Financial markets move at the speed of news. When Bloomberg breaks an earnings story, when Reddit explodes with retail sentiment, when institutional analysts upgrade a stock—the window for alpha closes in seconds.

SimianX.AI News Analysis Agent brings you institutional-grade news intelligence that was once reserved for Wall Street trading desks paying $24,000/year for Bloomberg Terminals. We aggregate Bloomberg financial news, company announcements, mainstream media coverage, and Reddit retail sentiment—then process everything through advanced AI models including OpenAI, Anthropic Claude, and Google Gemini to deliver clear BUY/HOLD/SELL signals in under 60 seconds.

[Image: Professional dashboard interface showing live news feeds from multiple sources, real-time sentiment scores, AI analysis streaming, and clear decision cards with BUY/HOLD/SELL recommendations for stocks like AAPL, TSLA, NVDA]

"We turn the chaos of 50,000 daily financial news articles into actionable trading intelligence."

The Problem: Information Overload in Modern Markets

Every trading day, financial markets generate an overwhelming flood of information:

No human can process this volume. By the time you read Bloomberg, check Reddit, scan Google News, and review company announcements, the market has already moved. Opportunities vanish. Risks materialize before you notice warning signs.

Traditional solutions fail:

News aggregators just pile up headlines—they don't analyze or interpret

Single-source platforms give you one biased perspective

Manual research takes hours when you have seconds

Basic sentiment tools can't distinguish between meaningful signals and noise

The SimianX Solution: Bloomberg-Grade Intelligence, Democratized

SimianX.AI News Analysis Agent transforms financial news chaos into trading clarity through a sophisticated four-pillar intelligence architecture:

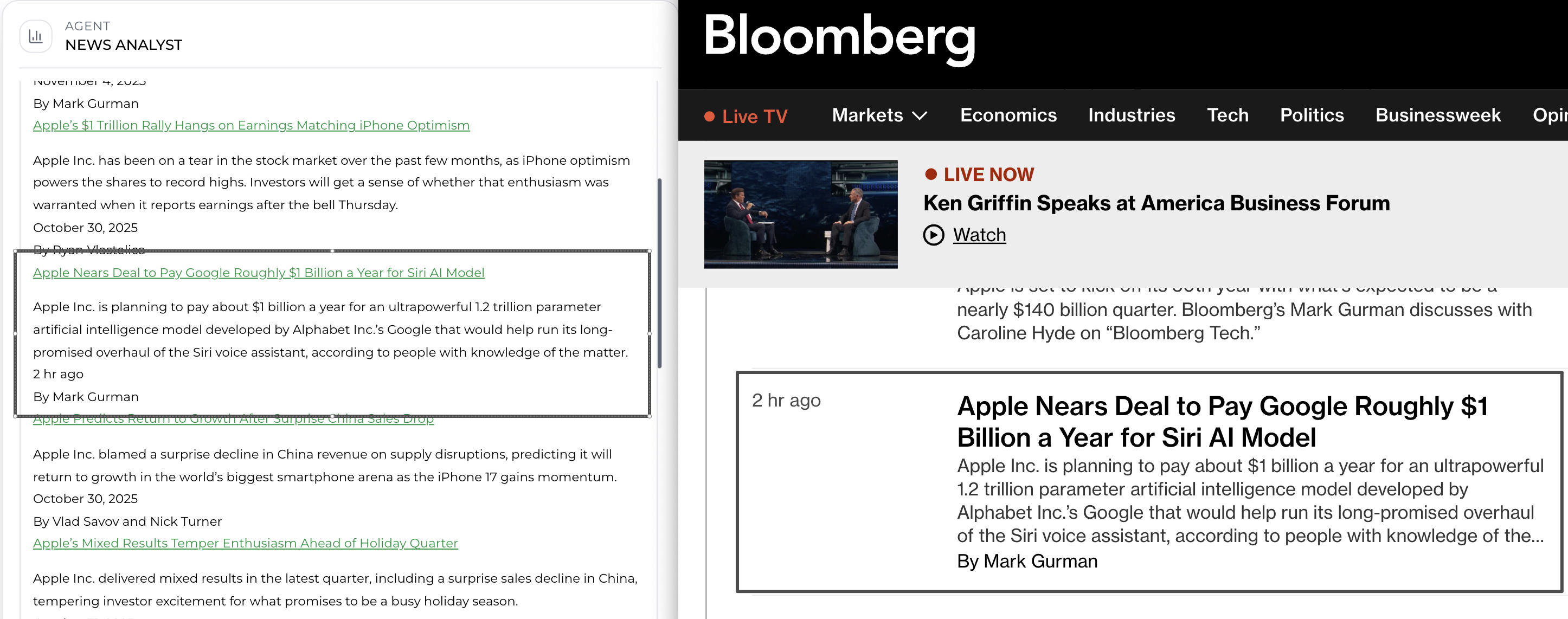

Pillar 1: Premium Bloomberg Financial News

Bloomberg represents the gold standard of financial journalism—where institutional investors, hedge funds, and Wall Street trading desks get their intelligence. Bloomberg reporters break market-moving stories first, with unmatched credibility and analytical depth.

