Real-Time Data + AI Analysis: Why 5-Minute Delayed Quotes Can Cost You Money

Introduction: The High-Speed Race of Modern Markets

The financial markets are no longer a place where the swift merely have an advantage; they are an ecosystem where speed is the fundamental determinant of survival and profitability. In this digital coliseum, traders and algorithms battle over microsecond advantages, where information is not just power—it is currency. For decades, retail investors have relied on delayed stock data, often 15 or 20 minutes behind, with many modern platforms offering a "compromise" of a 5-minute delay. This was once considered sufficient for making informed decisions. However, the advent of sophisticated Artificial Intelligence (AI) and algorithmic trading has fundamentally altered this calculus.

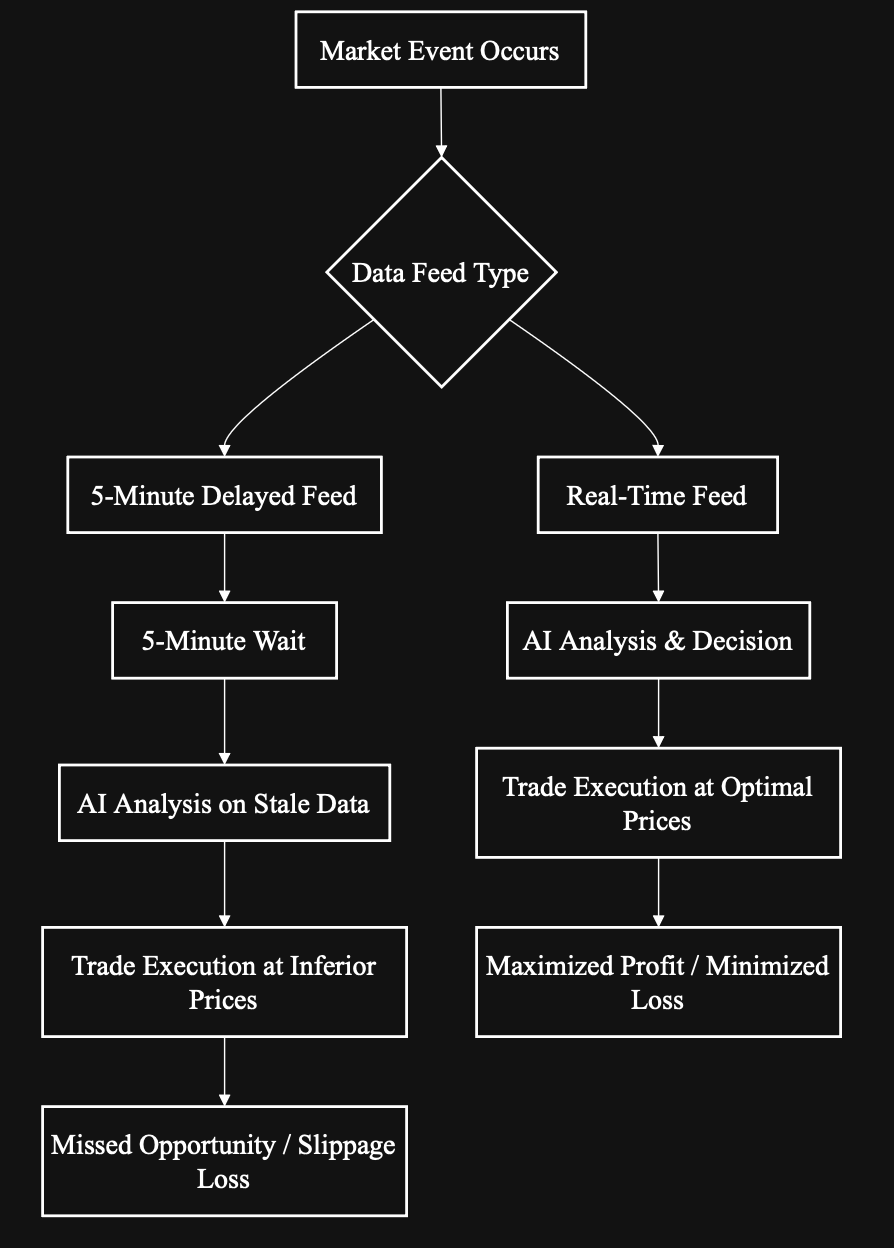

This article delves into a critical and often underestimated vulnerability: the combination of powerful AI analysis with delayed market data. It's a paradox of modern investing: using a tool capable of millisecond-level insights but feeding it information that is minutes old. We will explore how this latency creates a dangerous lag in the decision-making loop, leading to missed opportunities, execution at inferior prices, and exposure to unseen risks. The core thesis is simple: In the age of AI, 5-minute delayed quotes are not just a minor inconvenience; they are a direct and quantifiable financial liability. Pairing a state-of-the-art AI engine with delayed data is like putting a champion race car driver in a traffic jam—their skill is rendered nearly useless by the constraints of their environment.

