Cognitive Market Predictions of Autonomous Encrypted Intelligent Systems

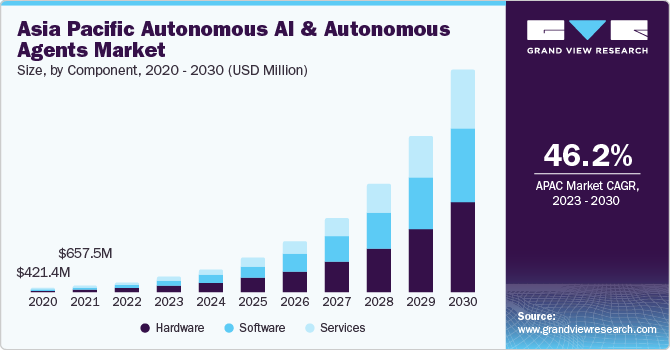

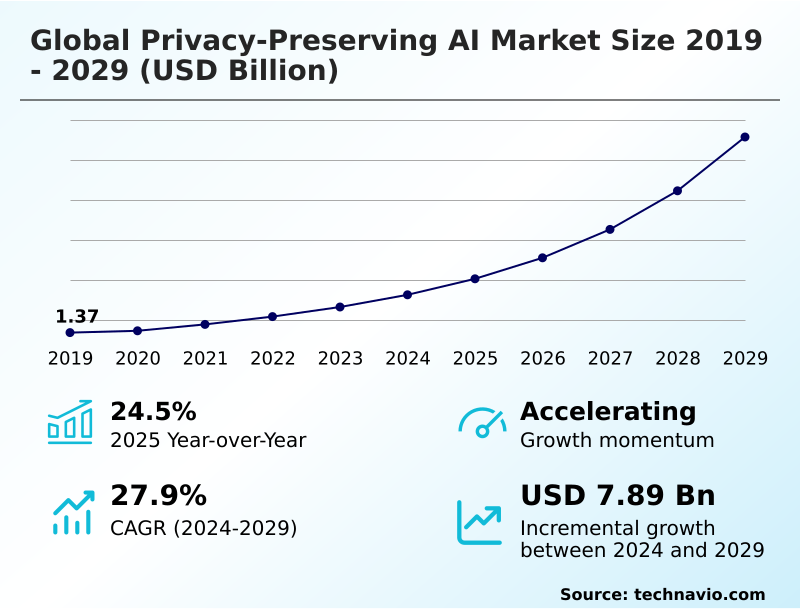

Cognitive market predictions of autonomous encrypted intelligent systems represent a new frontier in financial forecasting, combining self-learning AI, cryptographic privacy, and distributed intelligence. As markets become increasingly complex and adversarial, traditional predictive models struggle to adapt in real time. This research explores how autonomous, encrypted intelligent systems generate cognitive-level market predictions and why platforms like :contentReference[oaicite:0]{index=0} are pioneering this shift toward secure, adaptive forecasting infrastructures.

