or malicious—and aggregate accordingly.

Step D: Regime state estimation

The system maintains a market “state machine,” e.g.:

Warnings are triggered on state transitions, not single anomalies.

Swarm Consensus: What “Agreement” Really Means

Markets are noisy. A good swarm doesn’t need unanimous agreement. It needs structured agreement.

Useful consensus signals

Example consensus rule (conceptual)

- ≥3 independent domains show elevated risk, and

- at least one is a leading domain (flows, liquidity, credit), and

- disagreement is rising (uncertainty growing).

This prevents false alarms from single-channel noise.

| Consensus Pattern | Interpretation | Action |

|---|---|---|

| High convergence | strong signal | de-risk / hedge |

| High divergence | regime transition likely | reduce leverage, widen stops |

| Localized anomaly | possible manipulation | investigate + monitor |

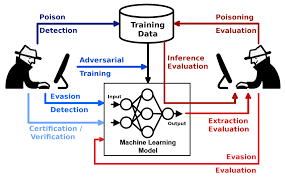

Threat Model: Why Encrypted Swarms Are Harder to Game

Any early-warning system must assume adversaries. In crypto and DeFi, the threat surface includes:

How swarms reduce attack success

Security insight: If the attacker must fool multiple independent sensors, the cost of manipulation rises sharply.

Key Early Warning Signals (By Market Layer)

Below is a practical “signal map” that teams can implement.

Liquidity layer (often the earliest)

Flow layer (silent capital movement)

Volatility & derivatives layer (risk repricing)

Governance & protocol layer (DeFi-specific)

Measurement: How to Evaluate an Early Warning System

Early warning should be measured differently than forecasting.

Core metrics

A practical evaluation table

| Metric | What “good” looks like | Why it matters |

|---|---|---|

| Lead time | hours → days | time to hedge/de-risk |

| False alarm rate | low & stable | operator trust |

| Stress recall | high | crisis avoidance |

| Robustness score | stable under attacks | survivability |

| Decision uplift | measurable | business value |

Operator reality: A mediocre model that reliably gives 12 hours of lead time can outperform a “smart” model that detects the crash at the same time as everyone else.

Turning Warnings Into Actions: The Response Playbook

An early warning system is only valuable if it drives decisions.

Alert tiers (example)

Action automation (with guardrails)

- confidence > threshold,