Section 1: The Anatomy of Market Data - Real-Time vs. Delayed

To understand the risk, one must first understand the nature of market data feeds.

What is Real-Time Data?

A real-time data feed is a direct stream of information from the stock exchanges (e.g., NYSE, NASDAQ) that provides immediate updates on every single market event. This includes:

This feed is continuous and unbroken, providing a live, tick-by-tick view of the market's pulse. Accessing this data typically requires a subscription fee paid to the exchange or a data vendor, which is why many "free" trading platforms do not provide it.

What is Delayed Data?

Delayed data is exactly what it sounds like: a snapshot of the market from a point in the past. The common "5-minute delayed quote" means the price you see on your screen actually occurred five minutes ago. This delay is a regulatory concession that allows brokers to provide market data at a lower cost (or for free) to retail investors. While it may seem minor, in the context of modern electronic markets, five minutes is an eternity.

Section 2: The AI Engine - Why It Craves Real-Time Fuel

Artificial Intelligence, particularly in the form of machine learning and natural language processing, has revolutionized stock research. Its advantages, as highlighted in the reference article, are immense. However, these advantages are entirely contingent on the quality and timeliness of the data they process.

1. Pattern Recognition at the Speed of Light

AI algorithms are designed to identify complex, non-linear patterns across thousands of variables. They can detect a subtle correlation between a news headline, a slight change in options volume, and a shift in order book pressure that predicts a short-term price move. However, this pattern has a temporal component. The predictive signal might only be valid for a few seconds or minutes. By the time a delayed feed delivers the data, the pattern has already played out, and the AI is effectively analyzing history, not predicting the future.

2. Sentiment Analysis in a Blink

A core strength of AI is performing sentiment analysis on thousands of news articles, social media posts, and earnings call transcripts in real-time. Imagine an AI detects a sharply negative sentiment from a CEO's tone in an earnings call that just concluded. In a real-time system, this could trigger an analysis and a potential sell signal within seconds. With a 5-minute delay, the market has already absorbed this information, the stock price has likely dropped, and the AI's "insight" is now a widely known fact, offering no edge.

3. Predictive Analytics and Scenario Modeling

AI systems run thousands of simulations for scenario analysis and stress testing. A real-time AI can continuously re-run these simulations as new data ticks in, constantly updating its probabilistic forecast for a stock's direction. A delayed-data AI is stuck running simulations on a stale market state. Its "predictions" are based on a reality that no longer exists, making its outputs inherently unreliable and potentially dangerously misleading.

Section 3: The Tangible Costs of 5-Minute Delays in an AI-Driven World

The theoretical risks translate into concrete financial losses. Here’s how a 5-minute delay can directly cost you money when paired with an AI tool.

