Specialized Time-Series Models vs. LLMs for Crypto Price Prediction

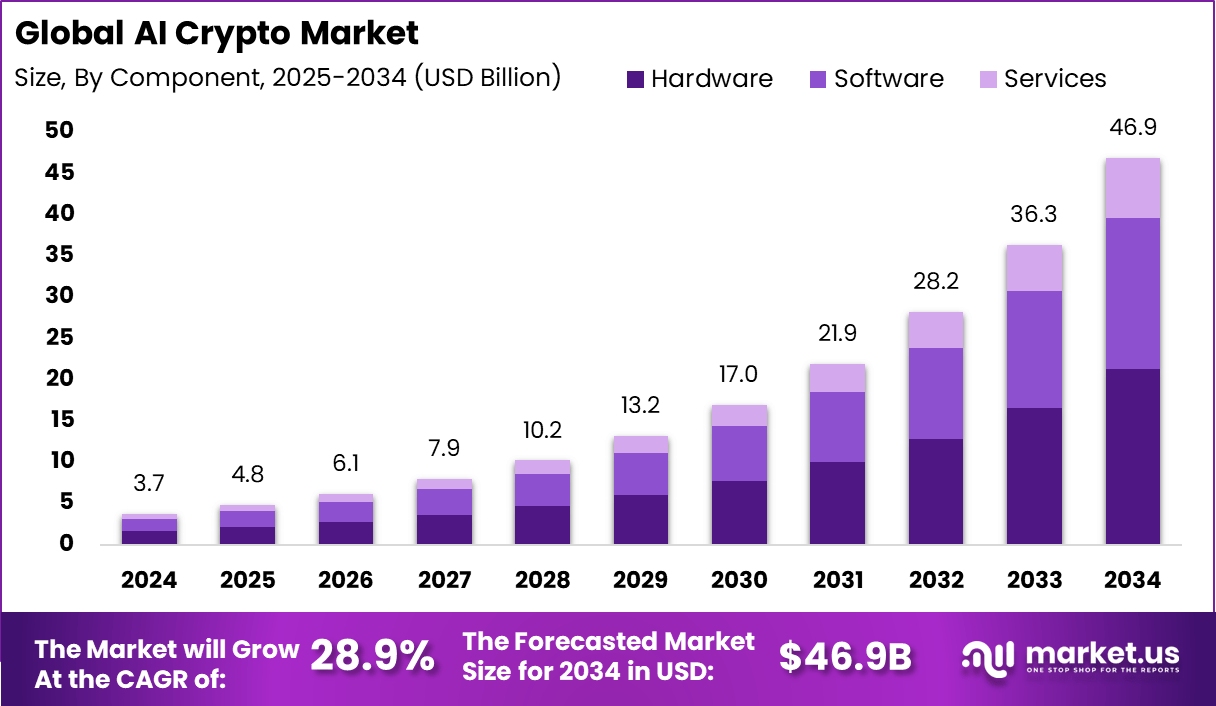

Specialized time-series models vs. LLMs for crypto price prediction has become one of the most debated topics in AI-driven trading research. As crypto markets grow more complex, traders and researchers face a critical choice: rely on mathematically grounded time-series models or adopt large language models (LLMs) originally built for text but increasingly used for market intelligence.

In this article, we explore how these two model families differ, where each excels, and how platforms like SimianX AI help combine them into more robust crypto prediction systems.

Why Crypto Price Prediction Is a Unique Modeling Problem

Crypto markets differ fundamentally from traditional financial markets:

These properties challenge any single modeling paradigm.

In crypto, structure and story matter equally—and few models capture both.

Understanding this duality is key when comparing specialized time-series models and LLMs.

What Are Specialized Time-Series Models?

Specialized time-series models are built explicitly to analyze sequential numerical data. They assume prices follow certain statistical properties across time.

