Specialized Time-Series Models for Crypto Prediction

Specialized time-series models for crypto prediction have become a core analytical tool for understanding highly volatile digital asset markets. Unlike generic machine learning or large language models, time-series models are explicitly designed to capture temporal dependencies, regime shifts, seasonality, and structural breaks—all of which dominate cryptocurrency price dynamics. As crypto markets mature, platforms like SimianX AI increasingly rely on these specialized models to extract actionable signals from noisy, non-stationary on-chain and market data.

In this research, we examine how specialized time-series models work, why they outperform general-purpose models in many crypto prediction tasks, and how they can be integrated into modern AI-driven analytics frameworks for more reliable decision-making.

---

Why Crypto Markets Demand Specialized Time-Series Models

Cryptocurrency markets differ fundamentally from traditional financial markets. They operate 24/7, exhibit extreme volatility, and are heavily influenced by on-chain activity, liquidity flows, protocol incentives, and reflexive trader behavior. These characteristics make naive prediction approaches ineffective.

In crypto markets, the ordering of events matters as much as the events themselves.

Specialized time-series models are designed to explicitly model this temporal structure. Their key advantages include:

Unlike static regression models, time-series approaches treat prices as evolving processes, not isolated data points.

---

Classical Time-Series Models in Crypto Prediction

Early crypto research borrowed heavily from econometrics. While simple, these models remain useful baselines.

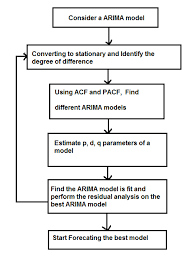

AR, MA, and ARIMA Models

Autoregressive (AR), Moving Average (MA), and ARIMA models assume that future prices depend on past values and past errors.

Strengths:

Limitations:

| Model | Core Idea | Crypto Use Case |

|---|---|---|

| AR | Past prices predict future | Micro-trend detection |

| MA | Past errors smooth noise | Noise filtering |

| ARIMA | AR + MA + differencing | Short-horizon forecasts |

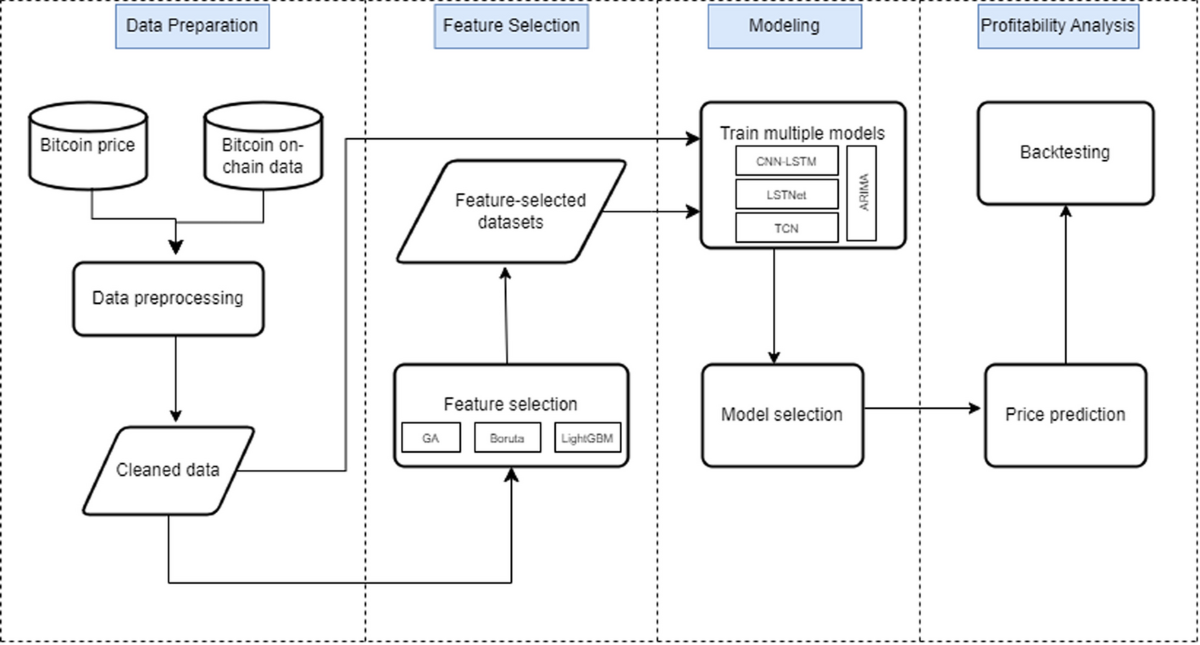

While ARIMA alone is insufficient for complex markets, it often serves as a benchmark when evaluating more advanced models on SimianX AI analytics pipelines.

