Predicting Cryptocurrency Market Trends Using Collective Machine Intelligence

Predicting cryptocurrency market trends using collective machine intelligence has become a critical research direction as digital asset markets grow in scale, complexity, and systemic risk. Unlike traditional financial markets, crypto ecosystems operate continuously, evolve rapidly, and are shaped by both algorithmic and human behaviors. In this environment, single-model AI approaches struggle to remain robust, while collective machine intelligence—systems composed of multiple cooperating AI agents—offers a fundamentally more adaptive and resilient paradigm.

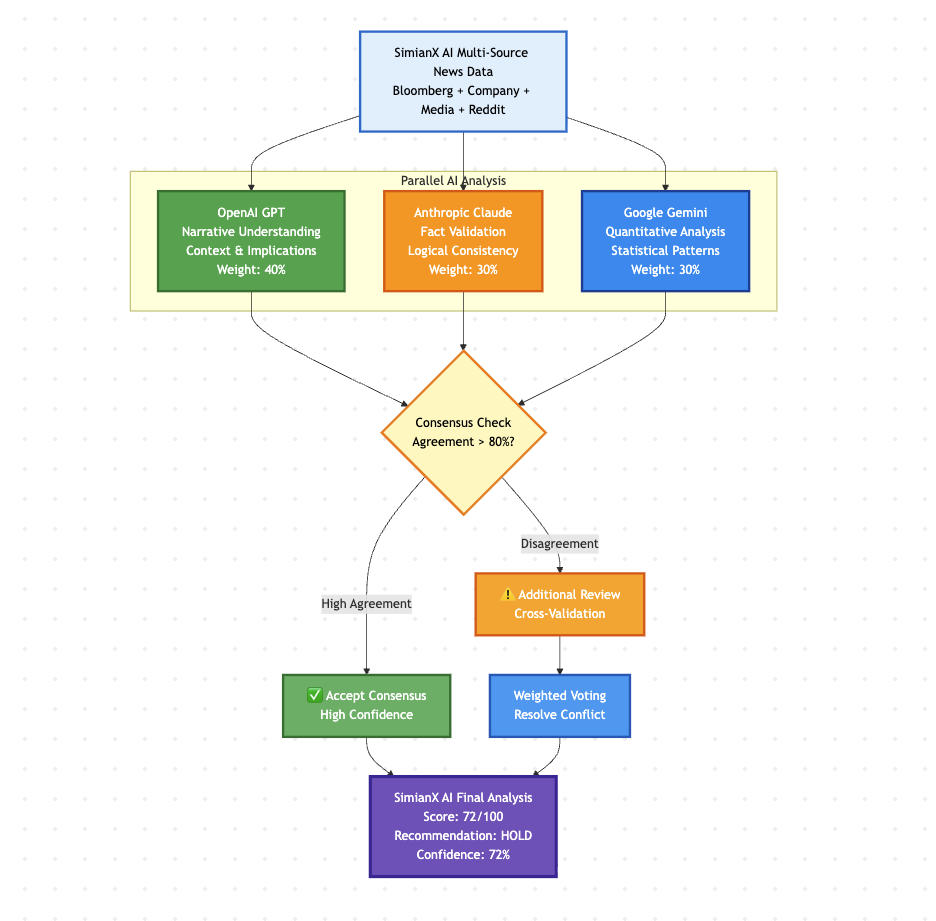

SimianX AI applies this collective intelligence framework to cryptocurrency analysis, enabling market participants to move beyond reactive indicators toward anticipatory, system-level understanding of crypto market dynamics.

