Multi-Agent AI Pipeline for Hedge Funds: From Data to Alpha

In institutional investing, information isn’t just power—it’s alpha. Hedge funds compete on how quickly and accurately they can turn noisy data into conviction. That’s exactly where a multi-agent AI pipeline for hedge funds comes in: a coordinated team of specialized AI analysts that replicate the workflows of a top-tier research pod. Platforms like SimianX AI bring this institutional-grade architecture to life, orchestrating multiple agents to run deep-dive equity investigations across fundamentals, sentiment, and alternative data in a fully traceable way.

Instead of asking one large language model for an opinion and hoping it’s right, a multi-agent pipeline assigns different jobs to different AI specialists, then reconciles their views into a coherent, auditable investment thesis. In this guide, you’ll learn how these pipelines work, why hedge funds are adopting them, and how tools such as SimianX AI can help you build your own research-grade AI stack.

Why Hedge Funds Are Moving to Multi-Agent AI Pipelines

For years, quant and fundamental funds have spent millions on:

The reason is simple: edge comes from process, not single insights. A one-shot LLM query can be a useful brainstorming tool, but it is not a process. It’s not repeatable, auditable, or robust enough to run money against.

A multi-agent AI pipeline changes that by combining:

“Institutional investors don’t want one opinion; they want a debated opinion that’s been challenged from multiple angles.”

Bolded key benefit:

Multi-agent pipelines give hedge funds risk-adjusted truth, not just fast answers.

Here’s how this shift looks in practice:

- An analyst pulls filings, listens to calls, reads news, builds a model, then debates with the team.

- An LLM is prompted with a ticker and some context, and spits out a narrative.

- A coordinated team of AI agents each handles a slice of the thesis, and a final arbiter merges their conclusions into a structured, explainable report.

Core reasons hedge funds are upgrading to multi-agent AI

1. Reduce single-point failure risk – One hallucinated metric can ruin a thesis.

2. Scale deep dives – Run specialist-level research on many tickers in parallel.

3. Improve compliance readiness – Trace every step for regulators and LPs.

4. Standardize best practices – Encode your “house view” into the pipeline logic.

5. Compress time-to-insight – Investigations that took days can compress into minutes.

![High-level multi-agent workflow sketch]()

Inside a Hedge-Fund-Style Multi-Agent AI Pipeline

At a high level, a multi-agent AI pipeline for hedge funds looks like a virtual research pod: multiple analysts with different job descriptions collaborating on the same ticker.

