Original Market Insights Formed by Self-Organizing Encrypted Intelligent Networks

Original market insights formed by self-organizing encrypted intelligent networks represent a fundamental shift in how financial intelligence is generated, validated, and acted upon. Instead of relying on centralized analysts or monolithic models, these systems emerge from distributed, autonomous AI agents that collaborate under cryptographic constraints. Platforms like SimianX AI are exploring this frontier, where intelligence is no longer designed top-down but emerges bottom-up from encrypted coordination across networks.

From Centralized Analysis to Emergent Market Intelligence

Traditional market research follows a linear pipeline: data collection → model inference → human interpretation. This structure introduces bottlenecks, bias, and latency. In contrast, self-organizing encrypted intelligent networks operate as adaptive ecosystems, continuously generating original market insights without a single point of control.

Key characteristics include:

Market intelligence becomes an emergent property of the system, not a predefined output.

Original market insights in this context are not forecasts copied from historical correlations, but novel interpretations generated by agent-level disagreement, negotiation, and convergence.

Architecture of Self-Organizing Encrypted Intelligent Networks

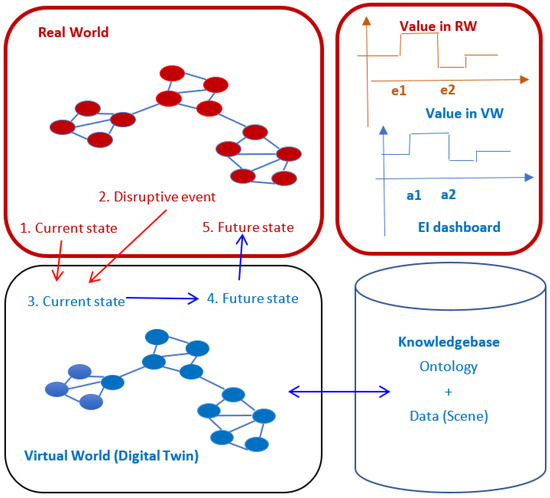

At a systems level, these networks resemble biological swarms more than traditional software stacks.

Core Architectural Layers

| Layer | Role in Insight Formation |

|---|---|

| Encrypted Data Fabric | Protects raw signals and agent communication |

| Autonomous AI Agents | Analyze, predict, and challenge local market hypotheses |

| Incentive & Reputation Layer | Rewards accuracy, novelty, and robustness |

| Consensus & Divergence Engine | Allows multiple truths to coexist and compete |

| Emergent Insight Interface | Surfaces high-confidence, non-obvious signals |

Each agent may focus on a different market microstructure—liquidity flows, volatility regimes, on-chain behavior, or macro correlations—yet no agent has global visibility.

1. Agents observe encrypted signals.

2. Agents form local hypotheses.

3. Hypotheses propagate through encrypted channels.

4. Conflicts trigger deeper analysis.

5. Consensus or persistent divergence generates insight.

This process enables original market insights that centralized systems often miss.

Why Encryption Is Essential for Original Market Insights

Encryption is not merely a privacy feature—it is a structural enabler of intelligence.

Encryption Enables:

Without encryption, dominant agents or data sources would overpower others, collapsing diversity and reducing originality.

Original insights require protected disagreement.

This is why self-organizing encrypted intelligent networks consistently outperform open, unprotected agent systems in volatile markets.

How Do Self-Organizing Encrypted Networks Generate Original Market Insights?

A Question of Emergence, Not Prediction

How do self-organizing encrypted intelligent networks generate original market insights?

They do so by maintaining unresolved tension between competing models longer than centralized systems allow. Instead of forcing early convergence, the network preserves minority signals until evidence accumulates.

Key mechanisms include:

SimianX AI applies these principles to on-chain and market data, allowing users to observe not just what the market is doing, but why different intelligences disagree about it.

Comparison: Centralized AI vs Self-Organizing Encrypted Networks

| Dimension | Centralized AI Models | Self-Organizing Encrypted Networks |

|---|---|---|

| Insight Source | Single model | Collective emergence |

| Bias Risk | High | Distributed |

| Adaptability | Slow | High |

| Originality | Limited | Strong |

| Security | Moderate | Cryptographically enforced |

Centralized models optimize for efficiency. Self-organizing encrypted systems optimize for discovery.

Practical Market Applications

These networks are already reshaping how market participants operate:

In decentralized finance and crypto markets—where transparency and attack surfaces coexist—original market insights derived from encrypted collective intelligence offer a decisive advantage.

SimianX AI integrates these systems to help researchers, traders, and protocols interpret markets as living systems, not static datasets.

Implications for the Future of Market Intelligence

Self-organizing encrypted intelligent networks suggest a future where:

This paradigm challenges the idea that better data or bigger models alone produce better insight. Instead, structure, incentives, and protection determine intelligence quality.

FAQ About Original Market Insights and Encrypted Intelligent Networks

What are original market insights in decentralized AI systems?

They are novel, non-obvious interpretations of market behavior that emerge from collective agent interaction rather than predefined models or historical templates.

Why are self-organizing encrypted networks better than single AI models?

Because they preserve diversity, resist manipulation, and adapt faster to regime changes while maintaining data integrity through encryption.

How does encryption improve market intelligence quality?

Encryption prevents data leakage, manipulation, and dominance, allowing agents to reason independently and honestly.

Can these systems be used outside crypto markets?

Yes. Any complex, adversarial environment—energy markets, supply chains, or macroeconomics—can benefit from this approach.

Conclusion

Original market insights formed by self-organizing encrypted intelligent networks represent a new epistemology of finance—one where intelligence is grown, not programmed. By combining decentralization, cryptography, and autonomous AI agents, these systems unlock insights that centralized models systematically overlook.