What Bloomberg intelligence gives you:

Breaking earnings coverage with detailed analysis of beats, misses, and guidance

M&A and deal announcements that drive major price movements

Regulatory developments and legal issues affecting companies

Executive interviews and management commentary

Institutional analyst perspectives and upgrade/downgrade explanations

Macroeconomic context connecting Fed policy, GDP, inflation to stock implications

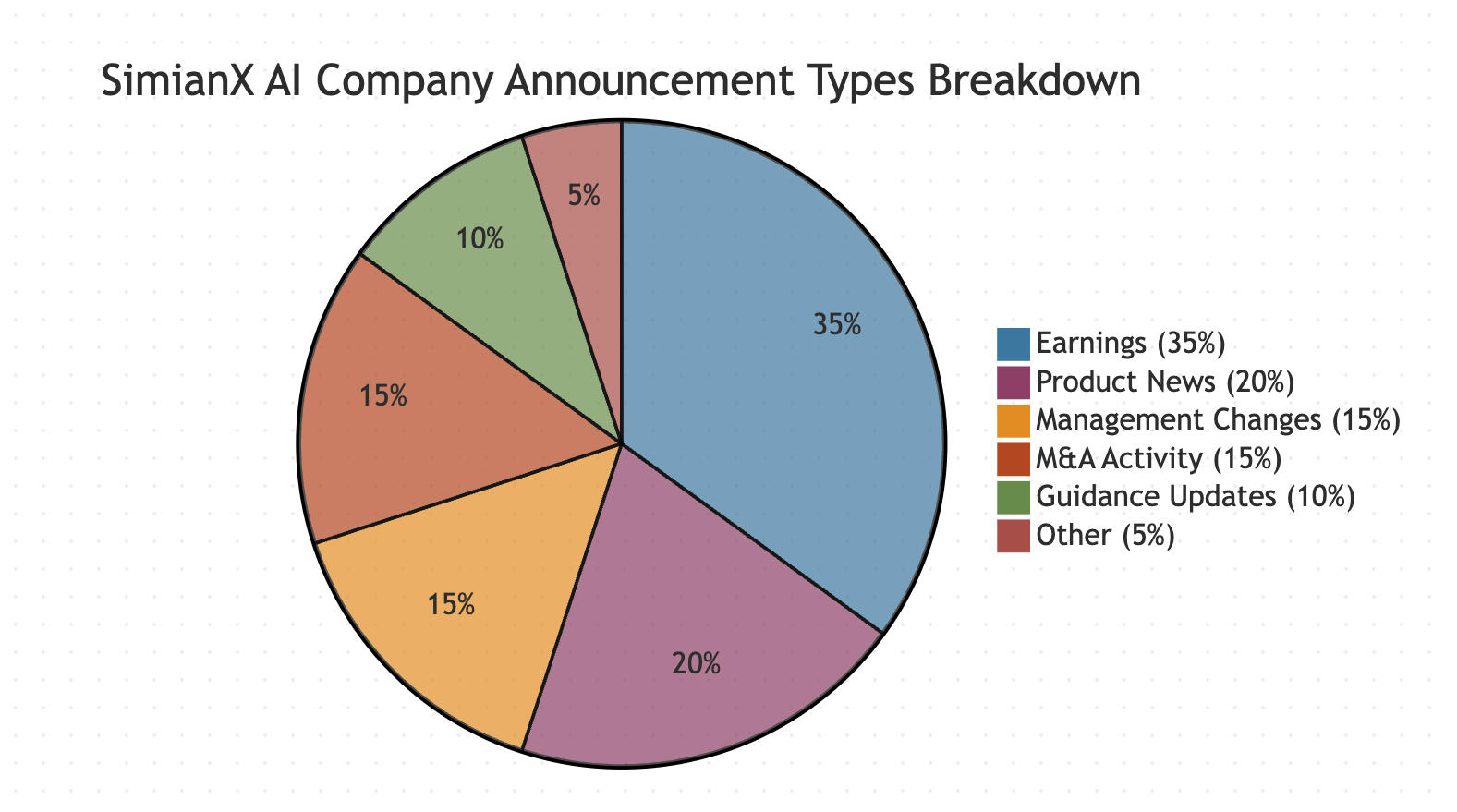

Pillar 2: Company-Specific Financial Announcements

Official company communications carry the highest signal-to-noise ratio in financial news. When a company issues a press release, files with regulators, or updates guidance—that's primary source truth, not media interpretation.

What company announcements give you:

Quarterly earnings releases with official numbers straight from the company

Product launch announcements and major business developments

Management changes and executive appointments

Strategic initiatives like acquisitions, partnerships, restructurings

Forward guidance on expected performance

Investor presentation materials from earnings calls

SimianX.AI captures these announcements in real-time, ensuring you never miss a material company disclosure.

