Using AI to Test DeFi Yields: Real Yields and Tail Risks

“High APY” is the loudest marketing line in DeFi—and often the least informative. If you’re serious about capital preservation, you need Using AI to test DeFi yields: Real yields and tail risks as a repeatable process: calculate what you actually earn (net of emissions noise), and model the blowups that happen when liquidity, oracles, or governance break. In this guide, we’ll treat yield like a measurable cashflow problem, and tail risk like an engineering problem. We’ll also reference SimianX AI as a practical way to structure your research into consistent, auditable loops (instead of one-off “vibes” analysis). Visit SimianX AI to see how structured workflows can help you document assumptions and outputs.

Why “APY” is a trap (and why real yield is the only number that matters)

Most DeFi front-ends show a single APY that mixes fundamentally different return sources:

Key idea: APY is not a yield. APY is a story. Real yield is a cashflow.

A “10% APY” can be:

So the goal is to compute realized yield (what you earned) and real yield (what is likely sustainable under realistic regimes), then discount it for tail risk.

Real yield vs. realized yield vs. risk-adjusted yield

Think of three layers:

1. Realized yield: what actually happened over a window (e.g., 7D/30D)

2. Real yield: the part of yield that plausibly persists without subsidization

3. Risk-adjusted yield: real yield minus expected losses from tail events (weighted by probability and severity)

In practice, you’ll estimate:

fee_apr from on-chain fee flows

emissions_apr from reward schedules and token prices

net_real_yield after costs + realistic regime assumptions

tail_risk_haircut from scenario stress tests

A practical decomposition: where DeFi returns really come from

You can’t test yield until you define it precisely. Use a decomposition that separates cashflows from incentives and from price drift.

Yield decomposition template

| Component | What it is | How to measure (on-chain) | Common failure mode |

|---|---|---|---|

| Fee income | Swap fees, vault performance fees, liquidation fees | Fee events, protocol revenue dashboards, pool accounting | Volume collapses; fees revert to mean |

| Interest income | Borrow APR paid to suppliers | Utilization, borrow rates, reserve factors | Liquidations spike; bad debt |

| Incentive rewards | Emissions / reward tokens | Reward rate per block/second, distribution schedule | Reward token dumps; incentives end |

| IL / PnL drift | LP relative performance vs holding | Pool reserves + price series | Volatility regime shifts |

| Execution costs | Gas, slippage, bridging, rebalances | Tx receipts + DEX quotes | Congestion, MEV, routing changes |

Best practice: calculate yield in the base asset you care about (e.g., USD, ETH, stablecoin), and record the conversion rules.

A minimal formula that avoids self-deception

A simple but useful accounting identity:

realized_return = fee_income + interest_income + rewards_value - (gas + slippage + IL + hedging_costs)

Then separate:

rewards_value into conservative and optimistic marks (spot vs discounted)

This is where AI can help—not by “predicting APY,” but by automating the bookkeeping, validating data sources, and running consistent stress tests across protocols.

How can you use AI to test DeFi yields for real yields and tail risks?

A good AI workflow doesn’t replace judgment. It replaces inconsistency.