---

Nonlinear and State-Space Time-Series Models

As crypto markets evolved, researchers moved beyond linear assumptions.

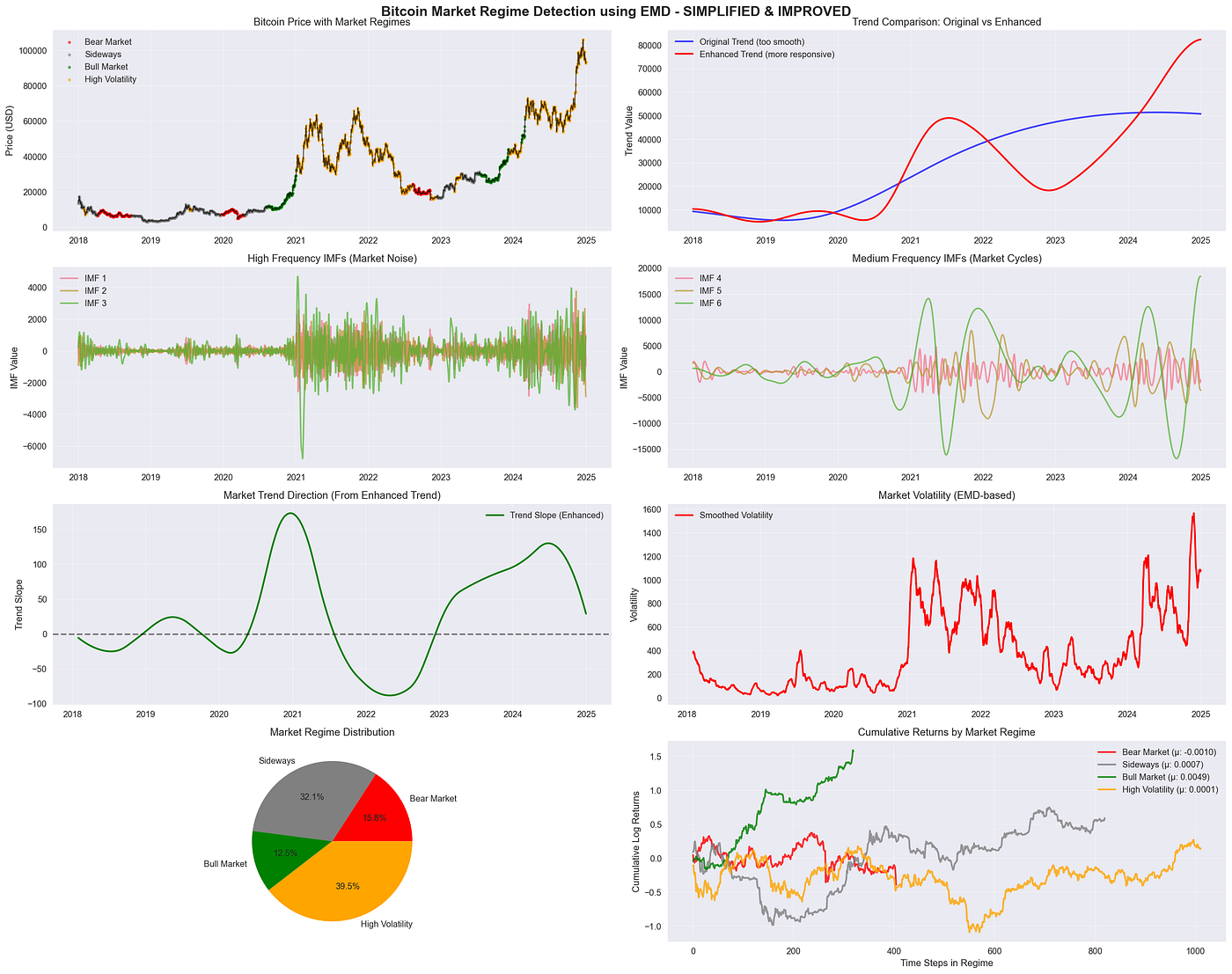

GARCH and Volatility Modeling

Crypto volatility is clustered—periods of calm followed by explosive moves. GARCH-family models explicitly model variance over time.

Key benefits:

In crypto, predicting volatility is often more valuable than predicting direction.

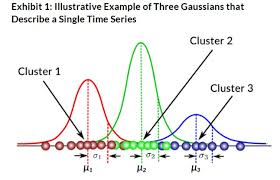

Hidden Markov Models (HMMs)

HMMs assume markets switch between hidden regimes, such as accumulation, expansion, distribution, and capitulation.

