AI-driven DeFi yield analysis: annualized yield, liquidity, and hidden risks

DeFi “yield” is rarely just yield. In practice, it’s a bundle of cashflow, incentives, price exposure, and exit constraints—and those pieces change quickly. This is why AI-driven DeFi yield analysis: annualized yield, liquidity, and hidden risks matters: it forces you to measure where returns come from, whether you can actually exit, and what can break in the stack. In this guide, we’ll use a research-first mindset (and tools like SimianX AI as a structured analysis workflow) to turn noisy APYs into decision-ready, risk-aware yield estimates.

Why “annualized yield” can mislead even careful analysts

Annualizing is a convenience—not a truth. When protocols display APY, they usually assume:

Real DeFi doesn’t cooperate.

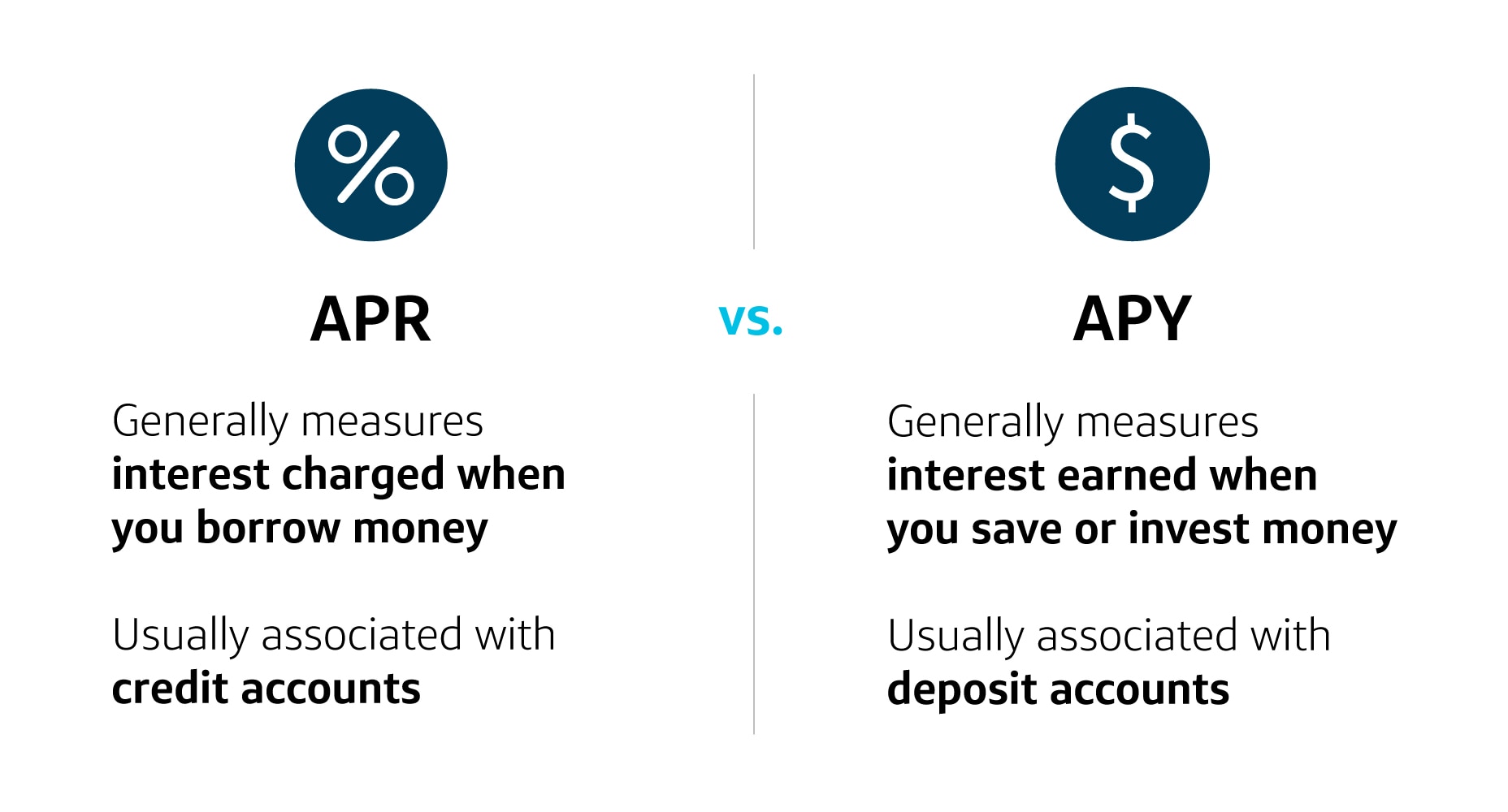

APR vs APY (and the compounding trap)

APR is the simple rate: what you earn without compounding.

APY assumes compounding: reinvesting earnings back into the position.

A common approximation:

income / principal over a period, annualized linearly

(1 + period_return)^(periods_per_year) - 1

The trap: DeFi compounding is not free. Harvesting rewards, swapping, and re-depositing incur gas, swap fees, and slippage. If compounding costs exceed incremental yield, the displayed APY is fantasy.

Key takeaway: In DeFi, the “best” APY is often the one that is least sensitive to assumptions—not the one with the biggest number.

Time-weighted vs money-weighted reality

Displayed yields are often time-weighted snapshots (what was true right now). Your realized return is money-weighted (what happened after you entered, including market moves and incentives decay). Any yield analysis that ignores this difference will systematically overestimate outcomes.

