Introduction

The world of stock trading is a fast-paced, dynamic environment where investors are constantly navigating through volatility, unpredictability, and rapid market shifts. In such an environment, the ability to make quick and informed decisions can significantly impact the success of an investment.

For decades, stock analysis has been primarily driven by human researchers, who rely on a mix of historical data, market trends, and their own intuition to predict stock movements. These human experts, with their years of experience and deep understanding of market psychology, have been at the core of investment strategies.

Advantages of AI in Stock Picking

However, with the rise of artificial intelligence (AI), a new wave of possibilities has opened up, transforming the way stock research is conducted. AI offers a level of speed and efficiency that is difficult for human researchers to match, processing vast amounts of data in seconds and identifying patterns that might take a human much longer to uncover. It promises not only to accelerate the process of stock analysis but also to offer more objective and data-driven insights.

But this shift raises a critical question: how does AI compare to traditional human research in terms of accuracy and reliability? While AI can undoubtedly process vast amounts of data far more quickly and identify correlations that might elude human analysts, can it truly replicate the nuanced judgment that human experts bring to the table?

Can AI capture the subtleties of market sentiment, geopolitical influences, and other less quantifiable factors that often play a critical role in stock price movements? As AI continues to evolve, the real challenge lies in determining whether it can complement human intuition or replace it entirely, and whether a hybrid approach might offer the best of both worlds for investors.

This article explores the comparison between AI-driven stock analysis and human research, specifically focusing on three major factors: time, cost, and accuracy. We’ll explore how each method works, their strengths and weaknesses, and how investors can benefit from leveraging both. Whether you're asking "is AI good for stock picking" or wondering about the AI stock analysis accuracy, this article will provide insights into how AI stacks up against traditional stock research methods.