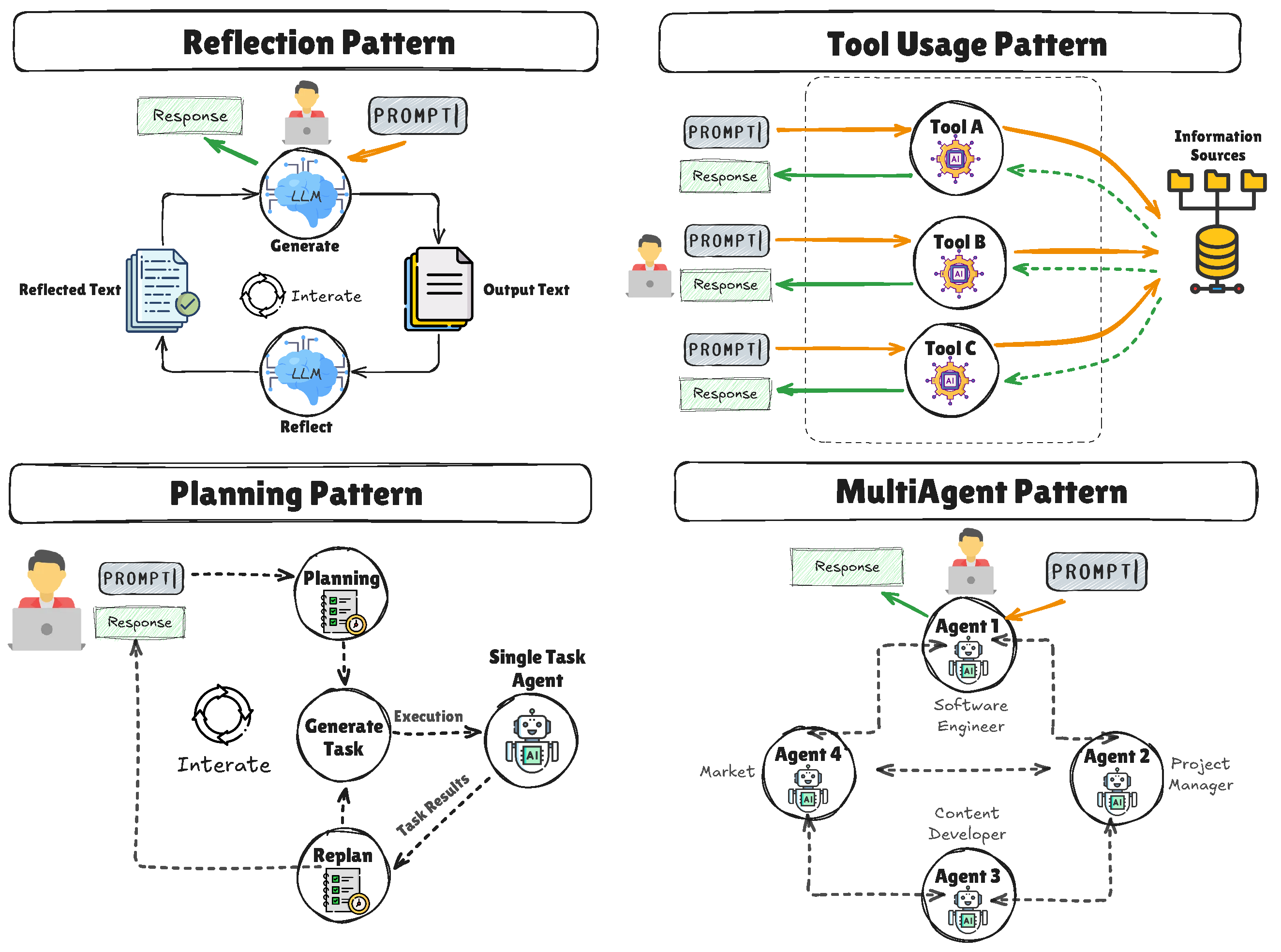

Instead of one monolithic model, use a multi-agent pipeline where each agent has a narrow job, clear inputs/outputs, and an audit trail. This reduces hallucinations and makes your research reproducible.

Here’s a practical architecture you can implement with LLM agents + deterministic on-chain analytics:

1. Ingestion Agent

Pulls raw data: pool events, reward schedules, rates, balances, governance changes, oracle configs. Outputs normalized tables with timestamps and provenance.

2. Protocol Mapper Agent

Reads docs/contracts and outputs a “mechanism map”: upgradeability, admin roles, oracle dependencies, fee paths, liquidation rules, bridged components.

3. Yield Accountant Agent

Computes realized fee APR, interest APR, incentive APR; reconciles compounding assumptions; flags “APY math tricks.”

4. Risk Scoring Agent

Scores risk categories with evidence: contract risk, oracle risk, liquidity risk, governance risk, bridge risk, economic design risk.

5. Tail-Risk Simulator Agent

Runs stress scenarios and outputs loss distributions, max drawdowns, and “break points” (what conditions cause insolvency or forced unwind).

6. Monitoring & Alert Agent

Watches for parameter changes, admin actions, large wallet flows, oracle deviations, depeg risk, liquidity evaporation.

7. Report Agent

Produces a consistent memo: what you earn, why, what breaks it, and what you monitor.

Tools like SimianX AI can help you keep this workflow structured—same sections, same assumptions, same decision trail—so your analysis scales across chains and protocols rather than living in scattered notebooks.

Building the “real yield” calculator: step-by-step (with checks that matter)

Below is a practical implementation plan. The key is to treat yield as a data product.

Step 1: Define the unit of account and the evaluation window

Pick:

Common mistake: comparing a compounding APY vault to a non-compounding APR pool without normalizing.

