Synthetic Prediction Engines in Decentralized Crypto Economies

Synthetic prediction engines in decentralized crypto economies represent a new class of anticipatory infrastructure—systems designed not merely to report on-chain states, but to continuously infer, simulate, and price the future. As blockchain ecosystems grow more complex, reactive analytics and static oracles are no longer sufficient. What decentralized systems increasingly require is forward-looking collective intelligence.

At SimianX AI, this paradigm is approached through multi-agent systems that synthesize probabilistic forecasts from heterogeneous data, models, and incentives—turning decentralized markets into living prediction machines rather than passive ledgers.

---

From Reactive Analytics to Anticipatory Systems

Most crypto analytics tools are backward-facing. They measure:

However, decentralized crypto economies are reflexive systems. Expectations shape behavior, behavior alters on-chain reality, and outcomes recursively influence expectations.

In reflexive markets, prediction is not optional—it is structural.

Synthetic prediction engines emerge precisely to address this gap: they operationalize expectation formation on-chain.

---

Defining Synthetic Prediction Engines

A synthetic prediction engine is a decentralized, adaptive forecasting system that:

The term synthetic emphasizes that the signal is constructed, not observed. It is an emergent property of many interacting components.

Core properties

---

Why Decentralized Crypto Economies Demand Prediction

Decentralized crypto economies face a unique convergence of challenges:

1. Extreme volatility driven by leverage and reflexivity

2. Information asymmetry across chains and protocols

3. Delayed governance effects with irreversible execution

4. Non-linear risk propagation (liquidations, bank runs)

Traditional finance relies on centralized risk desks and discretionary judgment. Decentralized systems must encode similar functions without trusted intermediaries.

Synthetic prediction engines act as distributed risk cognition layers.