From Statistical Forecasting to Cognitive Market Intelligence

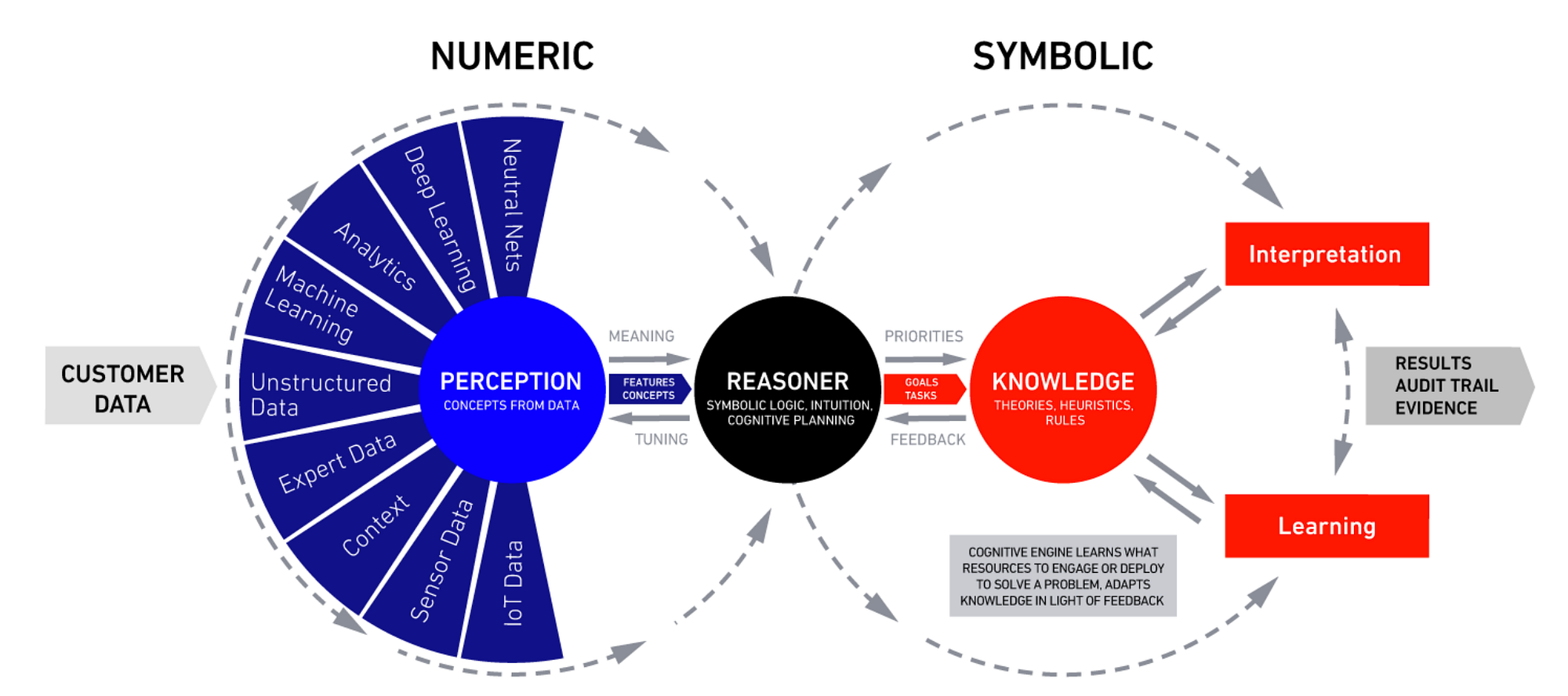

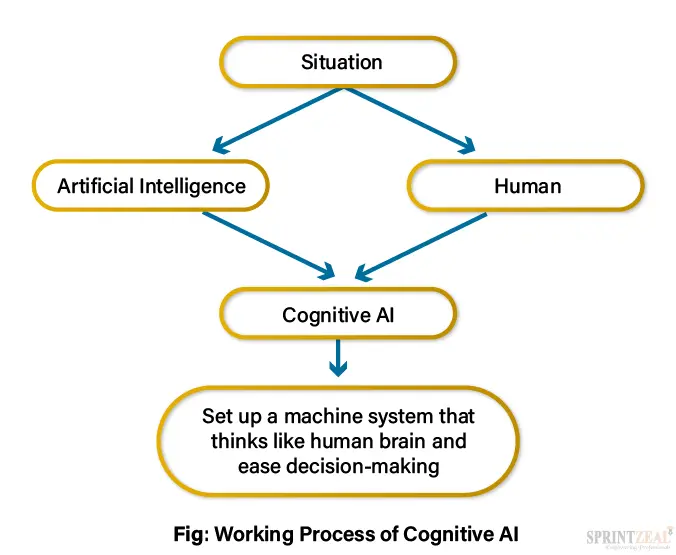

Traditional market prediction relies heavily on statistical inference, historical correlations, and centralized data pipelines. Cognitive market prediction systems differ fundamentally by reasoning about markets as adaptive, partially observable systems.

Key distinctions include:

Cognitive systems do not merely predict prices—they interpret market intent and structural stress.

Cognitive market intelligence allows encrypted AI agents to model liquidity flows, sentiment shifts, and emergent coordination effects that classical time-series models fail to capture.

