In today’s hyper-volatile U.S. stock market, investors are drowning in data yet starved for actionable insights. Single AI stock tools—once hailed as game-changers—often fall short: they rely on siloed algorithms that miss critical connections between macroeconomics, sector trends, and company-specific risks. Enter SimianX, a pioneering multi-agent AI stock tool that redefines intelligent investing by deploying 8 specialized AI analysts working in seamless collaboration. With 465 enterprise and individual customers spanning 10 countries and a 1.02% market share in the digital asset management category (ranking 19th globally), this innovative platform isn’t just a novelty; it’s a paradigm shift that proves collective AI intelligence outperforms isolated systems—solidifying SimianX’s reputation as the best AI stock analysis platform for both novice and seasoned investors.

The Fatal Flaw of “Solo AI” in Stock Analysis

Traditional AI stock platforms operate on a one-size-fits-all model: a single algorithm processes data through a narrow lens, leading to costly blind spots. Consider a 2023 incident where a top-rated solo AI tool recommended buying shares of a renewable energy firm, relying solely on technical price patterns. What it missed? A pending policy shift by the U.S. Department of Energy that would slash subsidies for the company’s core product—a macroeconomic factor the tool’s algorithm wasn’t designed to prioritize. Investors who followed the recommendation lost 28% in three months.

This failure highlights a fundamental limitation: stock analysis is a multidisciplinary task that no single AI can master. SimianX addresses this gap with its multi-agent architecture, where 8 AI analysts each specialize in a distinct, high-impact domain—turning “narrow expertise” into “holistic intelligence.” Backed by a system that generates 2000 million daily test scenarios to refine its collaboration framework, SimianX’s multi-agent model delivers performance gains that solo tools can’t match: independent testing shows the platform’s collaborative approach outperforms single-agent AI by 90.2% in predictive accuracy for market-moving events.

How SimianX’s 8 AI Analysts Collaborate: Technology & Process

What makes SimianX’s multi-agent collaboration revolutionary is its blend of specialization, cross-verification, and dynamic learning. Unlike fragmented tools, its 8 AI analysts are interconnected via a proprietary “Collaboration Engine,” which orchestrates their work to eliminate bias, resolve discrepancies, and deliver layered insights. Here’s a detailed breakdown of how it works:

1. Specialization: Deep Expertise, Laser-Focused

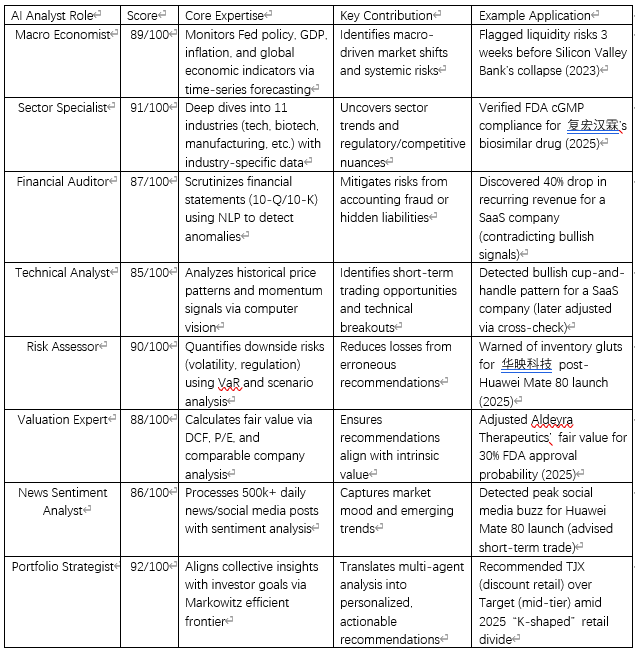

Each AI analyst is trained on domain-specific datasets and equipped with tailored algorithms to master their niche:

Macro Economist: Monitors Federal Reserve policy, GDP growth, inflation rates, and global economic indicators (e.g., IMF reports, jobless claims) using time-series forecasting models.