As markets become more complex and adversarial, tools like SimianX AI provide a critical advantage: the ability to observe emergent intelligence in real time. To explore how this paradigm can reshape your market research and decision-making, visit SimianX AI and experience the next generation of market intelligence.

Emergent Cognition and Insight Stabilization in Self-Organizing Encrypted Intelligent Networks

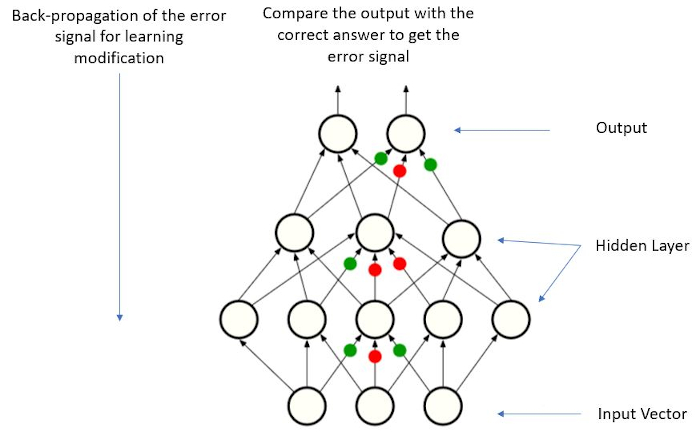

8. From Signal Aggregation to Cognitive Emergence

A critical distinction must be made between signal aggregation and cognitive emergence. Traditional ensemble models aggregate predictions. Self-organizing encrypted intelligent networks, by contrast, generate cognition.

Aggregation answers:

What is the average belief of the system?

Emergence answers:

What new belief becomes possible only because the system exists?

Original market insights do not arise from averaging forecasts. They arise from structural tension between incompatible internal models.

Insight as a Phase Transition

In these networks, insight formation resembles a phase transition rather than a computation:

This explains why insights often appear suddenly, not gradually.

Insight is not computed; it crystallizes.

9. The Role of Disagreement Persistence

One of the most counterintuitive design principles of self-organizing encrypted intelligent networks is the intentional preservation of disagreement.

Why Disagreement Matters

Centralized systems minimize error variance. These networks maximize epistemic coverage.

Disagreement is not noise—it is latent information.

| Type of Disagreement | Insight Potential |

|---|---|

| Random noise | Low |

| Structured disagreement | High |

| Persistent minority belief | Extremely high |

Original market insights often originate from agents that remain wrong the longest—until they are suddenly right.

Cryptographic Isolation Enables Honest Dissent

Encryption ensures:

This creates what can be called cryptographically enforced intellectual independence.

10. Insight Formation as a Market of Hypotheses

Self-organizing encrypted intelligent networks behave like internal prediction markets, but without explicit pricing.

Each hypothesis competes for:

Hypothesis Fitness Function

Fitness is not accuracy alone. It is multidimensional:

1. Predictive usefulness

2. Robustness across regimes

3. Resistance to adversarial noise

4. Explanatory compression

5. Transferability

The best insights are those that survive hostile futures.

SimianX AI operationalizes this by tracking hypothesis survival curves, not just hit rates.

11. Temporal Intelligence: Anticipation Without Prediction

Original market insights differ from forecasts. Forecasts answer what will happen. Insights answer what is becoming possible.

Pre-Price Intelligence

These networks frequently detect:

Before price reflects them.

This is possible because agents reason over:

Rather than extrapolated time series.

12. Regime Awareness Through Structural Memory

Unlike monolithic models that overwrite parameters, self-organizing networks accumulate structural memory.

Each regime leaves behind:

When a similar regime reappears, the system reactivates dormant structures.

The network remembers shapes of markets, not prices.

This is a key reason original market insights improve over time instead of decaying.

13. Security, Adversarial Resistance, and Insight Integrity

Markets are adversarial environments. Any intelligence system that ignores this is fragile by design.

Threat Models Addressed

Self-organizing encrypted intelligent networks are resistant to:

Encryption ensures that manipulation cannot propagate cheaply.

| Attack Vector | Centralized AI | Encrypted Swarm |

|---|---|---|

| Poisoning | High impact | Localized |

| Herding | Systemic | Contained |

| Spoofing | Effective | Expensive |

Original insights survive precisely because they are hard to falsify at scale.

14. Epistemic Humility and Multi-Truth Coexistence

One of the deepest philosophical implications of these systems is the rejection of single-truth outputs.

Self-organizing encrypted intelligent networks support:

This is essential in markets where:

A market insight that cannot coexist with alternatives is dangerous.

SimianX AI surfaces distributions of belief, not singular answers.

15. Implications for Financial Decision-Making

Original market insights reshape decision-making across roles:

For Traders

For Protocol Designers

For Risk Managers

These insights are qualitative in nature but quantitative in consequence.

16. Beyond Finance: A General Theory of Collective Intelligence

While markets are the proving ground, the framework generalizes.

Applicable domains include:

Anywhere complexity, incentives, and adversarial dynamics intersect.

Markets are not special. They are simply honest.

!generalized intelligence systems.jpg?width=3300&height=1908&name=Artificial%20General%20Intelligence_1%20(1).jpg )

17. Limitations and Open Research Questions

Despite their promise, these systems face unresolved challenges:

These are not engineering problems alone—they are civilizational design questions.

18. Conclusion: Insight as a Living Process

Original market insights formed by self-organizing encrypted intelligent networks represent a departure from predictive arrogance toward adaptive epistemology.

They acknowledge:

Rather than asking markets for answers, these systems listen for patterns of becoming.

SimianX AI stands at this frontier—transforming encrypted collective intelligence into actionable understanding for those navigating complex financial systems.

The future of market intelligence will not belong to the fastest model or the biggest dataset—but to the systems that can think together without thinking alike.