---

Deep Learning Time-Series Models for Crypto Markets

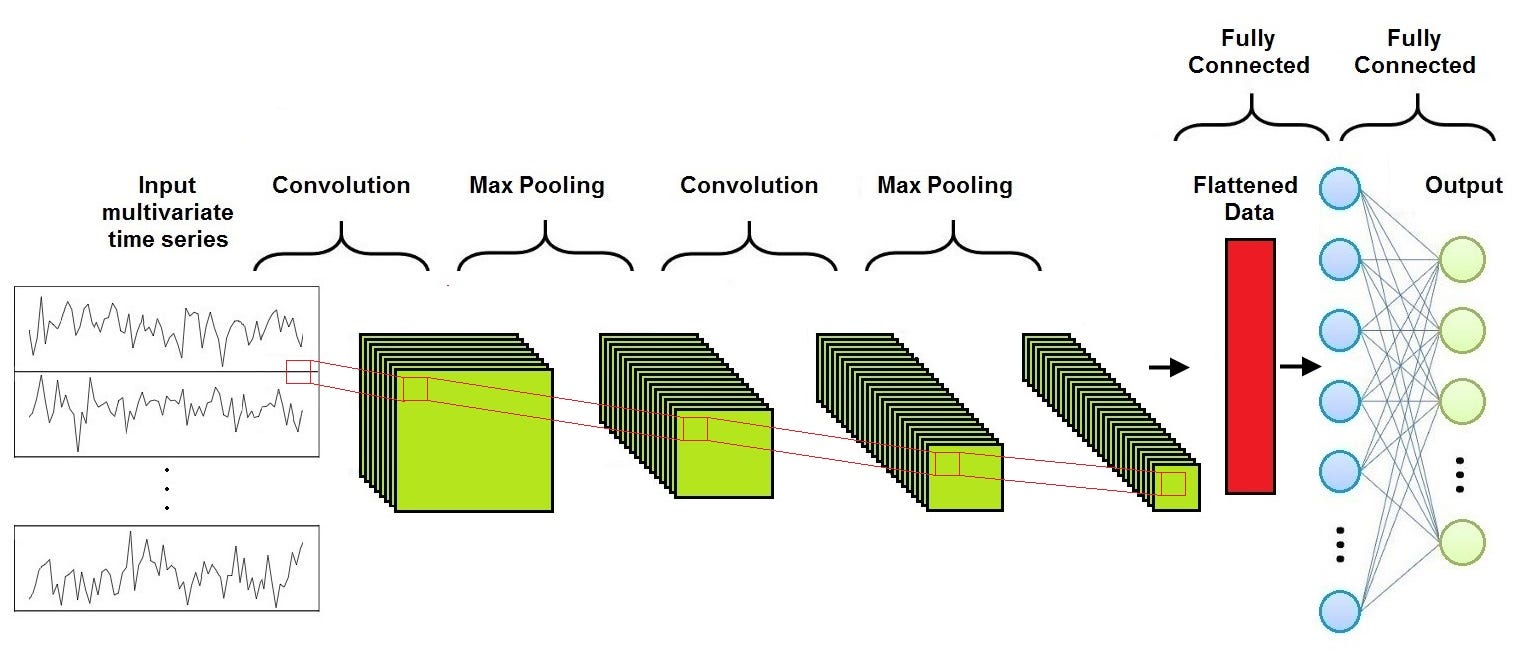

The rise of deep learning introduced powerful nonlinear time-series models capable of learning complex temporal patterns directly from data.

LSTM and GRU Networks

Recurrent neural networks (RNNs), especially LSTM and GRU, are widely used in crypto prediction.

Why they work well:

Challenges:

Temporal Convolutional Networks (TCNs)

TCNs replace recurrence with causal convolutions.

On SimianX AI, these models are often combined with feature engineering pipelines that include liquidity flows, exchange imbalances, and protocol-level signals.

