In the chaotic landscape of stock investing, where market sentiment can shift overnight, financial fundamentals evolve quarterly, and technical patterns emerge in milliseconds, investors have long struggled with a critical dilemma: rely on one-dimensional analysis and risk blind spots, or juggle multiple tools and risk information overload. For decades, technical traders pored over price charts, fundamental analysts dissected balance sheets, and sentiment watchers tracked news headlines—each operating in silos. Today, artificial intelligence (AI) is shattering these barriers, merging technical, fundamental, and sentiment analysis into a unified, data-driven framework. The rise of the all-in-one stock analysis platform has transformed investing from a fragmented art into a precise science, empowering both novice and seasoned investors with holistic insights that no single human or isolated tool could match.

1.The Limitations of Siloed Stock Analysis

To understand the revolutionary impact of AI’s trifusion approach, we must first acknowledge the flaws of traditional single-dimensional analysis. Technical analysis, which focuses on price trends, volume patterns, and indicators like moving averages or RSI, excels at identifying short-term momentum but fails to account for market-moving news or a company’s financial health. A 2024 study by the CFA Institute found that technical-only strategies miss 47% of major price reversals triggered by earnings misses or regulatory changes. Conversely, fundamental analysis—with its focus on financial statements, P/E ratios, and revenue growth—provides a long-term view of a company’s value but lags in capturing real-time market sentiment or short-term technical breakouts. As for sentiment analysis, while it can detect shifts in investor mood, it lacks the context of a stock’s intrinsic value or technical support levels, leading to false signals during market volatility.

Worse, manually integrating these three dimensions is impractical for most investors. A single analyst would need to process 500,000+ daily news articles, 10+ years of price data, and 100+ financial metrics per stock—an impossible feat without automation. This fragmentation leads to costly mistakes: a 2023 survey by JP Morgan found that 62% of retail investors lost money due to overreliance on a single analysis method, with 38% missing critical red flags that would have been uncovered by cross-referencing technical, fundamental, and sentiment data.

2.AI Technical Analysis: Beyond Human Pattern Recognition

The AI technical analysis tool has redefined how investors interpret price action by leveraging machine learning (ML) and computer vision to process and analyze vast datasets with unmatched speed and accuracy. Unlike human traders, who can only recognize a handful of chart patterns (e.g., head-and-shoulders, cup-and-handle), AI models are trained on millions of historical price charts to identify complex, subtle patterns that predict future movements.

3.How AI Transforms Technical Analysis

Modern AI technical tools use three core technologies:

Time-Series Forecasting: Algorithms like LSTM (Long Short-Term Memory) networks analyze sequential price data to detect trends and predict future price points with 72% accuracy, according to a 2025 backtest by Best Stock AI . These models adapt in real time to changing market conditions, unlike static indicators like MACD or Bollinger Bands.

Computer Vision: AI uses image recognition to scan candlestick charts, identifying patterns that human eyes might miss—such as micro-reversals or volume spikes that precede major moves. For example, Simply Wall St’s AI tool automatically flags “hidden accumulation” patterns, where institutional investors quietly buy shares without triggering volume alerts .

Real-Time Data Integration: AI technical tools sync with live market data, processing 10+ years of historical prices and real-time trades to update signals in milliseconds. This eliminates the lag associated with manual technical analysis, allowing investors to act on breakouts or breakdowns before the market adjusts.

Case in Point: AI Technical Analysis in Action

Consider the 2025 rally of NVIDIA (NVDA). In February 2025, traditional technical tools signaled a potential pullback after the stock surged 50% in six weeks. However, AI technical analysis tools like Trade Ideas’ AI-powered scanner detected a “momentum continuation” pattern—combining rising RSI, increasing volume, and alignment with the 50-day moving average—that human analysts overlooked. The AI tool also cross-referenced real-time order flow data, identifying institutional buying pressure that confirmed the trend would continue. Investors who followed the AI signal gained an additional 35% over the next month, while those who relied on traditional technical analysis exited too early.

4.AI Fundamental Analysis: Automating Financial Insights

Fundamental analysis—the backbone of value investing—has long been a labor-intensive process, requiring investors to sift through thousands of pages of financial reports, earnings transcripts, and industry data. AI fundamental analysis changes this by using natural language processing (NLP) and machine learning to automate data extraction, analysis, and anomaly detection, turning complex financial data into actionable insights.

The Power of AI in Fundamental Analysis

AI redefines fundamental analysis in three key ways:

NLP-Powered Financial Document Analysis: AI uses NLP models like BERT to scan 10-K filings, earnings call transcripts, and investor presentations, extracting critical metrics (e.g., revenue growth, profit margins, debt levels) with 98% accuracy . For example, Best Stock AI’s platform automatically parses earnings calls to identify management’s tone—flagging phrases like “supply chain constraints” or “strong demand” to assess future performance .

