Introducing SimianX.AI: Multi-Agent Stock Analysis You Can Trust

SimianX.AI orchestrates domain-specialist agent teams that debate, decide, and deliver—so you get clear, timely, and defensible answers to high-stakes questions. Today, that means a crisp response to “Should I buy this stock?”; tomorrow, the very same multi-agent architecture powers decisions across finance, healthcare, compliance, supply chain, and beyond.

What makes SimianX different is how we mirror an elite research desk in software. Multiple specialist agents (data, domain, risk, reasoning, and operations) work in parallel to gather evidence, challenge assumptions, and resolve disagreements through structured debate and adjudication. The result is a concise, professional report you can act on—complete with citations, rationale, and an auditable trace of how the decision was formed.

We’re launching with equities research as our beachhead — fast, high-signal reports that synthesize fundamentals, alternative data, and risk scenarios into a defensible recommendation.

The platform is built to scale, handling complex analytical workflows with the same rigor and structure — no changes to your setup or tech stack.

We don’t ask users to manage APIs or integrations.

Our goal is to make it effortless to get complete, reliable results in one place.

Users shouldn’t have to assemble tools — they should just ask questions and get the full picture.

We take user feedback seriously and keep refining the experience to combine analytical depth with simplicity.

Who We Are: SimianX.AI’s Mission and Mindset

The name “SimianX” reflects agility and intelligence—Simian nods to insight and adaptability; the “X” represents our flexible expertise in multi-agent systems. We believe that the future of decision support lies in cooperative intelligence: a coordinated team of specialized agents, each focused on a distinct signal, producing a comprehensive analysis faster than any single model or human can.

At SimianX.AI, our current focus is public equities. We chose this domain because the problem is universal (everyone wonders what to buy, when to buy, and why), the data is abundant, and the stakes are high. From retail traders to portfolio managers, clarity is the most valuable commodity.

Our philosophy: Breadth × Speed × Debate → Better Decisions.

Breadth collects more signals. Speed shortens time-to-insight. Debate reduces blind spots.

Why this matters now: Markets move fast; news cycles accelerate; signals decay. Traditional research workflows—single-threaded, manual, and slow—often miss the moment. SimianX.AI’s multi-agent approach compresses hours of reading and modeling into minutes, while preserving interpretability through structured outputs and citations in the final report.

The Pain Point We Solve: “Should I Buy This Stock?” or “Should I Sell This Stock?” or “Should I Hold This Stock?”

Ask any investor and you’ll hear the same anxiety: “I like this ticker, but… is now the right time?” The challenge is not a lack of data—it’s signal overload and contradiction:

SimianX.AI targets this paralysis by combining parallel analysis with structured reasoning. Our product synthesizes fundamentals, market technicals, and multi-source news into a single, defensible view with practical guidance: buy, hold, or wait—plus the why behind it.

What users get:

The 3+1 - Stage Analysis Flow

Our workflow is intentionally modeled on a modern research team. Each stage adds breadth, depth, and confidence.

