Using AI for Early Warning of DeFi Liquidity: Detecting Fund Outflows Before a Decline

Decentralized Finance (DeFi) markets move fast, and liquidity often disappears before prices collapse. Using AI for early warning of DeFi liquidity has become one of the most powerful ways to detect fund outflows before a decline actually hits the market. By combining on-chain data, behavioral signals, and machine learning models, platforms like SimianX AI help traders, funds, and risk teams identify stress signals before they show up in charts.

Why Liquidity Is the First Domino in DeFi Crises

In DeFi, liquidity is the foundation of everything: pricing efficiency, slippage control, leverage safety, and protocol stability. When liquidity weakens, risk compounds rapidly.

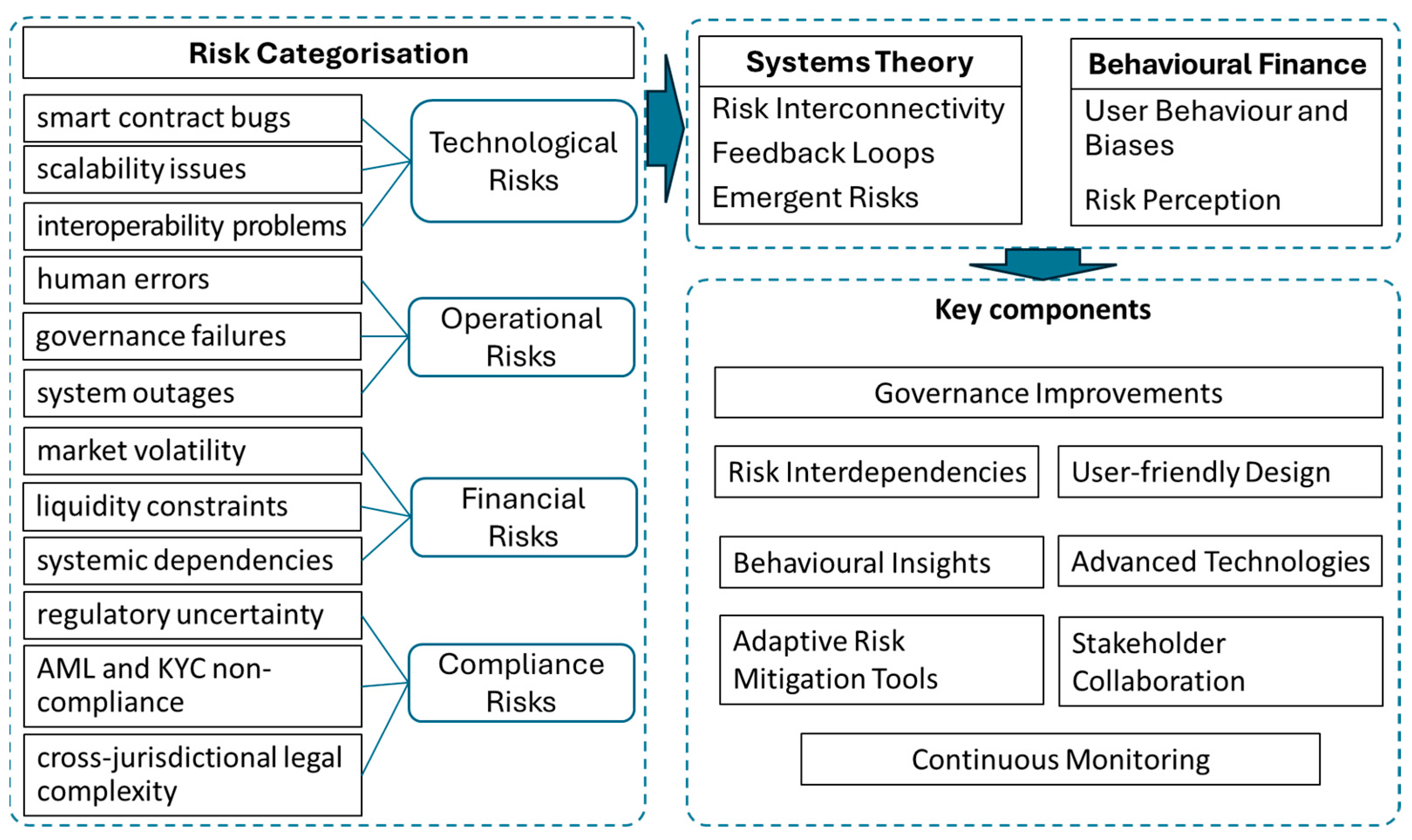

Common DeFi liquidity failure patterns include:

Liquidity does not vanish randomly — it leaves footprints on-chain long before prices react.

AI systems are uniquely suited to detect these footprints at scale.

What Does “Early Warning” Mean in DeFi Liquidity?

An early warning system does not predict prices directly. Instead, it identifies structural stress signals that historically precede declines.

These signals typically appear in three layers:

1. Capital movement signals – wallets, pools, and bridges

2. Market microstructure signals – depth, slippage, spreads

3. Behavioral signals – LP, whale, and governance actions

Using AI for early warning of DeFi liquidity means monitoring all three layers simultaneously.