---

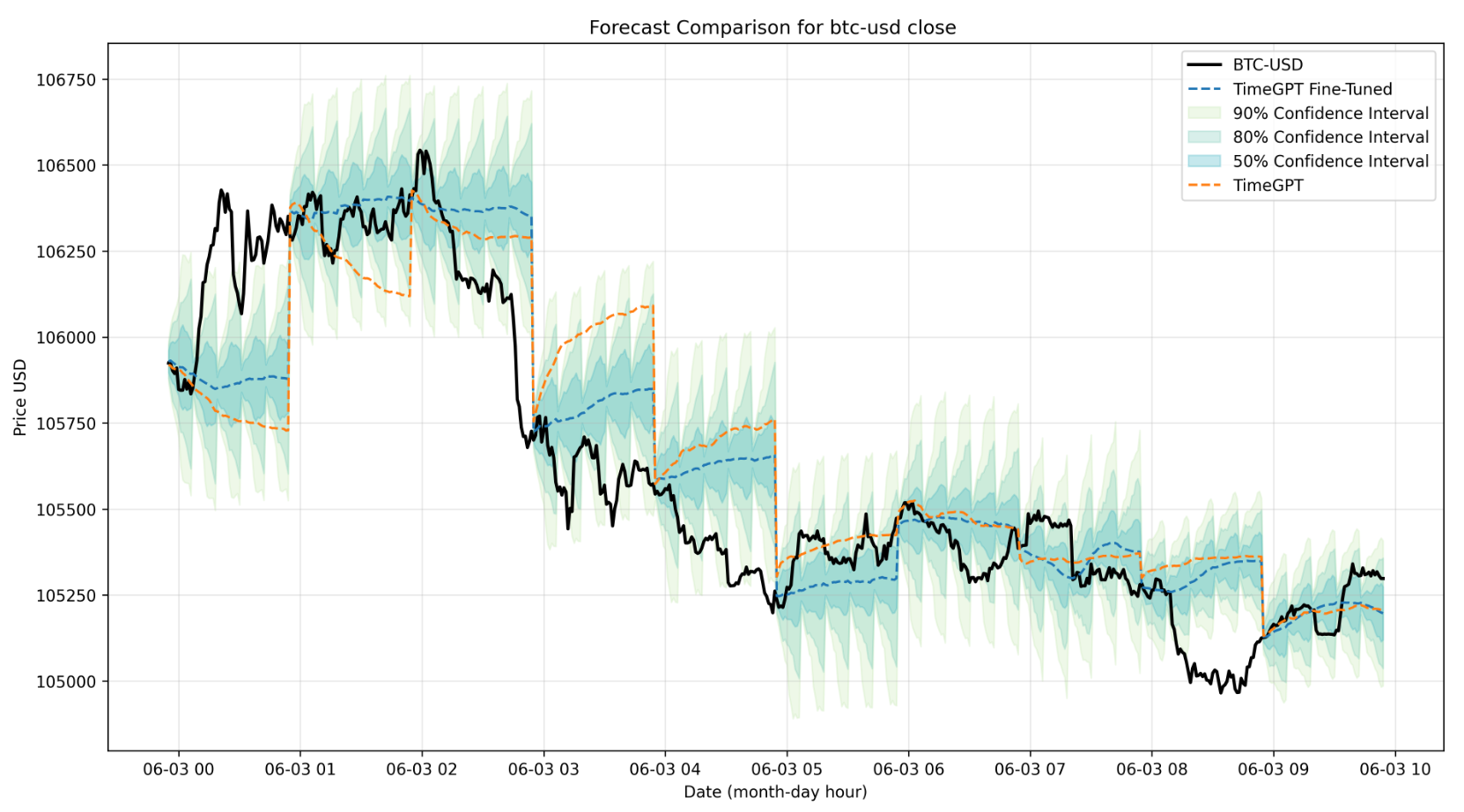

Transformer-Based Time-Series Models

Transformers, originally developed for language, are now adapted for time-series forecasting.

Temporal Transformers

Key features include:

Transformers excel when:

However, they require careful regularization in crypto contexts due to noise and regime instability.

---

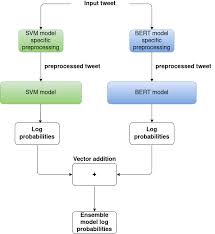

Hybrid and Ensemble Time-Series Systems

No single model dominates across all market conditions. Modern crypto prediction systems increasingly rely on ensembles.

Hybrid approaches include:

| Component | Role in Ensemble |

|---|---|

| Linear models | Stability, interpretability |

| Deep models | Nonlinear pattern capture |

| Regime filters | Model switching logic |

Ensembles reduce model risk in adversarial market environments.

---

How Do Specialized Time-Series Models Improve Crypto Prediction Accuracy?

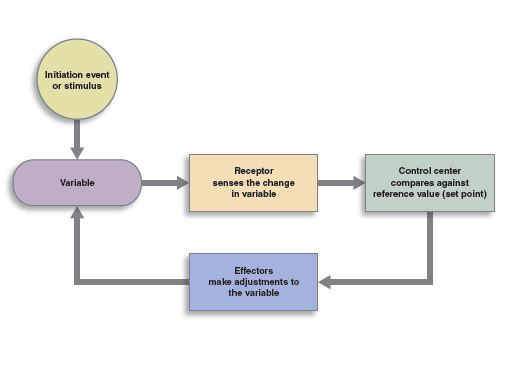

Specialized time-series models improve crypto prediction accuracy by aligning model structure with market mechanics. Instead of forcing crypto data into generic frameworks, they:

1. Respect temporal causality

2. Adapt to non-stationary distributions

3. Encode volatility and regime shifts

4. Reduce overfitting through structural constraints

This alignment is critical for producing robust, deployable signals, not just backtest performance.