A yield decomposition framework: where returns actually come from

A practical AI-driven approach starts by splitting yield into components. This turns “APY” into a transparent ledger you can stress-test.

The four return buckets

1. Fees / interest (cashflow-like)

- AMM swap fees distributed to LPs

- lending interest paid by borrowers

- protocol revenue share

2. Token incentives (emissions)

- liquidity mining rewards

- “boosted” rewards via staking or ve-token mechanics

3. Price effects (mark-to-market)

- reward token price volatility

- LP inventory drift (exposure to underlying tokens)

4. Costs and frictions

- gas + MEV leakage

- slippage on entry/exit and compounding swaps

- borrow costs (if leveraged)

- bridging costs and delay risk (if cross-chain)

A simple “net real yield” calculation

A usable starting model:

Net Real Yield ≈ Fee/Interest Yield + Sustainable Incentives - (IL + Costs + Tail Risk Premium)

This isn’t a perfect equation—it’s a decision tool. The goal is to avoid treating emissions and price noise as “income.”

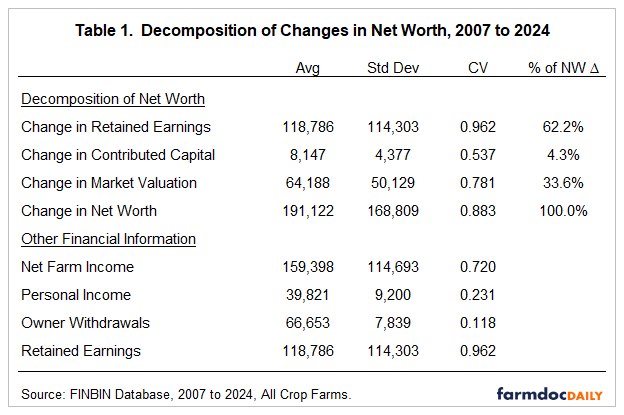

A comparison table you can reuse

| Component | What to measure | Common illusion | What AI should sanity-check |

|---|---|---|---|

| Fees / interest | fee APR, borrow APR, utilization | “Fees always scale with TVL” | volume quality, wash trading, concentration |

| Incentives | reward rate, schedule, unlocks | “Incentives are stable yield” | emissions decay, governance changes, token liquidity |

| Price effects | volatility, correlation, drawdowns | “Reward token will hold” | liquidity depth, sell pressure, unlock cliffs |

| Costs | gas, slippage, routing, MEV | “Compounding is free” | net-of-cost APY at realistic harvest frequency |