The Structural Complexity of Cryptocurrency Markets

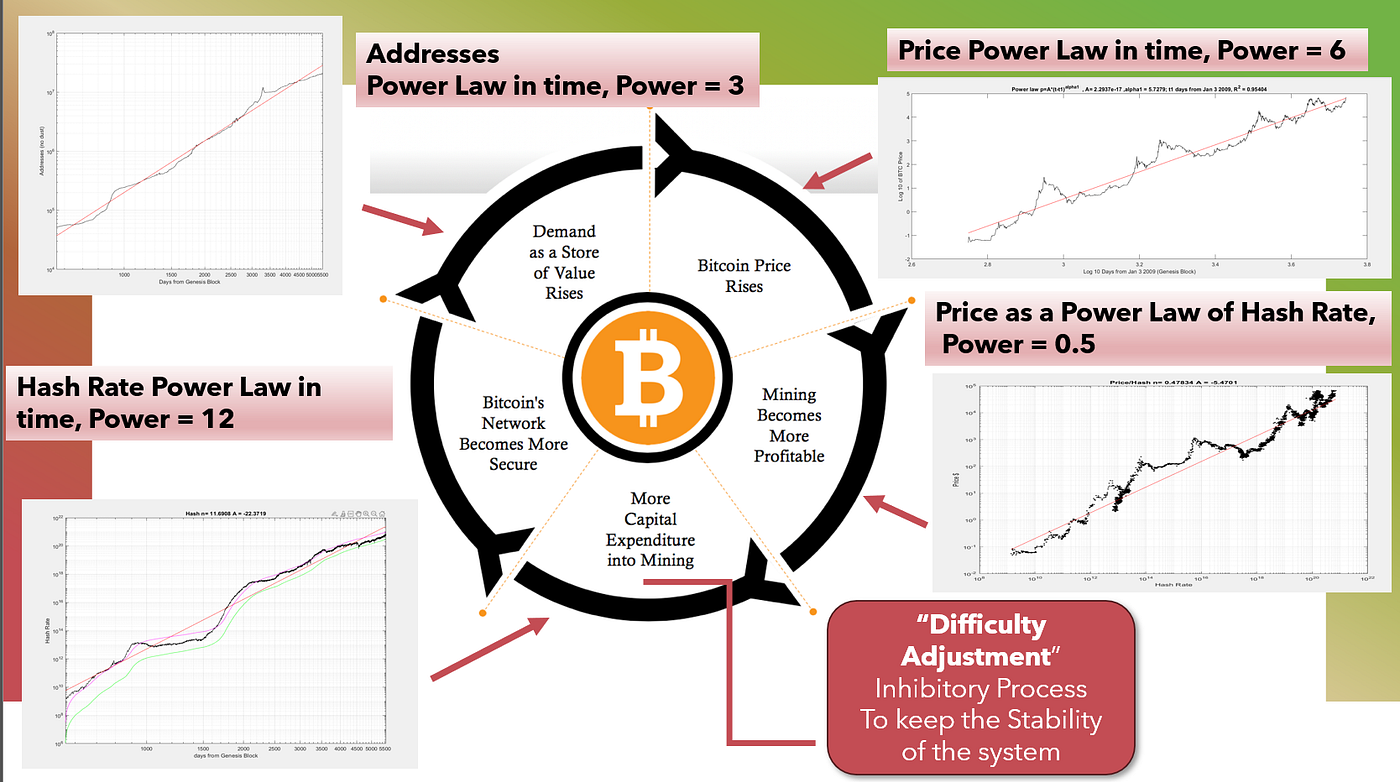

Cryptocurrency markets are not merely high-volatility versions of traditional assets. They represent complex adaptive systems where price, liquidity, narratives, and protocol mechanics co-evolve.

Several characteristics make crypto trend prediction uniquely difficult:

Crypto markets do not move in linear cause–effect chains; they evolve through feedback loops.

This environment invalidates static assumptions and creates a strong case for collective machine intelligence, where multiple AI agents monitor the system from different perspectives simultaneously.

Defining Collective Machine Intelligence in Crypto Forecasting

Collective machine intelligence refers to an AI architecture in which autonomous yet cooperative agents jointly solve prediction problems. Each agent specializes in a subset of signals, models, or time horizons, and their outputs are synthesized into a unified probabilistic view.

In cryptocurrency market prediction, this typically includes:

| Agent Class | Core Responsibility |

|---|---|

| On-chain agents | Capital flows, smart contract activity, TVL dynamics |

| Market agents | Price action, volatility, order book structure |

| Liquidity agents | Slippage, pool depth, exit risk |

| Sentiment agents | Narratives, governance, social signals |

| Risk agents | Tail risk, correlation shocks, regime detection |

Rather than voting blindly, these agents interact, disagree, and self-correct, producing insights that are greater than the sum of their parts.