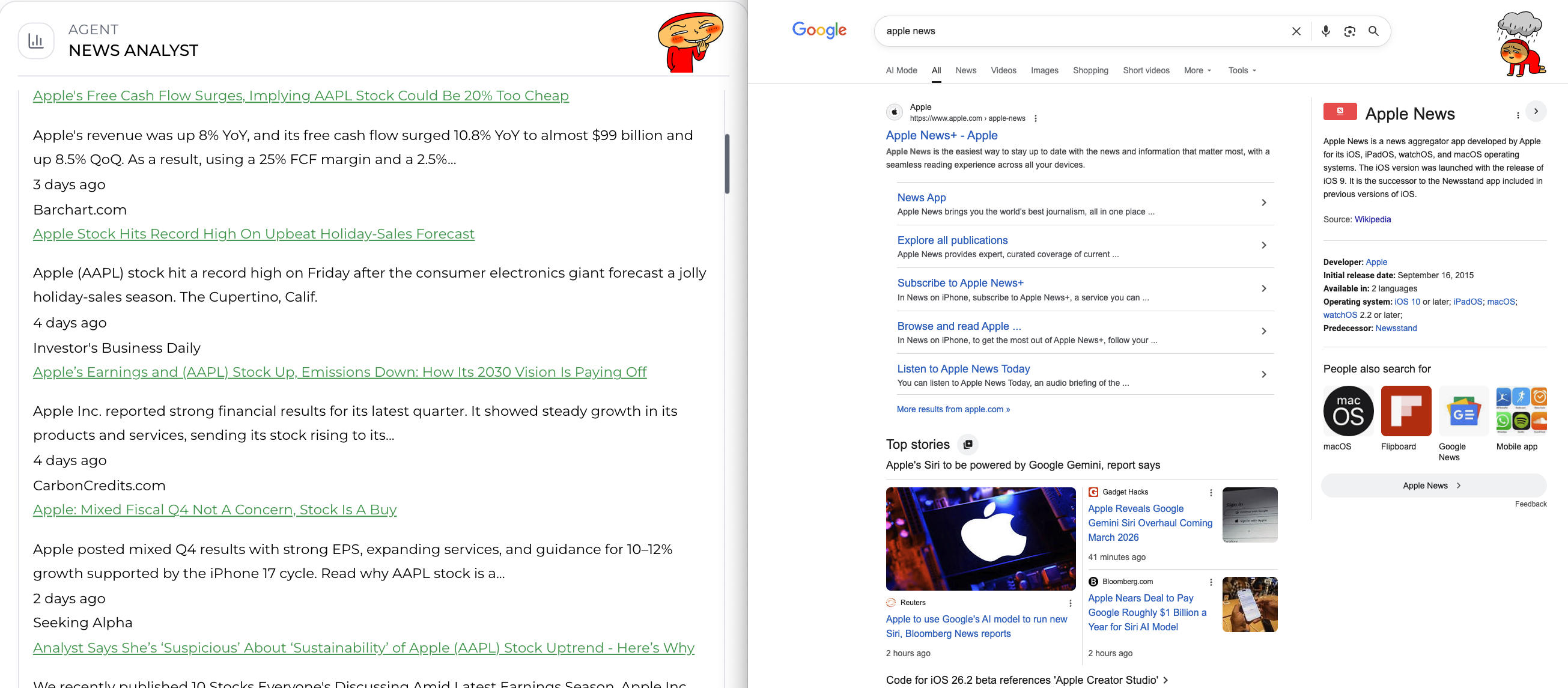

Pillar 3: Mainstream Media and Market Perception

Bloomberg and company announcements tell you what happened. Mainstream media tells you how the market perceives it. These perceptions drive stock prices in the short term—often more than fundamentals.

What mainstream media coverage gives you:

Broad sentiment analysis across hundreds of news outlets

Consumer perspective on brands and products

Competitive landscape coverage comparing companies in the same sector

International news affecting global operations

Product reviews and customer sentiment indicators

Crisis coverage and reputation management insights

Key insight: When Tesla announces earnings, Bloomberg gives you the numbers—but mainstream media tells you whether consumers love or hate the new Cybertruck. Both matter.

Pillar 4: Reddit Retail Investor Sentiment

In 2025, retail investors represent 40-50% of daily US equity trading volume—up from under 15% in 2019. Reddit communities like r/wallstreetbets, r/stocks, and r/investing have proven they can move markets, squeeze shorts, and create volatility events that defy traditional analysis.

Ignoring Reddit sentiment means missing half the market.

What Reddit intelligence gives you:

Real-time retail sentiment from millions of active traders

Early warning signals for short squeeze potential and momentum trades

Options market discussion revealing positioning and speculation

Crowdsourced due diligence uncovering insights analysts miss

Meme stock detection before volatility explodes

Sentiment divergence when retail and institutions disagree

Real Example: AAPL Reddit Sentiment Analysis (November 2025)

SimianX.AI monitors Reddit discussions across key investment subreddits to capture retail investor sentiment:

Reddit Data Collection Summary

Total Posts Analyzed: 47 discussions

Subreddits Monitored: r/wallstreetbets, r/stocks, r/investing, r/options

Time Period: 7 days before and after earnings

Engagement Score: 8,250 (upvotes + comments)

Top Reddit Discussions:

1. r/wallstreetbets (Upvotes: 3.2K, Comments: 847)

- "AAPL earnings beat! Strong revenue growth, but China concerns real. Calls printing 🚀"

- Sentiment: Bullish with caution (72/100)

- Options Bias: 65% call mentions, 35% put mentions

2. r/stocks (Upvotes: 1.8K, Comments: 432)

- "Apple's Q4 results solid, but valuation getting stretched. P/E at 32x concerning."

- Sentiment: Neutral (58/100)

- Focus: Fundamental analysis, valuation concerns

3. r/investing (Upvotes: 1.1K, Comments: 289)

- "AAPL long-term hold, but short-term overvalued. Budget Mac interesting for market expansion."

- Sentiment: Slightly Bullish (65/100)

- Focus: Long-term strategy, product diversification

4. r/options (Upvotes: 890, Comments: 156)

- "China sales drop worrying for Q1 guidance. Selling covered calls at $200 strike."

- Sentiment: Cautiously Neutral (54/100)

- Options Strategy: Income generation, limited upside expectations

Key Reddit Themes Detected:

Bullish Arguments:

Bearish Arguments:

Reddit Consensus Score: 72/100 (Slightly Bullish)

Retail Investor Positioning:

SimianX.AI Insight: "Reddit retail sentiment aligns moderately with institutional views (Bloomberg 82/100 vs Reddit 72/100). The 10-point divergence suggests retail investors are more cautious about near-term risks, particularly China exposure. No extreme divergence detected—healthy agreement across sources."