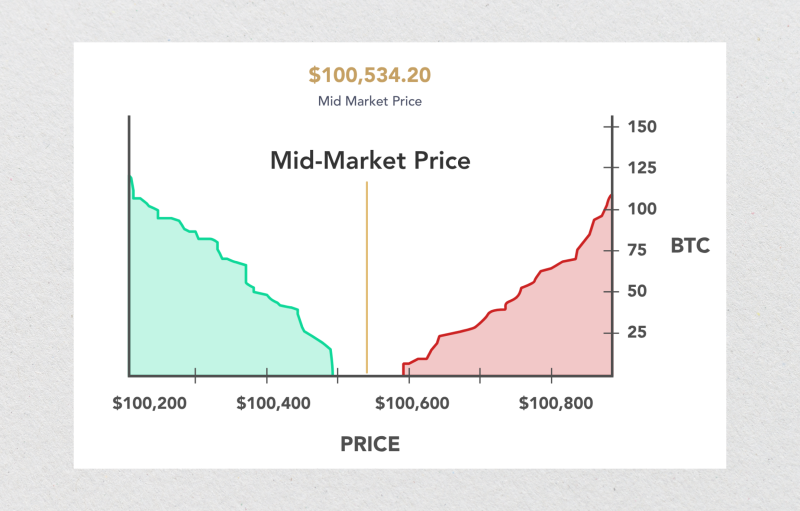

Liquidity: the hidden half of yield (and the first thing you should model)

In traditional finance, you can often assume you can exit. In DeFi, exit is a feature you must verify.

What “liquidity” really means in DeFi

Liquidity isn’t just TVL. It includes:

A farm can show 60% APY while hiding the truth: you can’t exit without donating 8% to slippage.

Practical liquidity metrics for yield analysis

Use a minimum set of “exit-aware” metrics:

Bold rule: If you can’t model your exit, you don’t have yield—you have a story.