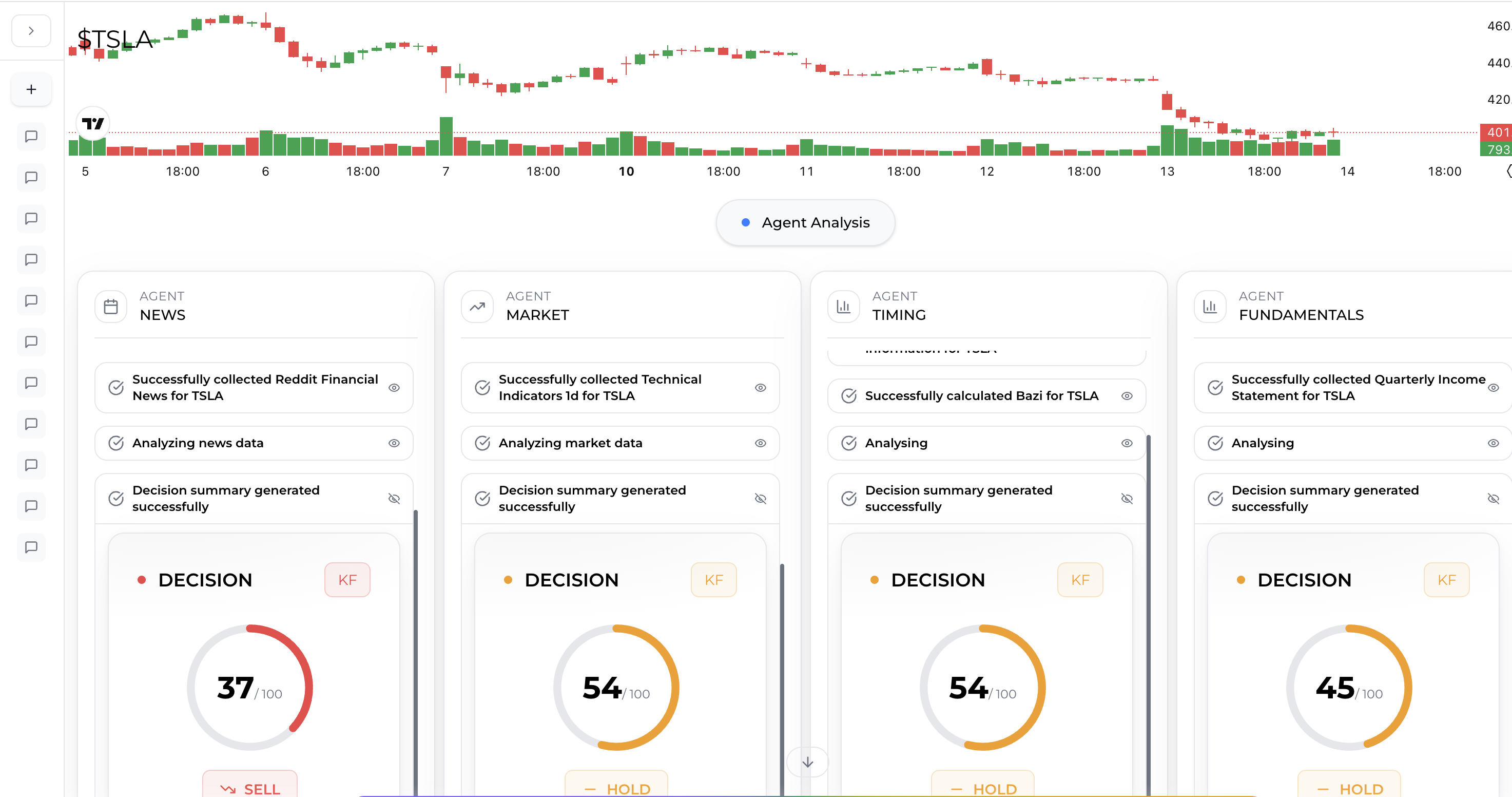

A modern implementation—such as the one used in SimianX AI—can coordinate eight or more specialized agents:

| Agent Type | Primary Role | Example Question It Answers |

|---|---|---|

| Fundamental Agent | SEC & financial statement analysis | “Is revenue growth quality or purely price-driven?” |

| Earnings Call Agent | Tone, language, and guidance analysis | “Does management sound more cautious than last quarter?” |

| News & Narrative Agent | Multi-source sentiment & narrative tracking | “Is the market overreacting to recent headlines?” |

| Valuation Agent | DCF, multiples, and peer comparison | “Is the stock cheap or expensive vs. its sector?” |

| Risk Agent | Tail risk and idiosyncratic event detection | “What could blow up this thesis?” |

| Model Ensemble Agents | Cross-model reasoning (OpenAI, Claude, Gemini) | “Where do models disagree and why?” |

How does a multi-agent AI pipeline for hedge funds actually work?