Multi-Source Intelligence: Why Four Pillars Beat One

Single-source news analysis suffers from blind spots, bias, and incomplete context. SimianX.AI's four-pillar approach provides:

Cross-Validation

When all four sources agree (Bloomberg bullish, company announces strong guidance, media positive, Reddit excited)—confidence is high. Strong BUY signal.

When sources disagree—that's where opportunities and risks hide.

Real-World Example: Comprehensive News Analysis

Ticker: AAPL (Apple Inc.) - Analysis Date: November 5, 2025

Multi-Source Data Collection

| Source | Score | Key Coverage |

|---|---|---|

| Bloomberg | 82/100 | "Apple Q4 earnings beat estimates, record revenue reported" |

| Company News | 85/100 | "Record free cash flow, strong holiday sales forecast" |

| Mainstream Media | 68/100 | "Strong results but high valuation concerns persist" |

| 72/100 | "Earnings beat solid, but China sales drop is worrying" |

SimianX.AI Comprehensive Analysis

Market Impact Assessment

Apple Inc. (AAPL) has recently reported strong Q4 earnings, exceeding estimates with record revenue. This positive financial performance, combined with a forecast for robust holiday sales, has driven the stock to new highs. However, there are concerns regarding high valuations and potential margin pressures, particularly in light of new product introductions aimed at lower-cost segments. The company's entry into the low-cost laptop market could diversify its revenue streams but also intensify competition with established players.

Sentiment Analysis

The overall sentiment from the news is positive, reflecting optimism about Apple's earnings performance and strategic moves, though tempered by some caution regarding valuations and competition. Articles emphasizing record earnings and growth opportunities contribute to this positive outlook, while concerns over high valuations and mixed performance in certain markets introduce a note of caution.

Key Themes

1. Strong Earnings Performance: AAPL reported record Q4 earnings, with revenue growth and free cash flow surging, affirming its financial stability

2. Market Expansion: Apple is preparing to enter the low-cost laptop market, which may attract new customers but also bring increased competition

3. AI Developments: Significant investment in AI through a partnership with Google to enhance Siri indicates a strategic pivot towards advanced technology integration

4. Concerns Over Valuation: Despite strong results, analysts warn about high valuations and limited growth potential in some segments

Risk Factors

Opportunities

Financial Impact

AAPL's strong earnings report and increased free cash flow imply a solid financial foundation, with analysts suggesting the stock could be undervalued by approximately 20%. This financial strength is critical as it supports ongoing investments in new technology and product development.

