Introducing SimianX AI US Stock Fundamental Analysis Agent: SEC Data Meets Multi-Model Financial Intelligence

Financial analysis is entering a new age—one driven not by spreadsheets and manual reviews, but by intelligent systems that truly understand financial disclosures. SimianX.AI Fundamental Analysis brings this transformation to life, using multi-model AI collaboration to decode and interpret corporate filings from the U.S. Securities and Exchange Commission (SEC).

“We make AI understand the language of financial regulation and corporate reality.”

Why SEC Filings Are Central to True Financial Intelligence

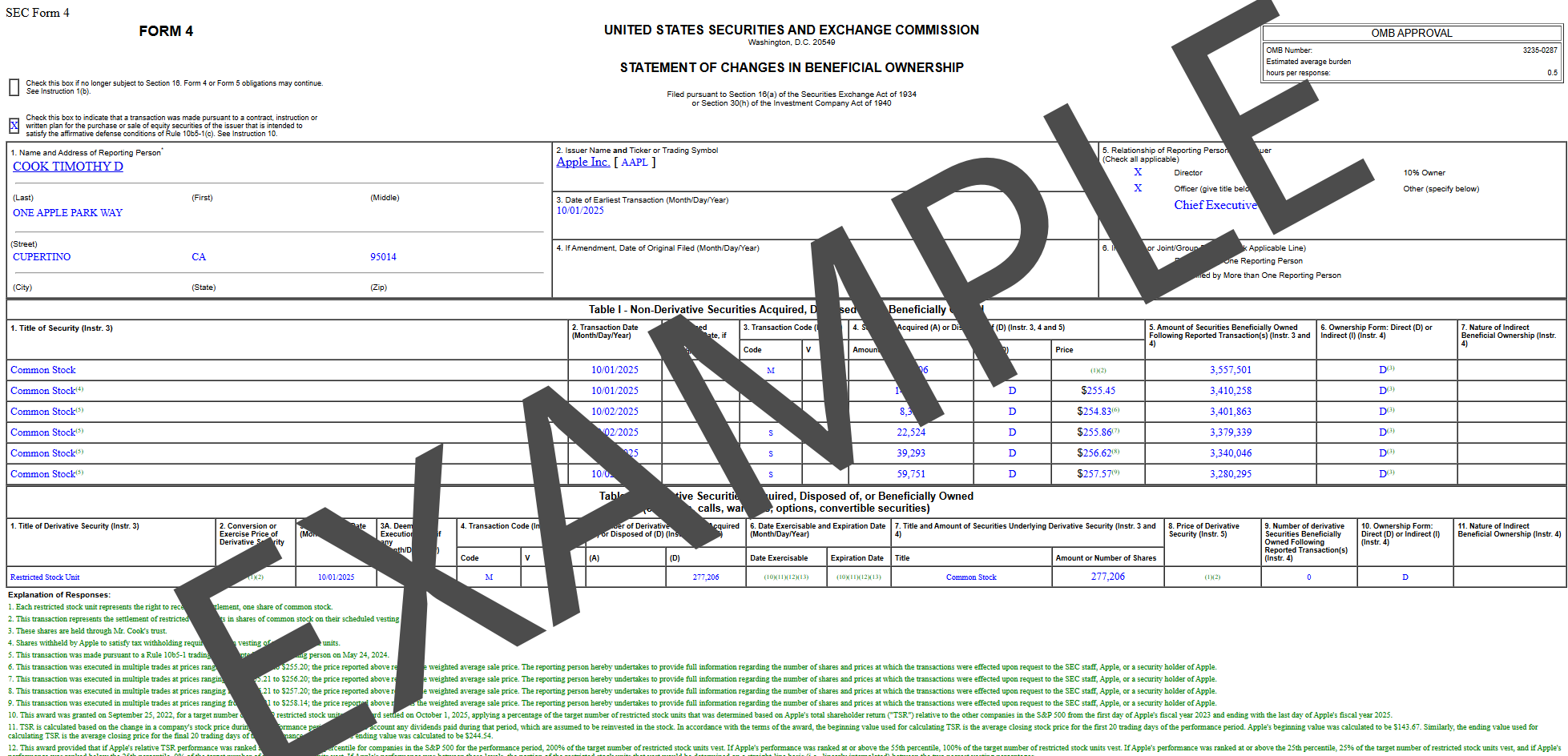

The SEC (U.S. Securities and Exchange Commission) publishes corporate disclosures such as 10-K, 10-Q, 8-K, and Form 4/5, which contain the most detailed, verified financial data available.

These filings define how companies perform, spend, and evolve—and they’re the only universal, legally binding financial reports accessible to the public.

However, raw SEC filings come in highly complex structures (XBRL, HTML, JSON). They’re inconsistent across issuers, full of nested tables and metadata, and therefore unreadable for AI models in their original form.

That’s where SimianX.AI changes the game.

Transforming Raw SEC Data into AI-Ready Knowledge

SimianX.AI doesn’t just scrape SEC data—it transforms it.

