AI Stock Research for Earnings and Market News

If you trade around earnings or react to headlines, you already know the problem: there’s too much information and not enough time. Quarterly reports, earnings call transcripts, breaking market news, macro data, social sentiment—by the time you’ve read a fraction of it, the price has already moved. That’s where AI stock research for earnings and market news changes the game, compressing hours of reading into minutes of clear, prioritized insight. Platforms like SimianX AI bring this power into a workflow any serious investor or trader can use without becoming a data scientist.

Why Earnings and Market News Are the Core Signal

Before you think about AI, it’s worth asking: why focus so much on earnings and news?

At a high level, prices move because expectations change. Two of the biggest expectation shocks come from:

Together, they drive:

The challenge is that:

AI doesn’t magically make noise disappear. Instead, it:

1. Reads everything fast (filings, transcripts, news, social),

2. Ranks what matters, and

3. Summarizes implications in plain language you can act on.

The edge isn’t just “having more data”—it’s understanding faster than others what actually matters for earnings and news.

Bold takeaway: AI doesn’t replace your judgment; it removes the grunt work so your judgment is focused only on the top 5% of signals that move price.

1. Start with the core events (earnings, key headlines).

2. Let AI digest, cluster, and summarize the information.

3. Use your own playbook to decide how to trade or invest around the insights.

| Feature / Step | Example / Explanation |

|---|---|

| Earnings event parsing | Extracting revenue, EPS, guidance, and management tone |

| News clustering | Grouping 100+ similar headlines into 3–4 main narratives |

| Sentiment scoring | Labeling text as bullish, bearish, or uncertain |

| Actionable summary | Turning raw text into clear “what changed and why it matters” |

How does AI stock research for earnings and market news actually work?

Under the hood, the workflow is surprisingly systematic. A modern AI research stack typically follows these steps:

1. Data aggregation

- Fetch filings, press releases, earnings transcripts.

- Stream financial news and sometimes social data.

- Integrate price, volume, and basic fundamentals.

2. Natural language understanding

- Use language models to identify entities (companies, products, geographies).

- Extract key metrics (growth rates, margins, guidance ranges).

- Detect qualitative signals (confidence, hedging language, risk mentions).

3. Sentiment and impact modeling

- Score each document or section as positive, negative, or neutral.

- Estimate likely impact on revenue, risk, or valuation.

- Map sentiment changes against price reactions.

4. Surface-level outputs

- Bullet-point summaries of earnings calls.

- “What changed vs last quarter” reports.

- Risk/driver dashboards for news narratives.

5. Deep-dive on demand

- Ask follow-up questions in plain language:

- “Why did gross margin drop?”

- “How does this guidance compare to last year?”

- “What risks did management emphasize?”

Platforms like SimianX AI package this entire workflow into a conversational interface, so you can ask questions like you would to a human analyst, and get structured, research-style answers instead of raw text dumps.

From Manual to AI: What Actually Changes in Your Workflow?

Let’s compare how a trader or analyst handles a big earnings day with and without AI.

The manual way

The AI-augmented way

- Beat/miss vs expectations

- Key drivers (pricing, volume, costs)

- Guidance changes

- Management tone (confident, cautious, defensive)

Instead of fighting to collect information, you spend almost all your energy deciding what to do about the information.

Core benefit: AI turns a firehose of earnings and news data into a prioritized decision feed that matches how humans actually think.

1. Let AI scan the earnings and news first.

2. Read the synthesized summary, not the raw inputs.

3. Dive deeper only where your edge or curiosity is strongest.

| Workflow Aspect | Traditional Approach | AI-Augmented Approach |

|---|---|---|

| Time per stock on earnings | 30–90 minutes | 5–15 minutes |

| Coverage breadth | Dozens of names | Hundreds or more |

| Missed subtle signals | High (humans tire and skim) | Lower (AI doesn’t fatigue or skim) |

| Cognitive load | High—many tabs, scattered notes | Lower—central, conversational research hub |