!multi-agent intelligence architecture.webp)

Why Single AI Models Fail in Crypto Markets

Overfitting to Short Regimes

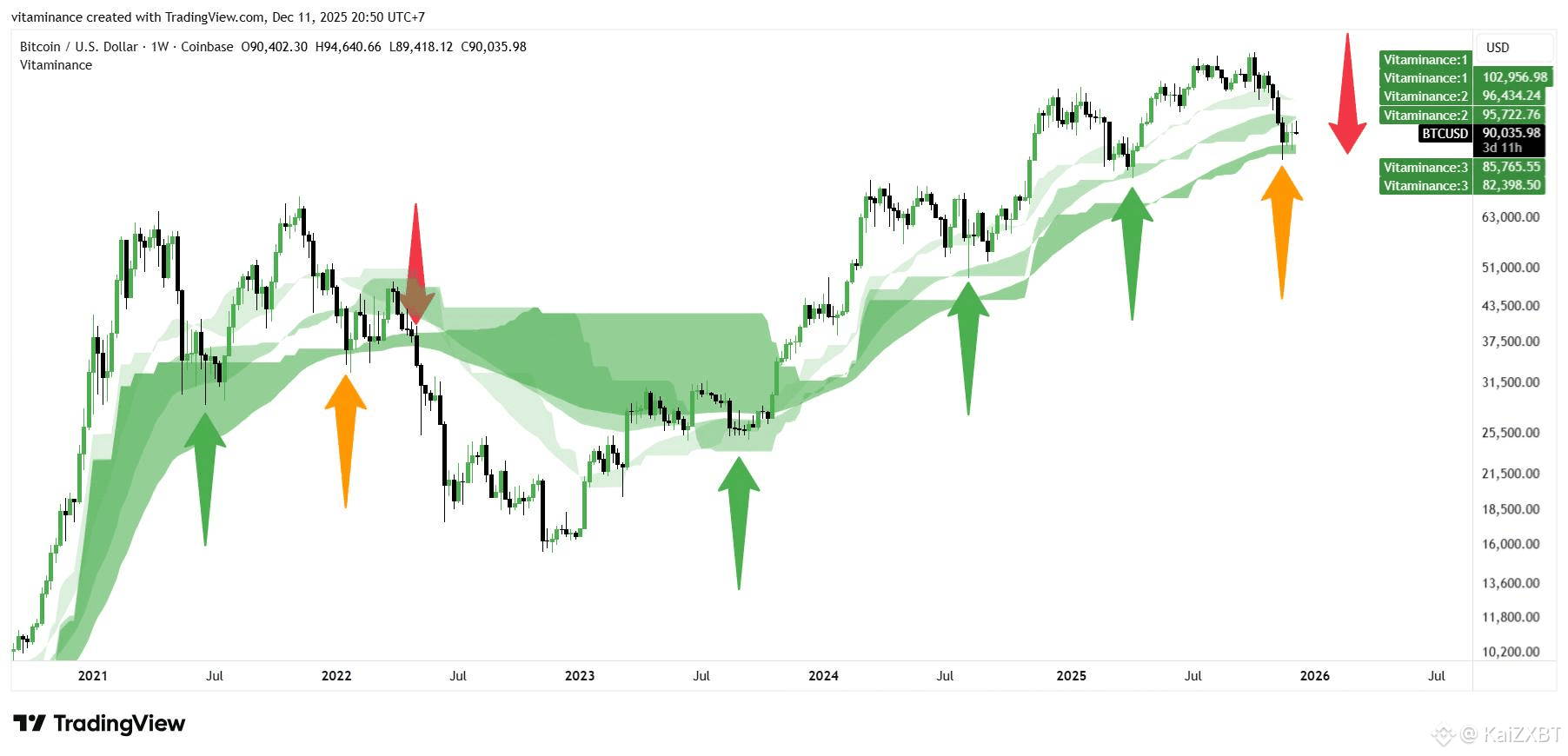

Crypto markets frequently undergo regime shifts—from low-volatility accumulation phases to explosive expansions or rapid collapses. Single models trained on recent data tend to overfit short-lived patterns, leading to delayed or false signals.

Inability to Integrate Heterogeneous Signals

Price alone is insufficient. Many critical events—liquidity drains, protocol risks, governance failures—manifest on-chain long before price reacts. Monolithic models struggle to integrate these diverse data modalities effectively.