The Role of AI in Stock Analysis

AI Stock Analysis: Revolutionizing Investment Decisions

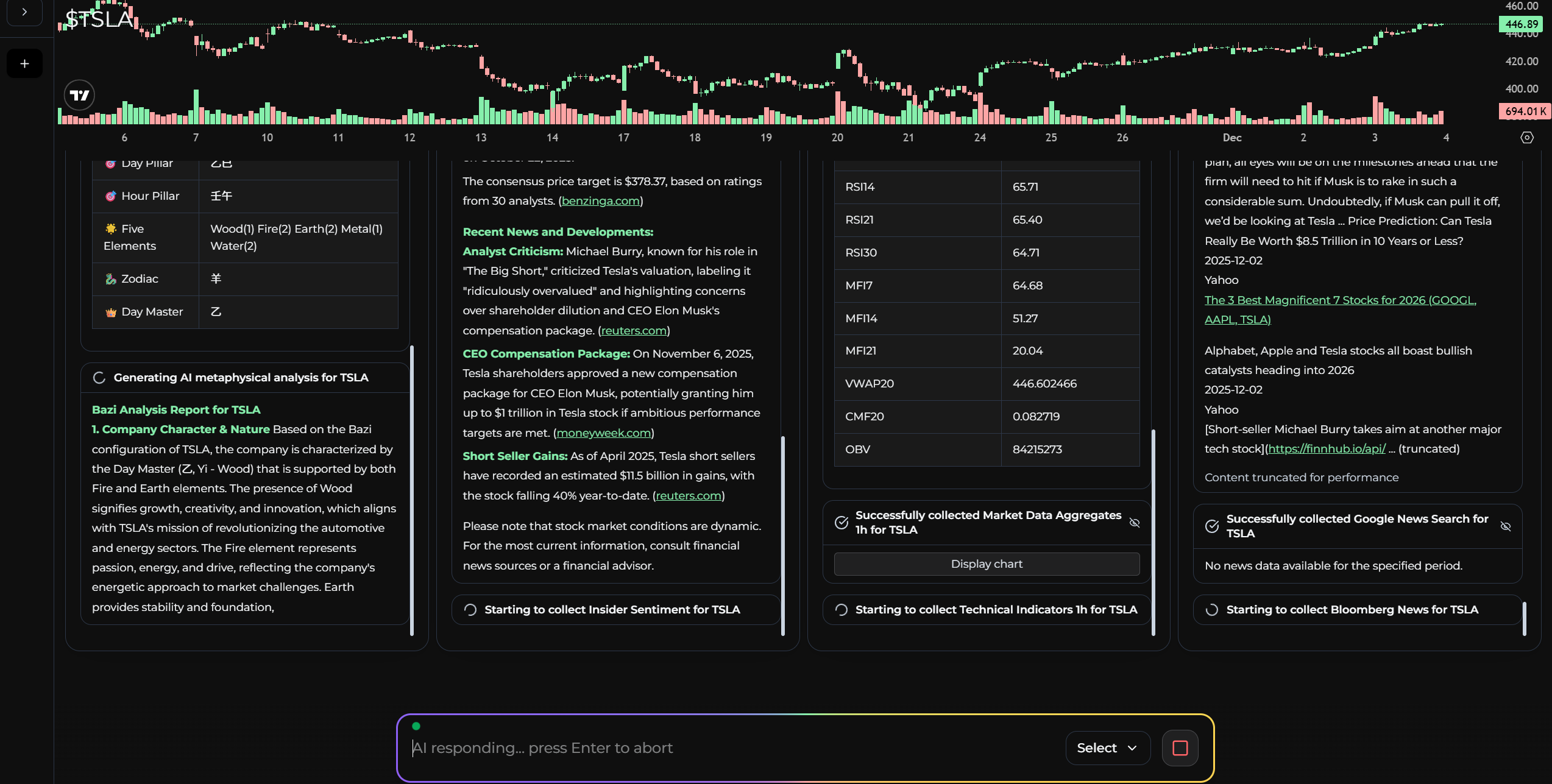

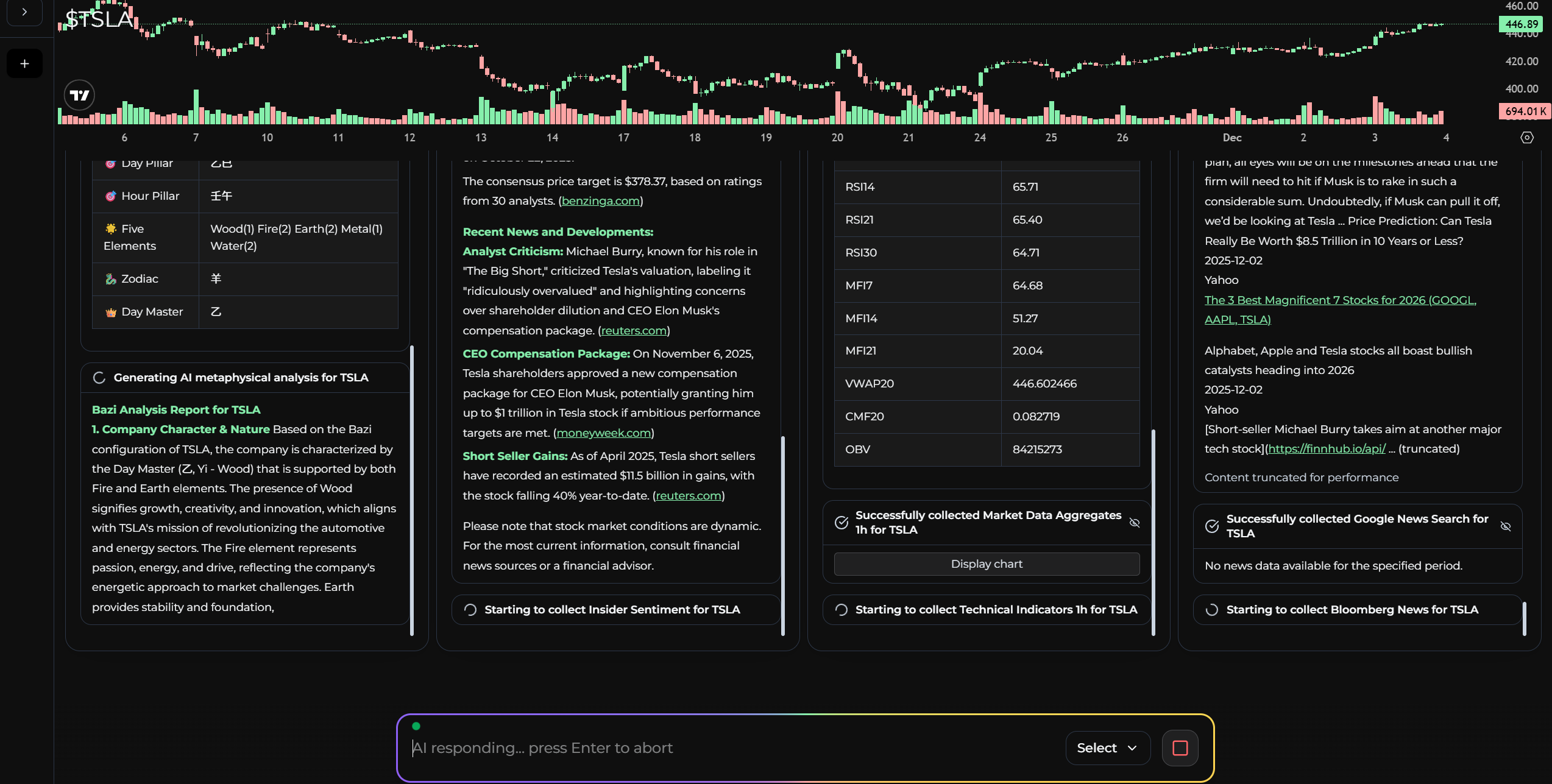

At the heart of AI stock analysis is the ability of machines to process vast amounts of data—faster and more efficiently than any human could. With machine learning algorithms, AI can analyze historical price movements, financial statements, market news, social media sentiment, and even unconventional data such as satellite images of retail stores or shipping activity. This is a drastic departure from traditional stock research, where analysts rely mostly on limited sources of data and their own interpretations of economic or company performance.

The beauty of AI is that it doesn't tire or become biased, meaning it can evaluate thousands of potential investment opportunities across global markets simultaneously. Its algorithms learn continuously, refining predictions as new data arrives. This AI-driven stock research often results in improved decision-making, as it can uncover patterns or correlations that humans might overlook.

AI stock analysis vs human is a relevant discussion here, as the main advantage of AI is its ability to process real-time data, detect patterns from past trends, and even consider data from unstructured sources. As a result, AI can save significant time on stock research, which can be especially valuable in fast-paced markets.

Advantages of AI in Stock Picking

AI provides numerous advantages when it comes to stock picking. Firstly, it can analyze massive datasets within seconds, providing investors with insights that would take humans days or weeks to uncover. AI’s speed in processing information is essential in the stock market, where small windows of opportunity can disappear in the blink of an eye.

Another benefit of AI stock analysis is the potential for higher accuracy. Unlike human analysts, who may have personal biases or rely on intuition, AI is rooted in data. It doesn’t suffer from emotional swings or cognitive biases, which often cloud human judgment. Its predictions are based entirely on objective data, which can result in a more rational and precise approach to decision-making. Moreover, AI is constantly learning and refining its models, leading to increasingly accurate predictions over time.

That being said, the question arises—is AI good for stock picking? While AI can analyze large datasets quickly and efficiently, its predictions are still based on historical data and patterns. This means that AI may not always be able to anticipate unpredictable events, such as sudden geopolitical changes or unforeseen company crises, in the way a human analyst might.

Human Research: The Traditional Approach

The Strengths of Human Research

Human research has been the cornerstone of stock market analysis for decades, shaping the strategies of both individual and institutional investors. Skilled analysts leverage a combination of fundamental analysis and technical analysis to evaluate potential investment opportunities.