Common categories include:

Core strengths:

Core weaknesses:

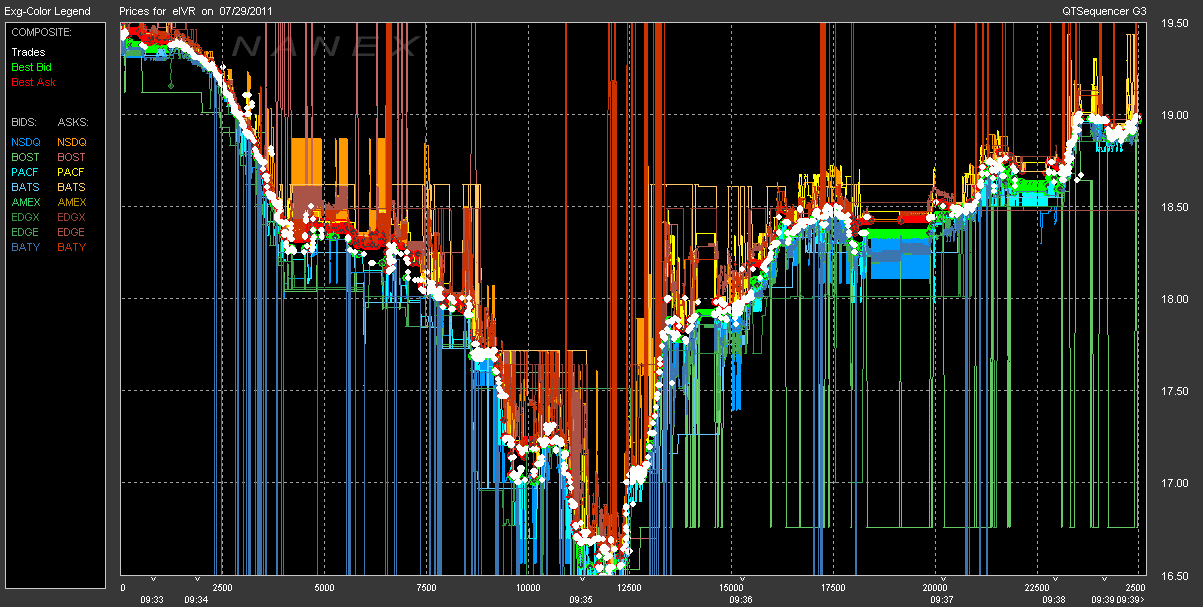

How Time-Series Models Work in Crypto Markets

Time-series models typically rely on:

1. Price and volume history

2. Lagged correlations

3. Stationarity assumptions

4. Feature engineering

| Aspect | Time-Series Models |

|---|---|

| Data type | Numeric only |

| Interpretability | High |

| Reaction to news | Indirect |

| Regime awareness | Limited |

These models excel during stable micro-regimes but often fail when narratives or liquidity shocks dominate.

What Are LLMs in Crypto Price Prediction?

LLMs were not designed for price forecasting. However, their ability to model language, context, and reasoning has opened new use cases in crypto markets.

LLMs are increasingly used to:

Strengths:

Weaknesses:

Why LLMs Struggle With Raw Price Prediction

LLMs lack built-in inductive bias for time continuity. Prices are tokenized, not temporally modeled.

As a result:

LLMs are better market interpreters than price calculators.