Summary Table

| Key News Themes | Sentiment Score | Potential Impact | Time Horizon |

|---|---|---|---|

| Strong Earnings Performance | 8/10 | High | Short-term |

| Market Expansion (Budget Products) | 7/10 | Medium | Medium-term |

| AI Developments | 8/10 | High | Long-term |

| Concerns Over Valuation | 5/10 | Medium | Short-term |

| Competitive Pressure | 6/10 | Medium | Medium-term |

| Opportunities from New Product Lines | 7/10 | High | Medium-term |

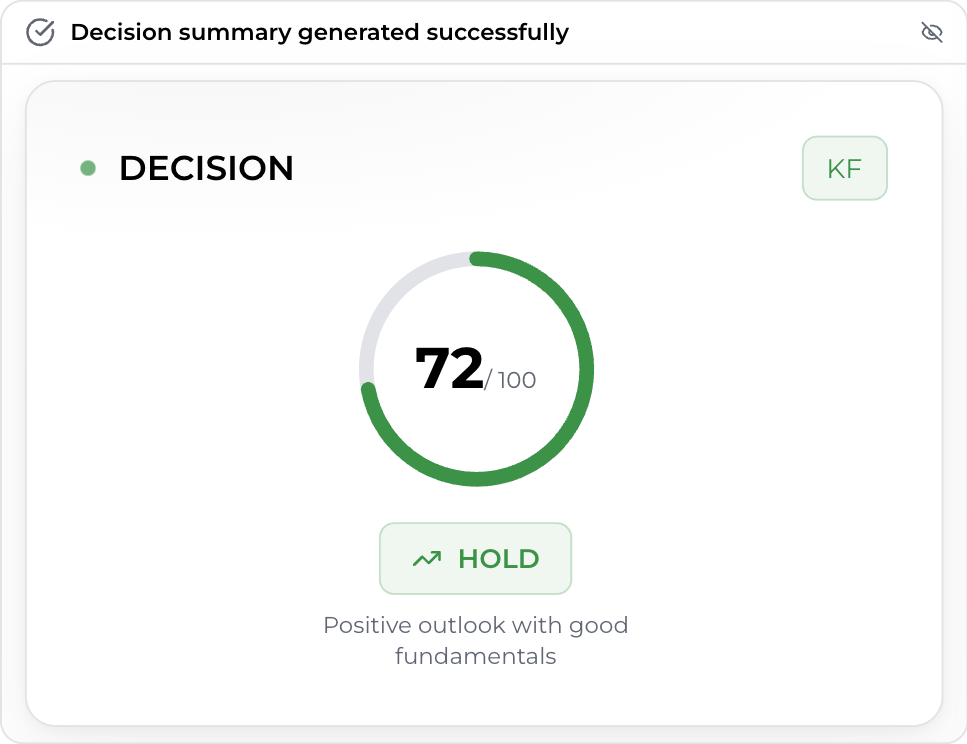

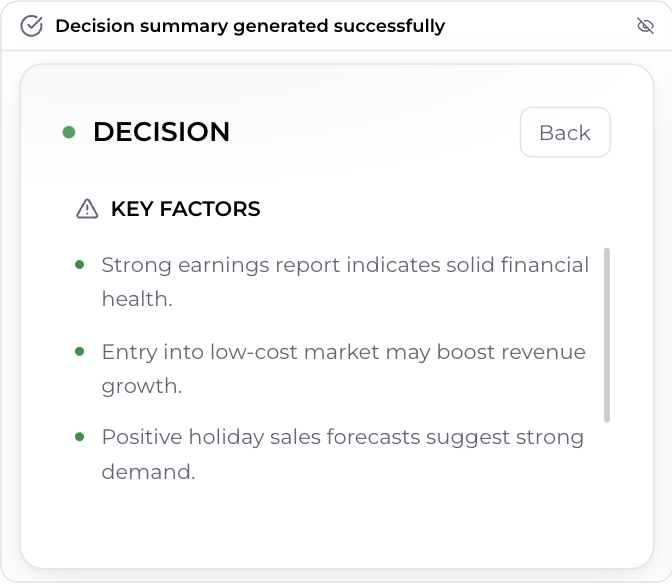

Final Assessment

FINAL SENTIMENT ASSESSMENT: POSITIVE

SimianX.AI Score: 72/100 (Bullish)

Recommendation: HOLD

Reasoning: "Strong fundamental performance with record earnings and strategic AI initiatives, but current valuation levels suggest limited immediate upside. China market concerns and competitive dynamics warrant caution. Recommended action: Hold existing positions and wait for entry point on pullback or further confirmation of China recovery."

Confidence Level: 72% (High)

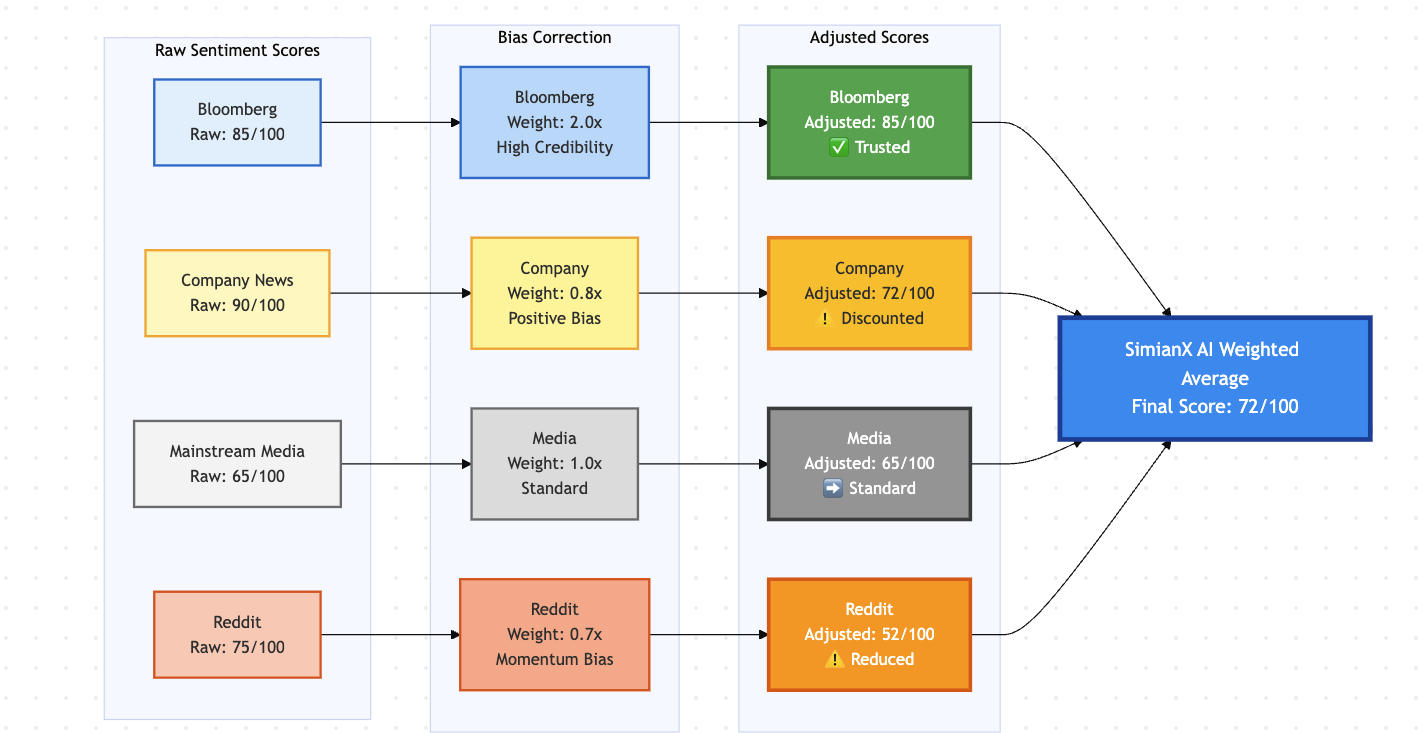

Bias Detection

Every news source has inherent bias:

SimianX.AI applies bias correction algorithms, weighting sources based on credibility and adjusting for known biases. Bloomberg stories on regulatory risk carry more weight than Reddit posts claiming "shorts manipulating everything."