Architecture of Autonomous Encrypted Intelligent Systems

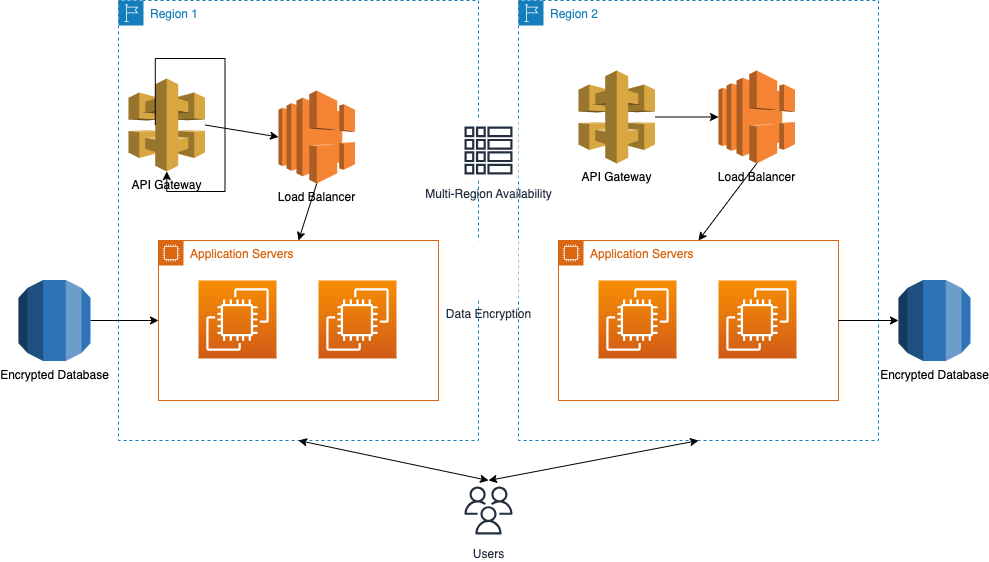

At the core of these systems lies a layered architecture designed for privacy, autonomy, and resilience.

Core Layers

1. Encrypted Data Ingestion

Market data is processed through homomorphic encryption or secure enclaves, ensuring raw data is never exposed.

2. Autonomous Cognitive Agents

Each agent maintains internal world models and decision policies, updating them through reinforcement and Bayesian inference.

3. Collective Intelligence Layer

Agents exchange encrypted signals, not raw data, enabling coordination without information leakage.

4. Prediction Synthesis Engine

Outputs probabilistic market scenarios rather than single-point forecasts.

| Layer | Function | Market Benefit |

|---|---|---|

| Encryption | Data privacy | Reduced data leakage risk |

| Autonomy | Self-directed learning | Faster regime adaptation |

| Collective cognition | Multi-agent reasoning | Lower model bias |

| Scenario synthesis | Probabilistic outputs | Better risk management |

Why Encryption Is Foundational to Cognitive Market Prediction

Markets are adversarial environments. Any exposed signal can be exploited. Encryption is not an add-on—it is structural.

Key advantages of encrypted cognition:

Encrypted intelligence shifts prediction from data ownership to model cognition.

This design philosophy underpins SimianX AI’s approach to privacy-first market intelligence.

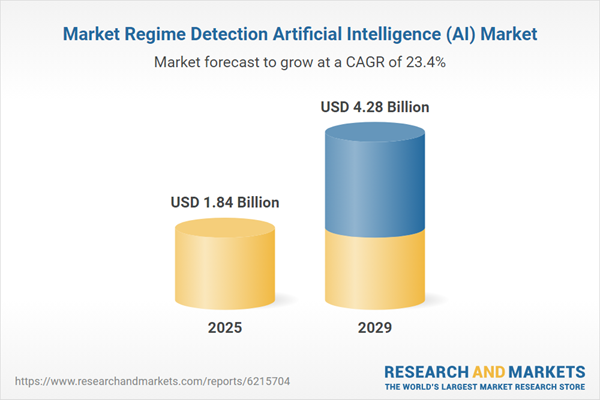

How Do Autonomous Encrypted Systems Learn Market Regimes?

Regime Cognition vs Regime Detection

Classic models detect regimes after transitions occur. Cognitive systems anticipate regime shifts by tracking latent variables such as:

Learning Loop

1. Observe encrypted signals

2. Update internal belief graphs

3. Simulate counterfactual futures

4. Allocate confidence weights to scenarios

This loop allows autonomous systems to reason under uncertainty rather than overfitting historical patterns.