| Signal Layer | Example Indicator | Why It Matters |

|---|---|---|

| Capital Flow | Net LP outflows | Shrinking exit liquidity |

| Market Depth | Slippage spikes | Fragile pricing |

| Behavior | Whale withdrawals | Informed capital exiting |

How AI Detects Fund Outflows Before Price Declines

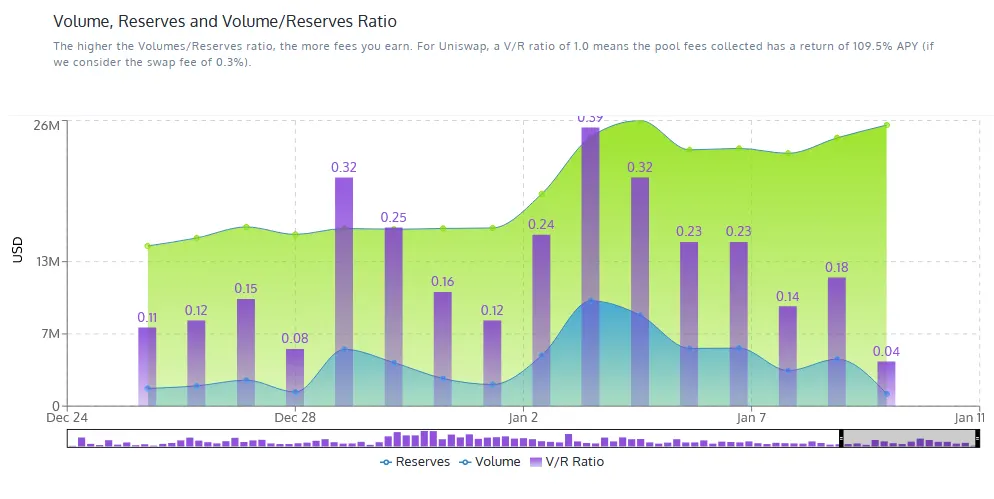

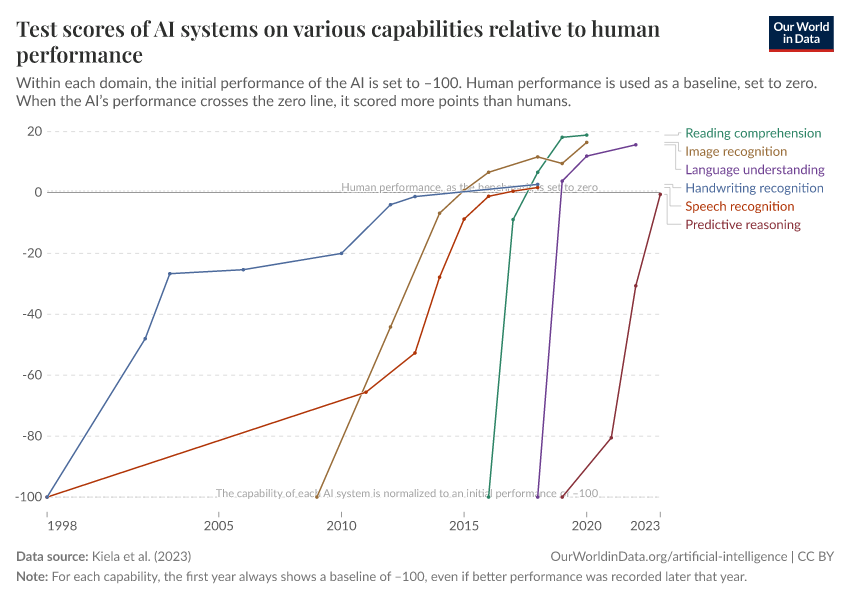

Traditional dashboards show what already happened. AI models focus on change, acceleration, and anomaly detection.

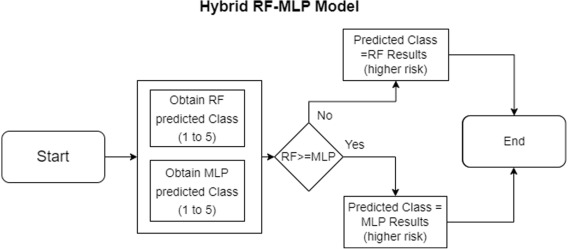

Key AI Techniques Used

SimianX AI applies these techniques to continuously scan DeFi protocols for early liquidity stress.

The goal is not perfect prediction — it is earlier awareness.

How to Predict DeFi Liquidity Crises Using AI Signals

AI models look for patterns, not single metrics. For example:

1. Declining LP deposits across multiple pools

2. Rising borrow utilization with flat deposits

3. Stablecoin outflows into centralized exchanges

4. Governance proposals increasing risk exposure

Individually, these may look harmless. Together, they form a warning cluster.