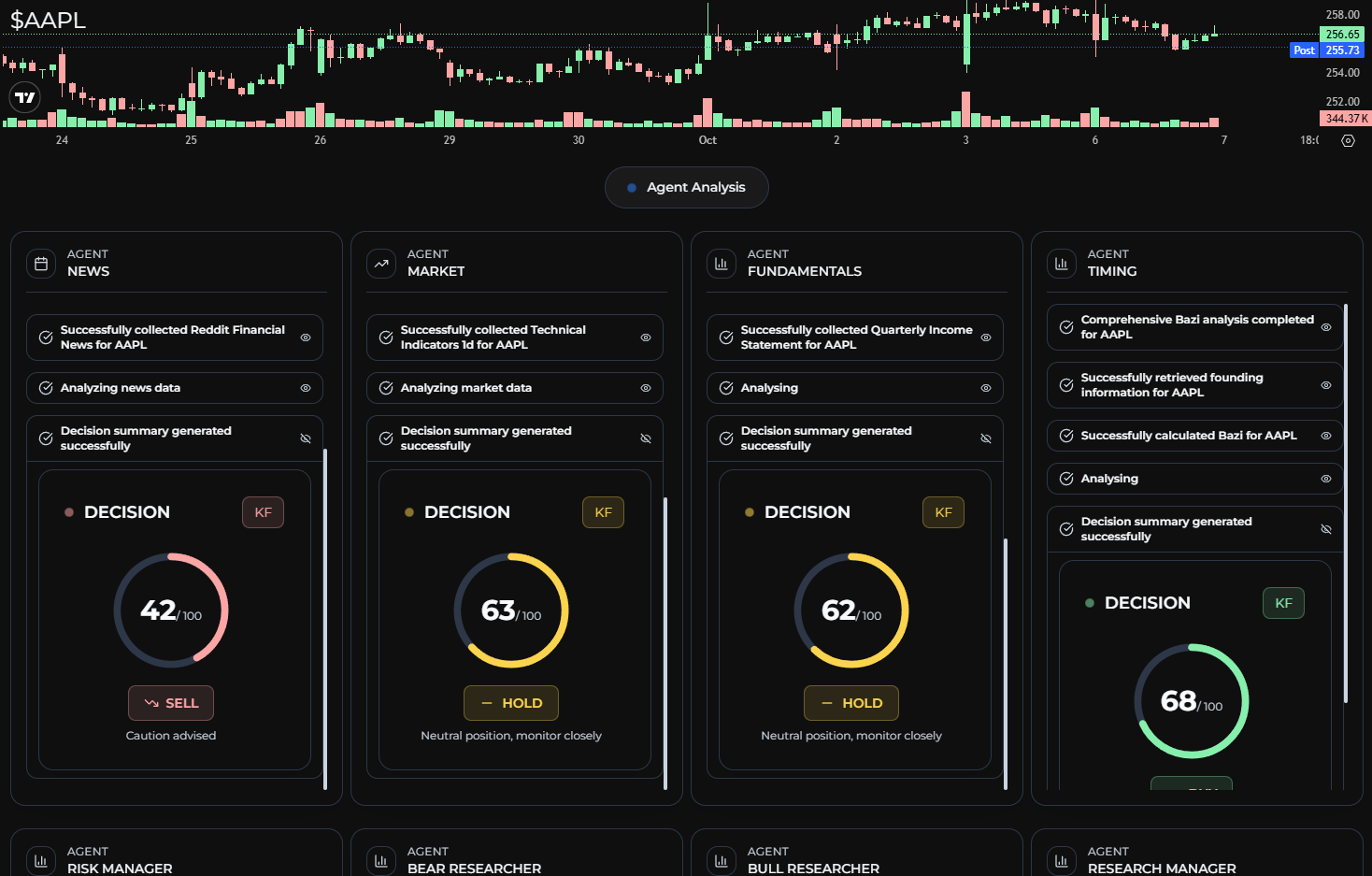

Stage 1 — Agent Analysis (Parallel, Specialized)

In this stage, multiple agents run simultaneously—each with a specialization and clear scope. The goal is to rapidly gather diverse, relevant signals.

For example of our agents:

1. Fundamental Agents

- Insider Transactions Agent: surfaces recent insider buys/sells and contextualizes activity (e.g., pattern vs. one-off, size relative to comp).

- Financials Agent: analyzes revenue growth, margins, FCF, leverage, and profitability trends.

- Valuation Agent: compares multiples (P/E, EV/EBITDA, P/S) vs. sector/peers and historical ranges.

- Quality Agent: checks accruals, cash conversion, and earnings persistence.

Want to understand more about Fundamental Agent? - SimianX AI Fundamental Analysis: SEC Data Meets Multi-Model AI

2. News & Sentiment Agents

- News Aggregation Agent: consolidates coverage from trusted sources (e.g., Bloomberg), community signals (e.g., Reddit), and search (e.g., Google).