---

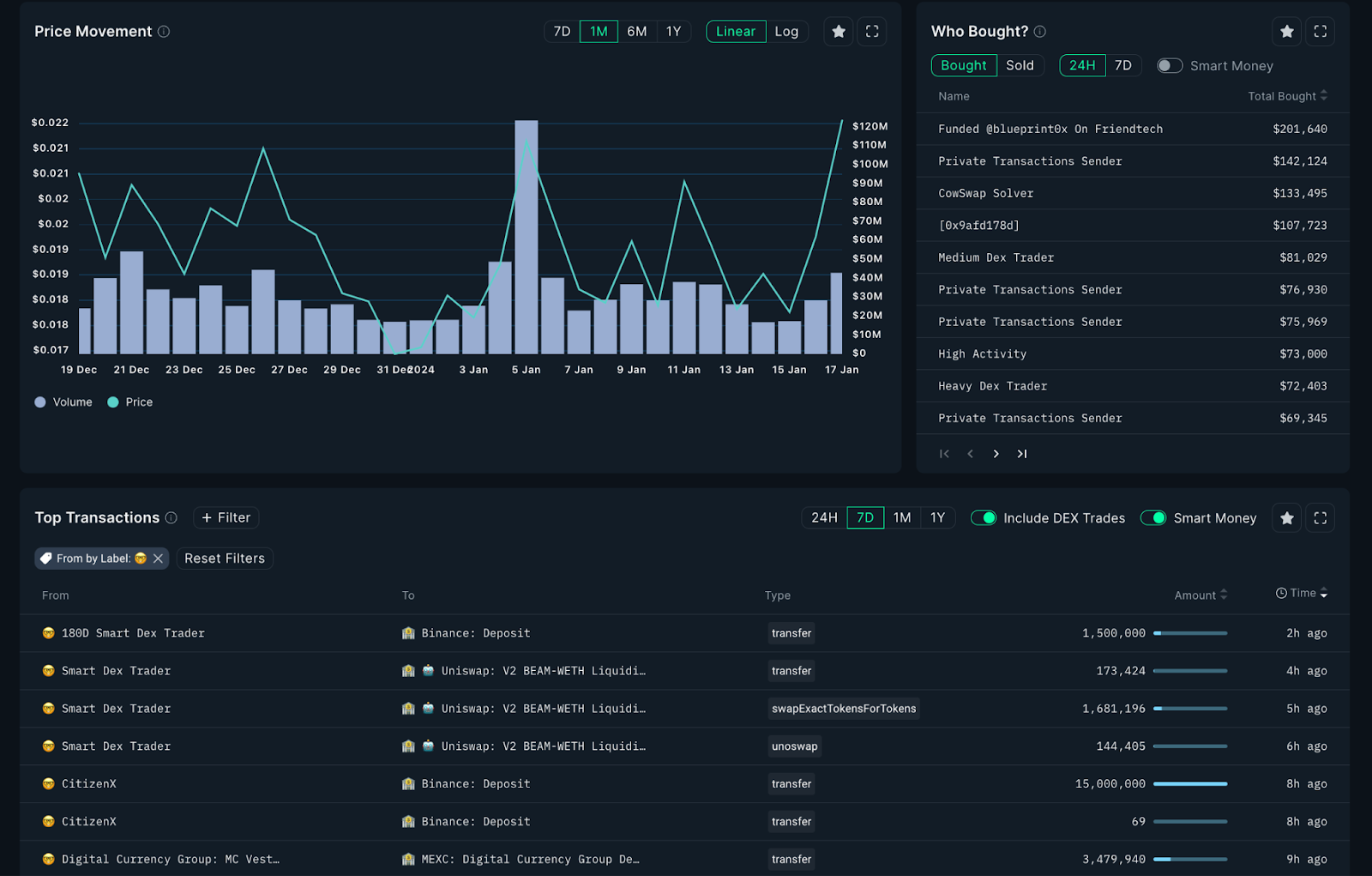

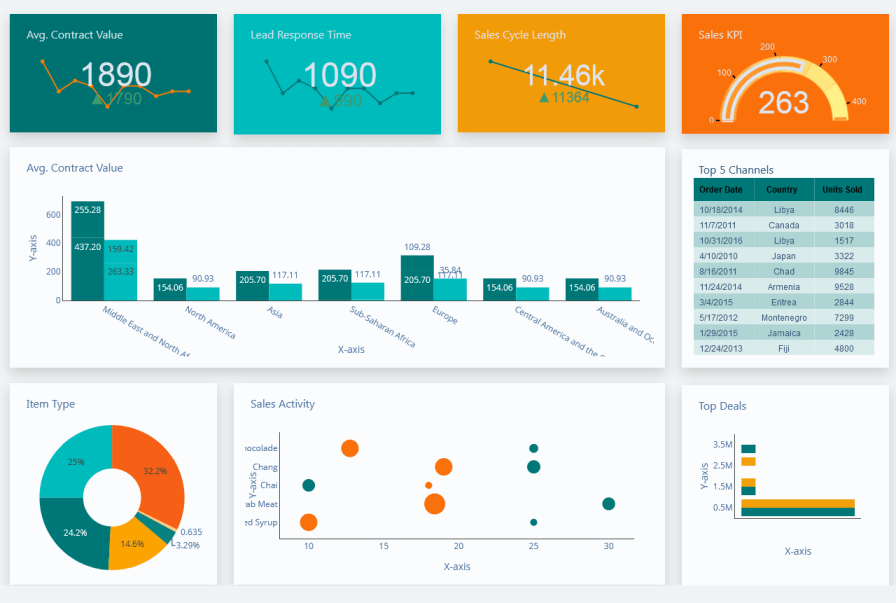

Practical Applications in Crypto Analytics

Specialized time-series models power a wide range of real-world use cases:

At SimianX AI, these models are integrated into AI-driven workflows that transform raw market and on-chain data into interpretable insights for traders, researchers, and protocol teams.

---

Limitations and Open Research Challenges

Despite their power, specialized time-series models face ongoing challenges:

Future research focuses on adaptive learning, self-calibrating ensembles, and decentralized model validation.

---

FAQ About Specialized Time-Series Models for Crypto Prediction

What are specialized time-series models in crypto?

They are models explicitly designed to analyze sequential crypto data, capturing trends, volatility, and regime changes over time rather than treating prices as independent observations.

How do time-series models differ from LLMs in crypto prediction?

Time-series models focus on numerical temporal structure, while LLMs excel at unstructured data. For price prediction, specialized time-series models are typically more precise and stable.

Are deep learning time-series models always better?

Not always. Deep models outperform in complex environments but can fail under regime shifts. Hybrid and ensemble approaches often work best.

Can time-series models use on-chain data?

Yes. Multivariate time-series models can incorporate wallet flows, TVL changes, and protocol metrics alongside price data.

---

Conclusion

Specialized time-series models for crypto prediction represent the most reliable analytical foundation for navigating volatile digital asset markets. By explicitly modeling time, volatility, and regime dynamics, these approaches outperform generic models in both accuracy and robustness. As crypto markets continue to evolve, platforms like SimianX AI demonstrate how combining advanced time-series modeling with AI-driven analytics can turn complex data into actionable intelligence.

To explore practical implementations, research workflows, and production-grade crypto analytics powered by specialized time-series models, visit SimianX AI and discover how next-generation AI is redefining crypto market prediction.