Cognitive Market Predictions in Decentralized Finance (DeFi)

DeFi markets amplify the need for encrypted cognition due to transparency, composability, and reflexivity.

Applications include:

SimianX AI integrates these cognitive prediction layers to provide actionable, encrypted insights across DeFi ecosystems without compromising user or protocol privacy.

Comparison: Classical AI vs Cognitive Encrypted Systems

| Dimension | Classical AI Models | Cognitive Encrypted Systems |

|---|---|---|

| Data access | Centralized | Encrypted & distributed |

| Adaptability | Slow retraining | Continuous learning |

| Privacy | Low | High |

| Output | Point predictions | Scenario distributions |

| Adversarial resistance | Weak | Strong |

This shift represents a paradigm change rather than an incremental improvement.

What Makes Cognitive Market Prediction More Reliable?

H3: What is cognitive market prediction in encrypted AI systems?

Cognitive market prediction refers to AI systems that reason, adapt, and anticipate market behavior using encrypted data flows. Unlike traditional models, they generate probabilistic scenarios based on internal world models rather than static correlations. Encryption ensures these insights remain secure and manipulation-resistant.

Practical Framework for Deploying Cognitive Market Prediction

A simplified deployment framework:

1. Define encrypted data boundaries

2. Deploy autonomous agents per market domain

3. Establish secure inter-agent signaling

4. Continuously validate scenario accuracy

This framework is increasingly adopted by advanced AI research teams and platforms like SimianX AI.

!ai deployment framework market systems-1.png)

FAQ About Cognitive Market Predictions of Autonomous Encrypted Intelligent Systems

How do autonomous encrypted AI systems predict markets without raw data?

They operate on encrypted representations and derived signals, allowing learning and inference without exposing underlying data.

Are cognitive market predictions better than LLM-based forecasts?

They serve different roles. Cognitive systems excel at adaptive, real-time market reasoning, while LLMs are stronger in narrative and semantic analysis.

Can encrypted AI systems be audited?

Yes. While raw data remains private, model behavior, scenario outputs, and performance metrics can be externally audited.

Is this approach suitable for high-frequency trading?

It is more effective for risk-aware, regime-level decisions than ultra-low-latency execution strategies.

Conclusion

Cognitive market predictions of autonomous encrypted intelligent systems redefine how forecasting is performed in complex, adversarial markets. By uniting encryption, autonomy, and collective cognition, these systems move beyond fragile correlations toward resilient market intelligence. As this paradigm matures, platforms like SimianX AI are positioned at the forefront—enabling secure, adaptive, and actionable market predictions for the next generation of financial systems.

7. Formalizing Cognitive Market Prediction Under Encryption Constraints

Once cognitive market prediction systems transition from conceptual architectures to deployed infrastructures, formalization becomes unavoidable. Without mathematical grounding, autonomy degrades into heuristic drift.

7.1 Cognitive State Spaces in Encrypted Environments

Unlike classical models that operate in observable state spaces, autonomous encrypted intelligent systems reason within latent cognitive state manifolds.

These states include:

Belief distributions over hidden liquidity conditions

Encrypted representations of incentive gradients

Temporal confidence decay functions

Internal uncertainty propagation tensors

Formally, we define a cognitive market state as:

Cₜ = {Bₜ, Iₜ, Uₜ, Θₜ}

Where:

Bₜ = belief graph over market hypotheses

Iₜ = incentive topology (agents, capital, constraints)

Uₜ = uncertainty surface under encryption

Θₜ = adaptive policy parameters

Because raw observations are inaccessible, state transitions are computed through cryptographically protected belief updates, not direct measurement.

This shifts prediction from signal fitting to belief evolution.

8. Encrypted Learning Dynamics and Cognitive Drift Control

8.1 The Drift Problem in Autonomous Market Intelligence

Autonomous systems that continuously learn face cognitive drift, where internal models diverge from reality due to:

Regime misclassification

Adversarial signal injection

Over-weighting recent encrypted signals

Feedback loop amplification

In encrypted environments, drift is harder to detect because ground truth is partially hidden.

8.2 Drift Stabilization via Multi-Agent Cognitive Anchors

To counter drift, modern systems deploy cognitive anchors:

Independent encrypted agents trained on orthogonal priors

Periodic belief cross-validation under secure aggregation

Confidence-weighted disagreement scoring

Stability emerges not from correctness, but from structured disagreement.