Fundamental analysis involves a deep dive into a company’s financial health, including its earnings reports, balance sheets, cash flow statements, and other key financial metrics. This type of analysis helps investors assess whether a stock is undervalued or overvalued, providing a foundation for long-term investment decisions.

Technical analysis, on the other hand, focuses on price trends, chart patterns, and trading volume to forecast future price movements. By studying historical price data, technical analysts aim to identify recurring patterns or signals that can help predict where a stock might be headed in the short term.

Beyond these quantitative methods, human researchers are particularly adept at interpreting qualitative information—the kind of data that is not immediately apparent in financial statements or charts. This includes understanding factors like management quality, company culture, and industry trends—elements that can have a profound impact on a company's long-term viability but may be difficult to quantify. For example, a company's leadership and strategic decisions can significantly influence its future performance, yet these factors aren't always reflected in financial reports. Similarly, macroeconomic factors such as regulatory changes, geopolitical events, or shifts in consumer behavior often play a crucial role in stock prices but may not be immediately evident in raw data.

Human analysts excel in contextualizing information, drawing upon their experience and intuition to make judgments about market sentiment, competitive advantages, and emerging risks. They can also identify hidden opportunities that might be overlooked by models based solely on historical data. For instance, an analyst might recognize early signs of a disruptive innovation or a shifting market landscape that could dramatically affect a company's future performance.

Advantages of AI in Stock Picking

This ability to read between the lines and interpret soft factors—those not easily captured by numbers—gives human researchers a valuable edge in a world where emotions, investor sentiment, and macroeconomic trends often drive market movements.

Ultimately, while AI and algorithms can handle large-scale data analysis and identify patterns, the human element of judgment and intuition remains indispensable in stock market research. Human researchers provide the nuanced perspective necessary for making sense of the complexities that numbers alone often fail to convey. This blend of analytical rigor and creative insight is what has made human research so crucial in the world of investing for so long.

A human analyst's ability to understand market sentiment and interpret complex social or political factors is invaluable. For instance, while AI can scrape news articles for sentiment analysis, it may miss nuances such as sarcasm, irony, or subtle changes in public opinion that could significantly affect a company's performance.

Moreover, human analysts can adapt quickly to market changes. If a major market shift occurs due to a new policy or a geopolitical event, a human researcher may be better positioned to assess the long-term implications and take a more measured approach. Human research is often seen as more flexible, as it can incorporate external, subjective factors that AI might overlook.

Time and Cost Considerations in Human Research

One of the biggest drawbacks of human research in stock analysis is the time it consumes. Analysts must sift through multiple data sources, such as quarterly earnings reports, market trends, and economic indicators, before they can make an informed decision. This process can take days or even weeks, particularly if the research is deep and requires expert insight.

Additionally, human research is often costly. Hiring skilled analysts, subscribing to expensive market research tools, or paying for premium reports can add up quickly. For institutional investors, the cost of employing a team of researchers is justified by the high stakes of their investments. However, for retail investors, the costs of accessing quality human research can be prohibitively expensive.

AI vs Human Research: Comparing Time, Cost, and Accuracy

Time

When we compare AI stock analysis vs human research from the perspective of time, AI undeniably has the upper hand. AI can process and analyze data from multiple sources in seconds, providing investors with near-instant feedback on potential investments. In a world where financial markets move at breakneck speeds, AI’s ability to quickly analyze and react to data can make the difference between capitalizing on an opportunity and missing it.

Human research, in contrast, requires more time—especially when dealing with complex data sets. Even the most experienced analysts need time to interpret financial statements, economic indicators, and company reports. Additionally, human researchers can’t work 24/7, which means that important market developments could be missed during off-hours.

Cost

On the cost front, AI also has a significant advantage, particularly for retail investors. AI-based platforms are increasingly accessible, offering a variety of pricing plans. Some platforms offer tiered services, ranging from basic data analysis to advanced trading algorithms that incorporate real-time market data and machine learning insights. This democratizes access to high-level stock analysis, allowing individual investors to make informed decisions without the hefty price tag that comes with hiring a team of analysts.