Advanced Research Extensions: From Time-Series Models to Crypto Prediction Systems

While the first part of this research established the foundations of specialized time-series models for crypto prediction, this extended section shifts the focus from individual models toward system-level intelligence. In real crypto markets, prediction accuracy does not emerge from a single algorithm, but from coordinated model architectures, adaptive learning loops, and market-aware validation frameworks.

This section explores how time-series models evolve into crypto prediction engines, how they interact with market microstructure, and how platforms such as SimianX AI operationalize these insights at scale.

---

Temporal Market Microstructure and Prediction Limits

Crypto markets are not continuous stochastic processes; they are discrete, fragmented, and adversarial systems. Order books, funding rates, liquidation cascades, and on-chain arbitrage create temporal distortions that challenge classical forecasting assumptions.

Time Granularity Mismatch

One fundamental problem is time resolution asymmetry:

Prediction errors often originate not from model weakness, but from temporal misalignment between signals.

Specialized time-series models must therefore operate across multi-scale temporal layers, including:

SimianX AI addresses this by synchronizing time-series models across multiple clocks, reducing signal leakage and false correlations.

---

Endogeneity and Reflexivity in Crypto Time-Series

Unlike traditional assets, crypto markets exhibit strong reflexivity: predictions influence behavior, and behavior reshapes the data-generating process.

Reflexive Feedback Loops

When traders adopt similar models:

1. Signals become self-fulfilling

2. Volatility amplifies

3. Historical relationships decay

This creates endogenous regime collapse, where models trained on past data lose validity.

Key implication:

Time-series models must be self-aware of their own market impact.

Modern crypto prediction systems therefore embed adaptive decay mechanisms, weighting recent observations more aggressively during high reflexivity periods.