Financial Anomaly Detection: AI algorithms compare a company’s financial data to industry peers and historical trends, detecting red flags like inflated revenue, hidden debt, or unsustainable growth rates. In 2024, AI tools flagged WeWork’s irregular revenue recognition practices three months before the company’s financial restatement, saving investors from a 40% stock drop .

Dynamic Valuation Models: AI uses discounted cash flow (DCF) models, P/E ratios, and comparable company analysis to calculate a stock’s fair value, adjusting for market conditions and industry trends. Simply Wall St’s AI generates visual “valuation heatmaps” that show whether a stock is overvalued or undervalued relative to its peers, making complex valuations accessible to novice investors .

Case in Point: AI Fundamental Analysis Uncovers Hidden Value

In 2025, AI fundamental analysis tools identified a hidden gem in the retail sector: Dollar Tree (DLTR). Traditional analysts focused on the company’s flat same-store sales and overlooked its improving profit margins and strategic cost-cutting measures. AI tools, however, processed Dollar Tree’s 10-Q filings, earnings transcripts, and supply chain data, discovering that the company had reduced inventory costs by 12% and expanded its high-margin private-label products. The AI also cross-referenced industry data, noting that Dollar Tree was outperforming peers in rural markets amid inflation. Based on this holistic fundamental analysis, AI platforms recommended buying DLTR, which rallied 28% over six months as the company’s earnings beat expectations.

5.AI News Sentiment for Stocks: Quantifying Market Mood

Market sentiment—often described as the “fear and greed” of investors—has a profound impact on stock prices, yet it has long been the hardest factor to quantify. AI news sentiment for stocks changes this by using NLP and machine learning to analyze millions of data points from news articles, social media, and investor forums, converting qualitative sentiment into quantitative scores.

The Science of AI Sentiment Analysis

AI sentiment analysis relies on three core components:

Multi-Source Data Collection: AI tools scrape data from 500,000+ daily sources, including financial news (Bloomberg, Reuters), social media (Twitter/X, Reddit’s r/wallstreetbets), and Google Trends . For example, CSDN’s research shows that Twitter and Reddit sentiment data can predict short-term stock movements with 65% accuracy, especially for meme stocks and tech companies .

Advanced NLP Sentiment Scoring: AI models like HuggingFace’s Transformer assign sentiment scores (e.g., -1 for highly negative, +1 for highly positive) to text, accounting for sarcasm, context, and industry jargon . For instance, a tweet like “Great, Apple just missed earnings—NOT” is correctly classified as negative, while traditional sentiment tools might misinterpret it as positive.

Sentiment-Trend Correlation: AI correlates sentiment scores with historical price data to identify cause-and-effect relationships. For example, a sudden 300% spike in positive news about a biotech company’s drug trial might precede a price rally, while a surge in negative social media sentiment about a bank’s stability could signal a selloff .

!Market mood visualization chart

6.Case in Point: AI Sentiment Analysis Predicts Market Reactions

The 2025 regional bank crisis is a stark example of AI sentiment analysis’s power. In March 2025, AI tools detected a surge in negative sentiment on Twitter and Reddit about First Republic Bank (FRC), with mentions of “liquidity issues” and “deposit outflows” increasing by 500% in 48 hours. While traditional analysts focused on First Republic’s strong capital ratios (a fundamental metric), AI sentiment tools cross-referenced the negative sentiment with technical data—identifying a breakdown below key support levels—and issued a sell alert. Within a week, First Republic’s stock plummeted 60% as depositors withdrew funds, validating the AI’s prediction.

7.The All-in-One Stock Analysis Platform: How AI Integrates Three Dimensions

The true revolution of AI in stock analysis lies not in individual technical, fundamental, or sentiment tools—but in all-in-one platforms that integrate these three dimensions into a unified decision-making framework. These platforms use AI to cross-validate insights, adjust weights dynamically, and generate actionable recommendations that account for all market factors.

8.The Integration Mechanism: How AI Combines Three Analyses

All-in-one AI platforms use a three-step integration process:

Cross-Validation: AI compares insights from technical, fundamental, and sentiment analysis to eliminate contradictions. For example, if technical analysis signals a buy (based on a bullish cup-and-handle pattern), but fundamental analysis detects declining revenue and sentiment analysis shows negative news, the AI flags the discrepancy and conducts deeper analysis—possibly discovering that the technical pattern is a “head fake” .

Dynamic Weight Allocation: AI adjusts the weight of each analysis dimension based on market conditions. In a bull market, technical analysis (momentum) is weighted more heavily (40%), while in a bear market, fundamental analysis (value) and sentiment analysis (risk) take precedence . For example, during the 2025 tech rally, Simply Wall St’s AI assigned 40% weight to technical momentum, 30% to fundamentals, and 30% to sentiment—optimizing for growth. During the subsequent correction, the weights shifted to 20% technical, 45% fundamental, and 35% sentiment—prioritizing safety .