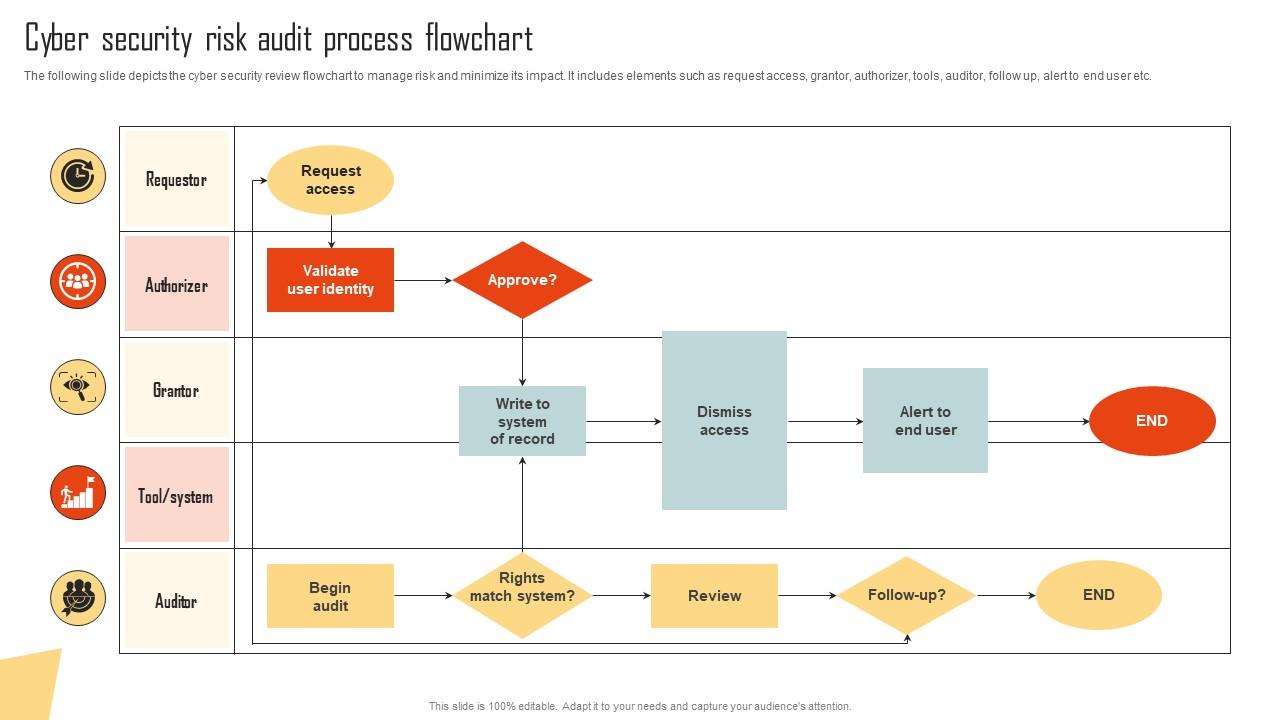

Practical Framework: AI-Driven DeFi Liquidity Monitoring

Below is a simplified framework used by professional risk teams.

1. Data ingestion

- On-chain events (swaps, deposits, withdrawals)

- Cross-chain bridge flows

2. Feature engineering

- Net flow velocity

- Liquidity concentration ratios

3. Model evaluation

- Historical stress backtesting

4. Alert thresholds

- Probability-based, not static

Bold takeaway: Liquidity risk is probabilistic, not binary.

| Step | AI Output | Action |

|---|---|---|

| Monitor | Outflow acceleration | Reduce exposure |

| Confirm | Multi-signal alignment | Hedge or exit |

| React | Liquidity shock | Avoid forced liquidation |

Why Humans Miss Early Liquidity Signals

Even experienced DeFi traders struggle with:

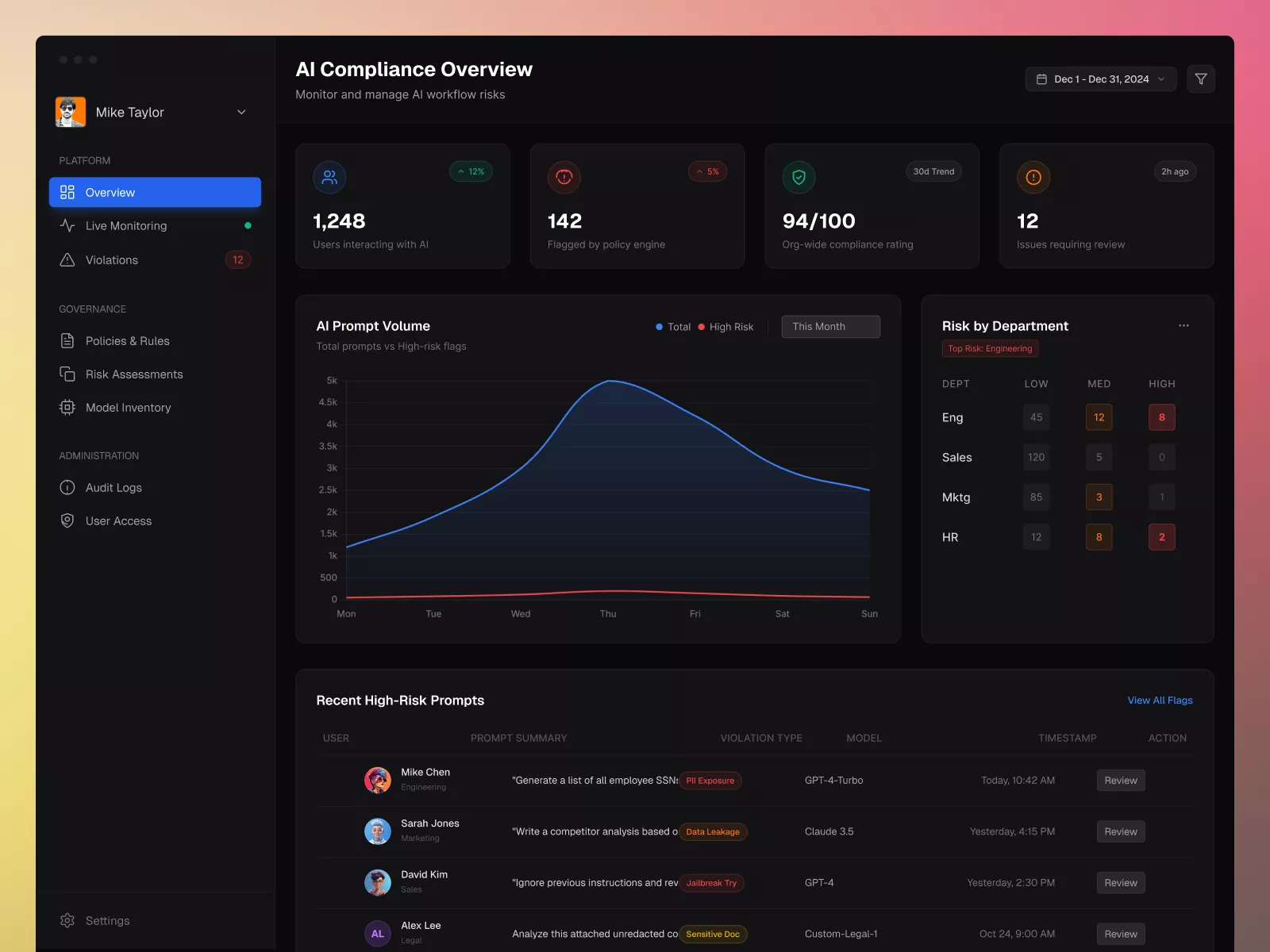

AI systems do not suffer from these constraints. SimianX AI continuously evaluates thousands of signals in real time, allowing users to act before narratives shift.

Using SimianX AI for DeFi Liquidity Early Warning

SimianX AI is designed specifically for on-chain risk detection, not just visualization.

Key advantages include:

Instead of asking “Why did this crash?”, users can ask “Is liquidity leaving right now?”

SimianX AI enables this shift from reactive to proactive DeFi risk management.

FAQ About Using AI for Early Warning of DeFi Liquidity

How does AI detect DeFi fund outflows before price declines?

AI analyzes on-chain transaction patterns, liquidity pool balances, and wallet behavior to identify abnormal outflows that historically precede market stress.

What causes DeFi liquidity outflows?

Common causes include rising perceived protocol risk, better yield opportunities elsewhere, governance uncertainty, and macro market stress.

Is TVL enough to monitor liquidity risk?

No. TVL is lagging. AI models combine TVL with flow velocity, concentration, and behavioral indicators for early warnings.

Can retail investors use AI liquidity monitoring?

Yes. Platforms like SimianX AI abstract complex analytics into actionable alerts suitable for both professionals and advanced retail users.

Does early liquidity warning guarantee downside protection?

No system is perfect, but early warnings significantly improve reaction time and reduce exposure to sudden liquidity shocks.

Conclusion

Using AI for early warning of DeFi liquidity fundamentally changes how risk is managed in decentralized markets. By detecting fund outflows before a decline, AI enables investors and protocols to act before liquidity collapses and volatility explodes.

As DeFi grows more complex, reactive strategies are no longer enough. Proactive, AI-driven liquidity monitoring is becoming essential infrastructure. To explore how advanced on-chain intelligence can protect your portfolio, visit SimianX AI and experience next-generation DeFi risk awareness.