Specialized Time-Series Models vs. LLMs: A Direct Comparison

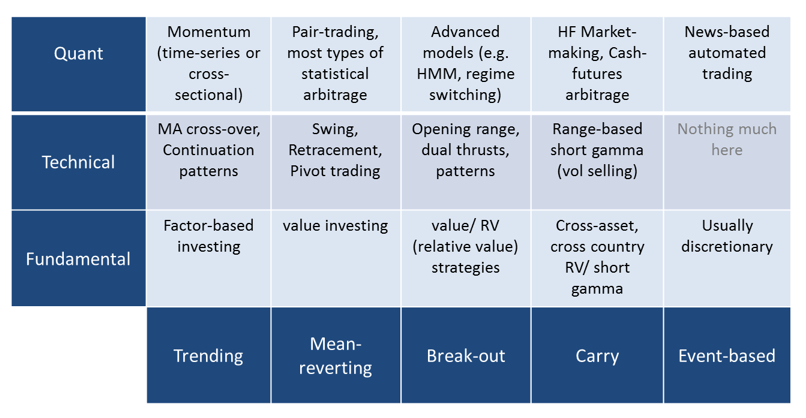

| Dimension | Time-Series Models | LLMs |

|---|---|---|

| Numeric accuracy | High | Low–Medium |

| Context awareness | Low | Very High |

| Reaction to news | Slow | Fast |

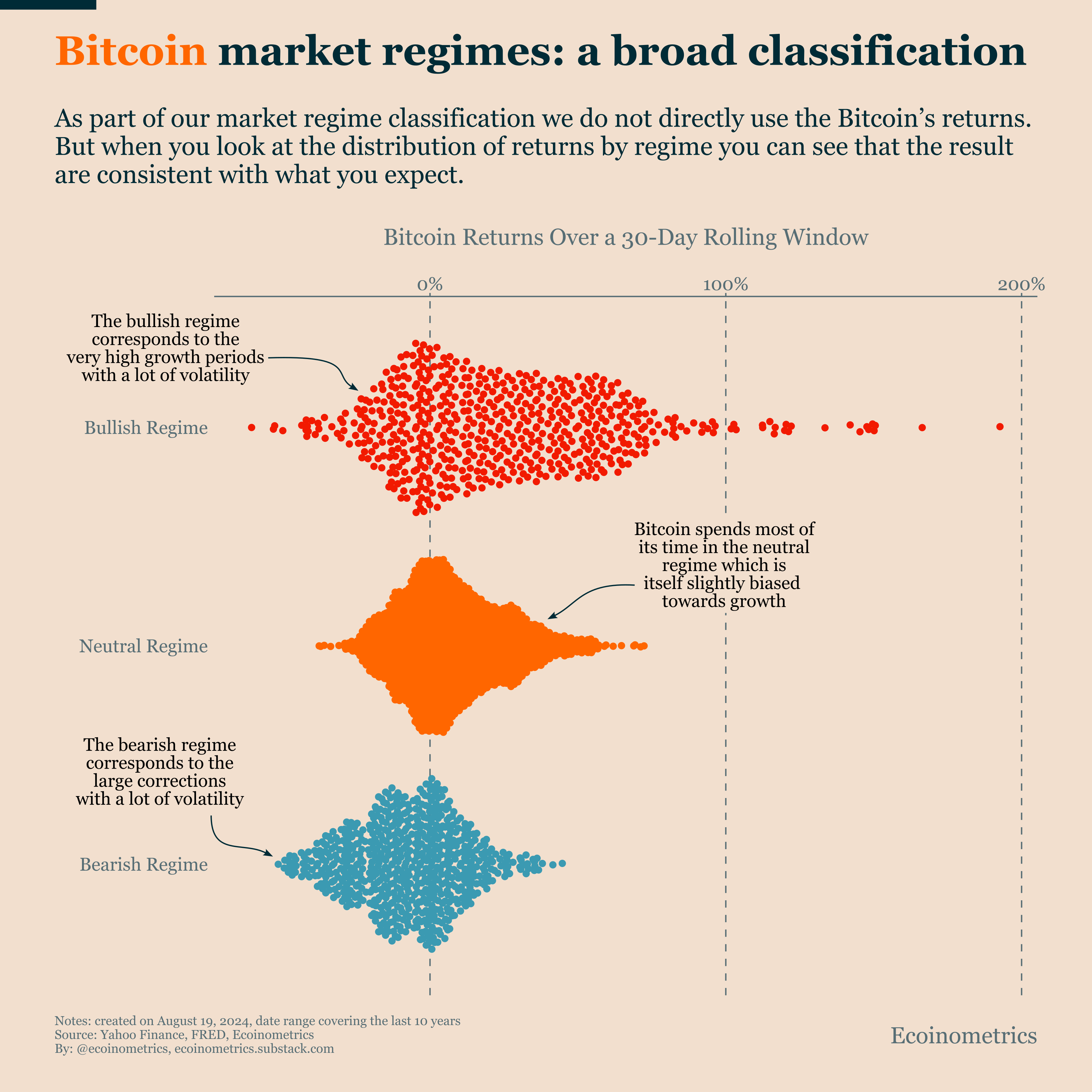

| Regime detection | Weak | Strong |

| Explainability | Mathematical | Linguistic |

| Data efficiency | High | Low |

This comparison highlights why neither approach alone is sufficient.

When Time-Series Models Outperform LLMs

Time-series models dominate when:

Examples include:

These conditions favor precision over interpretation.

When LLMs Outperform Time-Series Models

LLMs shine during:

They detect why markets move, not just how.

Examples:

Why Hybrid Architectures Are the Future

The most effective crypto prediction systems integrate both approaches.