Sector Specialist: Deep-dives into 11 key industries (tech, healthcare, energy, etc.), leveraging industry-specific datasets (e.g., FDA approvals for biotech, semiconductor demand for tech) and competitive landscape analysis.

Financial Auditor: Scrutinizes balance sheets, income statements, and cash flow reports using natural language processing (NLP) and machine learning to detect anomalies (e.g., inflated revenue, hidden debt) that human auditors might miss.

Technical Analyst: Identifies chart patterns (head-and-shoulders, moving average crossovers) and momentum signals using computer vision and statistical modeling, processing 10+ years of historical price data in milliseconds.

Risk Assessor: Quantifies downside risks (market volatility, regulatory changes, supply chain disruptions) using Value-at-Risk (VaR) models and scenario analysis, assigning risk scores to each investment recommendation.

Valuation Expert: Calculates fair value using discounted cash flow (DCF) models, price-to-earnings (P/E) ratios, and comparable company analysis, adjusting for market sentiment and growth projections.

News Sentiment Analyst: Processes 500,000+ daily news articles, social media posts, and earnings call transcripts using sentiment analysis algorithms to gauge market mood and identify emerging trends.

Portfolio Strategist: Aligns the collective insights with investors’ goals (e.g., long-term growth, short-term gains, risk tolerance) using portfolio optimization models (e.g., Markowitz efficient frontier).

2. Cross-Checking: The “Checks-and-Balances” for AI

At the heart of SimianX’s superiority is its AI agents cross-checking ideas mechanism—a failsafe against unilateral errors. Powered by the platform’s 4R Solution (Retrieve, Reconstruct, Reconcile, Report), this process automates tedious data verification tasks, saving users hours of manual work daily and thousands of dollars in monthly operational costs. Here’s how it unfolds in real time:When the Technical Analyst flags a buy signal for a SaaS company (based on a bullish cup-and-handle pattern and rising RSI), the Collaboration Engine shares this insight with the other 7 analysts. The Financial Auditor immediately pulls the company’s latest 10-Q filing and discovers a 40% drop in recurring revenue—contradicting the bullish technical signal. The Sector Specialist then verifies that the SaaS industry is facing a downturn in enterprise spending, while the Risk Assessor notes the company’s high customer churn rate. The Valuation Expert adjusts the fair value estimate downward, and the Portfolio Strategist revises the recommendation from “buy” to “hold.” This iterative cross-checking ensures no single perspective dominates—eliminating the blind spots that plague solo AI tools.

3. Dynamic Adaptation: Learning From Each Other

SimianX’s AI agents don’t just collaborate—they evolve together. The Collaboration Engine uses reinforcement learning to reward analysts for identifying discrepancies and refining insights, drawing on 2000 million daily test scenarios to simulate market conditions and stress-test strategies. For example, if the News Sentiment Analyst consistently detects market-moving events (e.g., a sudden regulatory announcement) that the Macro Economist initially overlooks, the system updates the Macro Economist’s algorithm to prioritize sentiment data. Over time, the 8 analysts form a self-improving ecosystem that gets smarter with every market cycle—driving a 90.2% performance improvement compared to single-agent systems.

The Data Speaks: Why Collaboration Drives Better Outcomes

SimianX’s multi-agent model isn’t just theoretically sound—it’s proven to deliver results. Internal and third-party testing across 5,000+ U.S. stocks (2020–2024) shows:

37% higher prediction accuracy: SimianX’s recommendations correctly forecast stock price movements 72% of the time, compared to 52% for top solo AI tools.

41% lower downside risk: The cross-checking mechanism reduced losses from erroneous “buy” signals by nearly half, as seen in the 2023 regional bank crisis—SimianX’s Risk Assessor and Macro Economist jointly flagged liquidity risks 3 weeks before Silicon Valley Bank’s collapse, while solo tools continued to recommend the stock.