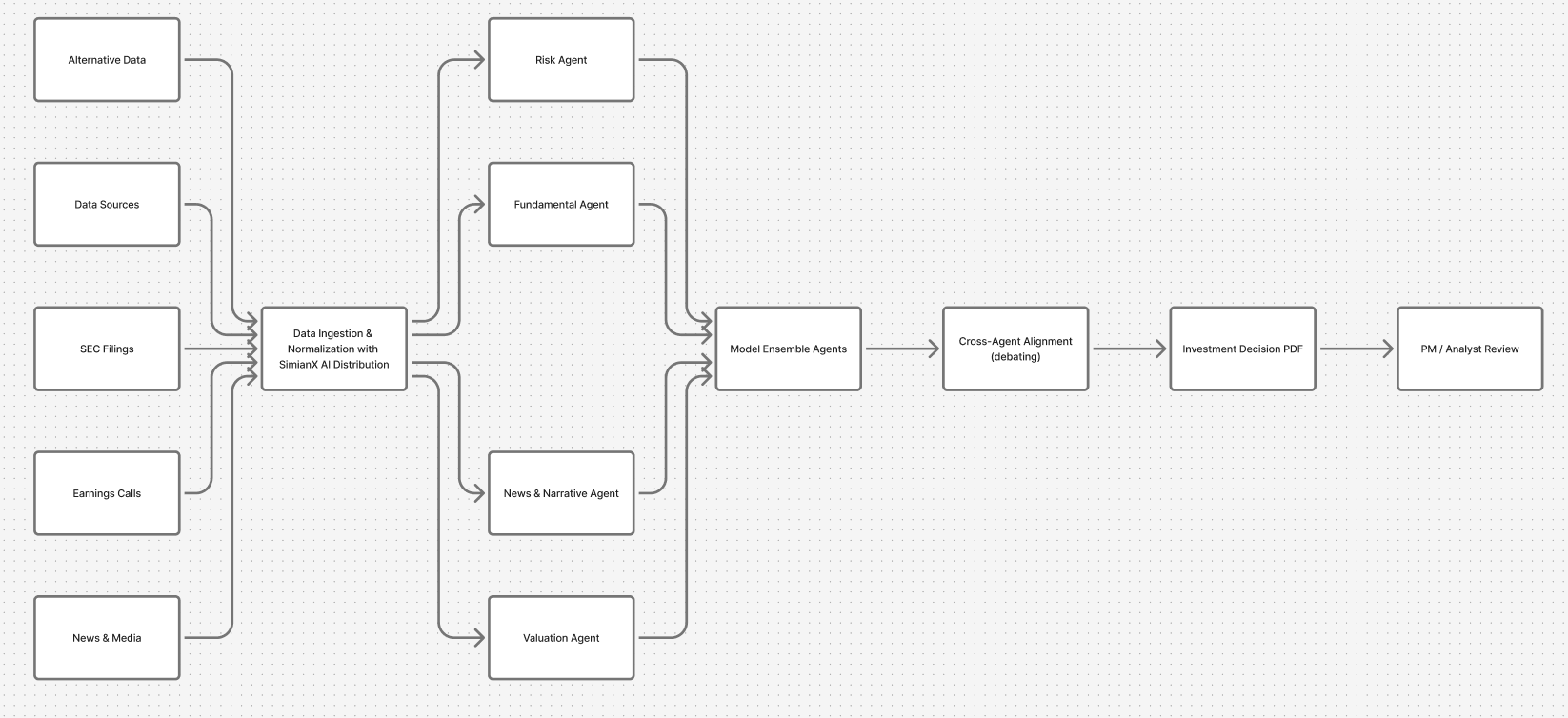

A hedge fund PM or analyst typically starts with a simple input—ticker, time_horizon, and thesis_type (e.g., long, short, pair trade). From there, the pipeline automatically orchestrates a multi-step investigation:

1. Data acquisition layer

- Ingests SEC filings (10-K, 10-Q, 8-K), insider activity, broker notes, earnings call transcripts/audio, news feeds, and sometimes alternative data (web traffic, app data, supply-chain signals).

2. Agent-level specialization

- Each agent focuses on one slice of the puzzle:

- The Fundamental Agent dissects revenue, margins, segments, and cash flows.

- The Earnings Call Agent analyzes tone, hedging language, and Q&A dynamics.

- The News Agent separates structural narrative shifts from short-lived reactions.

- The Valuation Agent cross-checks DCFs, multiples, and peer spreads.

- The Risk Agent hunts for litigation, leadership churn, credit moves, and fragilities.

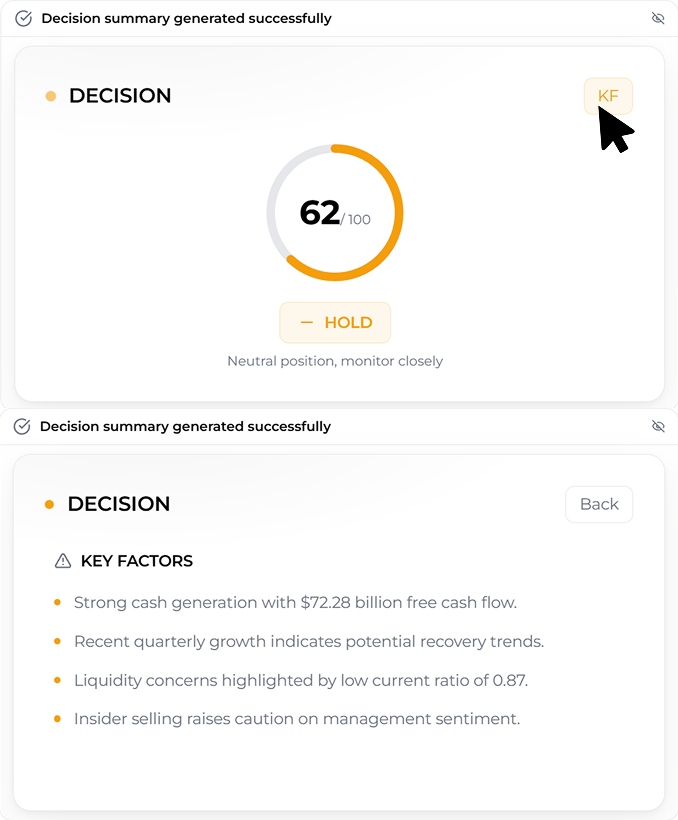

3. Cross-agent alignment

- A coordinator agent looks for agreement and conflict:

- Does valuation look cheap and sentiment look overly negative?