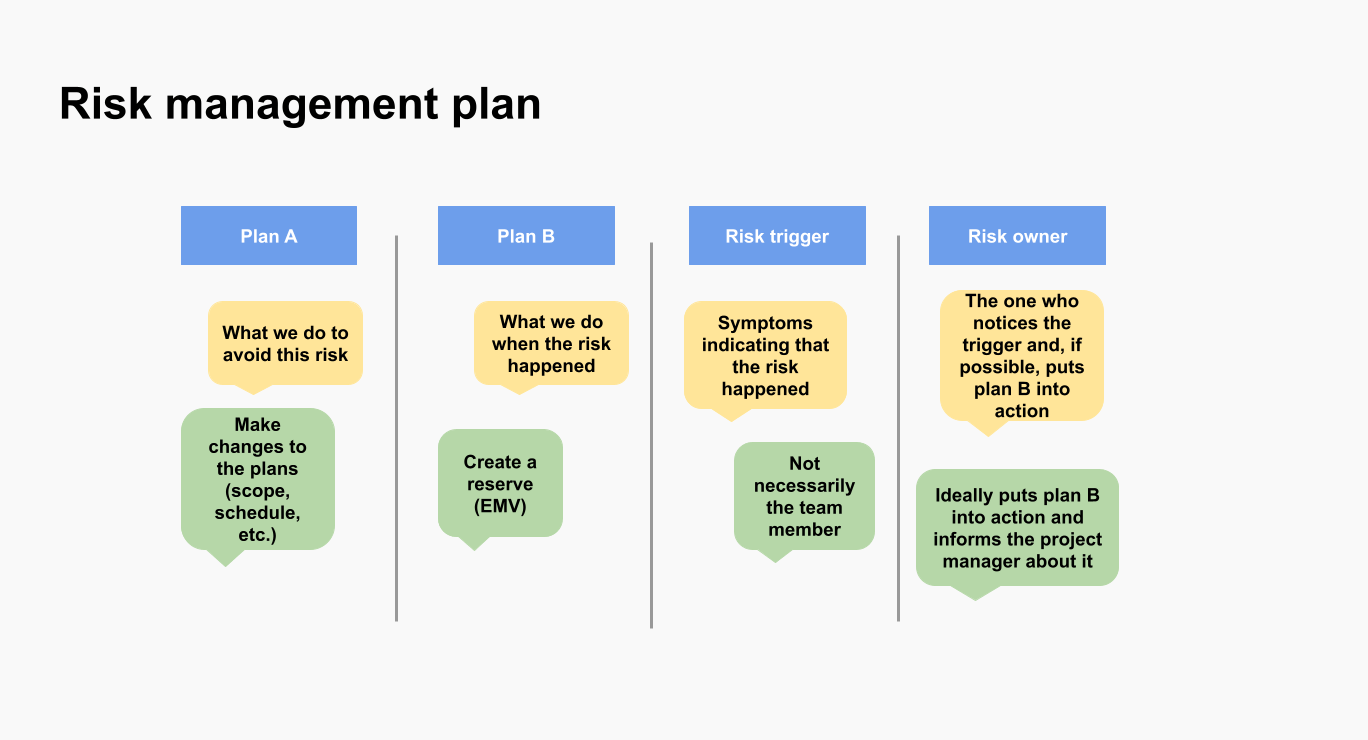

Hidden risks: a taxonomy you can score (and keep updated)

Yield is compensation for risk. The problem is that DeFi risks are layered, and many are invisible in a headline APY.

The main “hidden risk” categories

Smart contract risk

Oracle risk

Governance and admin risk

Bridge and cross-chain risk

Liquidity shock risk

Market structure risk

MEV extraction, sandwich attacks, liquidation cascades

Asset risk

A checklist-style scoring rubric (simple but effective)

If you can’t explain the dependency graph in plain English, you can’t price the risk.

How does AI-driven DeFi yield analysis separate real yield from emissions?