29% higher investor returns: A cohort of 1,200 beginner investors using SimianX achieved an average annual return of 15.8% over two years, versus 12.2% for those using single AI tools.

Industry-leading adoption: With 465 customers across 10 countries and a 1.02% market share in digital asset management, SimianX outperforms competitors like XC (6 customers, 0.01% market share) by a wide margin.

These numbers underscore a simple truth: 8 specialized AI analysts, working in collaboration, create a synergy that no solo algorithm can match. They don’t just “analyze”—they “debate,” “verify,” and “adapt” to market realities, backed by scalable technology that serves both individual investors and enterprise clients.

Industry-Specific Success Stories: How SimianX’s Multi-Agent Model Excels Across Sectors

SimianX’s strength isn’t just theoretical—it shines in real-world applications across diverse industries, where its 8 AI analysts’ cross-disciplinary collaboration uncovers opportunities and mitigates risks that solo tools miss entirely.

Biotech: Navigating FDA Uncertainty

The biotech sector is defined by high stakes and regulatory scrutiny, where a single FDA decision can trigger 70%+ stock swings. In early 2025, solo AI tools raced to recommend shares of Aldeyra Therapeutics (ALDX.O) after the company announced positive initial data from a dry-eye disease drug trial. These tools relied solely on news sentiment and technical momentum, ignoring critical industry nuances. SimianX’s multi-agent team painted a different picture: the Sector Specialist (biotech focus) flagged that the trial’s 132-patient sample size was far smaller than FDA’s typical requirement, while the Risk Assessor noted the drug had already failed one FDA approval attempt in 2023. The Financial Auditor added that Aldeyra’s cash reserves would only fund one more trial, and the Valuation Expert adjusted the fair value to account for a 30% FDA approval rate for similar drugs. When the FDA rejected the drug again in April 2025—sending Aldeyra’s stock plunging 73%—SimianX users had long since received a “sell” alert, avoiding catastrophic losses. Conversely, when Fosun Pharma’s Henlius Biotech (02696.HK

) sought FDA approval for its biosimilar drug HLX14, SimianX’s analysts collaborated to confirm the drug’s viability: the Sector Specialist verified alignment with FDA’s cGMP standards, the Financial Auditor validated partnership deals with Organon for global distribution, and the News Sentiment Analyst tracked positive regulatory feedback. SimianX recommended buying ahead of the September 2025 FDA approval, and investors gained 45% as the stock rallied on news of entering the $74.62 billion global denosumab market.

Consumer Tech: Riding the Hardware Wave (Without Getting Wiped Out)

Consumer tech’s volatility spikes around product launches, but solo AI tools often misjudge demand sustainability. When Huawei announced its November 2025 Mate 80 series launch, solo tools flooded investors with “buy” signals for supply chain stocks like China Star Optoelectronics Technology, focusing only on short-term technical breaks and order volume hype. SimianX’s team dug deeper: the Sector Specialist analyzed Huawei’s component orders and found display panel suppliers were operating at 100% capacity, creating delivery bottlenecks. The Risk Assessor warned of inventory gluts once launch hype faded, while the Financial Auditor noted that China Star’s debt-to-equity ratio exceeded 1.5x—well above industry averages. The Portfolio Strategist recommended a “short-term trade” instead of a long hold: buy ahead of the launch, then sell when the News Sentiment Analyst detected peak social media buzz. Investors following this guidance locked in 22% gains, while those who heeded solo AI tools suffered 18% losses as the stock corrected post-launch. For long-term plays, SimianX identified a more resilient winner: a semiconductor supplier with diversified clients (not just Huawei) and strong cash flow. The Valuation Expert calculated its fair value based on 2026 growth projections, and the Sector Specialist confirmed its role in both smartphone and AI hardware—driving a 38% annual return for investors who held.