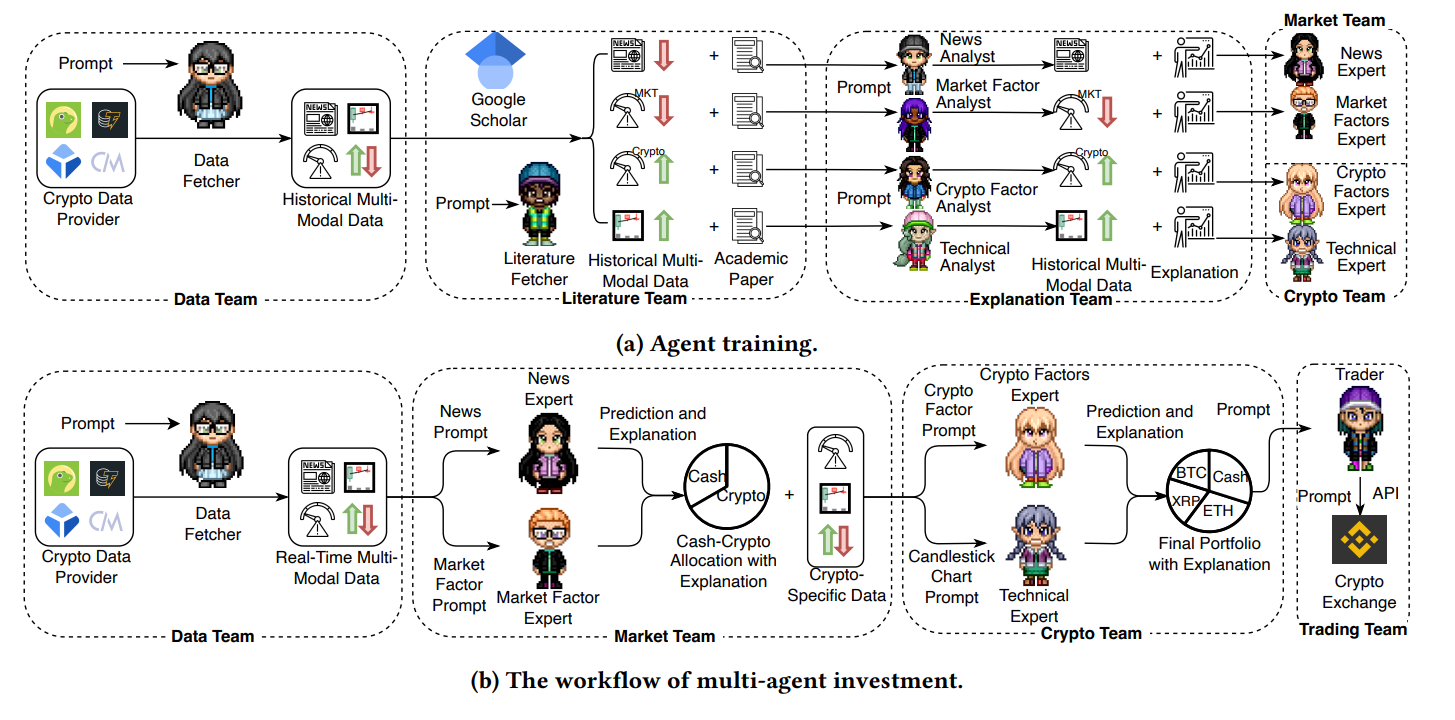

A common architecture:

1. Time-series models generate numeric forecasts

2. LLMs interpret context, narratives, and anomalies

3. Meta-models reconcile conflicts and manage uncertainty

| Layer | Role |

|---|---|

| Numeric layer | Short-term price signals |

| Semantic layer | Narrative & risk interpretation |

| Decision layer | Portfolio or execution logic |

This is the philosophy behind SimianX AI’s multi-agent research framework.

How SimianX AI Uses Time-Series Models and LLMs Together

SimianX AI treats crypto prediction as a systems problem, not a single-model task.

On the platform:

This reduces overfitting, hallucination, and false confidence.

You can explore this approach directly at

Why Multi-Agent Systems Matter for Prediction

Single models fail silently. Multi-agent systems fail loudly.

Benefits include:

In crypto, knowing when not to trade is as valuable as prediction accuracy.

Practical Guidance: Which Model Should You Use?

Use time-series models if you need:

Use LLMs if you need:

Use both if you want survivability across market regimes.