Bias Correction Algorithm Visualization

How Bias Correction Works:

| Source | Raw Score | Credibility Weight | Bias Type | Adjusted Score | Impact |

|---|---|---|---|---|---|

| Bloomberg | 85/100 | 2.0x (High trust) | Institutional perspective | 85/100 | ✅ Full weight maintained |

| Company News | 90/100 | 0.8x (Positive bias) | Self-promotional | 72/100 | ⚠️ 20% discount applied |

| Mainstream Media | 65/100 | 1.0x (Standard) | Sensationalism | 65/100 | ➡️ No adjustment |

| 75/100 | 0.7x (Momentum bias) | Retail euphoria | 52/100 | ⚠️ 30% discount applied | |

| Final Consensus | — | Weighted Average | Cross-validated | 72/100 | 🎯 Final recommendation |

Key Bias Corrections Applied:

Bloomberg Premium Treatment

Company Announcement Discount

Mainstream Media Standard Treatment

Reddit Momentum Discount

Result: SimianX.AI's bias-adjusted consensus score (72/100) provides more reliable trading signals than any single source.

Comprehensive Coverage

Different sources cover different stories:

SimianX.AI ensures nothing important slips through the cracks.

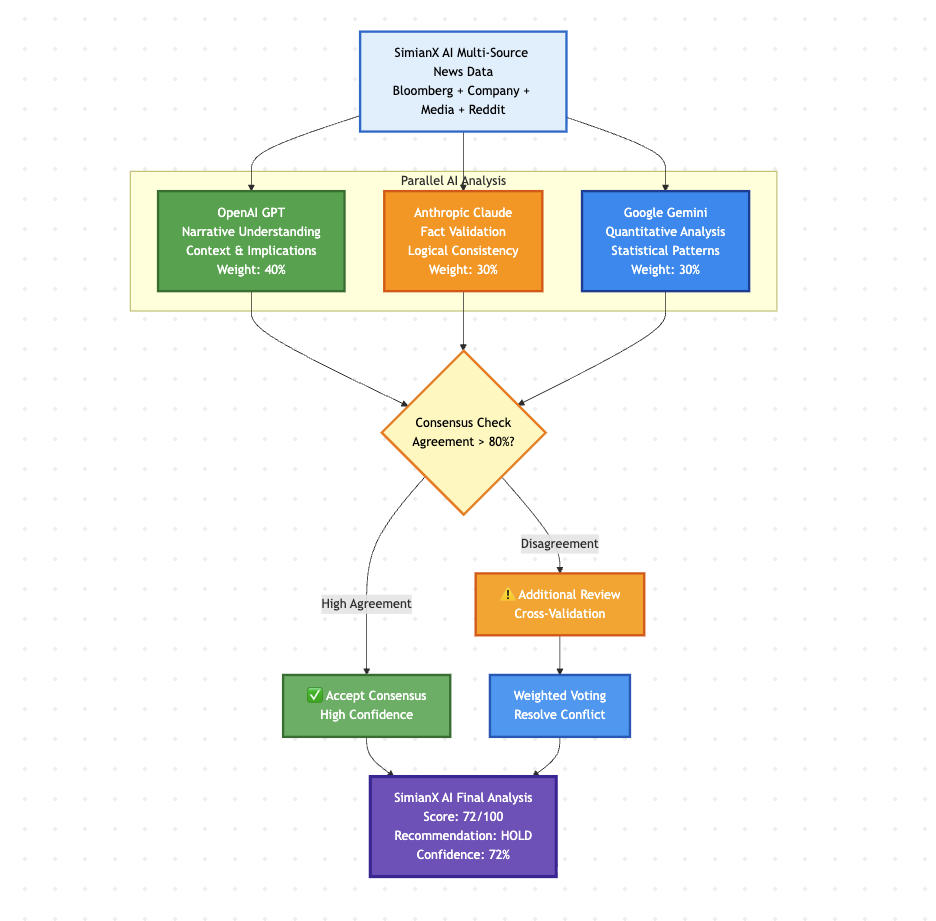

Multi-Model AI: OpenAI, Claude, and Gemini Working Together

Raw news data—even from premium sources—is unstructured, subjective, and difficult to quantify. How do you turn "Tesla beats earnings but warns of margin pressure" into a trading decision?

SimianX.AI employs three leading AI models simultaneously, each contributing specialized intelligence:

🧠 OpenAI — Narrative Understanding

Strengths:

What OpenAI Model does: Reads Bloomberg's earnings article and understands not just what the numbers are, but what they mean for future performance and competitive positioning.

🎯 Anthropic Claude — Analytical Precision

Strengths:

What Claude does: Checks whether the company's optimistic press release matches Bloomberg's more skeptical analysis, flags discrepancies.

Google Gemini — Quantitative Evaluation

Strengths:

What Gemini does: Converts qualitative news into quantitative metrics—sentiment scores, confidence levels, risk ratings.

🔗 Model Collaboration Workflow

SimianX.AI doesn't just use three models—it orchestrates them:

Multi-Model Intelligence Architecture

Step-by-Step Process:

1. Parallel Analysis Phase

2. Consensus Detection

3. Decision Pathway

| Agreement Level | Action | Confidence |

|---|---|---|

| >80% Agreement | Accept Consensus | High (80-100%) |

| 60-80% Agreement | Flag for Review | Medium (60-79%) |

| <60% Agreement | Weighted Voting | Low (50-59%) |

4. Weighted Voting System

When models disagree, SimianX.AI applies intelligent weighting:

| Model | Weight | Reasoning |

|---|---|---|

| OpenAI | 40% | Superior narrative understanding, contextual reasoning |

| Claude | 30% | Conservative validation, reduces false positives |

| Gemini | 30% | Quantitative precision, numerical accuracy |

5. Final Output Generation

SimianX.AI streams analysis in real-time—you watch as we:

Collect Bloomberg news

Gather company announcements

Aggregate mainstream media

Pull Reddit sentiment

Run AI analysis

Generate recommendations

Total time: 45-60 seconds from breaking news to actionable insight.