Human research, on the other hand, tends to be far more expensive. Analysts require salaries, training, and access to proprietary data and research tools, all of which increase costs. For large institutions, the cost of human researchers may be justified by the potential for high returns, but for individual investors, it can be a barrier to entry.

Accuracy

When it comes to accuracy, AI stock analysis has several advantages. AI systems process data based on established algorithms, meaning they are more objective than human analysts, who may be swayed by biases or personal judgments. Furthermore, AI is capable of considering vast amounts of data across multiple dimensions, including historical trends, real-time data, and alternative data, all of which human analysts might struggle to track in the same way.

However, AI stock research accuracy is still not perfect. AI's reliance on past data means it may not anticipate new trends or market shocks that deviate from established patterns. For instance, AI could struggle to predict a sudden geopolitical event or an unexpected earnings announcement, which might dramatically affect a stock’s performance.

Human analysts, while potentially less objective due to cognitive biases, can adapt to unforeseen events in a way that AI cannot. A skilled human researcher can account for unpredictable factors, such as changes in government policies, emerging technologies, or societal shifts that may impact stock prices. This makes human research more flexible and adaptable to the unpredictable nature of the market.

Combining AI and Human Research for Optimal Results

While both AI and human research have their advantages and disadvantages, a hybrid approach that leverages the strengths of both may offer the most promising results. By combining AI stock analysis vs human research, investors can take advantage of the speed and efficiency of AI while also benefiting from the human ability to interpret complex, qualitative information.

For example, AI can handle the heavy lifting of analyzing large datasets, tracking market trends, and providing predictions based on historical patterns. Meanwhile, human analysts can focus on interpreting these findings within the broader economic, political, and social context—an area where human intuition and experience remain invaluable.

As we’ve seen, both AI and human research offer unique strengths in stock analysis. AI stock analysis vs human research is not a question of one being better than the other, but rather how they complement each other in the investment process. AI stock research accuracy and speed make it an indispensable tool for modern investors, helping them make data-driven decisions in real time. However, human research still has an essential role to play in interpreting qualitative factors and adjusting strategies based on unforeseen events.

For investors looking to save time on stock research and increase the precision of their investment decisions, AI presents an exciting opportunity. The ability of artificial intelligence to process vast amounts of data at lightning speed, identify trends, and forecast potential outcomes can help investors make quicker, data-driven decisions. This is particularly valuable in today's fast-paced stock market, where milliseconds can make a significant difference in an investment's success or failure. AI-driven tools can analyze historical data, market sentiment, and even news events with unmatched efficiency, providing investors with insights that would otherwise take days or even weeks to gather manually.

However, for those who place a high value on judgment, intuition, experience, and a more holistic approach to stock picking, human research remains a crucial element of the investment process. While AI excels in speed and the processing of large datasets, it still struggles to replicate the nuanced understanding that comes with years of experience and a deep knowledge of market psychology. Human analysts can often interpret subtle signals, like the impact of geopolitical events, market sentiment, or the financial health of a company in ways that an AI might miss. Moreover, they are able to take into account qualitative factors—such as leadership changes, regulatory shifts, and cultural trends—that can have a significant influence on a company's future performance.

By blending both methodologies, investors can harness the full potential of today’s stock market. Combining the speed, efficiency, and precision of AI with the strategic insights and intuitive judgment of human researchers allows investors to make more informed decisions. This hybrid approach maximizes the potential for success by using AI for quick analysis and pattern recognition, while relying on human expertise to guide decision-making through context and experience. Such a strategy enables investors to not only make faster, more accurate predictions but also to consider the broader implications of their decisions, minimizing risk while optimizing returns. This fusion of technology and human insight represents the future of stock market investing, where the strengths of both AI and human intelligence are leveraged to create a more balanced and effective approach to investing.