---

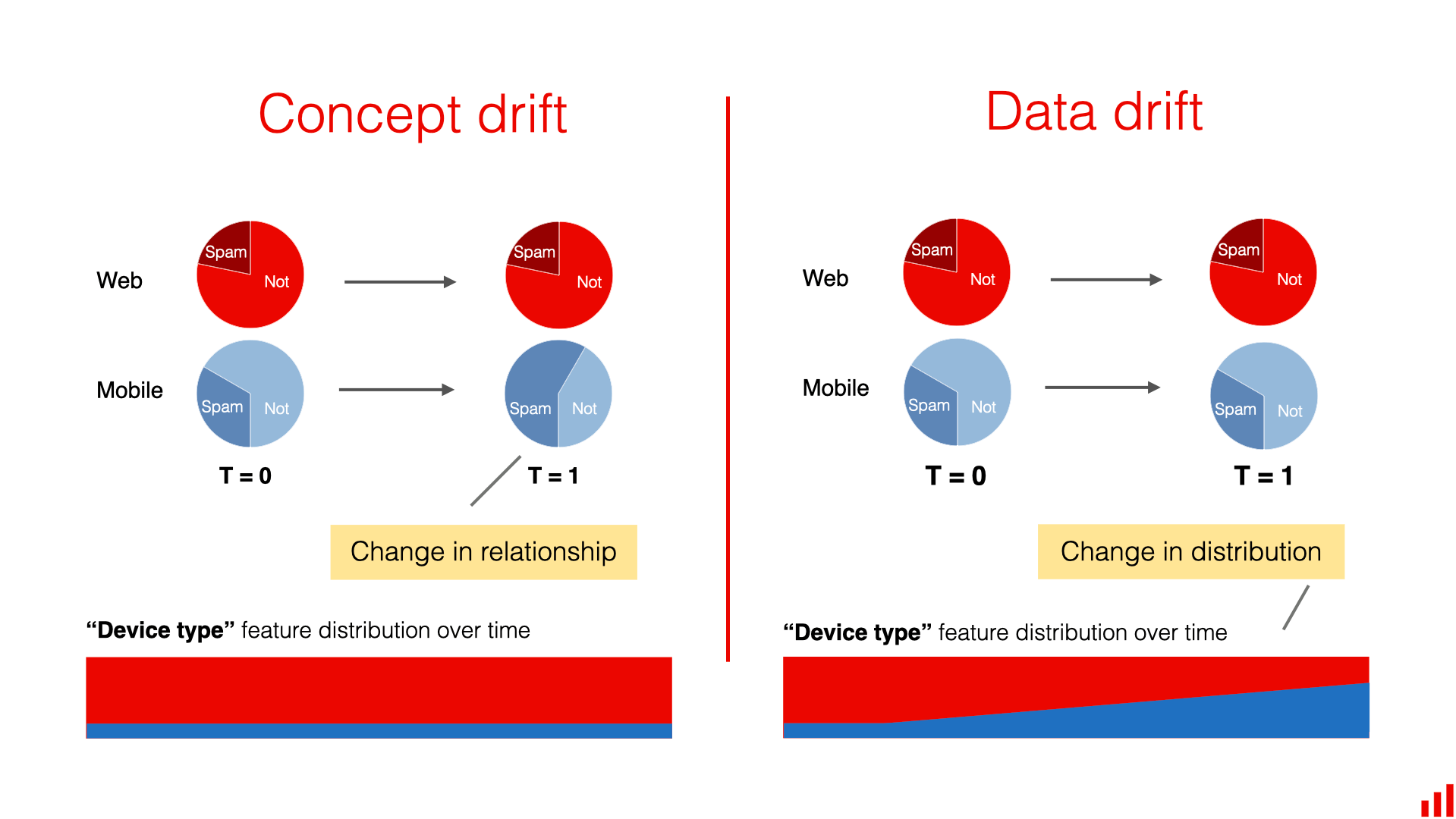

Adaptive Time-Series Learning Under Concept Drift

What Is Concept Drift in Crypto?

Concept drift refers to structural changes in the relationship between inputs and outputs. In crypto, drift occurs due to:

Classical retraining schedules fail because drift is non-linear and bursty.

Drift-Aware Time-Series Models

Advanced systems use:

| Drift Type | Example | Model Response |

|---|---|---|

| Sudden | Exchange collapse | Hard reset |

| Gradual | Liquidity migration | Parameter decay |

| Cyclical | Funding arbitrage | Seasonal adaptation |

SimianX AI incorporates drift detectors that trigger model reconfiguration rather than naive retraining.

---

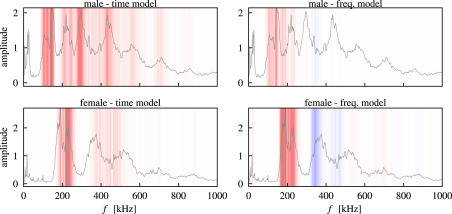

Time-Series Explainability in Crypto Prediction

Accuracy alone is insufficient. In adversarial markets, interpretability becomes a survival constraint.

Why Explainability Matters

However, deep time-series models are often opaque.