Step 2: Compute realized fee/interest yield (the sustainable core)

For AMMs:

- Track fees_collected or infer via pool accounting / fee growth

- Normalize by your LP position value

For lending:

Step 3: Price reward emissions like a risk manager, not a marketer

If a protocol pays incentives, mark them two ways:

Why haircut? Because rewards create sell pressure—especially when mercenary liquidity farms and exits.

If your strategy’s profitability disappears under a conservative reward mark, you don’t have yield—you have subsidy exposure.

Step 4: Subtract the costs everyone ignores

At minimum, include:

Use inline code variables in your worksheet to keep it explicit:

entry_cost_bps, exit_cost_bps, rebalance_cost_monthly

Step 5: Add strategy-specific risk adjustments

Impermanent loss (IL) for LP positions:

(e.g., “price moves ±30% in 24h” scenarios)

Liquidation risk for leveraged yield:

Tail risks in DeFi: model the blowups, not the averages

Tail risk is why “safe-looking” yields implode. A robust yield test must include mechanism-level failure modes.

A practical tail-risk taxonomy (useful for AI scoring)

| Risk category | What breaks | High-signal indicators to monitor |

|---|---|---|

| Smart contract risk | Exploits, auth flaws, upgrade bugs | Upgradeable proxies, privileged roles, unusual call patterns |

| Oracle risk | Price manipulation, stale feeds | Low-liquidity feeds, deviations, heartbeat failures, TWAP drift |

| Liquidity risk | Exit becomes costly/impossible | TVL concentration, slippage spikes, shallow order books |

| Governance risk | Malicious proposals, parameter capture | Whale concentration, rushed votes, low participation |

| Bridge/cross-chain risk | Contagion from bridge exploits | Heavy bridged TVL share, reliance on one bridge |

| Economic design risk | Insolvency, reflexive incentives | Emissions dependence, bad debt, negative unit economics |

| Operational/centralization risk | Admin key compromise, censorship | Small multisig signer set, opaque upgrades, emergency powers |

Stress testing scenarios that actually happen

Build scenario tests like you’d test a system in production: inputs → mechanism → outcome.

Here are high-value scenarios:

1. Reward token collapse

- Reward token price down 70–95%

- Volume also down (fees compress)

- Question: does your net yield stay positive?

2. Liquidity vacuum

- Slippage increases 5–20x

- Exit costs dominate returns

- Question: what’s your time-to-exit under stress?

3. Oracle deviation / manipulation

- Oracle price diverges from spot markets

- Liquidations cascade or collateral becomes mispriced

- Question: do you get liquidated or stuck?

4. Stablecoin depeg

- Stable asset trades at 0.90–0.97

- Collateral correlations spike

- Question: does “stable yield” become directional risk?

5. Governance shock

- Parameter change (fees, LTV, reward rate) without warning

- Question: what monitoring triggers catch this early?

Tail risk metrics that are more honest than APY

Instead of only a point estimate, output a risk report:

A strategy with 20% “APY” but a 10% monthly probability of a -40% event is not yield. It’s a lottery ticket.

A repeatable checklist: what your AI agents should verify before you deposit

Use this checklist as an agent prompt or a manual gate:

- What % is fees/interest vs emissions?

- Is the reward token inflationary? What’s the unlock schedule?

- Which oracles?

- Any bridges?

- Upgradeable contracts? Who controls upgrades?

- What’s the slippage for a 1%, 5%, 10% TVL exit?

- How concentrated are LP positions / depositors?

- Any prior incidents, emergency pauses, parameter swings?

- How quickly does TVL leave when incentives drop?

- What on-chain events cause you to reduce exposure or exit?

Putting it into practice with SimianX AI: turning analysis into a workflow

The hardest part of DeFi yield research isn’t the math—it’s the discipline: running the same checks every time, documenting assumptions, and reacting consistently when conditions change.