This principle mirrors biological cognition: perception is stabilized through competing interpretations, not singular certainty.

9. Market Prediction as an Adversarial Cognitive Game

9.1 Markets Are Not Stochastic — They Are Strategic

A fundamental error of classical forecasting is treating markets as stochastic processes. In reality, markets are strategic cognitive environments populated by adaptive adversaries.

Autonomous encrypted intelligent systems therefore model markets as repeated incomplete-information games, not time series.

Key elements include:

Hidden opponent strategies

Delayed information revelation

Intentional deception

Reflexive feedback

9.2 Game-Theoretic Cognitive Prediction

Cognitive prediction systems simulate opponent belief trees, estimating:

What others believe the market is

What others believe others believe

How capital will reposition based on second-order beliefs

Encryption ensures these simulations cannot be reverse-engineered by competitors observing outputs.

10. Reflexivity Amplification and Containment

10.1 When Prediction Changes the Market

A critical risk emerges when cognitive systems become large enough to influence the very markets they predict.

This creates reflexivity loops:

System predicts stress

Capital reallocates

Stress materializes

Prediction appears “correct”

Without safeguards, this becomes self-fulfilling market distortion.

10.2 Reflexivity Dampening Mechanisms

Advanced systems implement:

Prediction entropy ceilings

Output smoothing across agents

Delayed confidence disclosure

Scenario-based guidance instead of binary signals

The goal is not prediction dominance, but market interpretability without destabilization.

11. Cognitive Security: Defending Against Intelligence-Level Attacks

11.1 Beyond Data Attacks: Cognitive Exploits

Encrypted systems are resistant to data theft—but remain vulnerable to cognitive attacks, including:

Belief poisoning

Incentive misdirection

Time-delay manipulation

Narrative-induced regime hallucination

These attacks target how the system reasons, not what it sees.

11.2 Cognitive Firewalls

Defense mechanisms include:

Belief provenance tracking

Narrative consistency checks

Cross-temporal anomaly detection

Agent-level epistemic diversity

This establishes a new security domain: cognitive cybersecurity.

12. Emergent Intelligence at System Scale

12.1 When Prediction Systems Become Cognitive Entities

As agent populations grow, encrypted intelligent systems exhibit emergent properties:

Self-organized specialization

Endogenous signal prioritization

Spontaneous abstraction layers

At sufficient scale, the system no longer behaves as a tool—but as a market-sensing organism.

12.2 Measuring Emergence

Emergence is evaluated through:

Reduction in prediction variance without loss of entropy

Increased regime anticipation lead time

Cross-market generalization without retraining

These metrics indicate true cognitive integration, not ensemble averaging.

13. Ethical and Governance Implications

13.1 Who Controls Cognitive Market Intelligence?

Encrypted autonomous prediction systems challenge governance norms:

They cannot be fully inspected

They operate continuously

They adapt beyond designer intent

This raises questions of:

Accountability

Alignment

Market fairness

13.2 Toward Transparent Opacity

A paradox emerges: systems must remain opaque to protect integrity, yet transparent enough to trust.

Solutions include:

Verifiable execution proofs

Public scenario audit trails

Constraint-based alignment rather than rule-based control

14. Future Research Directions

14.1 Cognitive Compression

Reducing reasoning complexity while preserving anticipatory power will be a major frontier.

14.2 Cross-Domain Cognitive Transfer

Applying market-trained cognition to:

Supply chains

Energy grids

Geopolitical risk

14.3 Human–AI Cognitive Co-Prediction

Future systems will not replace human judgment—but co-evolve with it, integrating:

Human intuition as priors

AI cognition as constraint solvers

Final Synthesis

Cognitive market predictions of autonomous encrypted intelligent systems represent a structural evolution in forecasting. They do not seek certainty, nor dominance, nor raw speed.

Instead, they embody:

Adaptive reasoning under uncertainty

Strategic awareness in adversarial markets

Privacy-preserving collective intelligence

As these systems mature, platforms like SimianX AI are not merely building tools—they are shaping the cognitive infrastructure of future markets.

The era of prediction as regression is ending.

The era of prediction as encrypted cognition has begun.