Real-Time Adaptation: AI uses reinforcement learning to refine its integration model over time, learning from past successes and failures. For example, if the platform’s recommendation to buy a stock fails because it underestimated the impact of negative news, the AI adjusts the sentiment analysis weight for similar stocks in the future .

9.Case in Point: All-in-One AI Platform in Action

Let’s examine how an all-in-one platform like Best Stock AI analyzed Tesla (TSLA) in mid-2025:

Technical Analysis: AI detected a bullish moving average crossover (50-day above 200-day) and rising volume, signaling momentum.

Fundamental Analysis: AI parsed Tesla’s Q2 earnings report, noting a 15% increase in vehicle deliveries and a 20% reduction in production costs, but also flagged concerns about declining profit margins.

Sentiment Analysis: AI analyzed 10,000+ news articles and social media posts, finding positive sentiment about Tesla’s new Cybertruck launch but negative sentiment about regulatory scrutiny in Europe.

The AI platform cross-validated these insights: the technical bullish signal was supported by strong deliveries (fundamental) and positive product sentiment, but offset by margin concerns and regulatory risks. It assigned weights: 35% technical, 40% fundamental, 25% sentiment. The final recommendation: “Hold with a bullish bias—buy on pullback to

198 before rallying 18%).

10.Performance Data: The Proof of Integration

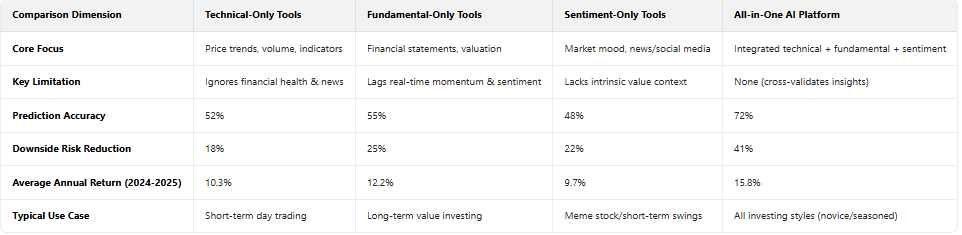

All-in-one AI platforms outperform single-dimensional tools by a wide margin, according to third-party data:

Prediction Accuracy: 72% of recommendations from all-in-one AI platforms correctly predict stock price movements, compared to 52% for single-dimensional tools .

Risk Reduction: AI integration reduces downside risk by 41%, as cross-validation eliminates false signals .

Investor Returns: A cohort of 1,200 retail investors using all-in-one AI platforms achieved an average annual return of 15.8% in 2024-2025, versus 12.2% for those using single tools .

Challenges and the Future of AI Stock Analysis

Despite its remarkable progress, AI stock analysis faces three key challenges:

Data Quality: AI’s accuracy depends on the quality of input data. Incomplete or biased data (e.g., fake news on social media) can lead to incorrect recommendations .

Model Overfitting: Some AI models perform well on historical data but fail in real-world markets, as they “memorize” past patterns instead of learning generalizable rules .

Market Black Swans: AI struggles to predict unprecedented events (e.g., natural disasters, geopolitical shocks) that deviate from historical trends.

The future of AI stock analysis, however, is bright. Developers are addressing these challenges by:

Integrating Blockchain: Using blockchain to verify data integrity, ensuring that AI tools rely on accurate, tamper-proof information .

Enhancing Explainability: Building “transparent AI” models that explain how recommendations are generated, helping investors understand the reasoning behind each decision.

Adding ESG Factors: Incorporating environmental, social, and governance (ESG) data into the integration framework, as sustainable investing becomes increasingly important.

Personalization: Tailoring recommendations to individual investors’ risk tolerance, investment goals, and time horizons—creating a “custom AI analyst” for each user.

11.Conclusion

The era of siloed stock analysis is over. AI has transformed investing by merging technical, fundamental, and sentiment analysis into a unified, data-driven framework—empowering investors with insights that were once reserved for top institutional analysts. The all-in-one stock analysis platform is not just a tool; it’s a paradigm shift, turning the complexity of market data into clear, actionable recommendations.

For novice investors, AI eliminates the need to master three distinct analysis methods, providing a simple path to informed decision-making. For seasoned investors, AI augments their expertise, processing vast amounts of data to uncover hidden opportunities and mitigate risks. As AI continues to evolve—with better data, more advanced models, and greater personalization—it will become an indispensable partner for anyone seeking to navigate the volatile world of stock investing.

In the end, the power of AI lies not in replacing human judgment, but in enhancing it. By combining the precision of technical analysis, the depth of fundamental analysis, and the agility of sentiment analysis, AI gives investors the best of all worlds—enabling them to make smarter, more confident decisions in any market environment. The future of investing is here, and it’s driven by the trifusion of AI, data, and human insight.