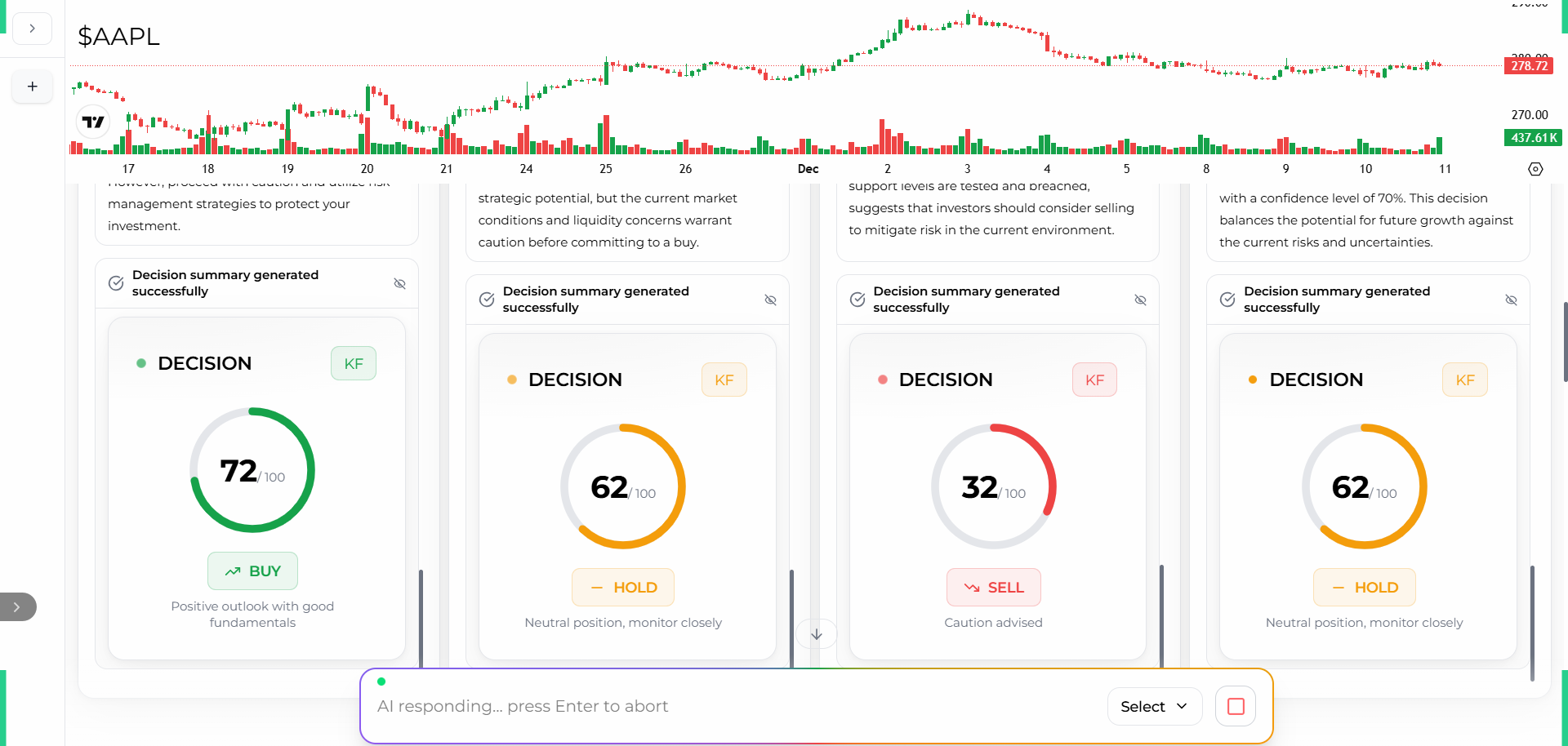

Where SimianX AI Fits in This Picture

Now, let’s anchor this in something concrete. SimianX AI is built specifically for investors who want AI-powered research without building their own models or data pipelines.

At a high level, you can think of SimianX as:

You might use SimianX AI like this:

The key is that SimianX doesn’t just give you raw answers—it helps you standardize your research process so every stock gets the same level of structured, repeatable analysis.

Practical Playbook: Using AI for Earnings and News, Step by Step

Let’s walk through a clear, reusable playbook you can apply around any earnings event or major news cycle.

Step 1: Pre-earnings setup

1. Define your watchlist

- Focus on names where earnings or news actually influences your P&L: core holdings, high-volatility trades, and sector leaders.

2. Collect baseline expectations

- Consensus EPS/revenue estimates

- Recent price action and valuation multiples

- Prior guidance and main story (turnaround, growth, restructuring, etc.)

3. Ask AI for a pre-earnings briefing

- “What is the market currently pricing in?”

- “What were the key themes from the last 2–3 quarters?”

- “Which risks or opportunities are investors most focused on?”

Step 2: During earnings release

- Did they beat or miss on top and bottom line?

- Did they raise, maintain, or cut guidance?