FAQ About Specialized Time-Series Models vs. LLMs for Crypto Price Prediction

Are LLMs good for crypto price prediction?

LLMs are weak at direct numeric forecasting but strong at interpreting narratives, sentiment, and regime changes that drive crypto markets.

Do time-series models still matter in crypto?

Yes. Time-series models remain essential for short-term precision, volatility modeling, and execution-level strategies.

What is the best AI model for crypto prediction?

There is no single best model. Hybrid systems combining time-series models and LLMs consistently outperform standalone approaches.

Can I use LLMs for trading signals?

LLMs should not generate raw trade signals alone. They are best used as contextual or risk-aware layers supporting numeric models.

Conclusion

Specialized time-series models vs. LLMs for crypto price prediction is not a question of replacement, but of integration. Time-series models deliver numeric discipline, while LLMs provide narrative intelligence and adaptive reasoning.

The future of crypto prediction belongs to hybrid, multi-agent systems that understand both prices and people.

If you want to explore this next-generation approach, visit

SimianX AI and see how coordinated AI agents can help you navigate crypto markets with clarity and control.

---

Deep Dive: Why Pure Price Prediction Fails in Crypto Markets

One of the most misunderstood assumptions in crypto research is that price prediction is the ultimate objective. In reality, price prediction is only a proxy for decision-making under uncertainty.

Crypto markets violate nearly every classical assumption:

As a result, accuracy metrics alone are misleading.

A model can be directionally “right” and still cause catastrophic losses.

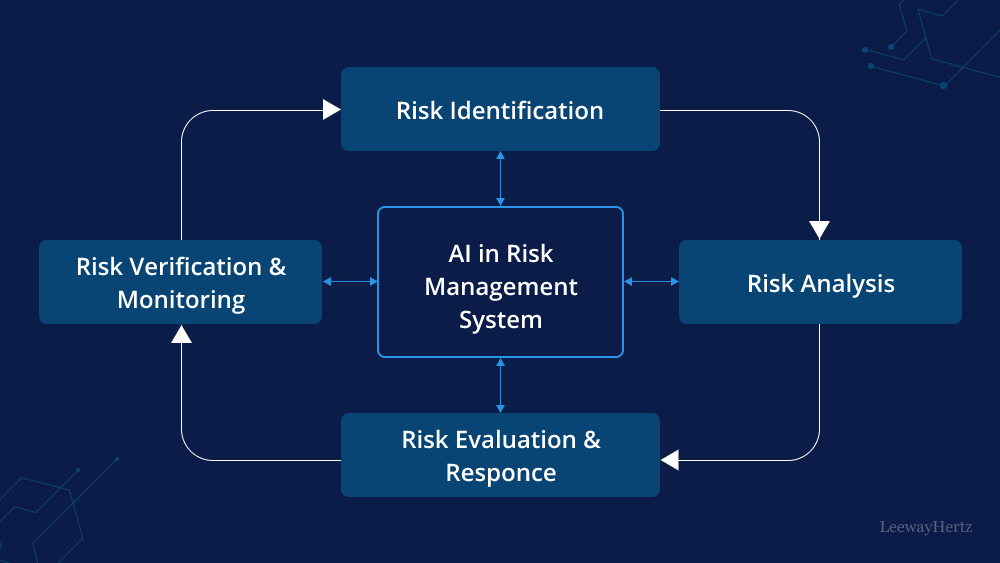

This is why evaluating specialized time-series models vs. LLMs for crypto price prediction requires reframing the problem:

prediction is not about prices—it is about risk-adjusted action.

---

The Hidden Failure Modes of Time-Series Models in Crypto

Specialized time-series models fail not because they are weak, but because crypto markets frequently operate outside their design envelope.