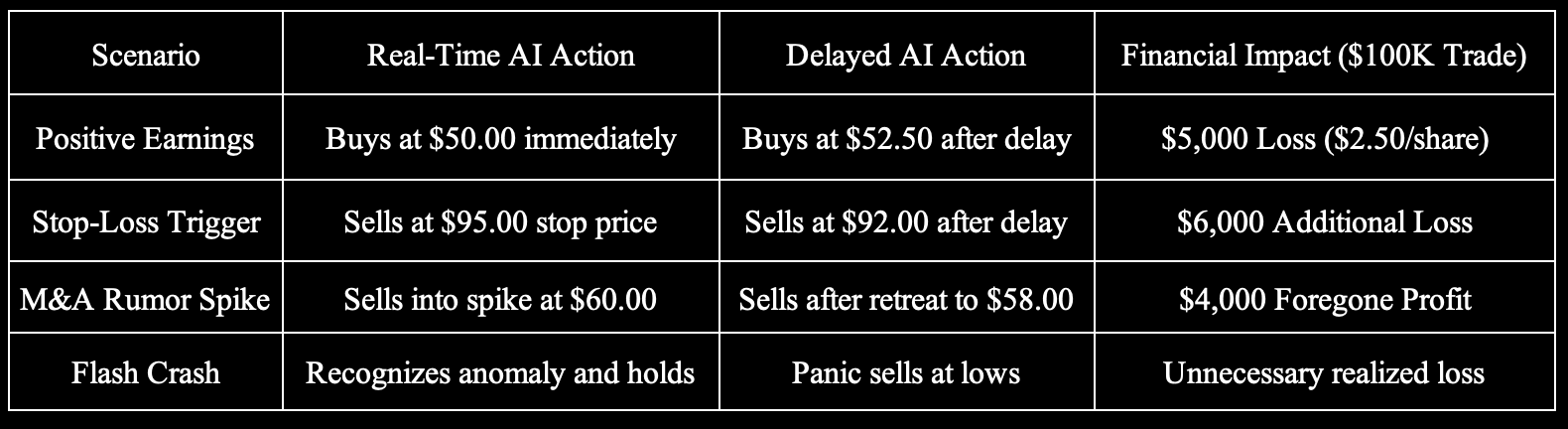

1. Missed Entry and Exit Points (Slippage)

This is the most direct cost. Your AI algorithm, based on its analysis of real-time data, might identify a perfect buy point when a stock hits $100.00 on strong volume. But with a 5-minute delay:

You instantly incur a $1.50 per share loss due to slippage. The same logic applies to stop-losses. Your AI may signal a sell if a stock breaks below $95.00 for risk management. With a delay, you might only discover the break after the stock has already plummeted to $92.00, realizing a much larger loss.

2. The Illusion of Opportunity (False Signals)

A delayed feed can present "opportunities" that are actually traps. A stock might show a sudden, sharp upward spike in a delayed feed, prompting your AI to flag a potential breakout. In reality, that spike happened five minutes ago, and the stock has already reversed and is now falling rapidly. Acting on this delayed signal means you are buying at the top of a move that is already over.

3. Ineffective Arbitrage and Mean Reversion Strategies

Many AI-driven strategies are based on statistical arbitrage or mean reversion, which rely on exploiting tiny price discrepancies between related assets (e.g., an ETF and its underlying stocks). These discrepancies often exist for mere seconds. A 5-minute delay ensures you will always be too late to capture this edge. The "alpha" (excess return) your AI has identified has long since been arbitraged away by firms using real-time data.

4. Increased Vulnerability to News and Events

Corporate announcements, economic data releases, and Fed statements can move markets violently in seconds. An AI with a real-time stock data AI feed can parse the news and execute a trade in the same second the information hits the wires. An AI on a delayed feed is blind to the initial move. By the time it receives the data, the major price adjustment has occurred, and you are left reacting to the aftermath rather than anticipating or participating in the initial move.

Quantitative Impact of Data Latency on a Hypothetical $100,000 Trade

Section 4: The Solution - Integrating AI with True Real-Time Data Feeds

The solution is not to abandon AI but to empower it with the data it deserves. The goal is to create a seamless, high-frequency decision loop.

The Optimal AI Trading System Architecture

Tools for Investors

- Advanced charting platforms (e.g., TradingView, Thinkorswim) that offer real-time data subscriptions.

- API-first brokerages (e.g., Alpaca, Interactive Brokers) that allow you to connect your own AI models to a real-time data feed and trading account.

- Specialized real-time AI trading insights services that provide pre-packaged AI analysis on live data.

Section 5: The Future is Real-Time and Adaptive

The market's trajectory is unambiguous. The use of AI will become more pervasive, and the value of speed will only increase. The future points towards:

Conclusion: Don't Neutralize Your Greatest Advantage

Using an AI-powered research and trading system without a real-time data feed is a fundamental misallocation of resources. You are investing in a powerful engine but chaining it to an anchor. The delayed stock data risks are not hypothetical; they are quantifiable, recurring, and significant. They manifest as consistent slippage, missed profits, and larger losses.

The real-time AI trading insights that could provide you with a competitive edge are instead converted into historical post-mortems. In the relentless, efficiency-driven environment of modern finance, you cannot afford to be five minutes behind. To truly harness the power of artificial intelligence for stock research and trading, you must fuel it with the one thing that matches its potential: instantaneous, real-time market data. Upgrade your data, and you will unlock the true power of your AI.