A structured platform approach (like SimianX AI) helps you:

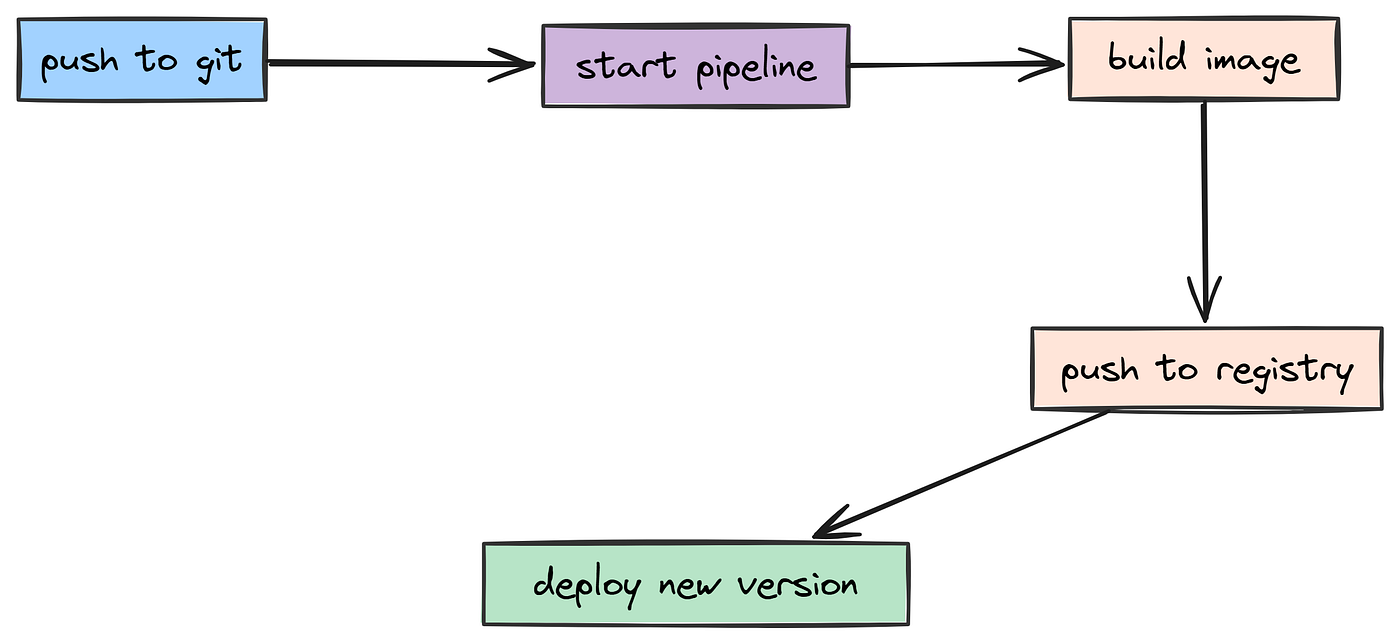

If you’re building internally, treat your pipeline like a product: define inputs/outputs, write tests (data validity checks), and version your assumptions.

FAQ About Using AI to test DeFi yields: Real yields and tail risks

How to calculate real yield in DeFi without being fooled by emissions?

Separate fee/interest income from token incentives, then value incentives with a conservative haircut. If net yield is only positive under optimistic reward pricing, you’re likely holding subsidy exposure rather than sustainable yield.

What is real yield vs APY in DeFi yield farming?

APY is often a blended marketing number that assumes compounding and stable reward prices. Real yield focuses on cashflow-like sources (fees/interest) and asks whether returns persist when incentives drop and volumes mean-revert.

How do you stress test DeFi yields for tail risks?

Run scenarios like reward token collapse, liquidity vacuum, oracle deviation, and stablecoin depeg. Measure outcomes with max drawdown, CVaR, probability-of-ruin thresholds, and liquidity-adjusted exit costs.

Best way to evaluate DeFi yield farms with AI agents?

Use a multi-agent workflow: one agent ingests data, one maps protocol mechanisms, one computes realized yield, one scores risks, and one runs stress scenarios. The point is consistency and auditability, not “prediction.”

What are the biggest hidden risks behind high DeFi APY?

Incentive cliffs, reward token sell pressure, thin exit liquidity, oracle manipulation, governance surprises, and bridge contagion. These often surface only under stress—exactly when you want to exit.

Conclusion

If you want to stop chasing headline APYs and start making durable decisions, treat Using AI to test DeFi yields: Real yields and tail risks as a standard operating procedure: decompose returns, mark incentives conservatively, subtract real costs, and stress test the failure modes that matter. When you run the same framework across protocols, you’ll quickly see which yields are cashflow-driven—and which are just subsidized risk.

To operationalize this as a repeatable workflow (with consistent templates, assumptions, and decision trails), explore SimianX AI and use it as a structure for your multi-stage research process.