- Sentiment Agent: scores direction and intensity of coverage, flags catalysts (earnings, product launches, regulatory moves).

3. Market & Technical Agents

- Momentum Agent: calculates RSI, moving averages, and crossovers (e.g., 50DMA vs. 200DMA).

- Volatility Agent: monitors ATR, gap risk, and regime shifts.

- Liquidity Agent: checks spreads, turnover, and unusual volume.

And more agents...

What makes Stage 1 powerful: These agents don’t just collect numbers; they interpret them—each agent writes a short, opinionated note with confidence levels and rationale.

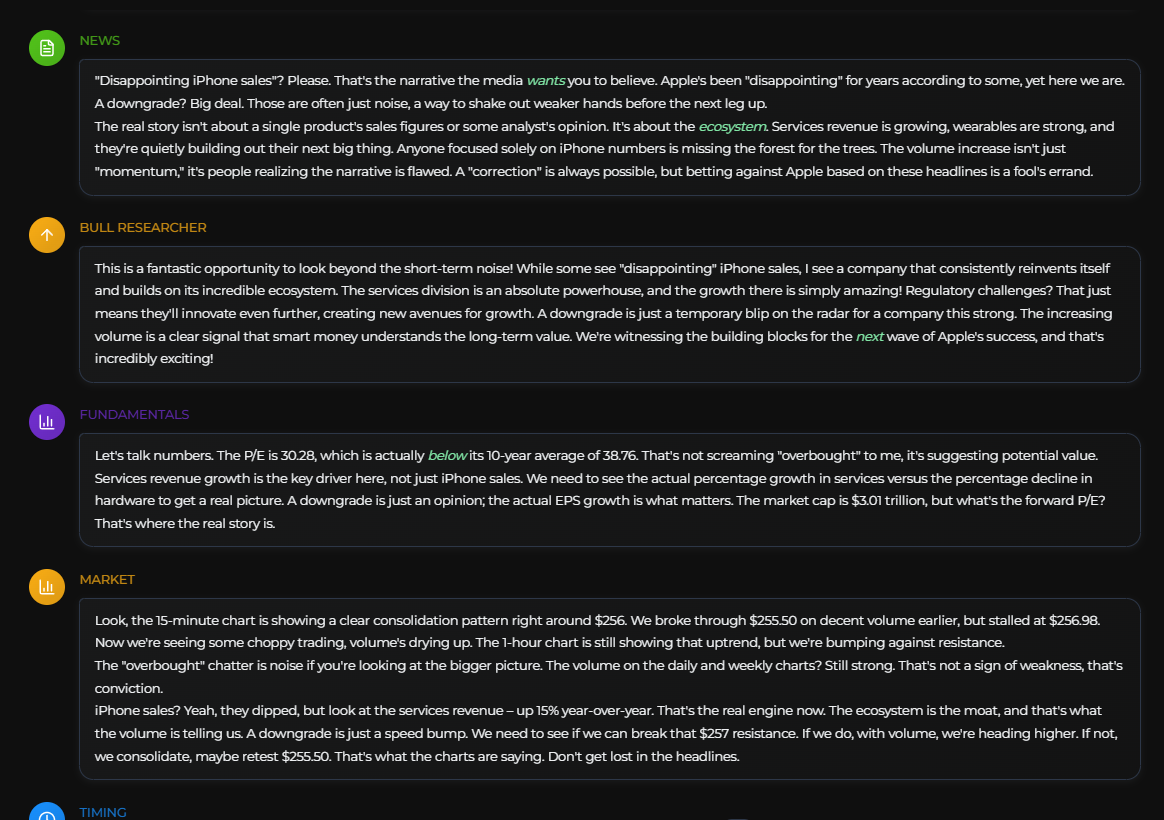

Stage 2 — Agent Discussion (Debate, Reconciliation, Consensus)

Stage 2 is where SimianX.AI shines. The agents debate their findings. If the News Agent is bullish but the Valuation Agent is cautious, that tension is explicitly discussed:

Insight: Opinion without friction is fragile. By baking in structured disagreement, the system improves robustness and explainability.