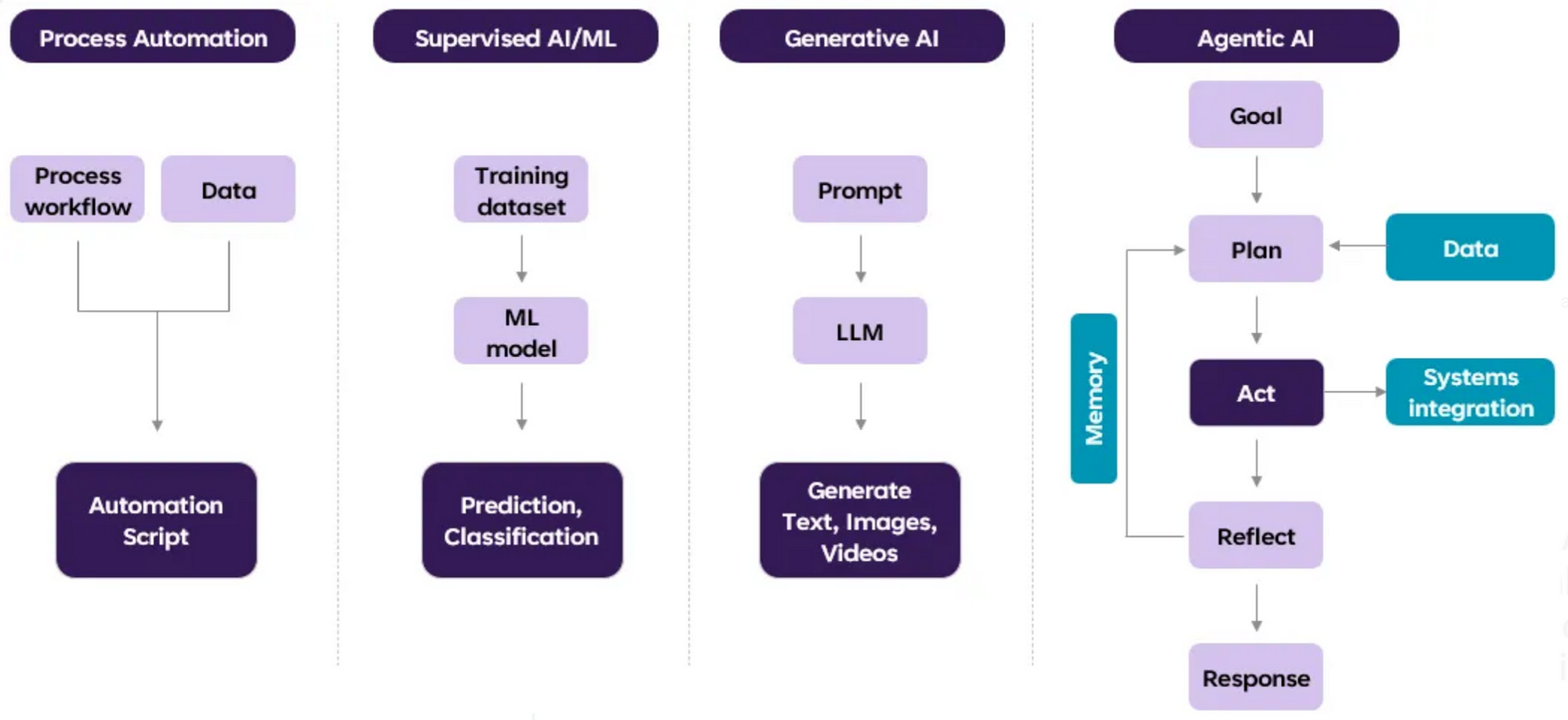

A good AI workflow doesn’t “predict APY.” It verifies mechanisms, cross-checks data, and produces auditable outputs.

What AI is good at (and what it is not)

AI is excellent at:

AI is not a substitute for:

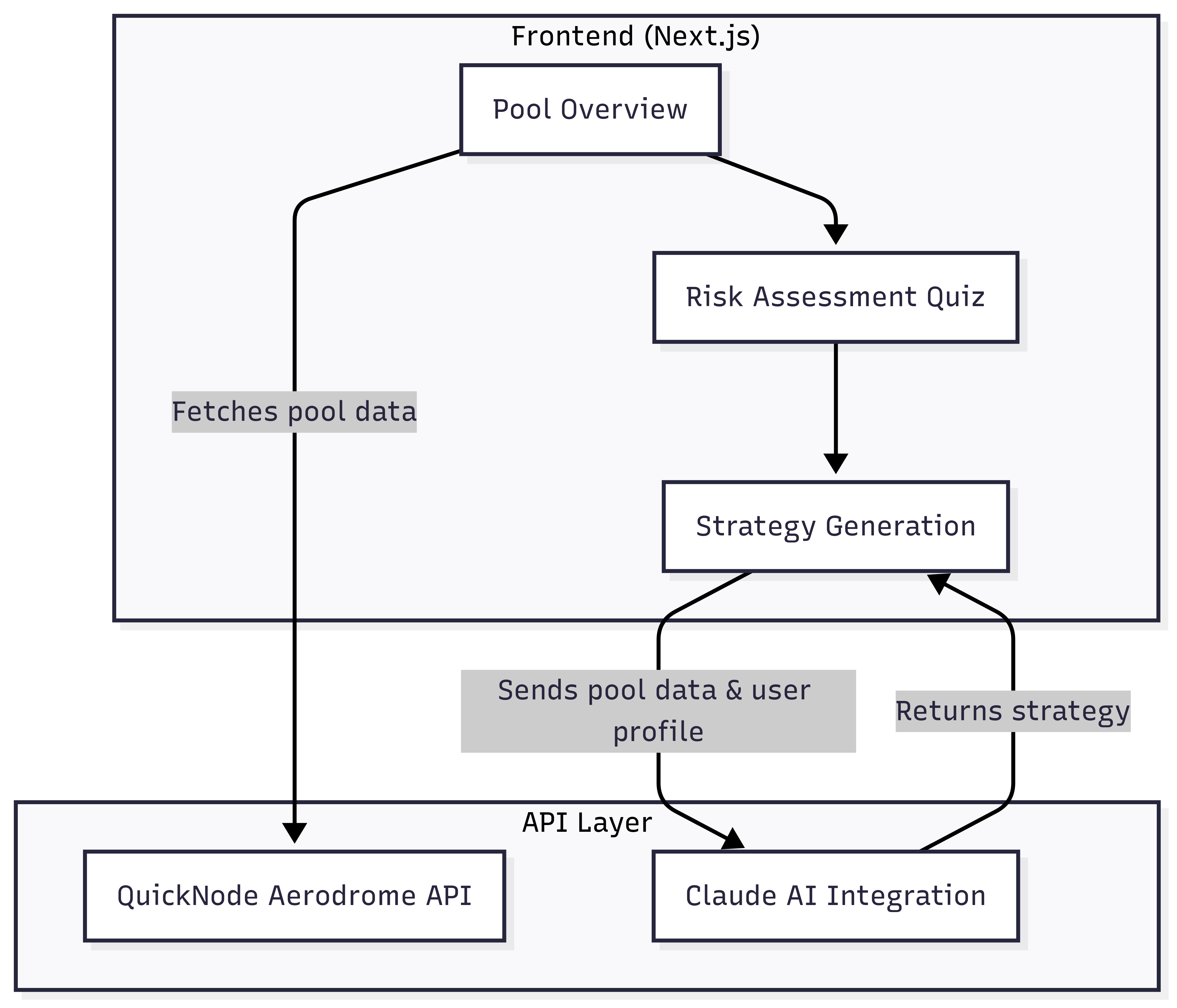

A multi-agent workflow you can implement today

Here’s a practical blueprint (works whether you build your own stack or use a structured tool like SimianX AI to keep the research consistent):

1. Ingestion

- Pull on-chain events, pool states, emissions, and price feeds.

- Store provenance: block numbers, timestamps, and sources.

2. Yield decomposition

- Compute fee/interest APR from realized history (not just current rates).

- Separate incentives and translate reward tokens into base currency using realistic sell assumptions.

3. Liquidity modeling

- Simulate entry/exit at your target size with route-aware slippage.

- Stress-test for liquidity withdrawal after incentive changes.

4. Risk mapping

- Extract admin roles, upgrade paths, oracle dependencies, bridge exposure.

- Assign risk flags (e.g., “upgradeable without timelock”).

5. Scenario testing

- Run shocks: volume down 70%, reward token down 50%, stablecoin depeg, oracle delay.

- Output ranges: best case / base case / worst case net yield.

6. Decision memo

- Convert outputs into a plain-English decision: size, entry conditions, exit plan, monitoring triggers.