- Is management bullish while fundamentals quietly deteriorate?

- Are insider trades contradicting the public narrative?

4. Model ensemble validation

- In the SimianX architecture, multiple foundation models—such as OpenAI, Claude, and Gemini—are asked to independently evaluate critical conclusions.

- A validation layer reconciles differences, flags uncertainties, and often requires consensus across models before major claims are accepted.

5. Report generation & decision card

- The final output is a hedge-fund-grade summary:

- risk_score

- Key catalysts

- Valuation direction (cheap/neutral/expensive)

- Sentiment divergence vs. price action

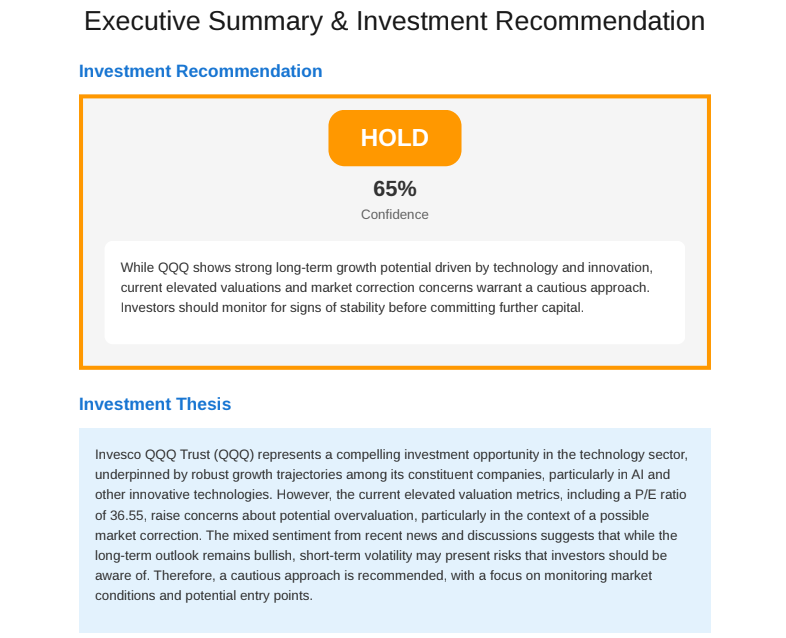

- Suggested stance: BUY, HOLD, or SELL (or long/short bias)

A strong multi-agent pipeline doesn’t just say what it thinks—it shows how it arrived there, so humans can challenge, override, or refine the thesis.

Designing Your Own Multi-Agent AI Pipeline for Hedge Funds

Not every firm can—or should—build everything from scratch. But understanding the design principles helps you evaluate solutions like SimianX AI and customize them to your workflow.

Key design principles

Don’t ask one agent to “analyze everything.” Create agents with clear mandates:

- fundamentals_agent

- news_agent

- risk_agent

- market_agent

Keep data acquisition, analysis, and decision-making logically distinct. This makes the pipeline easier to debug, scale, and audit.

Build in “devil’s advocate” behavior. Have one agent intentionally stress-test optimistic theses and vice versa.

Every agent should output:

- The conclusion

- The evidence it used

- Any assumptions or uncertainties

Practical steps to get started

1. Map your current human workflow

- Document how analysts today go from idea → research → model → IC memo.

2. Identify repeatable research blocks

- Examples: “Pull last four 10-Qs,” “Compare guide vs. realized,” “Scan litigation risks.”

3. Define agent roles around those blocks

- Assign each block to an AI agent with a focused job description.

4. Choose or evaluate a platform

- Decide whether to build in-house or leverage an orchestration platform such as SimianX AI, which already encodes hedge fund-style multi-agent logic.

5. Encode your house rules

- Define constraints like:

- “Never label a stock BUY unless at least two valuation methods agree.”

- “Flag any thesis where risk agent score exceeds 7/10.”

6. Pilot on a small universe

- Start with a watchlist of, say, 20–50 names. Compare AI output to existing analyst work.

7. Iterate and productionize

- Tighten prompts, add agents, adjust thresholds, and gradually integrate into live decision-making.

Bolded key outcome:

The goal isn’t to replace analysts—it’s to give them a programmable research super-team that never sleeps.

Why SimianX AI Is Built as a Multi-Agent Hedge Fund Workflow

SimianX AI is designed from the ground up to mirror how real hedge fund teams operate: multiple specialists collaborating through a controlled, traceable workflow rather than one monolithic model giving opaque answers.