Before a single token reaches an AI model, the system runs a deep processing pipeline designed to make SEC data machine-understandable:

1. Extraction: Retrieve filings directly from SEC’s EDGAR database.

2. Normalization: Convert inconsistent table formats and numeric scales into unified schemas.

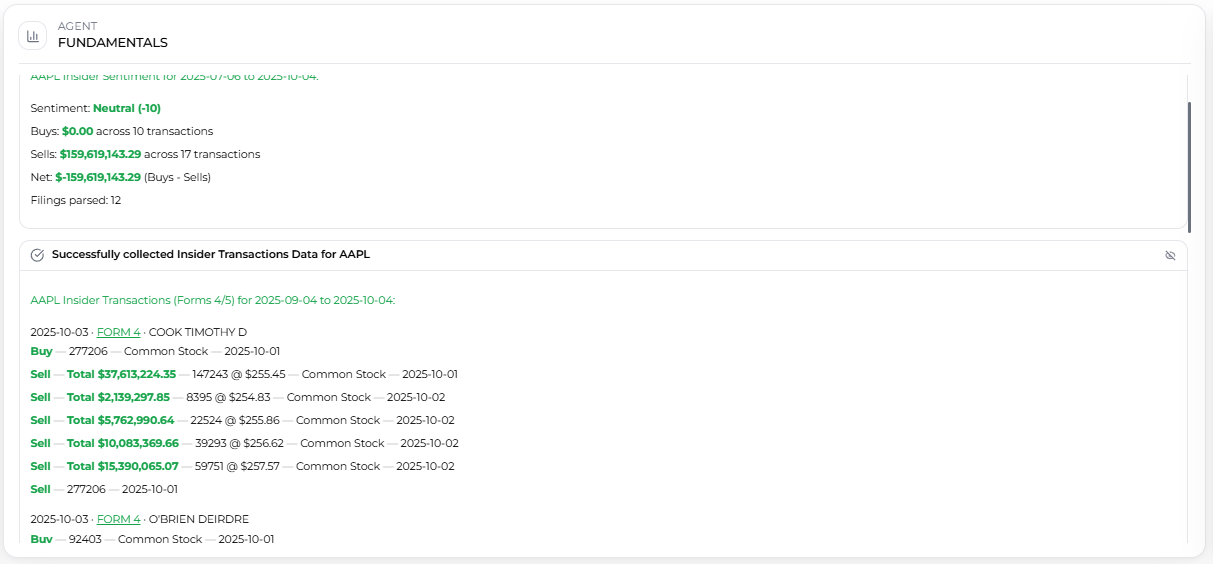

3. Semantic Mapping: Label key fields such as Revenue, Insider Transcations, Net Income, Operating Cash Flow, and Total Liabilities.

4. Context Alignment: Preserve structural meaning (e.g., differentiating MD&A from Notes).

5. Validation: Verify data coherence across quarterly and annual reports.

Without this structured transformation, even advanced models like OpenAI or Anthropic can misread financial context.

SimianX.AI ensures that every figure and paragraph is properly contextualized—ready for precise, explainable analysis.

“The raw filings aren’t plug-and-play for AI—SimianX.AI makes them interpretable.”

The Multi-Model Intelligence Stack: OpenAI, Claude, and Gemini

At the heart of SimianX.AI’s architecture is its multi-model orchestration layer, connecting three complementary AI engines:

| Model | Role | Strength |

|---|---|---|

| OpenAI | Narrative analysis & report generation | Exceptional contextual reasoning and language fluency |

| Anthropic | Consistency verification & cross-report comparison | Analytical precision and interpretive stability |

| Gemini | Quantitative evaluation & trend detection | Numerical accuracy and data pattern recognition |

Each model contributes a specialized perspective—OpenAI for storytelling logic, Claude for disciplined validation, Gemini for quantitative depth.

SimianX.AI synchronizes their outputs into a single, cohesive narrative and score.