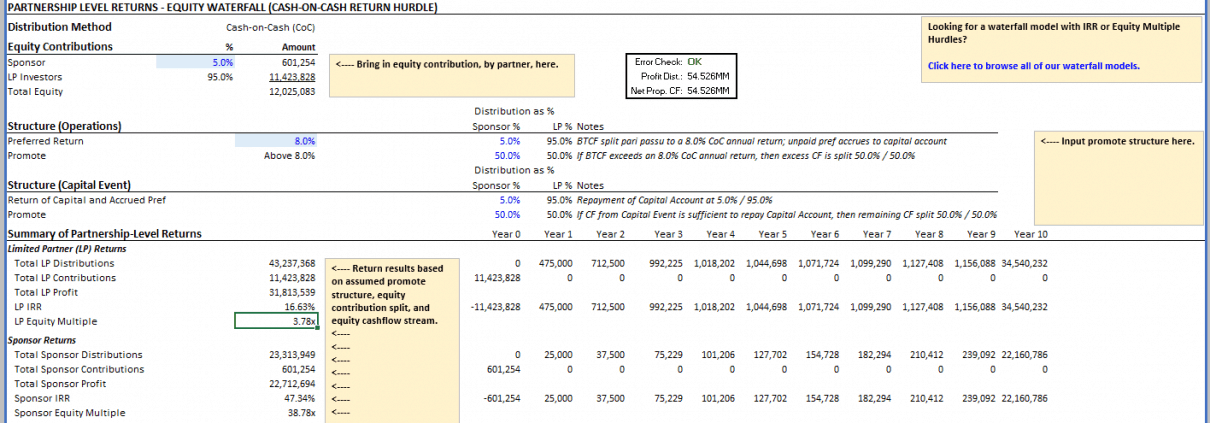

A worked example: turning a “40% APY” farm into a net-yield estimate

Imagine a stablecoin pool advertising 40% APY.

Step 1: Decompose the yield

Step 2: Convert incentives realistically

Ask: Can you sell reward tokens at size without crashing the price?

If reward token depth is thin, you might haircut incentives by 30–60% due to:

Example haircut:

Step 3: Model liquidity and exit

If exiting your position costs 2% in slippage during normal conditions and 6% during stress, your “annualized” return must account for expected exit costs.

Step 4: Add risk premiums

If the pool is upgradeable without a strong timelock, and relies on a fragile oracle, you should treat part of the yield as risk compensation (not return).

Result (illustrative):

Net expected yield ≈ 14%, with wide uncertainty bands.

This is how you turn a marketing number into a plan.

Where SimianX AI fits in a practical yield research loop

If your biggest challenge is not the math but the process—staying consistent, avoiding blind spots, and keeping a decision trail—SimianX AI can act as a structured “analysis notebook” layer for DeFi yield research. Use it to:

This matters most when you revisit decisions after market regime changes (volume collapses, incentives rotate, liquidity migrates). The goal is not perfect prediction; it’s repeatable, explainable analysis.

FAQ About AI-driven DeFi yield analysis: annualized yield, liquidity, and hidden risks

How to calculate DeFi APY after fees, gas, and slippage?

Start with realized fee/interest income, then subtract actual costs: estimated gas for harvesting/compounding, swap fees, and slippage for both compounding and exit. If you can’t estimate exit slippage at your size, treat the APY as incomplete.

What is real yield in DeFi (and why does it matter)?

“Real yield” usually means returns sourced from fees, interest, or revenue, not primarily from token emissions. It matters because emissions can drop suddenly, and reward token prices can collapse—turning “yield” into a transient subsidy.

How do I assess DeFi liquidity risk before farming?

Model exit first: simulate selling/withdrawing at your intended size under normal and stressed conditions. Watch LP concentration, incentive dependence, and whether liquidity is concentrated in narrow ranges (common in concentrated AMMs).

What are the most common hidden risks behind high APY pools?

Upgrade/admin key risk, fragile oracles, mercenary liquidity, bridge exposure, and reward token liquidity cliffs are the big ones. High APY often pays you for bearing a risk you haven’t mapped yet.

Can AI agents replace manual due diligence for DeFi protocols?

They can accelerate and structure it, but they shouldn’t replace verification. The best use of AI is to reduce blind spots, keep evidence organized, and continuously monitor changing conditions.

Conclusion

High DeFi yields are not “free money”—they’re a mix of annualized assumptions, liquidity constraints, and layered hidden risks. A strong approach decomposes returns into fees vs incentives, models liquidity as an exit constraint (not a vanity TVL number), and maintains a living risk map across contracts, oracles, governance, and dependencies. If you want a more consistent, auditable workflow for evaluating farms and documenting decisions, explore how SimianX AI can support your research loop—from yield decomposition to risk checklists and scenario-driven decision memos.