---

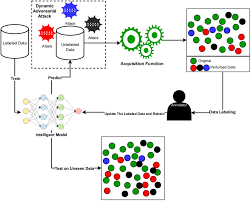

Multi-Agent Intelligence as the Engine Core

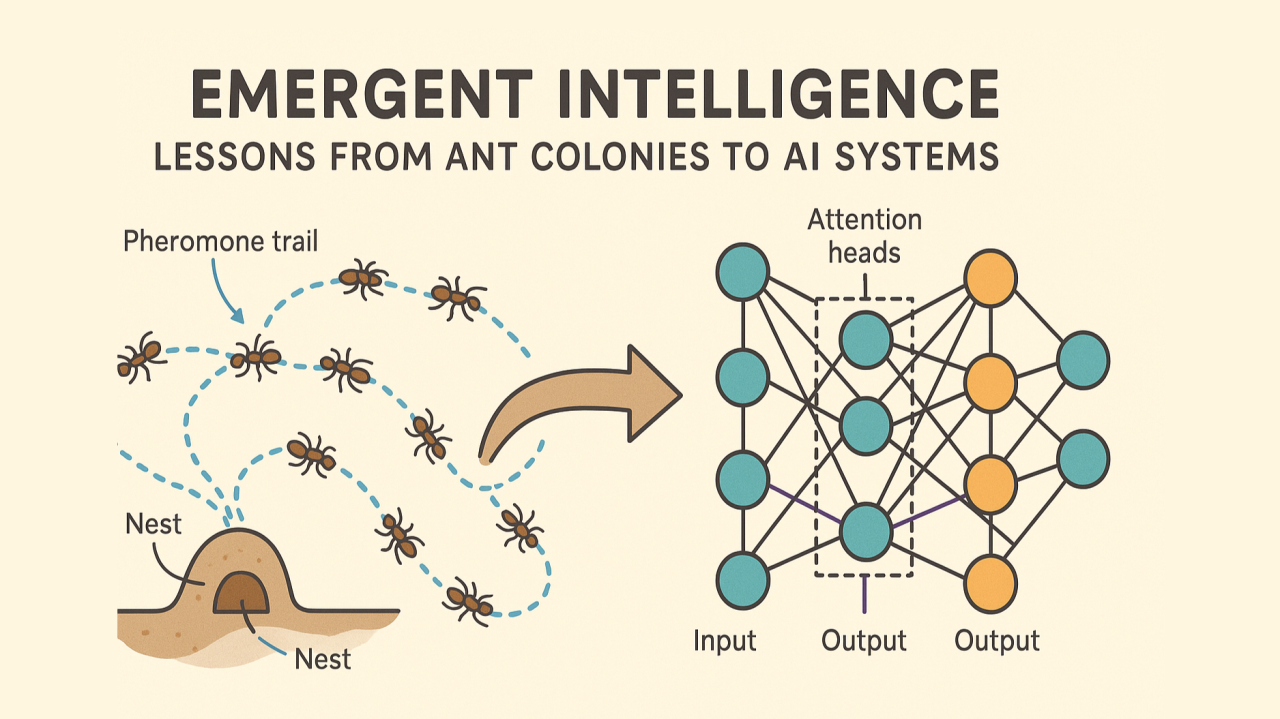

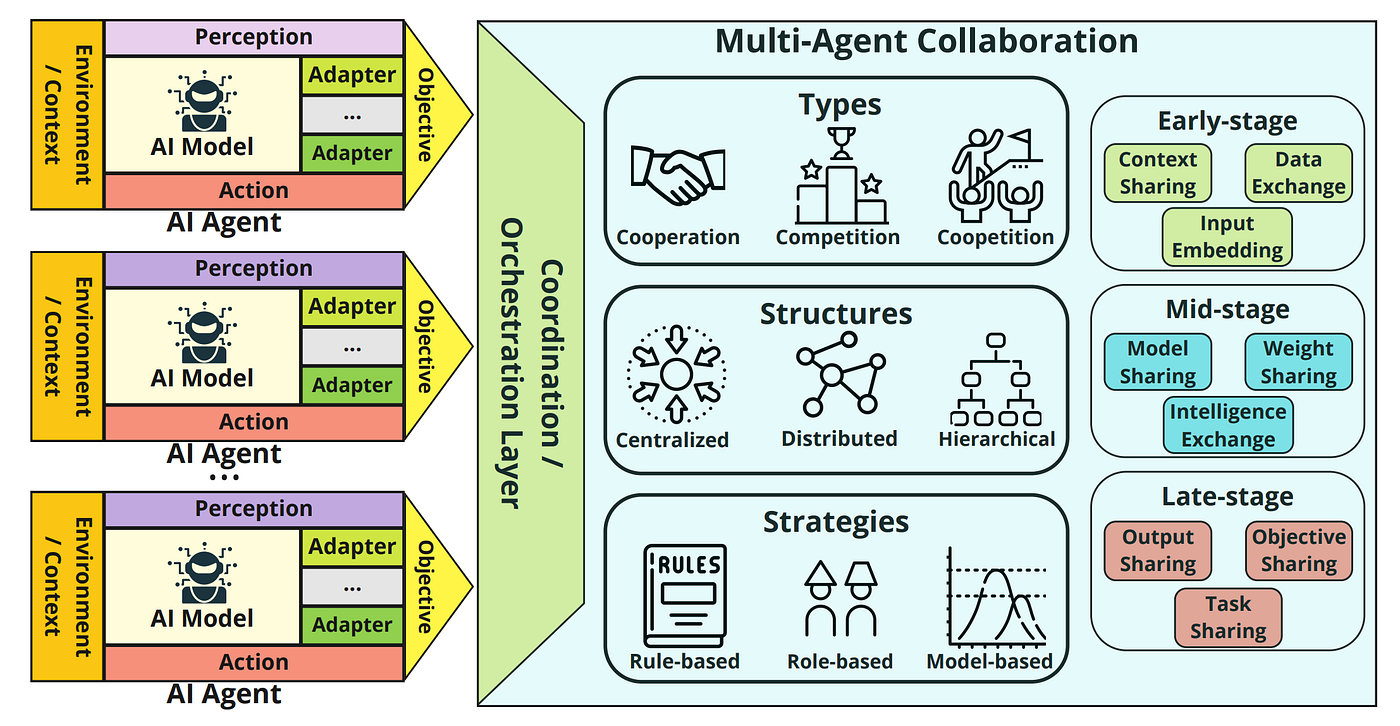

At the heart of synthetic prediction engines lies multi-agent intelligence. Rather than relying on a single “best” model, the system encourages model diversity.

Types of agents

Each agent operates with partial information and bounded rationality, yet collectively produces superior forecasts.

Diversity of models is not noise—it is antifragility.

SimianX AI designs agent ecosystems where specialization is rewarded rather than suppressed.

---

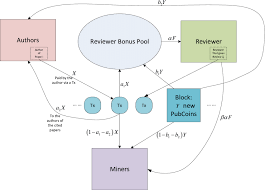

Incentive Design: The Core Challenge

Prediction accuracy alone does not guarantee honest participation. Synthetic prediction engines succeed or fail based on mechanism design.

Common incentive primitives

| Mechanism | Purpose | Failure Mode if Misdesigned |

|---|---|---|

| Staking | Signal confidence | Whale dominance |

| Slashing | Penalize noise | Over-conservatism |

| Reputation | Long-term alignment | Path dependence |

| Time weighting | Early signal discovery | Front-running |

---

Truth Revelation in Adversarial Environments