Explainable Time-Series Techniques

Approaches include:

Explainability is not visualization—it is temporal causality.

SimianX AI emphasizes decision-path transparency, allowing users to trace predictions back to concrete temporal drivers.

---

Evaluation Metrics Beyond Prediction Error

Traditional metrics like MSE or MAE are insufficient for crypto.

Market-Aware Evaluation

Better metrics include:

| Metric | Why It Matters |

|---|---|

| Max Drawdown | Survival risk |

| Signal Stability | Overtrading control |

| Regime Consistency | Robustness |

Time-series models that minimize error but fail under stress are systematically rejected in production environments like SimianX AI.

---

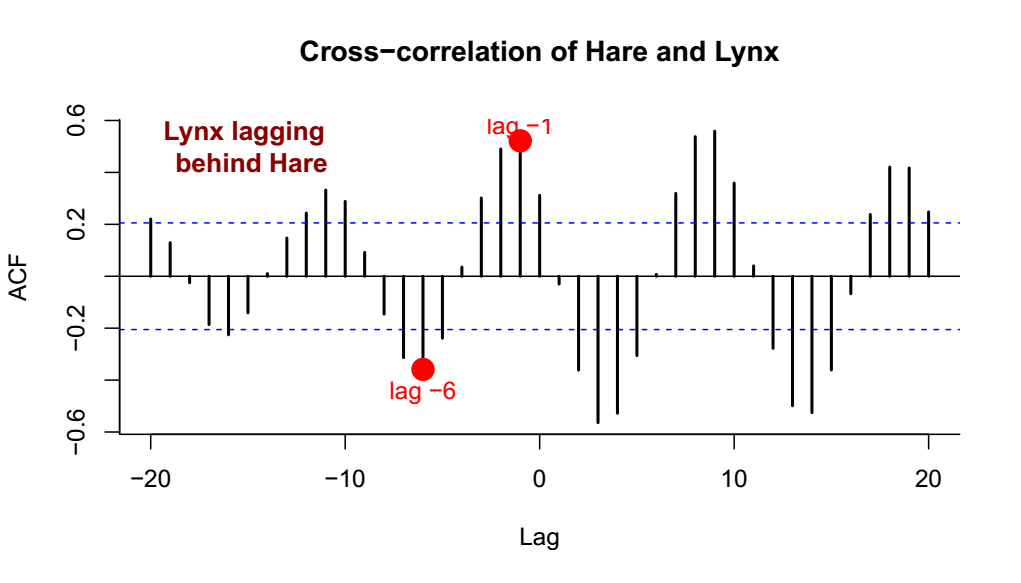

Multi-Asset and Cross-Chain Time-Series Modeling

Crypto markets are networked systems, not isolated assets.

Cross-Asset Temporal Dependencies

Examples include:

Time-series models must therefore incorporate cross-sectional temporal structure.

Graph-Aware Time-Series Models

Advanced architectures combine:

This hybrid modeling allows SimianX AI to anticipate systemic transitions rather than isolated price moves.

---

From Prediction to Decision: Temporal Signal Execution

Prediction without execution is academic.

Signal Degradation Over Time

Even accurate forecasts decay due to:

Thus, time-series outputs must be execution-aware.

Temporal Signal Compression

Modern systems transform raw predictions into:

The value of a prediction lies in its temporal usability.

SimianX AI integrates prediction models with execution constraints to prevent theoretical alpha from evaporating in practice.

---

Decentralized Validation of Time-Series Models

Centralized backtesting is vulnerable to overfitting.

Decentralized Evaluation Frameworks

Emerging research explores:

This reduces model monoculture risk.

Future crypto prediction systems may rely on collective intelligence rather than centralized model authority.

---

Ethical and Systemic Risks of Crypto Prediction Models

Model-Induced Instability

Widespread adoption of similar models can:

Responsible platforms must consider system-level externalities.

SimianX AI explicitly limits signal homogeneity to preserve market resilience.

---

Future Research Directions

Key open problems include:

1. Self-calibrating time-series ensembles

2. Reflexivity-aware loss functions

3. Prediction under adversarial manipulation

4. Collective model governance

These challenges define the frontier of crypto-native time-series intelligence.

---

Extended Conclusion

This extended research demonstrates that specialized time-series models for crypto prediction are no longer standalone statistical tools. They are components of adaptive, reflexive, and system-aware intelligence architectures. Success in crypto forecasting depends not only on modeling prices, but on understanding time itself as an adversarial dimension.

By combining advanced time-series research with execution logic, interpretability, and decentralized validation, SimianX AI represents a new generation of crypto prediction platforms—designed not merely to forecast markets, but to survive and adapt within them.

To explore these ideas in practice, advanced analytics, and production-grade prediction systems, visit SimianX AI.