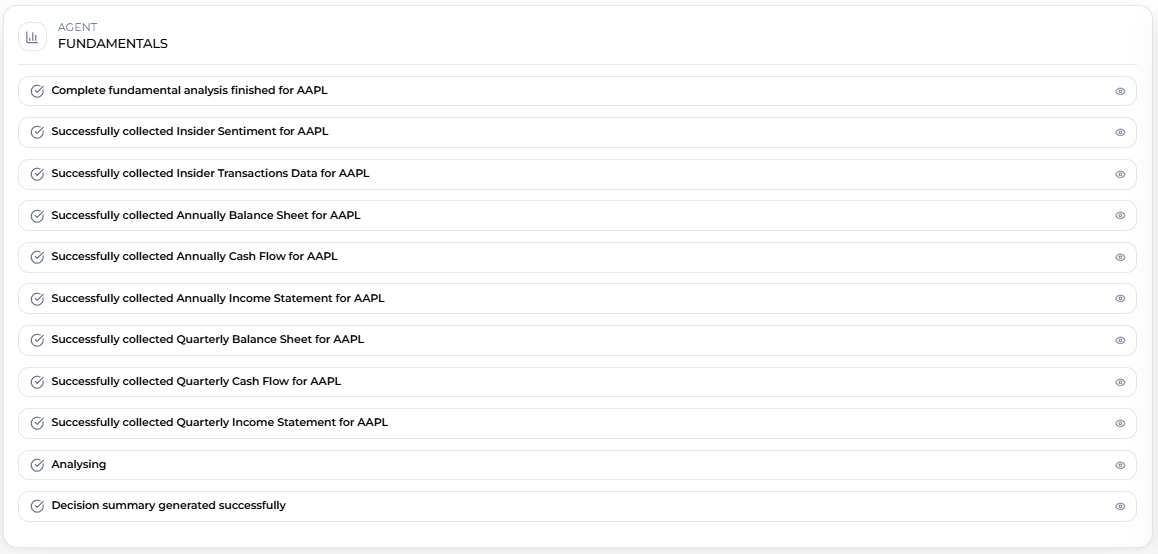

Analytical Flow: From Filing to Financial Insight

The SimianX.AI pipeline moves through five coordinated stages:

1. Retrieve & Parse – Fetch raw SEC 10-K, 10-Q, 8-K, and Form 4/5 filings.

2. Data Structuring – Normalize into standardized formats for AI ingestion.

3. AI Inference – Pass structured data through OpenAI, Claude, and Gemini simultaneously.

4. Cross-Model Validation – Merge, verify, and align insights across models.

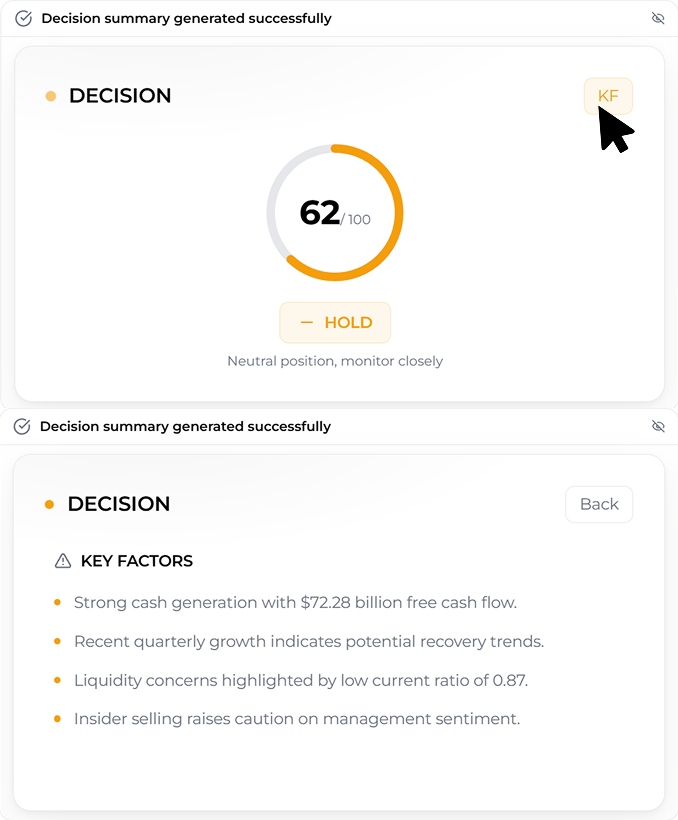

5. Final Report Generation – Produce a nice decision card with a 0–100 score and a BUY / HOLD / SELL recommendation with key factors.

A seamless blend of human-like interpretation and machine-level accuracy.

Why Raw SEC Data Cannot Be Fed Directly to AI

Raw SEC data is incredibly dense. Tables are nested, terminology shifts between filings, and numeric conventions (positive vs. negative for expenses) differ across companies.

If sent to an LLM in its native form, even advanced systems fail to identify context or compute consistent financial meaning.

SimianX.AI bridges this gap through:

Key Features, Impact And Transparency

Key Features and Advantages

| Feature | Description | Benefit |

|---|---|---|

| SEC-native data | Directly sourced from official EDGAR filings | Transparent and trustworthy |

| Structured preprocessing | Converts SEC data into AI-understandable format | Zero data ambiguity |

| Multi-model reasoning | Combines OpenAI, Claude, Gemini | Comprehensive perspective |

| Streaming analysis | Real-time, step-by-step generation | Interactive and fast |

Real-World Impact

From hedge funds to solo investors, SimianX.AI enables transparent, data-driven decision-making.

Data Legality and Transparency

All financial data processed by SimianX.AI originates from public SEC filings via the EDGAR system.

Under U.S. law (17 U.S.C. §105), government-generated works like SEC filings are public domain, meaning they can be freely analyzed and redistributed, provided the original data is not altered.

Disclaimer:

SimianX.AI provides interpretive analytics and does not modify or republish official SEC documents.

Data source: U.S. Securities and Exchange Commission (EDGAR).

From Complexity to Clarity

SimianX.AI transforms dense, technical SEC filings into clear, actionable insights through its data refinement engine and multi-model AI architecture.

By bridging structured regulatory data with the intelligence of OpenAI, Claude, and Gemini, the platform makes financial truth both understandable and usable.