- What drivers (pricing, costs, volume, mix) explain the change?

- What is management’s tone and outlook?

- Q&A portions with tough analyst questions.

- Mentions of new risks (e.g., regulatory, supply chain, demand softness).

- References to key products or segments you care about.

Step 3: Post-earnings reaction and positioning

1. Ask AI:

- “How does this quarter compare historically?”

- “Is guidance conservative, aggressive, or in line based on past behavior?”

- “What are the 3 most important sentences from the call, and why?”

2. Compare the AI’s interpretation to price action:

- Did the stock overreact or underreact relative to fundamentals and sentiment?

- Are there divergences between news narrative and actual numbers?

3. Make a decision:

- Trade the short-term reaction.

- Adjust your long-term thesis.

- Put the name on a “re-check later” list if the signal is mixed.

Step 4: Handling continuous market news

AI shines when news flow is constant and overwhelming. Build habits like:

This takes you from chasing notifications to owning a structured news process.

Example Walkthrough: AI-Assisted Earnings Research on a Single Stock

Imagine you’re preparing for earnings on a large-cap tech stock. Here’s how a SimianX-like workflow might look:

1. Three days before earnings

- You ask: “Summarize this company’s last four quarters in 10 bullet points.”

- AI highlights: revenue growth trends, margin changes, major product launches, and recurring risk themes.

2. On earnings day, after the release

- AI generates a fast snapshot: beat/miss, updated guidance, segment performance.

- It flags that while EPS beat expectations, free cash flow deteriorated and management mentioned “macro uncertainty” multiple times.

3. Digging into the call

- You ask: “Show me all mentions of ‘demand’, ‘pricing’, and ‘competition’ with context.”

- AI pulls sentences from the transcript, each with commentary like “management sounded cautious about enterprise demand in Europe.”

4. Comparing with news and sentiment

- AI clusters the day’s headlines into:

- “Beat on revenue but cautious tone on 2026 demand”

- “Cloud growth slowing vs peers”

- “Buyback increased despite uncertainty”

5. Decision-making

- You might conclude: the market is focusing too much on EPS beat and underweighting demand risk.

- Or the opposite: the cautious language is already priced in, and the real story is improving margins.

At every step, AI isn’t telling you what to think—it’s giving you a compressed, structured view of all the important information so you can think more clearly.

FAQ About AI stock research for earnings and market news

How accurate is AI stock research around earnings?

AI can be very effective at summarizing and contextualizing earnings data, but it’s not a crystal ball. The real power is in reducing human error from missed details and emotional reactions. Treat AI outputs as high-quality input for your process, not as guaranteed predictions.

How should I use AI earnings call analysis day to day?

Use AI for the things that normally drain your time: reading transcripts, tracking guidance changes, and spotting repeated risk themes. Make it a habit to start your earnings work by reading the AI summary, then drill into the raw transcript or filings only where it truly matters. This keeps you fast without becoming shallow.

What is the best way to use AI for market news monitoring?

Set up a rhythm where AI gives you portfolio-focused news dashboards instead of you chasing every headline. Ask for summaries by ticker, sector, or theme (“AI chips,” “regulation,” “consumer demand”). The goal is to move from reactive doom-scrolling to proactive, structured monitoring.

Can AI stock research replace human analysts?

Not realistically, and not safely. AI is exceptional at reading, summarizing, and pattern-finding at scale, but humans still provide strategy, context, ethics, and big-picture thinking. The strongest edge comes from combining both: let AI do the heavy lifting, and let humans focus on thesis-building and risk management.

How do I get started with AI-powered stock research if I’m not technical?

You don’t need to build your own models. Start with a platform like SimianX AI that wraps advanced AI into a conversational interface. Begin with simple prompts—“summarize this stock’s last earnings,” “highlight key risks from recent news”—and gradually build your own repeatable checklist of questions.

Conclusion

Earnings and market news will always be at the center of serious investing—but trying to cover everything manually is no longer realistic. AI stock research for earnings and market news turns that information overload into a competitive edge by scanning, ranking, and summarizing what matters before the market fully digests it. When you combine that power with your own judgment, you get faster decisions, clearer theses, and fewer “I missed that line in the call” regrets.

If you want to move from scattered tabs to a coherent, AI-augmented research process, consider giving SimianX AI a try. It brings conversational AI, structured stock research, and shareable reports into a single experience built for investors—not programmers. Explore what’s possible and see how much deeper (and faster) your research can become with SimianX AI as your always-on stock analysis partner.