Using AI for DeFi Fund Expenditure Analysis: Expenditure Rate and Sustainability

Using AI for DeFi fund expenditure analysis has become a critical capability as decentralized finance protocols mature and capital efficiency replaces growth-at-all-costs. For investors, DAO governors, and protocol operators, understanding how quickly funds are spent—and whether that spending is sustainable—can mean the difference between long-term survival and silent treasury depletion.

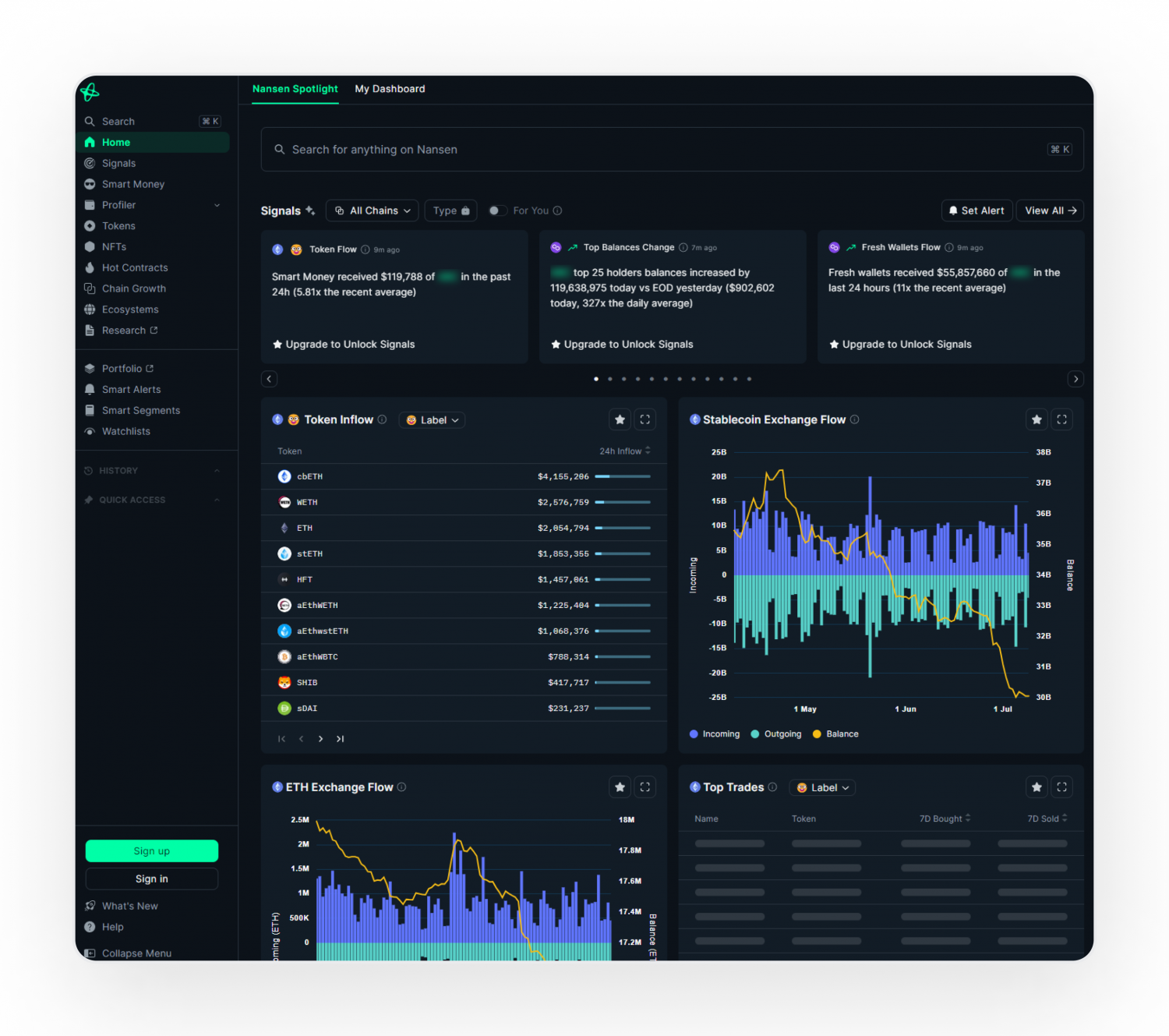

At SimianX AI, expenditure analysis is treated not as a static accounting task, but as a dynamic, predictive system built on on-chain data, behavioral signals, and machine learning models. This article explores how AI transforms DeFi fund expenditure analysis, focusing on expenditure rate, runway, and sustainability under stress.

Why DeFi Fund Expenditure Analysis Matters More Than Ever

In traditional finance, expenditure analysis relies on quarterly reports, budgets, and audits. In DeFi, capital moves continuously, transparently, and globally—yet interpretation remains difficult.

Key challenges include:

Transparency does not equal clarity. On-chain data is open, but without AI, it is rarely actionable.

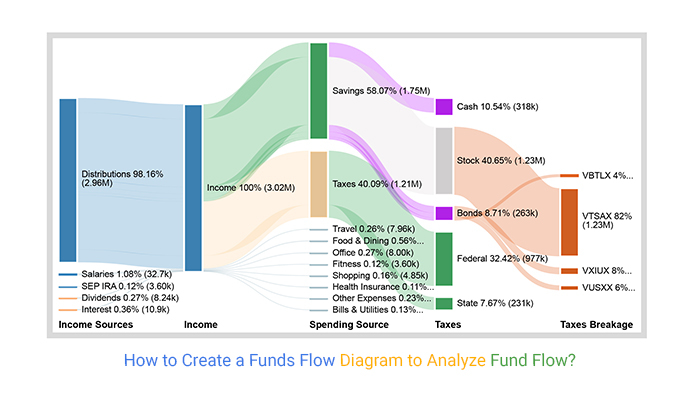

DeFi fund expenditure analysis aims to answer three core questions:

1. How fast is the protocol spending its funds?

2. What is the purpose and efficiency of that spending?

3. Can the current expenditure rate be sustained under adverse conditions?

AI enables these questions to be answered in near real time.

Defining Expenditure Rate in DeFi Contexts

The expenditure rate (often called burn rate) in DeFi measures how quickly treasury assets are leaving protocol-controlled addresses.

Unlike startups, DeFi expenditure is more complex:

Core Expenditure Categories

| Category | Description | Sustainability Risk |

|---|---|---|

| Core Ops | Dev salaries, audits, infrastructure | Medium |

| Liquidity Incentives | Token emissions, LP rewards | High |

| Grants | Ecosystem development | Medium |

| Marketing | User acquisition campaigns | Low–Medium |

| Treasury Ops | Rebalancing, swaps, hedging | Variable |

AI models classify and normalize these flows automatically, something manual dashboards struggle to do.

How AI Identifies True DeFi Expenditure Rate

A key advantage of AI-driven DeFi fund expenditure analysis is signal extraction from noisy on-chain activity.

AI Techniques Commonly Used

SimianX AI applies these techniques to calculate a real expenditure rate that reflects economic reality, not cosmetic token movements.

A protocol with growing TVL can still be burning capital unsustainably.

Expenditure Rate vs. Treasury Runway

Once expenditure rate is measured, AI models estimate treasury runway—how long the protocol can operate before funds are depleted.