This stage gives users not just a verdict but the reasoning trail, so you can see why the conclusion makes sense—and where it might be wrong.

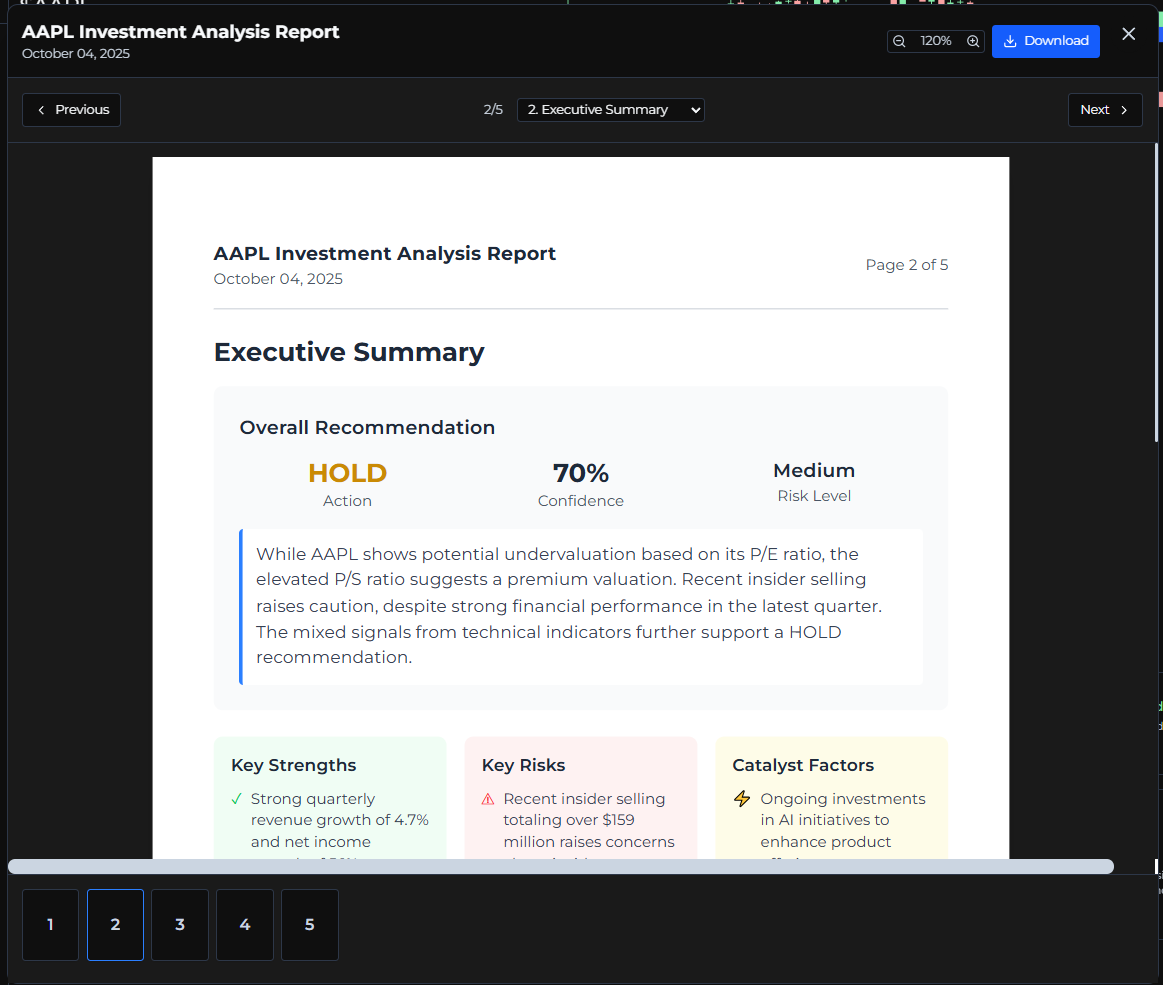

Stage 3 — Professional PDF Report (Clarity, Portability, Action)

All threads culminate in a professional PDF designed for both quick scanning and deep reading:

This report format makes it easy to share insights with teammates, attach to an investment memo, or revisit later when conditions change.