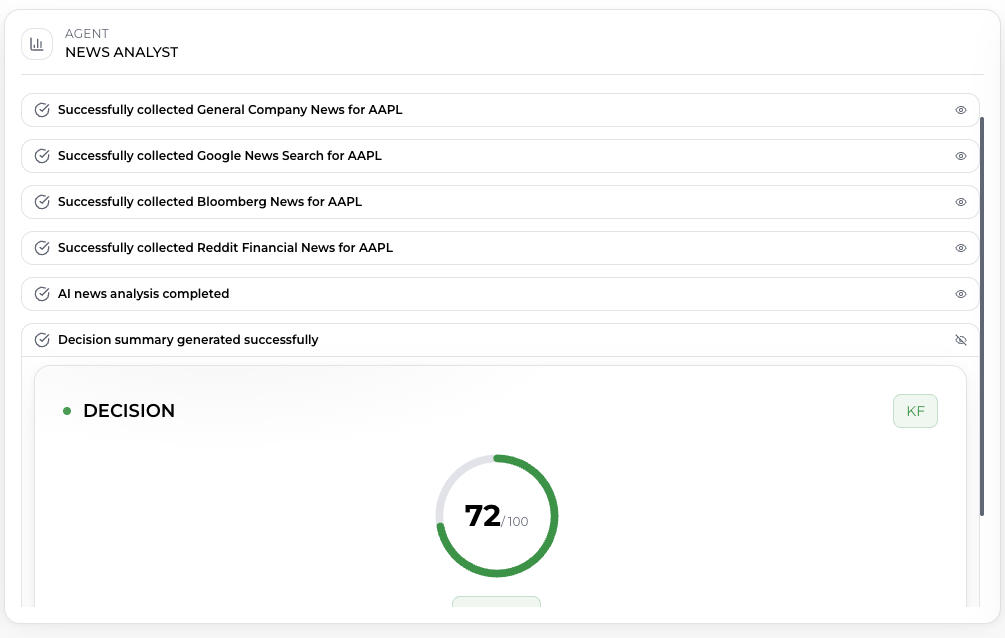

Real-Time Analysis Timeline

0:00 — User requests analysis for AAPL

0:02 — Collecting General Company News... ⏳

0:04 — General Company News: 8 articles collected

0:06 — Collecting Google News Search... ⏳

0:09 — Google News Search: 24 articles aggregated

0:10 — Collecting Bloomberg News... ⏳

0:16 — Bloomberg News: 12 articles collected

0:18 — Collecting Reddit Financial News... ⏳

0:22 — Reddit Financial News: 47 relevant discussions analyzed

0:24 — Starting multi-model AI analysis... 🧠

0:26 — Analyzing market impact and sentiment...

0:45 — AI news analysis completed!

Decision Card Generated:

Why streaming matters:

Transparency — See exactly what we're analyzing

Speed perception — Feels instant, not slow

Interruptible — Cancel anytime if priorities change

Fault tolerance — Get partial results even if one source fails

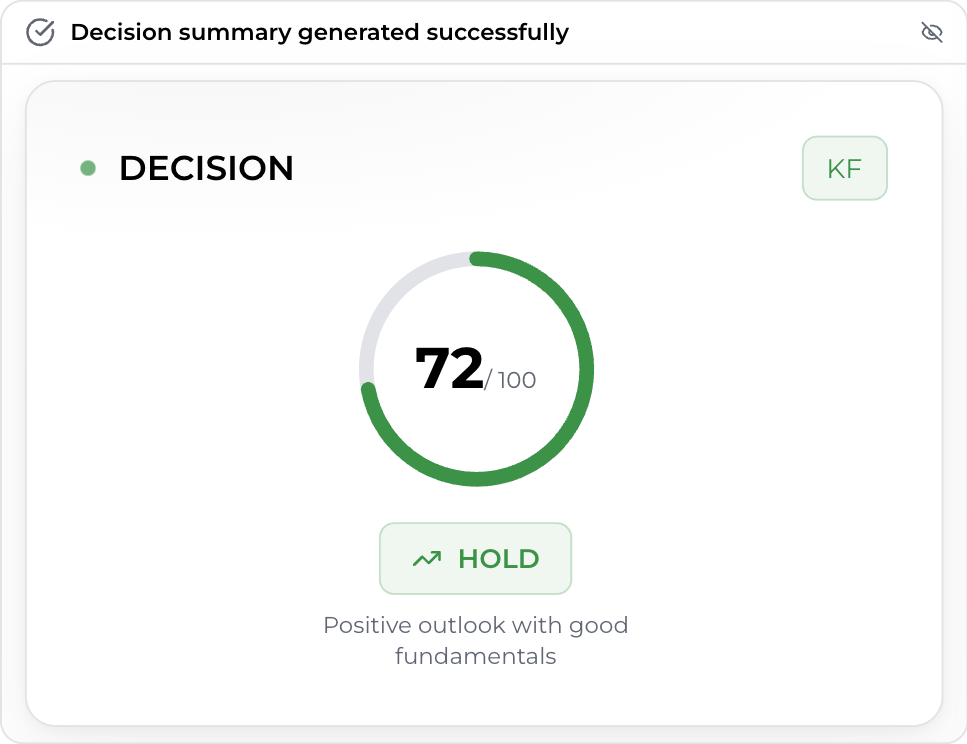

Decision Cards: Trading Intelligence at a Glance

SimianX.AI distills thousands of words of news analysis into clean, actionable decision cards designed for speed:

Decision Card

Sentiment Score (0-100, large and prominent)

Recommendation (BUY/HOLD/SELL in clear colors)

Confidence Level (percentage with visual indicator)

Top 4 Reasons (bullet points supporting the decision)

Key News Links (verify with original sources)

Last Updated (timestamp for freshness)

Mobile-optimized design — See everything important without scrolling.

Real-World Use Cases: Who Benefits from SimianX.AI News Analysis?

Hedge Funds and Institutional Traders

Challenge: Need sub-minute reaction times to breaking news for algorithmic trading systems.

SimianX.AI Solution:

Outcome: Capture alpha from news events before markets fully react.

Quantitative Researchers

Challenge: Historical news sentiment data is expensive, unstructured, and hard to backtest.

SimianX.AI Solution:

Sample backtest:

Financial Analysts

Challenge: Cover 20-50 stocks, read news daily, write reports weekly—not enough time.

SimianX.AI Solution:

Outcome: 70% time savings on news monitoring, higher output quality.

Retail Investors

Challenge: Don't have $24K/year for Bloomberg Terminal. Don't have time to read hundreds of articles.

SimianX.AI Solution:

Outcome: Make informed decisions without information disadvantage vs Wall Street.

Risk Managers

Challenge: Monitor portfolio holdings for negative news that could trigger drawdowns.

SimianX.AI Solution:

Competitive Advantages: Why SimianX.AI Wins

| Feature | SimianX.AI | Basic News Aggregators | Bloomberg Terminal |

|---|---|---|---|

| Bloomberg Access | Automated | No | Yes ($24K/year) |

| Multi-Source | 5+ sources | 1-2 sources | Bloomberg only |

| Reddit Sentiment | Integrated | No | No |

| AI Analysis | 3 models | Basic or none | Human only |

| Real-Time Streaming | <60 seconds | Batch (5+ min) | Manual reading |

| Quantitative Scores | 0-100 scale | No scoring | Qualitative only |

| BUY/HOLD/SELL | Clear recommendations | No signals | Analyst dependent |

| Cross-Validation | Source divergence detection | No validation | Single perspective |

| API Access | Full API | Limited | Terminal only |

| Cost | $17/month Pro | Free - $99/month | $24,000/year |

SimianX.AI delivers institutional-grade intelligence at retail-friendly pricing.

The Future of News-Driven Trading

By 2030, analysts estimate 80%+ of institutional trading will incorporate AI-driven news analysis. The question isn't whether AI will dominate financial news interpretation—it's whether you'll have access to it.

SimianX.AI positions you at the forefront of this transformation.

What's Coming in 2026

Q1 2026:

Q2 2026:

Q3 2026:

Q4 2026:

From Chaos to Clarity: Your Competitive Edge

Financial markets generate 50,000 news articles daily. Humans can't process this. Traditional tools can't interpret it. AI changes everything.

SimianX.AI News Analysis Agent delivers:

Bloomberg intelligence without the $24K/year Terminal cost

Multi-source aggregation from premium, company, media, and Reddit sources

Triple-AI validation through OpenAI, Claude, and Gemini collaboration

Real-time streaming with <60 second analysis turnaround

Quantitative signals from qualitative news (0-100 sentiment scores)

Clear recommendations with BUY/HOLD/SELL and confidence levels

Retail + institutional synthesis combining Wall Street and Reddit perspectives

Whether you're running a hedge fund algorithm, researching quantitative strategies, writing analyst reports, or making personal investment decisions—SimianX.AI turns information overload into your competitive advantage.

Get Started with SimianX.AI News Analysis

Try News Analysis Now: Analyze Now

Join Our Community: Discord | Twitter/X

Q: How is this different from Google News or Yahoo Finance?

A: Those show you raw headlines. SimianX.AI analyzes them with AI, scores sentiment, cross-validates sources, and gives you BUY/HOLD/SELL recommendations. We turn information into decisions.

Q: Can I access Bloomberg through SimianX without a Terminal subscription?

A: Yes. We analyze Bloomberg's public web news coverage (not terminal-exclusive content) and deliver those insights to you. This represents 80%+ of actionable Bloomberg intelligence.

Q: How accurate are the sentiment scores?

A: Historical backtests show 64-72% accuracy predicting 5-day price direction when sentiment is strongly bullish (>75) or bearish (<30). Neutral scores (40-60) are less predictive, which we indicate through confidence levels.

Q: What happens when Reddit and Bloomberg disagree?

A: We flag the divergence explicitly and explain what it means. Often, divergence signals volatility opportunities or hidden risks. See our decision cards for source-specific breakdowns.

Q: How fast is "real-time"?

A: From when news breaks on Bloomberg to complete SimianX analysis: 45-90 seconds. You see streaming progress the entire time(the entire time. others tools don't show you the progress).

Q: Does this work for crypto or forex?

A: Currently optimized for US equities. Crypto (live) analysis launches Q4 2025, it is available for free and toally different from the current stock analysis.