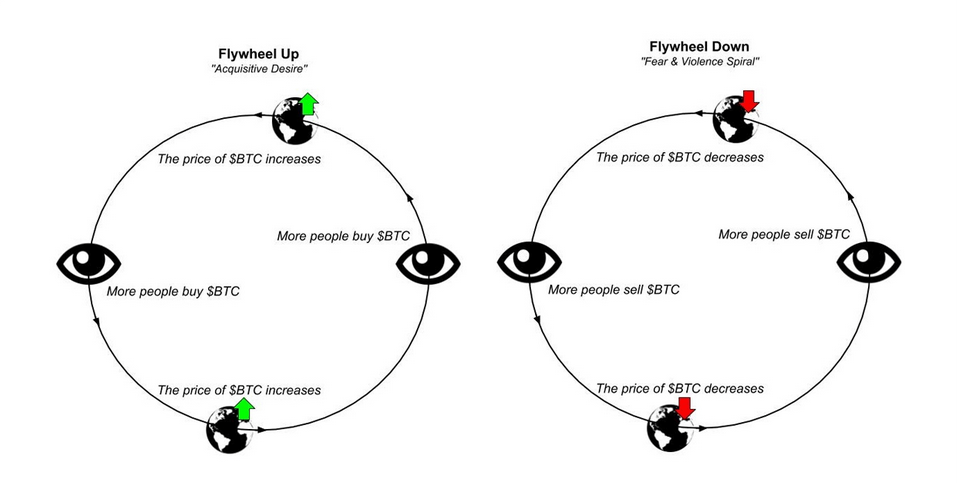

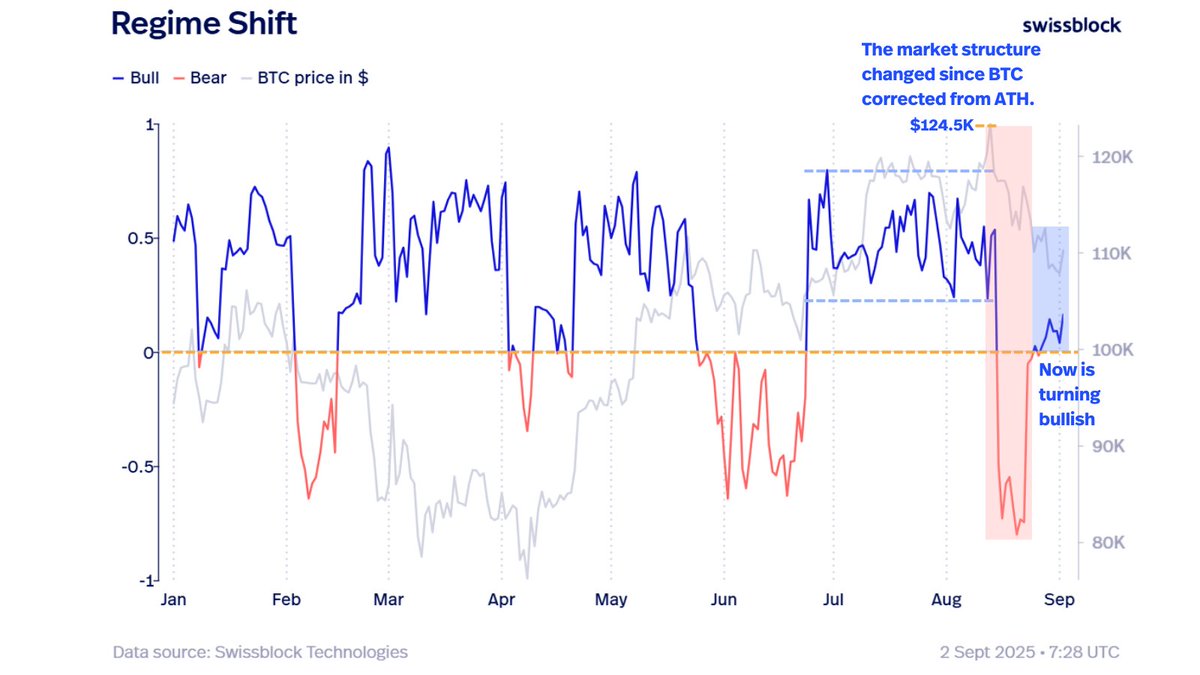

1. Regime Collapse

Time-series models assume continuity. Crypto markets break continuity.

Examples:

These events introduce structural breaks, invalidating learned parameters instantly.

2. Feature Drift and Overfitting

Crypto indicators decay rapidly.

| Feature Type | Half-Life |

|---|---|

| Momentum | Hours–Days |

| Volume spikes | Minutes–Hours |

| Volatility | Regime-dependent |

| On-chain metrics | Narrative-driven |

Without constant retraining, time-series models quietly degrade.

3. False Confidence Under Stress

Time-series models output numbers, not doubt.

This creates an illusion of certainty precisely when uncertainty is highest.