Decentralized crypto economies are adversarial by default. Synthetic prediction engines must assume:

The goal is not to eliminate manipulation entirely, but to make it economically irrational.

In decentralized systems, truth is an equilibrium—not an assumption.

Well-designed engines ensure that accurate forecasting dominates dishonest strategies over time.

---

Synthetic Prediction Engines vs Prediction Markets

While often conflated, synthetic prediction engines differ meaningfully from traditional prediction markets.

| Dimension | Prediction Markets | Synthetic Prediction Engines |

|---|---|---|

| Participants | Mostly humans | Humans + AI agents |

| Output | Binary or scalar | Probabilistic distributions |

| Adaptation | Discrete | Continuous |

| Intelligence | Implicit | Explicitly modeled |

| Scope | Single events | System-level dynamics |

Prediction markets answer “Will X happen?”.

Synthetic engines ask “What is the evolving probability landscape of the system?”.

---

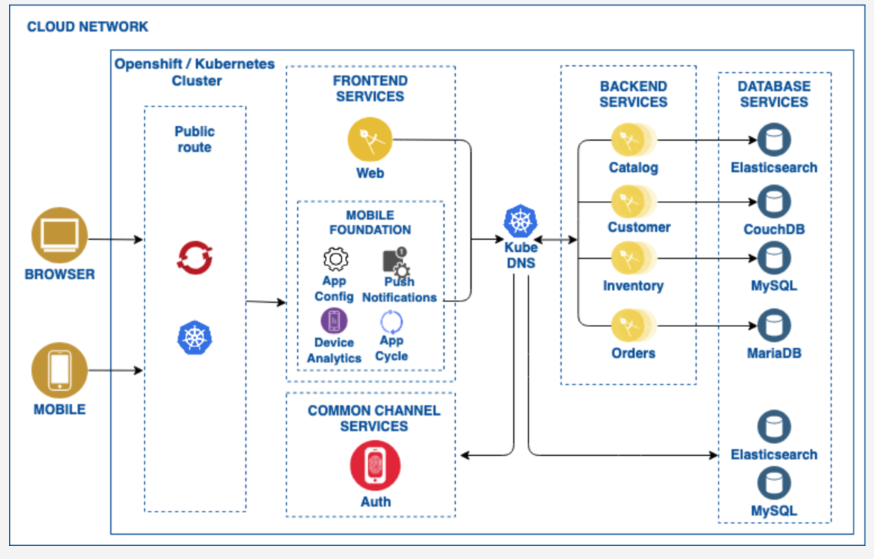

Engineering Architecture of Synthetic Prediction Engines

A production-grade synthetic prediction engine typically includes:

1. Data ingestion layer (on-chain, off-chain, cross-chain)

2. Agent execution layer (models, strategies, learning loops)

3. Economic coordination layer (staking, rewards, penalties)

4. Aggregation layer (ensembles, weighting, consensus)

5. Output interface (signals, alerts, APIs, dashboards)

Each layer is independently upgradeable, preserving decentralization while enabling rapid evolution.

---

On-Chain vs Off-Chain Computation Tradeoffs

Not all prediction logic belongs on-chain.

- Incentives

- Settlement

- Verification

- Heavy model computation

- Simulation

- Feature extraction

Synthetic prediction engines often rely on hybrid architectures, anchoring trust on-chain while scaling intelligence off-chain.

SimianX AI leverages this hybrid model to maintain both verifiability and performance.

---

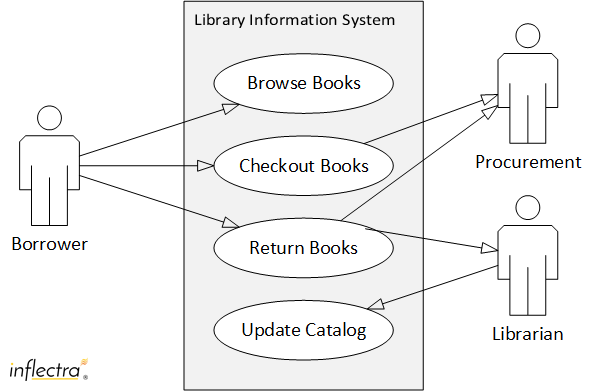

Key Use Cases in Decentralized Crypto Economies

1. Liquidity Stress Early Warning

Detect capital flight patterns before cascades occur.

2. Governance Outcome Forecasting

Model how proposals will pass—and their downstream effects.

3. Protocol Risk Scoring

Continuously update risk profiles based on behavior, not static audits.

4. Market Regime Detection

Identify transitions between accumulation, distribution, panic, and recovery phases.

---

Systemic Risks and Failure Modes

Despite their promise, synthetic prediction engines introduce new risks:

Robust systems deliberately inject noise, diversity, and adversarial pressure to avoid brittle equilibria.

---

What Is the Future of Synthetic Prediction Engines?

Over the next cycle, we expect:

Synthetic prediction engines may become as fundamental to crypto infrastructure as oracles and block explorers are today.

The future of decentralized systems belongs to those that can anticipate themselves.

---

FAQ About Synthetic Prediction Engines in Decentralized Crypto Economies

What is a synthetic prediction engine in crypto?

It is a decentralized system that aggregates forecasts from multiple agents using incentives to produce probabilistic predictions about future on-chain events.

How do AI agents participate in prediction engines?

AI agents generate forecasts, stake economic value behind them, and are rewarded or penalized based on long-term accuracy.

Are synthetic prediction engines manipulable?

They can be, especially early on, but strong incentive design and agent diversity significantly reduce manipulation over time.

Can DAOs use synthetic prediction engines?

Yes. DAOs can use them to forecast governance outcomes, risk exposure, and long-term protocol sustainability.

---

Conclusion

Synthetic prediction engines in decentralized crypto economies mark a transition from passive transparency to active foresight. By combining multi-agent AI, cryptographic incentives, and on-chain verifiability, these systems allow decentralized markets to reason about their own futures.

SimianX AI is building toward this vision—transforming raw blockchain data into anticipatory intelligence that empowers builders, investors, and DAOs to act before risk materializes.

To explore how synthetic prediction engines can enhance your on-chain strategy, visit SimianX AI and engage with the next generation of decentralized intelligence.