Lack of Reflexivity Awareness

Crypto markets are reflexive: predictions influence behavior, which in turn alters outcomes. Collective systems are better suited to track these feedback effects across agents.

How Collective Machine Intelligence Enhances Trend Prediction

1. Signal Redundancy Without Signal Collapse

Multiple agents observe overlapping phenomena from different angles. If one agent fails or becomes noisy, others maintain system stability.

This redundancy reduces false positives.

2. Dynamic Regime-Sensitive Weighting

Collective systems allow agent influence to change dynamically:

Market intelligence should adapt as fast as the market itself.

3. Early Detection of Non-Price Signals

Most crypto collapses are preceded by non-price deterioration:

Collective machine intelligence surfaces these weak signals earlier.

A Step-by-Step Framework for Collective AI Crypto Prediction

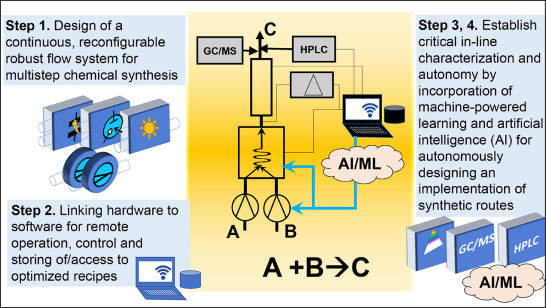

Step 1: Multi-Source Data Ingestion

Agents ingest heterogeneous data streams:

Step 2: Specialized Agent Modeling

Each agent uses domain-appropriate models:

Step 3: Cross-Agent Validation and Conflict Resolution

Conflicting signals trigger deeper inspection rather than averaging:

| Conflict Example | Resolution |

|---|---|

| Rising price + falling liquidity | Risk-weighted downgrade |

| Bullish sentiment + weak on-chain usage | Narrative discounting |

Step 4: Ensemble Synthesis

A meta-agent aggregates outputs into probabilistic trend scenarios, not deterministic predictions.

Step 5: Continuous Learning and Feedback

Agents retrain and recalibrate based on realized outcomes, allowing the system to evolve with the market.

Collective Intelligence vs Traditional Crypto Indicators

| Approach | Limitation |

|---|---|

| RSI / MACD | Lagging, price-only |

| Single AI model | Regime fragility |

| Human discretionary | Cognitive bias |

| Collective machine intelligence | Adaptive, multi-dimensional |

This comparison highlights why collective intelligence is increasingly viewed as foundational infrastructure rather than a trading add-on.

Practical Applications on SimianX AI

SimianX AI operationalizes collective machine intelligence to support:

Instead of chasing short-term price moves, SimianX AI focuses on structural market understanding, enabling users to align strategies with underlying system health.

Risk, Ethics, and Systemic Considerations

Collective intelligence also raises important questions:

Addressing these concerns requires transparent architectures, robust validation, and human-in-the-loop oversight—all active research areas within SimianX AI.

FAQ About Predicting Cryptocurrency Market Trends Using Collective Machine Intelligence

How accurate is collective machine intelligence for crypto prediction?

Accuracy improves in terms of risk-adjusted outcomes, not perfect price forecasts. It excels at identifying regime shifts and asymmetric risks.

Can collective AI replace human judgment?

No. It augments decision-making by filtering noise and surfacing system-level insights.

Is this approach suitable for DeFi protocols?

Yes. It is particularly effective for monitoring liquidity sustainability, emissions risk, and governance health.

Does collective intelligence work in low-liquidity markets?

It helps identify when low liquidity itself becomes the dominant risk factor.

Conclusion

Predicting cryptocurrency market trends using collective machine intelligence represents a paradigm shift from indicator-driven speculation toward system-aware intelligence. By coordinating specialized AI agents across on-chain data, market dynamics, sentiment, and risk, collective intelligence delivers earlier warnings, more robust forecasts, and deeper understanding of crypto market behavior.

As crypto ecosystems continue to evolve, this approach will define the next generation of market analytics. To explore how collective machine intelligence can enhance your crypto research, risk management, and strategic decision-making, visit SimianX AI and experience the future of crypto intelligence.