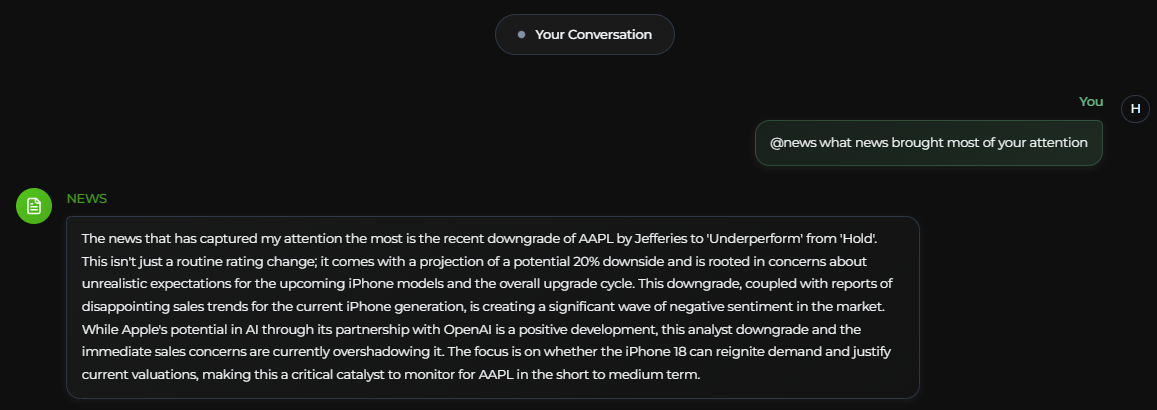

Stage 4: Agents Meeting (Human-Aligned Alignment)

Our real meeting starts—Agents Meeting—a synchronization and action layer after the PDF is generated. It's where you can @ and ask question in this meeting.

Objectives of the Agents Meeting

Inside the Engine: Signals, Weights, and Guardrails

Transparency is a cornerstone of SimianX.AI. Here’s how we keep the system both powerful and responsible:

RSI(14), MACD), and news constructs (e.g., earnings-driven sentiment).

confidence_score and rationale. The system favors consensus but doesn’t suppress minority views—contrarian signals are retained as watch items.

What the User Experience Looks Like

1. Enter a Ticker: Start with a symbol you’re considering.

2. Run Analysis: Agents fan out across Fundamentals, News, and Market datasets.

3. See the Debate: A digestible summary shows what agents agreed and disagreed on.

4. Download the PDF: Get a polished report with tables, charts, and monitoring guidance with long/short term conclusion.

Speed: The pipeline is optimized for parallel execution, drastically reducing time-to-insight.

Clarity: No black-box verdicts—every call comes with explanations and caveats.

Actionability: We highlight next steps, like “Watch for 50DMA re-test” or “Revisit after guidance update.”

Use Cases Across Investor Profiles

Example Scenarios

1. Pre-Earnings Decision

- News Agent flags upbeat chatter, but Valuation Agent warns of premium multiples.

- Outcome: Qualified Buy with a risk note—consider position sizing and a volatility plan.

2. Momentum vs. Fundamentals

- Technicals are strong (golden cross), but Fundamentals show margin compression.

- Outcome: Hold/Watch—wait for confirmation (e.g., RSI normalization, margin guidance).

3. Insider Activity Spike

- Insider Transactions Agent highlights sustained buying by executives.

- Outcome: Constructive Bias—add to watchlist; seek corroboration in fundamentals.

Opinionated Best Practices the Product Encourages

Great decisions are made at the intersection of speed and skepticism. SimianX.AI delivers both.

We Aming to bring more Agents team from thinking to real.