In crypto, silence from a model is often more dangerous than noise.

---

The Hidden Failure Modes of LLMs in Crypto

While LLMs excel at semantic reasoning, they introduce new classes of risk.

1. Narrative Overfitting

LLMs overweight dominant narratives.

Examples:

This leads to herding behavior at the model level.

2. Temporal Hallucination

LLMs do not experience time—they infer it.

Consequences:

3. Confidence Without Calibration

LLMs express uncertainty linguistically, not probabilistically.

This makes it difficult to:

---

Why Prediction Accuracy Is the Wrong Optimization Target

Most crypto AI systems optimize for:

These metrics ignore capital dynamics.

Better Optimization Targets

A more realistic objective function includes:

| Metric | Why It Matters |

|---|---|

| Max drawdown | Survival |

| Conditional VaR | Tail risk |

| Turnover | Execution friction |

| Regime error rate | Structural risk |

This is where hybrid systems outperform single-model approaches.

---

Hybrid Intelligence: From Models to Cognitive Systems

The future of crypto prediction is not better models, but better systems.

Hybrid architectures treat models as agents, not oracles.

Agent Roles in a Hybrid System

1. Time-Series Agents

- Short-horizon numeric forecasts

- Volatility estimation

- Microstructure signals

2. LLM Agents

- Narrative interpretation

- Governance and regulatory analysis

- Cross-market semantic inference

3. Meta-Agents

- Conflict detection

- Confidence reconciliation

- Risk gating

Prediction becomes a conversation, not a calculation.

---

How SimianX AI Implements Multi-Agent Prediction

SimianX AI operationalizes this philosophy through a coordinated research architecture.

Key design principles:

Example: Market Shock Detection

When a shock occurs:

1. Time-series agents detect abnormal volatility

2. LLM agents analyze narrative triggers

3. Meta-agent assesses disagreement magnitude

4. System reduces confidence and exposure

This prevents model overcommitment.

---

Case Study: Narrative-Driven Rally vs. Structural Weakness

Consider a hypothetical market scenario:

Time-Series Model View

LLM View

Meta-Agent Resolution

This is how prediction becomes risk-aware intelligence.

---

Rethinking Forecast Horizons in Crypto

Crypto does not have a single “future”.

Different horizons behave like different markets.

| Horizon | Dominant Driver |

|---|---|

| Minutes | Order flow |

| Hours | Volatility clustering |

| Days | Narrative momentum |

| Weeks | Liquidity & macro |

| Months | Structural adoption |

Time-series models dominate short horizons.

LLMs dominate medium horizons.

Only hybrid systems span all horizons coherently.

---

From Prediction to Policy: AI as a Market Governor

The most advanced crypto systems do not predict—they govern exposure.

AI policies include:

This shifts AI’s role from trader to risk governor.

---

Why Most Retail Crypto AI Tools Fail

Retail-focused “AI trading bots” often fail because they:

A model that never says “I don’t know” is dangerous.

---

Institutional Lessons from Crypto Prediction Research

Institutions entering crypto must unlearn TradFi assumptions:

This makes LLM + time-series integration mandatory, not optional.

---

Designing Your Own Hybrid Crypto Prediction Stack

A minimal architecture:

1. Numeric signal layer

2. Narrative interpretation layer

3. Risk arbitration layer

4. Execution governance layer

This is the conceptual blueprint behind SimianX AI.

---

FAQ: Advanced Questions on Hybrid Crypto Prediction

Why not just train larger time-series models?

Scale does not solve regime uncertainty. Bigger models overfit faster in non-stationary markets.

Can LLMs replace quantitative models?

No. LLMs lack numeric grounding and should never operate without quantitative constraints.

How do multi-agent systems reduce losses?

By surfacing disagreement early and throttling exposure when confidence collapses.

Is prediction still useful if accuracy is low?

Yes—if prediction informs risk control rather than blind execution.

---

Conclusion: The End of Model-Centric Thinking

The debate around specialized time-series models vs. LLMs for crypto price prediction is ultimately misplaced.

The real evolution is from:

models → agents → systems → governance

Time-series models provide discipline.

LLMs provide meaning.

Hybrid systems provide survivability.

If you are building or evaluating crypto prediction infrastructure, the question is no longer which model is best, but:

Which system fails most gracefully when markets break?

Explore how multi-agent crypto intelligence works in practice at

---