Here’s how SimianX implements a best-practice multi-agent AI pipeline:

- Cleans and normalizes 10-K, 10-Q, 8-K, and insider filings.

- Decomposes revenue and margins, inspects segment trends, and evaluates cash flow sustainability.

- Analyzes call transcripts and, when available, voice tone.

- Detects confidence vs. hedging language, and compares word choice to prior quarters.

- Aggregates sentiment from major newswires, industry outlets, and retail chatter (Reddit, X, etc.).

- Differentiates structural narrative shifts from transient reactions.

- Run DCFs, multiples, and peer comparison.

- Scan for tail risks: litigation, leadership changes, credit downgrades, and customer/supplier stress.

- Each model contributes a different strength:

- OpenAI → narrative coherence and scenario analysis

- Claude → structured reasoning and hallucination resistance

- Gemini → numerical stability and trend alignment across sources

- SimianX’s validation layer reconciles disagreements and flags areas of uncertainty for human review.

Because all of this is wrapped in a versioned, logged pipeline, outputs are:

This is where a specialized platform like SimianX AI saves you from reinventing the wheel while still letting you layer your proprietary rules and data on top.

Real Hedge Fund Use Cases for Multi-Agent AI Pipelines

1. Faster deep-dive investigations

Traditionally, a full deep-dive on a complex name might take:

With a multi-agent AI pipeline:

2. Hidden signal detection

Multi-agent systems are particularly good at catching weak but important signals that humans overlook:

Because agents are systematically scanning for these patterns as part of a repeatable process, the fund doesn’t depend on a single sharp analyst “getting lucky” on a given ticker.

3. Repeatability & auditability

Every run of a pipeline like SimianX’s generates:

This is invaluable for:

FAQ About multi-agent AI pipeline for hedge funds

What is a multi-agent AI pipeline in hedge fund research?

A multi-agent AI pipeline in hedge fund research is a coordinated system where multiple specialized AI agents handle different parts of the investment process—fundamentals, sentiment, valuation, and risk—before their conclusions are merged into a unified view. Instead of one model doing everything, each agent is optimized for a specific task, making the overall process more reliable, explainable, and repeatable.

How do hedge funds use multi-agent AI for stock selection?

Hedge funds feed tickers and constraints into the pipeline and let specialized agents perform deep-dive analysis across filings, earnings calls, news, and alternative data. The system then produces a structured output—often a decision card—that includes risk scores, key catalysts, valuation context, and a suggested stance such as BUY, HOLD, or SELL. Human PMs and analysts review this output, challenge it, adjust assumptions, and integrate it into their portfolio construction process.

Is multi-agent AI better than a single LLM for investment research?

For serious capital allocation, yes. A single LLM prompt can be helpful for brainstorming, but it’s prone to hallucinations and offers limited explainability. A multi-agent AI pipeline for hedge funds introduces redundancy, cross-checking, and explicit reasoning steps, dramatically reducing the chance that one wrong number or misinterpreted sentence undermines the thesis. It’s closer to how real-world investment teams operate—through debate and verification.

How can smaller funds access institutional-grade multi-agent AI?

Smaller funds don’t need to build everything in-house. Platforms like SimianX AI provide an out-of-the-box multi-agent workflow that mirrors hedge-fund-grade processes, while still letting you configure rules, data sources, and outputs. This lets emerging managers and family offices access institutional-style research automation without hiring a full machine learning and infra team.

What data sources can feed a multi-agent AI pipeline?

A robust pipeline can ingest structured and unstructured data, including SEC filings, earnings call transcripts and audio, real-time and historical news, insider transactions, credit and rating changes, and even alternative data such as web and app usage or supply chain signals. The key is not just having the data, but assigning it to the right agents and enforcing consistent, auditable transformations from raw data to investment insight.

Conclusion

The future of institutional investing is not a single, all-knowing model—it’s a coordinated team of AI specialists working together in a disciplined, auditable pipeline. A multi-agent AI pipeline for hedge funds turns scattered data into structured conviction by mirroring how top research teams already think: through specialization, cross-checking, and documented reasoning.

By adopting a platform like SimianX AI, you can compress research timelines from days to minutes, uncover hidden signals before they’re priced in, and standardize high-quality analysis across your entire universe. If you’re ready to upgrade from ad hoc prompts to a true institutional-grade research engine, explore how SimianX AI can help you build and deploy your own multi-agent hedge fund workflow—so your next edge comes not just from better ideas, but from a better process.