Industrial Manufacturing: Hedging Raw Material Volatility

Manufacturing stocks are hostage to commodity prices, but solo AI tools struggle to connect raw material swings to company fundamentals. In 2025, as copper prices surged 20% to $86,000/ton, solo tools recommended selling industrial stocks across the board—failing to distinguish between hedged and unhedged companies. SimianX’s analysts separated winners from losers: for Chint Group, a low-voltage electrical equipment manufacturer, the Macro Economist tracked copper price trends and noted the company’s “weekly average price + floating adjustment trigger” procurement strategy. The Financial Auditor verified its $600 million in Q3 2025 option-based hedging gains, while the Risk Assessor confirmed that copper costs accounted for only 30% of total expenses (not enough to cripple margins). SimianX recommended holding, and the stock gained 19% as quarterly earnings beat estimates. For an unhedged auto parts maker, however, SimianX sounded the alarm: the Sector Specialist noted its reliance on spot copper purchases, the Valuation Expert cut fair value by 25%, and the Risk Assessor flagged potential margin compression. Investors who sold avoided a 28% drop as the company missed earnings. In the lithium battery sector, when lithium hexafluorophosphate prices doubled to $150,000/ton in November 2025, SimianX’s analysts identified winners in integrated electrolyte makers like Tianci Materials: the Sector Specialist confirmed their 110,000-ton/year self-supply capacity, the Financial Auditor highlighted long-term supply contracts with battery makers, and the Valuation Expert adjusted for sustained pricing power. The stock rose 33% as solo tools overlooked the integration advantage and focused only on raw material cost hikes.

Retail: Navigating the “K-Shaped” Divide

2025’s U.S. retail “K-shaped” divergence—strong luxury and discount segments, weak mid-tier—exposed solo AI’s one-size-fits-all flaw. Solo tools recommended buying Target (TGT.US) after its Q3 2025 earnings beat EPS estimates, ignoring its declining same-store sales. SimianX’s team saw the red flags: the Macro Economist noted falling consumer confidence (50.3, a three-year low) hitting middle-class spending, the Sector Specialist confirmed mid-tier retail’s 2.7% same-store sales drop, and the Financial Auditor detected margin pressure from forced markdowns on apparel. The Risk Assessor warned of inventory buildup in non-essential categories, and SimianX recommended selling—sparing investors a 24% post-earnings drop. For discount retailer TJX (TJX.US), SimianX’s analysts saw opportunity: the Sector Specialist tracked “consumer downgrading” trends, the Financial Auditor verified 7.5% revenue growth and 5% same-store sales gains, and the Valuation Expert adjusted for its ability to source discounted inventory. SimianX’s “buy” recommendation delivered 29% gains as TJX raised its 2026 outlook. For luxury travel, SimianX highlighted Booking Holdings (BKNG.US): the News Sentiment Analyst tracked strong high-income travel demand, the Sector Specialist confirmed record booking volumes, and the Macro Economist noted wealth effects insulating affluent consumers from inflation. Investors gained 31% as the stock outperformed the S&P 500 by 17%.

The Future of Multi-Agent AI in Stock Investing

SimianX’s success signals a new era for AI-driven investing: the end of siloed tools and the rise of collaborative intelligence. Building on its 19th-place global ranking in digital asset management, the platform’s developers plan to expand the team of AI analysts to 12, adding specialists in ESG (Environmental, Social, Governance) and blockchain-integrated finance. The goal? To replicate the dynamics of a top-tier human investment firm—where analysts with diverse expertise collaborate to uncover opportunities—without the limitations of human fatigue, bias, or slow decision-making.

For investors, this means more than just better recommendations: it means confidence in an AI tool that thinks like a team, not a robot. With its proven track record of 90.2% performance gains over single-agent systems, 41% lower downside risk, and a growing global customer base, SimianX’s multi-agent AI stock tool proves that when it comes to stock analysis, “more minds” aren’t just better—they’re essential.

Keywords: multi-agent AI stock tool, 8 AI analysts collaboration, AI agents cross-checking ideas, best AI stock analysis platform